Welcome to another installment of our CEF Market Weekly Review, where we discuss closed-end fund (“CEF”) market activity from both the bottom-up – highlighting individual fund news and events – as well as the top-down – providing an overview of the broader market. We also try to provide some historical context as well as the relevant themes that look to be driving markets or that investors ought to be mindful of.

This update covers the period through the fourth week of July. Be sure to check out our other weekly updates covering the business development company (“BDC”) as well as the preferreds/baby bond markets for perspectives across the broader income space.

Market Action

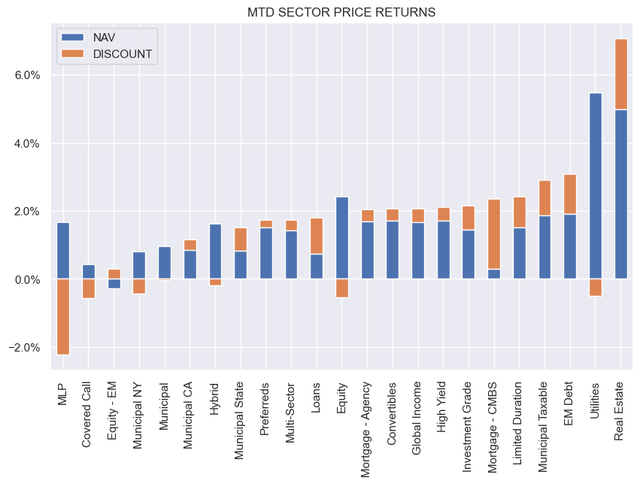

The week was mixed for CEFs with a high level of volatility. Convertible funds underperformed while Munis gained. Month-to-date, all but a handful of sectors are still in the green.

Systematic Income

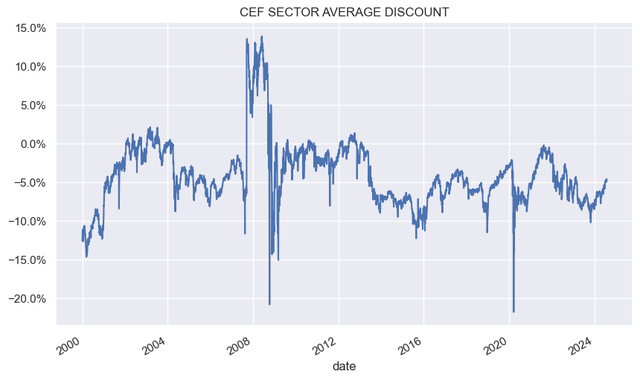

The average CEF sector discount continued to tighten steadily and looks slightly rich relative to the last decade.

Systematic Income

Market Themes

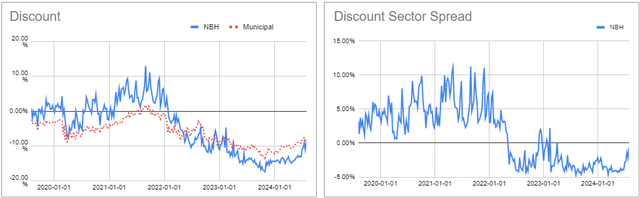

Neuberger Berman hiked the distribution of its Muni CEF (NBH) by 43%, resulting in a distribution rate of around 6%. The manager is late to the Muni CEF distribution hike party but it has caught up quickly. It is very clear in the press release that the hike is all about the fund’s “competitiveness” and increased demand in the secondary market. It goes without saying that this has nothing to do with a change in its net income. This appears to have worked as the fund’s discount differential to the sector average has narrowed quickly.

Systematic Income CEF Tool

There is obviously a self-defeating process happening. The initial hikes in the Muni sector from Nuveen and BlackRock were largely all about thwarting Saba’s takeover attempts by attempting to tighten the discounts. When that happened, the other funds did not want to be left behind and hiked their distributions as well. Obviously, if all the sector funds’ distributions move higher then the first movers no longer stand out.

The second problem with the hikes is that they are not a strong lever for discount tightening. Investors still remember the poor returns from 2022 and are less keen to buy the funds. Others are aware that leverage costs are still very high and the funds’ net income is not particularly efficient and has not improved a whole lot.

The overall case for Muni CEFs is still pretty strong however it has nothing to do with the artificial distribution hikes. If anything the distribution hikes could backfire once investors start seeing a lot of ROC in the distribution.

Market Commentary

Nuveen preferred term CEF (JPI) shareholders approved its proposal to potentially turn the fund into a perpetual CEF. The fund commenced its tender offer which will expire on 14-Aug. It’s important to tender all shares for those with a position as otherwise the fund’s discount will widen out if there are enough assets (>=$70m) for it to remain outstanding as a perpetual fund. It may then be merged into JPC which swallowed two other Nuveen preferred CEFs and trades at a 5% discount.

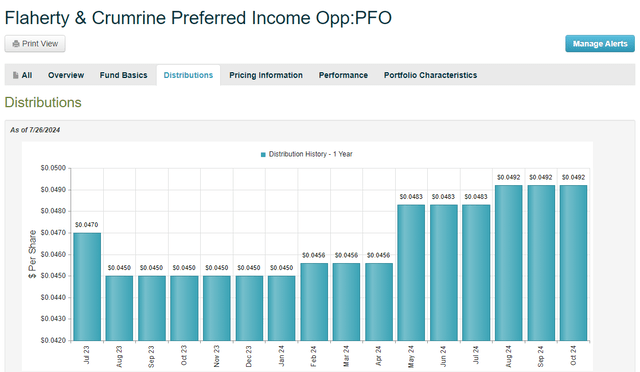

Flaherty preferred CEFs raised distributions once again, albeit by a small amount. This is the third set of hikes since the initial allocation to PFO in the Income Portfolios.

CEFConnect

There are four possible reasons for the distribution raises. One, the funds are likely running a little ahead and boosting distributions on expectation that leverage costs will be coming down. Two, they may be rotating into higher-yielding securities. Three, they may be getting a net income boost from preferreds that are beginning to float and benefitting from the inverted yield curve. Four, the Flaherty managers may be aiming to push the relatively low distributions rates of their funds closer to that of the broader sector, in part to tighten discounts – a dynamic we have seen in the Muni CEF sector.

Tool Update

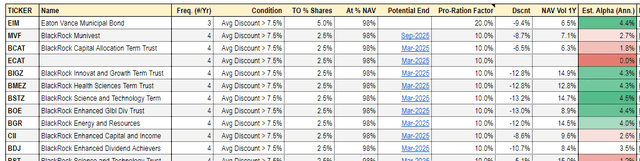

A new sheet was added to the service CEF Tool for interval / conditional tender offer funds. These funds offer periodic buybacks of their shares. It includes the familiar ones like RSF and EGF as well as the new conditional tender offer CEFs from Eaton Vance and BlackRock. EIM, RSF and MVF look fairly attractive as far as the additional alpha the funds can generate for shareholders through the tender offers. The last pro-ration factor (shares offered for buyback / tendered shares) for EIM was nearly 50% – a tremendous alpha boost. We use either conservative pro-ration factors for funds with recently established programs or the last ones available for more established funds like RSF and EGF.

Systematic Income CEF Tool

Check out Systematic Income and explore our Income Portfolios, engineered with both yield and risk management considerations.

Use our powerful Interactive Investor Tools to navigate the BDC, CEF, OEF, preferred and baby bond markets.

Read our Investor Guides: to CEFs, Preferreds and PIMCO CEFs.

Check us out on a no-risk basis – sign up for a 2-week free trial!

Read the full article here