Written by Nick Ackerman, co-produced by Stanford Chemist.

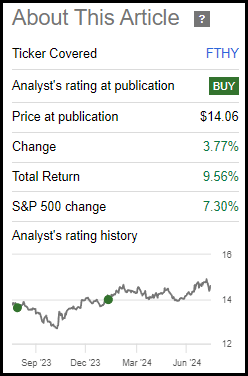

FIRST TRUST HY OPPORTUNITIES 2027 TERM (NYSE:FTHY) is a closed-end fund, or CEF, that provides investors with a high monthly distribution yield. The fund invests in both high-yield bonds and senior loans in an attempt to achieve that. The fund’s discount has narrowed since our prior update, which has helped to drive a meaningful total return during this period.

FTHY Performance Since Prior Update (Seeking Alpha)

That discount narrowing has pushed this fund to a ‘Hold’ rating within our target discount/premium parameters of -8% to 0%. With a fiscal year ending in May, we’ve now received the latest fiscal year 2024 annual report to give a look at the latest figures.

FTHY Basics

- 1-Year Z-score: 1.76.

- Discount/Premium: -4.52%.

- Distribution Yield: 10.69%.

- Expense Ratio: 1.82%.

- Leverage: 15.62%.

- Managed Assets: $665.8 million.

- Structure: Term (anticipated liquidation around August 1st, 2027).

FTHY’s investment objective is “to provide current income.” They intend to do this by:

“investing at least 80% of its Managed Assets in high yield debt securities of any maturity that are rated below investment grade at the time of purchase or unrated securities determined by the Advisor to be of comparable quality. High-yield debt securities include the U.S. and non-U.S. corporate debt obligations and senior, secured floating-rate loans (“Senior Loans”).”

FTHY comes with a relatively high expense ratio, but it has come down a touch from the 1.86% we saw at the end of fiscal 2023. The fund continues to use a rather modest amount of leverage, with an effective leverage ratio of 15.62%. With the leverage costs, the total annual expense ratio climbs to 3.34%. That was up from the 3.05% we saw in the prior year.

While leverage costs have risen on borrowings, as had been a headwind for many CEFs, FTHY was relatively sheltered. The expense ratio climbed higher, but thanks to the sleeve of senior loan investments, the fund was naturally hedged to a degree from experiencing that headwind as sharply.

Of course, it is always worth noting that any amount of leverage is going to add relatively more volatility and more risk.

Discount Narrowing Leads To A “Hold”

One of the main attractions of investing in closed-end funds, aside from the relatively higher distribution yields they often pay, is exploiting opportunities in discount/premiums of funds. In this case, investors were able to participate in some meaningful upside, enough to beat out the S&P 500 Index (SP500) since our last update, specifically because of the discount narrowing during this period.

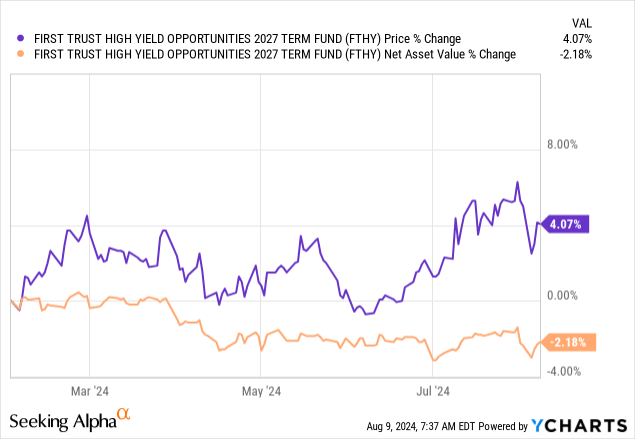

NAV actually fell slightly during this time while the share price was heading higher. The below is for share price and NAV movements only, not including distributions during this period. That’s why we see a difference from the opening chart, where total share price returns were 9.56% during this time.

YCharts

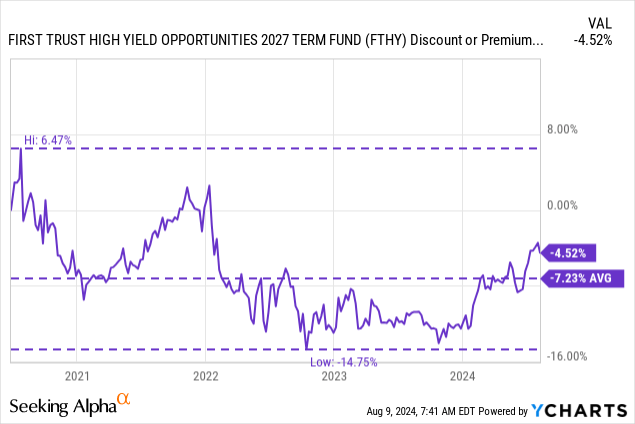

With that movement, it has pushed the fund to a level where it can still be a decent “Hold” candidate, but we wouldn’t be buyers here. The fund launched in mid-2020, so we are starting to get a decent historical track record on this name now in terms of looking at longer-term averages having some meaning.

