Investment overview

I wrote about Chegg Inc. (NYSE:CHGG) previously (14th May 2024) with a hold rating as I wanted to see evidence that CHGG is able to grow its subscribers and that growth can inflect upwards. I remain hold-rated for CHGG as there are still no major signs of improvement that convince me that growth can accelerate from here.

2Q24 earnings (announced on 5th August)

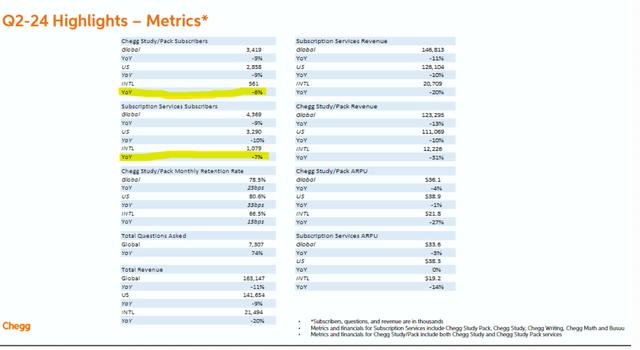

It was a very disappointing set of 2Q24 results. Total revenue saw $163.1 million, which was an acceleration in y/y decline (from -7.1% in 1Q24) to -10.8% this quarter. Once again, the poor performance was led by the subscription services revenue, which saw -11.5% growth (an acceleration from -8.5% in 1Q24) to $146.8 million. Profit metrics also fared poorly across the board: adj gross margin fell by 120 bps y/y, adj EBITDA margin fell by 570 bps y/y, and adj net margin fell by 470 bps.

Improvements made not translating to subscribers growth

I do give credit for the success it has seen with its new GenAI features, which have translated to some positive improvements. CHGG noted another quarter of improving retention rates. In the new metrics disclosed (refer below), there was a 23 bps of y/y retention improvement in total CHGG Study and CHGG Study Pack to 78.5% monthly retention rate (33 bps of improvement in the US to 80.6% monthly retention rate, and 15 bps y/y improvement in international subscribers to 66.5% monthly retention rate).

Management is also planning to roll out additional AI innovations, including AI-enhanced learning aids, a Next Best Action feature, a Starting Point feature (study tool recommendations), and a Stay on Track feature (organization and task completion). The idea is that these will improve the personalization of the CHGG learning experience, which should further improve retention rates and grow subscribers. Furthermore, things are in the works to enhance CHGG’s top-of-funnel awareness by extending marketing across TikTok, Instagram, on-campus, Discord, Chrome extensions, and other distribution channels and partners over time.

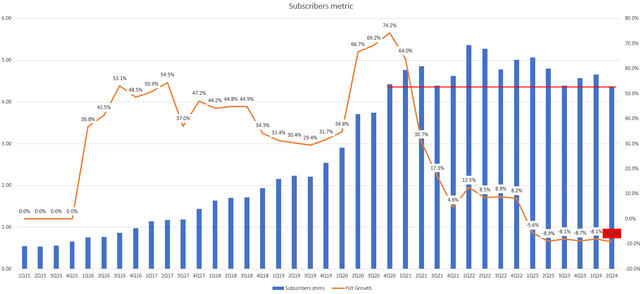

May Investing Ideas

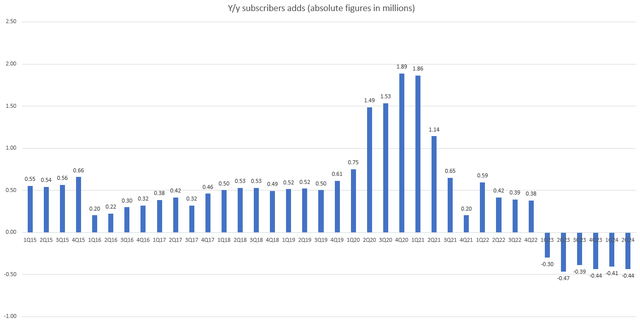

Now, all of these are good initiatives and sound really good on paper, but what I am not seeing is improvement in subscribers’ growth. If we take a step back and ignore all the “noise” from improvements in retention and whatnot, the reality is that the CHGG reported an acceleration in subscribers’ losses. 2Q24 saw a -9.1% y/y decline in the number of subscribers, the worst it has ever seen over the past 4 years.

