Synopsis

Toll Brothers (NYSE:TOL) designs, constructs, and markets luxury residential homes. TOL is well positioned to capitalize on the strong housing demand that is driven mainly by an undersupply of housing and a favourable demographic. Its strategic initiatives to focus on spec homes enable it to meet the demand of buyers who are looking for quick move-in options. In addition, TOL is well disciplined in its land acquisition approach, as it applies strict benchmarks to ensure that both margins and returns meet its expectations. Combining this with its community expansion growth plans, they are expected to bolster TOL’s growth outlook. Overall, I am reiterating my buy rating for TOL.

Recap of Previous Coverage

In my previous post and coverage on TOL, I recommended a buy rating driven by several favourable drivers. The growing US households, particularly those households that are earning more than $200,000 annually, presents a significant opportunity for the business. In addition, its low penetration rate in the fast-growing addressable market implies that there are opportunities for TOL to capture additional market share and grow the business. Furthermore, demand for luxury homes is primarily driven by wealth and net worth rather than mortgage rates. Therefore, it reduces TOL’s sensitivity to mortgage rate changes and positions TOL well in the current macroeconomic environment.

Demographic and Undersupply Support Housing Demand

Investor Relations

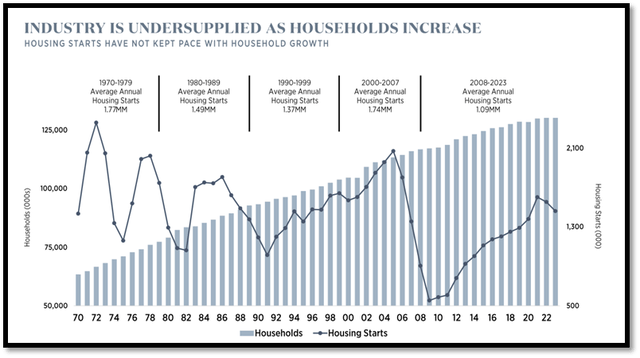

Currently, the outlook for home builders is favourable. This positive outlook is driven mainly by strong demand from demographics. Millennials are starting to enter their peak earning years, while baby boomers are moving into new homes as they retire.

Currently, there is a chronic shortage of homes caused by years of underproduction as well as the lock-in effect of high interest rates. The high interest rates discourage existing homeowners from selling their house, which results in low resale inventory levels.

Despite supply challenges, the demand side of the equation continues to be robust even when the mortgage rate is high. Year to date, TOL’s sales have grown by approximately 25%. This demonstrates the strength of the demand for housing and TOL’s ability to capitalise on this trend given the market positioning and strength it possesses.

Strategic Focus on Spec Homes

For the quarter, spec homes represented 54% of net orders and 49% of home deliveries. These figures indicate that TOL is still executing and expanding on its spec home strategy. For context, spec homes are defined as those that do not have buyers but have foundation port.

This strategy enables TOL to offer buyers with quicker move-in options, thus catering to those who do not want to wait for build-to-order [BTO] homes. Looking ahead, TOL is targeting 50% of its business to be comprised of spec homes as it wants to capitalise on the strong demand for quick move-in homes.

Community Count and Land Control

For its most recent quarter, TOL reported that it is on track to operate from 410 communities by the end of its fiscal year. At the beginning of the year, it operated from 370 communities, thus this represents a growth rate of approximately 11%.

For fiscal year 2025 and beyond, TOL intends to continue this growth strategy into it. Currently, it has enough land under its control to execute on this growth initiative. For the current quarter, TOL owned/controlled 72,700 lots, which has a 50/50 split between controlled and owned lots. Given the land position that TOL has on hand, it ensures that it has sufficient lots to support its future growth plans as discussed.

In addition to its growth strategy, how TOL acquires land is also crucial to the success of its growth initiatives. So far, TOL has been very careful and stringent with its underwriting standards, as it consistently applies strict benchmarks to ensure that both margins and returns meet its expectations. In addition, TOL also ensures that its land acquisitions and development strategies are capital efficient by leveraging on options arrangements, land banks, and joint ventures.

Third Quarter 2024 Results

TOL reported its 3Q24 results on August 21, 2024. TOL’s home sales revenue increased 1.86% year-over-year to approximately $2.72 billion, which is a third quarter record. TOL’s total delivered homes increased 11% year-over-year to 2,814. This strong increase in homes delivered is driven by TOL’s strategic initiatives to expand price range and increase spec homes supply. In addition, its net signed contract value also increased 11% to $2.41 billion.

Total backlog value for the quarter is approximately $7.07 billion. The cancellation rate stood at 2.4%, an improvement from the previous quarter’s 2.8%. TOL’s cancellation rate is considered low in the industry it operates in, and this is due to the significant upfront payments buyers paid.