YCharts

With an anticipated termination date in mid-2027, there is some potential alpha opportunity here. Annualized, that works out to 1.87%, but we still have around 2.4 years left-which is plenty of time for a lot to happen.

As is quite common, the other caveat applies here that the Board can, without shareholder approval, extend the termination for up to six months. It is also possible the Board could propose a conversion to a perpetual fund, but that would require shareholder approval.

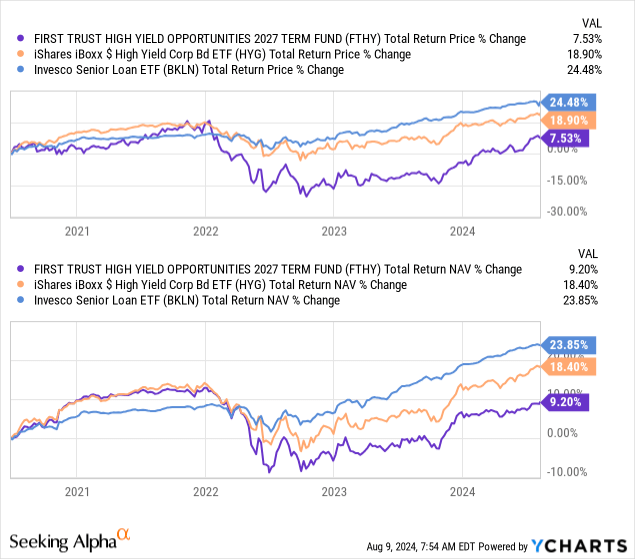

Since the fund’s inception, it has meaningfully underperformed what could be considered two of its benchmarks in the iShares iBoxx $ High Yield Corporate Bond ETF (HYG) and Invesco Senior Loan ETF (BKLN). More appropriately, it would be a blending of these two investible ETFs with a significant tilt more toward HYG over BKLN.

YCharts

That said, as the fund was leveraged heading into a more difficult time for fixed-income investments-as well as going to a discount shortly after launching, which is generally how CEFs work-this would be somewhat expected. So, there really is no surprise here, but over the last year, things have been looking quite a bit different.

After rates have been more stable and risk-free, rates actually decline, that’s helped provide some relief to the fixed-income space. Over this period, FTHY has been much more competitive in terms of total NAV returns. Even more importantly, on a total share price basis, has blown both HYG and BKLN away by a significant margin.

YCharts

That’s a great example of the discount/premium mechanic being exploited successfully in CEFs.

Distribution – Continuing To Watch Coverage

The fund comes with an appealing monthly distribution, with a current rate of 10.69% and on an NAV basis working out to 10.21% currently.

FTHY Distribution History (CEFConnect)

However, as we noted previously, the distribution coverage here isn’t that great. The fund’s higher expense ratio is one of the factors hindering better coverage, as the more the fund pays in operating expenses, the less there is left over for shareholders.

Unfortunately, it appears that coverage has slipped a bit further, even with this latest report. NII coverage came in at around 56%, which was a decline from nearly 60% in fiscal 2023.

FTHY Financial Metrics (First Trust)

Watching coverage is important to know how much of the yield here is actually being covered versus not. The portion that isn’t being covered is going to naturally erode assets and make it even more difficult to achieve the same payout over time. Besides some portfolio turnover, that can shake up the income-generation ability of the portfolio, seeing a decline over the last year could be some of that erosion at play.

On a bit of a brighter note, though, the fund has seen some realized and unrealized appreciation in the fund. That was clawing back some significant declines seen during 2022 and 2023 when the Fed was raising rates aggressively.

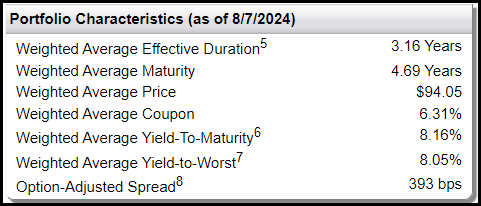

The fund carries a sizeable sleeve of high-yield bonds, coming with fixed rates that could allow for some further upside appreciation when the Fed starts cutting rates. The fund’s weighted average effective duration comes to 3.16 years, which means for every 1% change, the underlying should also move about 3.16%. At this point, it is highly anticipated that September will be the first rate cut, with more to follow over the next year.

In terms of tax characterization of the distribution, we aren’t seeing anything too surprising here. With a lack of coverage, we are seeing the return of capital in the distribution, and this has largely been a “destructive ROC.” Even over the last fiscal year, when the fund was able to generate NII and capital gains of $1.47, that still fell shy of the $1.56 distributed. The portion that isn’t classified as ROC will be ordinary income, which is also expected given the fixed-income underlying portfolio.

FTHY Distribution Tax Classification (First Trust)

Unless there is a distribution cut, we should expect more of the same going forward.