May Investing Ideas

This tells me that CHGG efforts and GenAI efforts are not good enough. Sure, it might improve retention rates by a few bps, but it doesn’t matter because they are still losing subscribers at an alarming rate. If you look at the first chart above, you might think that it’s not so bad because the business used to grow its subscriber count by >30%, and the total number of subscribers is still above the pre-covid level. I beg to differ because CHGG is losing ~440k subscribers y/y per quarter, and this is despite all the efforts made. If this 440k subscriber loss holds for the coming quarters, the y/y subscriber loss (in percentage) is going to accelerate.

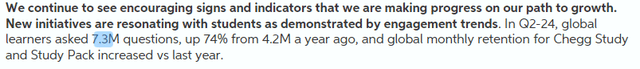

I also point out another data point to show that CHGG GenAI efforts may have peaked. Management noted that engagement rates have improved strongly compared to last year, as the total number of questions asked has grown by 74% y/y to 7.3 million in 2Q24. This seems strong, but this is a deceleration from 1Q24, which saw 9 million questions asked. This is puzzling to me because we should see strong sequential acceleration given that it is a new feature (adoption should ramp up over time). What I worry is that the learners have tested out the product a few times, which explains the spike in questions asked, but have found that it is not as good as it seems (which explains the sequential drop). If this is true, then CHGG may be in a lot more trouble than I initially thought (note that 2Q23 saw sequential improvement from 1Q23).

CHGG

To give you a sense of how quickly this is scaling in Q1 of this year, we had over 9 million questions asked, compared to 3.9 million questions asked at the same time last year. Company 1Q24 earnings

International expansion doesn’t seem to be working

The hope is that CHGG is able to rejuvenate subscriber growth by venturing overseas. The current plan is to roll out CHGG’s first fully localized app, to be rolled out in Mexico at the end of September. This will be the model for additional localization efforts in targeted countries, including Canada, Australia, the UK, Turkey, and South Korea. This is a good effort that I applaud. However, I am not sure how effective this will be since the newly disclosed metric slide on page 6 (of the earnings presentation) shows that international subscribers are falling by a mid-to-high single-digit percentage (which means the product isn’t seeing a strong demand at all). Given that CHGG is not even doing that well in the US, I don’t have high confidence that it will be able to do well internationally. Hence, I remain sceptical if this will lead to subscriber growth.

CHGG

Valuation

Given no major improvements to operating performance, I simply don’t see a convincing reason for investors to invest in CHGG today. I am not saying that the efforts made by management are not working. It is just that there is no compelling evidence to show that it is working. The stock currently trades at just 2x forward earnings, down from its past 3-year average of 16x forward PE, which I think clearly reflects the lack of confidence the market has. If CHGG continues to show disappointing subscriber metrics, I think there is a good chance for valuations to continue falling. The recent post 2Q24 share price action is good proof that the market is willing to further punish the stock.

The reason I am not giving a sell rating is because if CHGG does show positive inflection, the stock could see a violent rerating upwards as the market starts to price in a recovery. Given that the average multiple is at 16x, there is a lot of room for valuation to rerate upwards.

Conclusion

I give a hold rating for CHGG. Despite commendable efforts in enhancing its platform (improvements in retention rates are encouraging) the core issue of declining subscribers persists. The deceleration in question growth, which I see as a key indicator of product engagement, also raises further concerns. While the stock trading at a historically low valuation, until concrete evidence of a turnaround emerges, the share price is not going to go up.

Read the full article here