Thesis

The sentiment on Celestica (NYSE:CLS) by SA Analysts, Wall St and the Quant Rating system is overwhelmingly bullish:

Celestica Stock Ratings (Seeking Alpha)

However, I have more of a neutral view based on the following puts and takes:

- Growth expectations may be priced in

- Mix shift makes for a case of continued margin expansion

- Valuations leave little room for margin of safety

- Relative technicals signal caution near 12-monthly resistance

- Continued reduction in inventory days is an upside risk

Growth expectations may be priced in

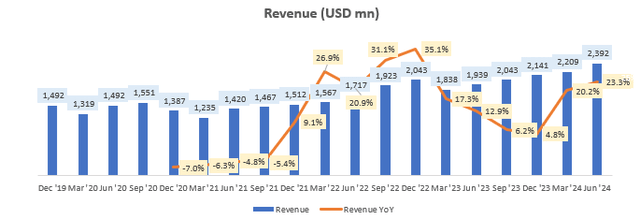

Celestica is growing at a good clip of 23.3% YoY. This is especially impressive considering the sequential comps base of 12.9% YoY in Q2 FY23 and 20.9% in Q2 FY22:

Revenue (USD mn) (Company Filings, Author’s Analysis)

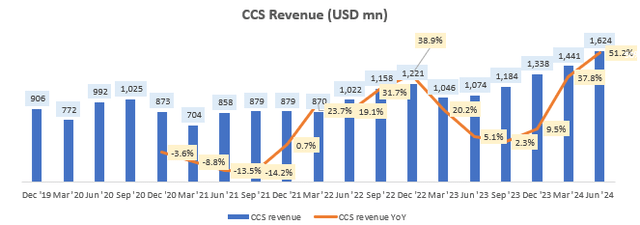

The company’s Connectivity and Cloud Solutions (CCS) segment, which makes up 68% of overall revenues, is the key driver of this growth:

CCS Revenue (USD mn) (Company Filings, Author’s Analysis)

In this segment, Celestica services hyperscaler customers such as Google (GOOG) (GOOGL) and Amazon (AMZN). The company’s hardware platform solutions (HPS) business sells networking products such as 800G switches, which supports high-speed (800 gigabits per second) Ethernet technology for data transmission. AI applications of compute increase the demand for these products due to the high throughput and low latency features necessary for handling large data transfers. In terms of outlook, management shared a rosy outlook driven by a higher number of data centers:

…we’re actually seeing accelerated demand for our HPS networking products and those are actually filling in nicely in the back half of the year and expect it to also fill in through all of 2025 as use cases for our networking products increase across all of our hyperscale customers. What we’re seeing now is a move towards more distributed regional data centers due to power constraints. And when you have that, you actually have an increased requirement for networking products.

– CEO Robert Mionis in the Q2 FY24 earnings call

Thus, logically, it is reasonable to expect continued strong growth in the company. Now at the margin, what matters for investors is whether these expectations are yet to be priced in as that would open up an opportunity for returns in the stock.

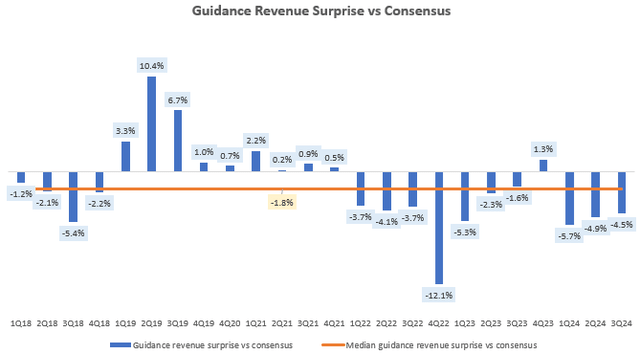

Guidance Revenue Surprise vs Consensus (Capital IQ, Author’s Analysis)

Looking at the guidance revenue surprises, however, I notice that the company has generally missed consensus expectations for the revenue guidance shared over 10 of the last 11 quarters. This makes me think the strong growth outlook may already be reflected in consensus expectations, leaving limited room for a bullish variant perception.

Mix shift makes a case for continued margin expansion

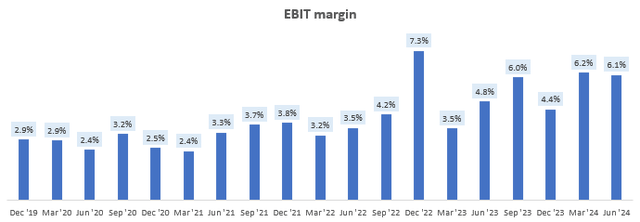

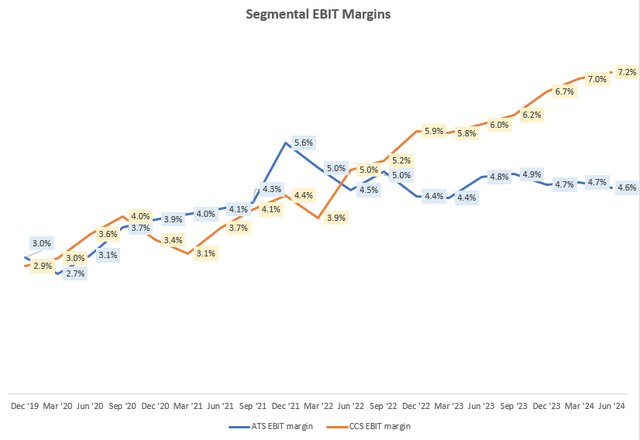

Since Q1 FY22, the revenue mix of CLS’ CCS segment has structurally increased from 55.5% to 67.9% now in Q2 FY24. Over this same time period, EBIT margins have stepped up from 3.2% to 6.1%:

EBIT Margin (Company Filings, Author’s Analysis)

This is mostly due to consistent margin expansion in the CCS segment from 3.9% to 7.2%:

Segmental EBIT Margins (Company Filings, Author’s Analysis)

The reason for this margin expansion is that the work Celestica does with hyperscalers in HPS commands much higher margins:

One is margins with the hyperscalers in totality are accretive to our margins in CCS. And then margins in HPS are also accretive to overall CCS. And so the dynamic that you’re seeing right now with hyperscalers continuing to grow and with our HPS revenue also continuing to grow, that’s helping pull margins up right now.

– CFO Mandeep Chawla in the Q2 FY24 earnings call

I estimate hyperscaler HPS margins to be in the mid-high teens, since management has shared that it is below 20% in the latest earnings call. More importantly, I expect the revenue mix shift arising from the accelerated demand from this customer group to expand margins further toward 10% over the next few years.

Valuations leave little room for margin of safety

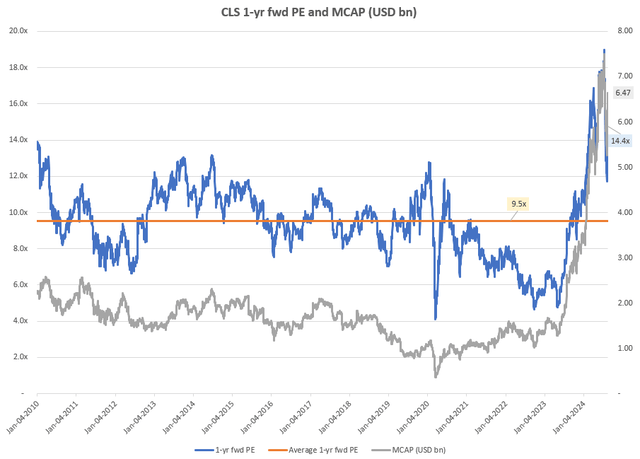

Today, CLS stock trades at a 1-yr fwd P/E of 14.4x; a 51% premium to the longer-term average of 9.5x:

CLS 1-yr fwd PE and MCAP (USD bn) (Capital IQ, Author’s Analysis)

Whilst I acknowledge that some premium is well-warranted due to the higher growth and margin profile today and likely in the future, I would be more comfortable with a lower 25% premium. This is because Celestica’s revenue streams are still subject to higher volatility based on product mix changes. Customer concentration is also very high, with 2 hyperscalers (my guess is Google and Amazon) making up 32% and 12% of total revenues respectively.

Relative technicals signal caution near 12-monthly resistance

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

Relative Read of CLS vs SPX500

CLS vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

The momentum in the relative technical chart of CLS vs the S&P500 (SPY) (SPX) is clearly bullish. However, I note that the ratio prices are not right at a key 12-monthly (yearly) resistance level. This makes me a bit cautious of initiating new buys right at this major resistance. Ideally, to have more confidence of upside continuation, I would like to see a sustained breakout of this level or a small pullback and another strong thrust challenging the key resistance level.

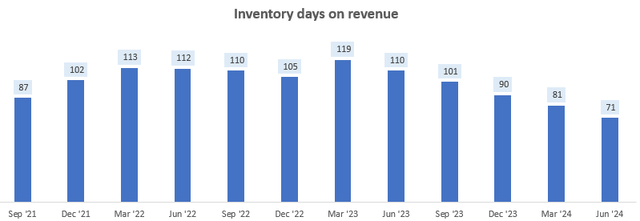

Continued reduction in inventory days is an upside risk

Celestica’s inventory level intensity has been steadily dropping over the past 5 quarters:

Inventory Days on Revenue (Company Filings, Author’s Analysis)

Management attributes this to broad-based stabilization in lead times:

…we’re seeing nice progressions in both ATS and CCS. From a macro perspective, lead times are starting to stabilize, still a little bit elevated

– CEO Robert Mionis in the Q2 FY24 earnings call

What caught my eye was the comment that lead times may still be a little elevated, thus indicating scope for further reduction ahead, which should be even better for inventory efficiency.

Takeaway & Positioning

I notice that the sentiment on Celestica is very bullish. No doubt, investors who have been able to enter the stock and ride the alpha-generating rally since 2020 have much reasons to rejoice.

However, on an incremental outlook basis, I am adopting a more cautious stance on the stock. This is because despite powerful longer-term growth drivers from hyperscaler customers, quarterly data on the guidance miss vs consensus expectations suggests that the market may be pricing in a lot of the bullish growth expectations. That said, I believe the hyperscaler-led growth also gives scope for the company to continue sustainably growing margins toward 10% over the longer term.

On the valuations side, CLS trades at a 51% premium to its longer-term average 1-yr fwd P/Es. I deem this to be a bit too high, especially when considering high customer concentration and the volatile nature of revenue product mix. I believe a 25% or lower premium would make the stock’s valuation more attractive.

Technically, relative to the S&P500, CLS/SPX500 is at a major yearly resistance level, which gives another reason to be cautious of initiating new buys in the hopes of continued alpha generation in the stock.

Rating: ‘Neutral/Hold’

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence. I also have a net long position in the security in my personal portfolio.

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Read the full article here