FTHY’s Portfolio

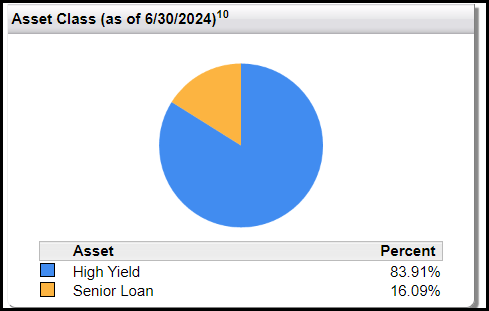

The management here has been fairly active in the latest FY, with a portfolio turnover rate of 52%. That was up from 35% and 39% seen in the prior two fiscal years. Overall, the fund continues to focus primarily on a high allocation to high yield over senior loan exposure. The weightings here were quite similar to where they landed at the end of last year, with 82.02% and 17.95% allocations.

FTHY Asset Allocation (First Trust)

Besides FTHY’s own somewhat more shallow discount these days, the fund’s underlying portfolio also presents its discount. That is, the underlying portfolio of securities trades below their own par value, which currently is listed at $94.05.

FTHY Portfolio Characteristics (First Trust)

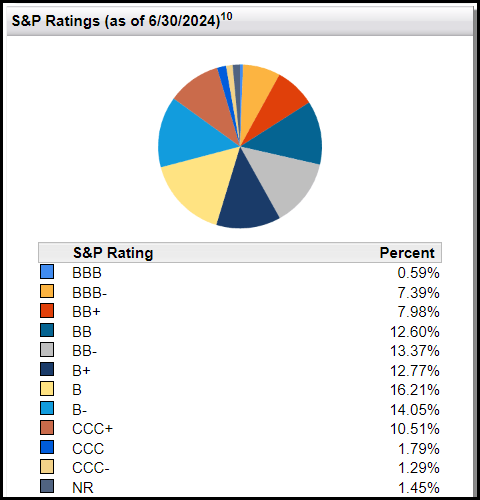

Fixed-income securities can often trade at discounts, especially those in the below-investment-grade or “junk” rating category, to reflect the expectation for some losses.

FTHY Portfolio Credit Rating (First Trust)

That’s because when you invest in this category, it is never a question of “if” there will be defaults and bankruptcies, but a question of “when” and “how many” might occur. That’s why being highly diversified can be beneficial so that no individual security can cause too much damage should things go sideways.

With the next portion of the economic cycle naturally going to be a slowdown, we should expect those to tick higher going forward. We’ve already seen default rates rise from the historically low levels we saw in 2022 and 2023. That said, S&P Global Ratings expects defaults to ease a touch going forward relative to where we have been.

Defaults should slow down in the coming months following a recent rise, according to S&P Global Ratings, which forecasts the rate of US speculative-grade defaults in the previous 12 months to cool to 4.5% by March 2025 from a rate of 4.71% in May 2024. Slower economic growth and high interest rates that force companies to refinance debt at greater cost continue to pressure companies, according to the rating agency.

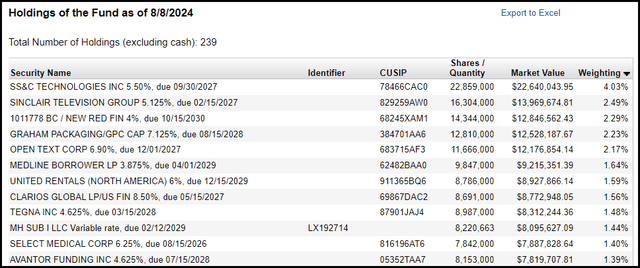

Of course, anything can happen. Projections and estimates can change rapidly based on any new information. In the case of FTHY, they list 239 total holdings, not counting cash. That’s actually on the lower end compared to what we can often see from their other high-yield-focused peers. For some quick examples, HYG lists 1241 and the similar CEF, BlackRock Corporate High Yield Fund, Inc (HYT), also lists 1125 holdings.

FTHY Top Ten Holdings (First Trust)

The weightings of each holding also show that several top positions carry a fairly sizeable weight, too. That could leave them potentially a bit more vulnerable relative to some peers when we get to a slower economic period.

On a side note, I’ve never seen a CEF provide a daily holding list before. It’s not a bad thing to provide, either, as we see many ETFs provide this.

Conclusion

FTHY has seen its discount narrow since our previous update, taking it out of the range of being a buy candidate. However, with some discounts available, it isn’t really overpriced either.

A negative for the fund is that the distribution coverage remains weak. Without a distribution adjustment or some significant change in the underlying portfolio, that doesn’t look set to change soon, either. There is potential for capital gains going forward, but even with that, coverage could remain rather weak.

That said, with a potential termination date coming up in around 3 years, this fund could be worth watching a bit more closely. Should we see some increased volatility in the coming year or two, that could shake up the fund’s valuation to drop to a deeper discount. Therefore, creating a potential opportunity for a discount that could be realized.

Read the full article here