Savings

If you want to set yourself up for success in retirement, personal finance expert and “The Ramsey Show” co-host Rachel Cruze explains the top rule to help you get on the path to millionaire status. The expert joined FOX Business’ “Mornings with Maria” on Monday and provided advice when it…

Tens of millions of private-sector workers lack access to a retirement savings plan through their employer, which experts at the AARP Public Policy Institute warn could pose a significant burden to future taxpayers. The institute estimates that 57 million private sector workers in the U.S. – about half of the…

‘Tis the season to gather and give thanks without breaking the bank. High grocery prices and travel expenses may threaten to put a dent in this year’s holiday fun, but a full stomach doesn’t have to mean an empty wallet. Thanksgiving should be about fun, family and festivities, not stressing over…

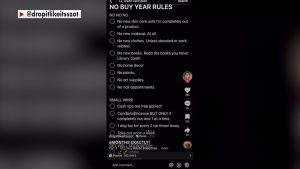

A Tiktok trend is encouraging people to save more money. It’s called the ‘no-buy year.’ The rules are simple. Make a list of the non-essential items you will not spend money on for a set length of time and stick to it. Many people start at the beginning of the year,…

July is often thought of as a time for home improvement projects, well-deserved vacations and leisurely day trips. In addition to these activities, financial pros say that the mid-year month of July is an ideal opportunity to assess your financial situation so you’re better prepared for the rest of the…

Americans may be missing out on an essential college savings tool, according to a recent survey. Half of all adults saving for education don’t know about the benefits of using a 529 savings plan, and less than a quarter of them are using this financial tool to save for college,…

Millions of American young adults are graduating from college this season and beginning the next chapters of their lives. The ceremonial celebrations of graduations often come with receiving gifts of congratulations from family and friends. Many gifts are money.New grads may be tempted to spend their gift money — but…

Want to watch your money grow? A high-yield savings account allows your money to make money, with very little work from you. A high-yield savings account offers a higher interest rate on deposits made than a traditional savings account. Shortly after depositing into a high-yield savings account, you’ll see how much…

EXCLUSIVE: The founder and CEO of Bass Pro Shops, Johnny Morris, says that despite inflation, the hunting, fishing and outdoor sporting brand will remain focused on affordability heading into boating and fishing seasons. Inflation remains high at 3.4%, above the Fed’s 2% goal, though it dropped from its peak of…

Saving money all starts with a tangible goal. So, let’s start with $10,000 in one year. Saving money is challenging, with pressures to buy, buy, buy all around us, bills to pay and debts to eliminate. If you want to save $10,000 in a single year, it is going to require…