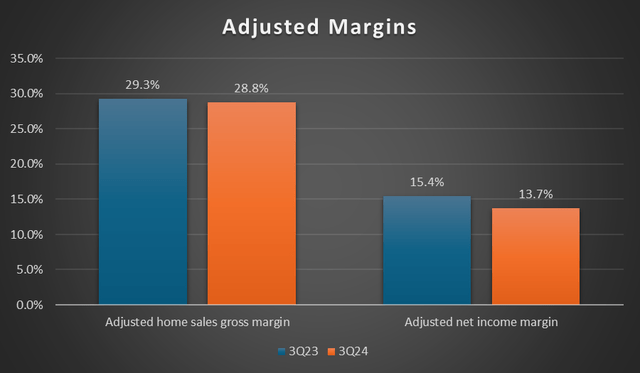

Moving on to adjusted home sales gross margin, although it contracted slightly to 28.8%, it beat TOL’s guidance by 1.1%. Previously, it guided adjusted home sales gross margin to be 27.7% for 3Q24. This outperformance against guidance was driven mainly by increased efficiencies in home building operations and a favourable mix of delivered homes. TOL’s 3Q24 adjusted net income margin contracted modestly to 13.7%. As a result, for the quarter, TOL reported adjusted diluted EPS of $3.60 vs. the previous period’s $3.73.

Due to its robust 3Q24 results, TOL is raising its FY2024 guidance. Starting with home deliveries, guidance has been increased to be between 10,650 and 10,750 with an average price of $975,000. As a result, home sales revenue is forecast to be between $10.4 billion and $10.5 billion. On to adjusted gross margins, guidance has been increased to 28.3%. The raising of guidance shows management’s confidence in the business outlook.

Author’s Chart

Relative Valuation Model

Author’s Relative Valuation Model

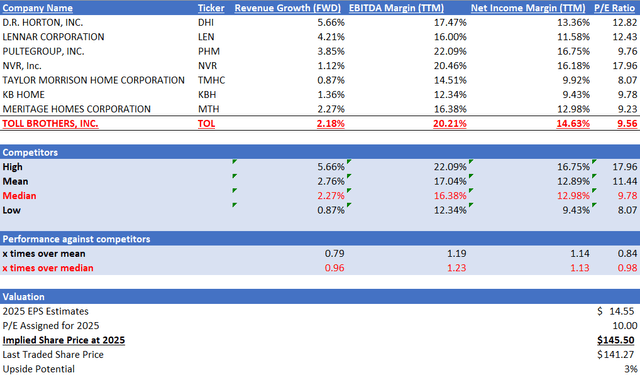

TOL operates in the homebuilding industry. In my relative valuation model, I will be comparing TOL to peers that operate in the homebuilding industry. I will be comparing their growth outlook and profitability margins trailing twelve months [TTM].

Starting with growth outlook, I will be comparing their forward revenue growth rate, as it is a forward-looking metric that will give us insights into their revenue trend for the next two years. Regarding growth, TOL is pretty much in line with its peers’ median as TOL has a forward revenue growth rate of 2.18% while peers’ median is 2.27%.

However, when it comes to profitability margins, TOL outperformed its peers’ median. For EBITDA margin TTM, TOL reported 20.21%, which is higher than peers’ median of 16.38%. This represents 1.23x over peers’ median. For net income margin TTM, TOL also outperformed its peers’ median, as it reported 14.63% while peers’ median is 12.98%. This represents 1.13x over peers’ median.

Currently, TOL’s forward non-GAAP P/E is trading 9.56x, slightly below peers’ median of 9.78x. However, given TOL’s outperformance in profitability margins, I argue that TOL’s P/E should be at least trading at peers’ median. Therefore, I will be setting my 2025 target P/E for TOL slightly above its peers’ median P/E at 10x to give credit to its stronger profit margins.

For 2024, the market revenue estimate for TOL is approximately $10.65 billion, while EPS is $14.59. For 2025, the revenue estimate increases to $11 billion, while EPS is $14.55. Taken together, TOL’s FY2024 raised guidance, and my forward-looking analysis as discussed supports the market’s estimate. Therefore, by applying my 2025 target P/E for TOL to its 2025 EPS estimate, my 2025 target share price is $145.50.

Risk and Conclusion

As discussed, TOL is placing emphasis on spec homes as a core part of their business strategy. The aim behind it is to capitalise on the demand for quicker homes. As a result, it is aiming for at least half of its business to consist of such homes. The downside risk is in relation to spec homes. During an economic downturn, it may have to lower the price of these homes rapidly in order to avoid having a lot of finished inventory on hand. When prices are cut, it will definitely have an impact on TOL’s financial and operating performance.

Looking ahead, it is strategically positioned to leverage the robust demand for housing, primarily driven by a lack of available housing and a favourable demographic. With its focus on spec homes, it is able to meet the needs of homebuyers who are looking for quick move-in options. Furthermore, it is disciplined in its land acquisition approach by applying stringent benchmarks to ensure that margins and returns align with its expectations. Together with its community expansion plan that will stretch into the years ahead, these strategic decisions and initiatives are expected to bolster TOL’s growth outlook.

Read the full article here