This article is part of a series that provides an ongoing analysis of the changes made to David Abrams’ 13F portfolio on a quarterly basis. It is based on Abrams’ regulatory 13F Form filed on 08/09/2024. Please visit our Tracking David Abrams’ Abrams Capital Management article for an idea on his investment philosophy and our last update for the fund’s moves during Q1 2024.

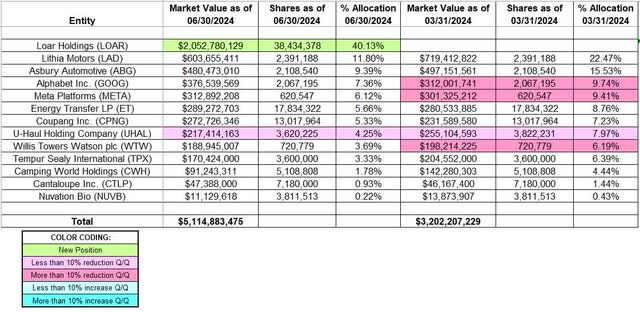

This quarter, Abrams’ 13F portfolio value increased from $3.02B to $5.11B. The number of holdings increased from 12 to 13. The top three stakes are at ~61% of the 13F portfolio while the top five holdings are at ~75%.

New Stakes:

Loar Holdings (LOAR): LOAR is currently the largest position in the portfolio at ~40%. Loar Holdings had an IPO in April priced at $28 per share. Shares started trading at $45 and currently go for $61.45.

Note: Abrams Capital Management owns ~43% of the business.

Stake Decreases:

U-Haul Holding Company (UHAL): UHAL is a ~4% position purchased in Q4 2016 at prices between $31 and $37 and increased by ~160% the following quarter at prices between $37 and $39. There was a ~45% increase in Q2 2017 at prices between $34 and $39 and that was followed with a similar increase in H1 2018 at prices between $32 and $38. Q4 2021 saw a ~20% reduction at prices between ~$65 and ~$76. The stock is now at $68.65. There was a ~6% trimming in the last quarter and that was followed by a ~5% trimming this quarter.

Kept Steady:

Lithia Motors (LAD): LAD is currently the second largest position at ~12% of the portfolio. It was established in Q2 2018 at prices between $95 and $105 and almost doubled the next quarter at prices between $81 and $99. The stock is now at ~$282.

Note: Their ownership stake in Lithia Motors is at ~9%.

Asbury Automotive (ABG): ABG is a top three ~9% position established in Q3 2017 at prices between $50 and $62 and increased by ~45% in Q3 2018 at prices between $67 and $77.50. The next quarter saw another 20% stake increase at prices between $59 and $72. Q1 2020 also saw a ~11% stake increase at an average cost in the high 40s. The stock currently trades at ~$234.

Note: Their ownership stake in the business is ~10%.

Alphabet Inc. (GOOG): GOOG is a large 7.36% of the portfolio position purchased in Q2 2018 at prices between ~$50 and ~$59. There was a ~20% stake increase in Q1 2020 at prices between ~$53 and ~$76. Q4 2022 saw a ~20% selling at prices between ~$83.50 and ~$105. The stake was decreased by 11% in the last quarter at prices between ~$133 and ~$155. The stock is now at ~$165.

Meta Platforms (META): META is a large (top five) 6.12% portfolio position purchased in Q4 2018 at prices between $124 and $163. Q1 2020 saw a ~18% stake increase at prices between $146 and $223. Q4 2022 saw another ~80% stake increase at prices between ~$89 and ~$140. There was a ~47% selling during Q2 2023 at prices between ~$208 and ~$289. That was followed by a ~18% reduction in the next quarter at prices between ~$283 and ~$325. Q4 2023 also saw a ~23% selling at prices between ~$288 and ~$358. The stake was decreased by 13% in the last quarter at prices between ~$344 and ~$512. The stock currently trades at ~$518.

Energy Transfer LP (ET): The 5.66% ET stake was established in Q1 2020 at prices between $4.55 and $13.75. There was a ~64% stake increase in Q3 2020 at prices between $5.40 and $7.15 while in Q4 2022 there was a ~20% selling at prices between ~$11 and ~$12.75. The stock is now at $15.66.

Coupang Inc. (CPNG): The 5.33% CPNG stake was purchased in Q3 2021 at prices between ~$27 and ~$44.50. The next quarter saw a ~120% stake increase at prices between ~$25.50 and ~$30.50. That was followed with a ~40% stake increase in Q1 2022 at prices between ~$15.50 and ~$28.75. The stock is now at $22.59.

Willis Towers Watson plc (WTW): WTW is a 3.69% position purchased in Q1 2017 at prices between $117 and $133. Since then, the activity had been minor. Q4 2022 saw a ~25% selling at prices between ~$201 and ~$248. The stake was decreased by 11% in the last quarter at prices between ~$238 and ~$277. The stock is now at ~$277.

Tempur Sealy International (TPX): TPX is a 3.33% of the portfolio stake established in Q3 2021 at prices between ~$37.50 and ~$49.60 and the stock currently trades at $49.87.

Camping World Holdings (CWH): CWH is a 1.78% position purchased in Q3 2018 at prices between $19 and $27 and increased by two-thirds in the next quarter at prices between $11.25 and $22.50. Q2 2019 saw a ~30% stake increase at prices between $11 and $13 per share. Q4 2019 also saw a ~12% stake increase at ~$7.90 per share while in Q3 2020 there was a ~12% reduction at ~$37.50. The stock is now at $19.93. They control ~12% of the business.

Cantaloupe Inc. (CTLP): The small 0.93% CTLP position was purchased in Q1 2021 at prices between ~$9.45 and ~$12.45. Q1 2022 saw a ~50% stake increase at prices between ~$6.50 and ~$8.75. That was followed with a ~130% increase during Q1 2023 at prices between ~$4.35 and ~$6.20. The stock is now at $6.73.

Note: They own ~10% of the business.

Nuvation Bio (NUVB): Panacea Acquisition merged with Nuvation Bio in a de-SPAC transaction that closed in February 2021. The stake was established during that quarter when it traded between ~$9 and ~$14.60. It currently trades at $2.83, and the stake is at 0.22% of the portfolio.

The spreadsheet below highlights changes to Abrams’ 13F stock holdings in Q2 2024:

David Abrams – Abrams Capital Management Portfolio – Q2 2024 13F Report Q/Q Comparison (John Vincent (author))

Source: John Vincent. Data constructed from Abrams Capital Management’s 13F filings for Q1 2024 and Q2 2024.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here