Thesis:

Influencing the market with its IT management software, SolarWinds has been turning its focus toward integrated AI technologies and subscription-based models lately. As we speak, the strategic repositioning of SolarWinds is in line with the overall trend of automation solutions and recurring revenue streams in the IT sector. Hence, SolarWinds can improve operational efficiency and customer satisfaction while also intelligently managing potential data security risks and AI-generated solutions. Given these strategic moves, my outlook on SolarWinds is bullish.

Firm Description:

Donald and David Yonce, the co-founders of SolarWinds (NYSE:SWI), established the company in 1999. The firm is now a leading, trusted, and secure IT management software provider to over 300,000 customers worldwide, including 499 out of the Fortune 500 companies. A wide range of SolarWinds solutions, such as SolarWinds Hybrid Cloud Observability, Database Performance Analyzer, and SolarWinds Service Desk, are used by the company to develop IT operation solutions which are especially tailored and concentrated on a number of industries such as healthcare, finance, and government. Some of their major clients are Lockheed Martin, Mastercard, and ViacomCBS.

New Initiatives and its Associated Vulnerabilities

SolarWinds has implemented SolarWinds AI technology and Database Performance Analyzer capabilities to remain highly competitive. Their most substantial effort comes in the form of SolarWinds AI, which is an artificial intelligence (AI) engine that assists in the process of IT transition from traditional to new IT systems without the obstruction of manual intervention resulting in reducing resolution time by even up to 40%. This innovative AI engine, the SolarWinds Service Desk, introduces a brand new concept where it employs high-level algorithms and large language models, to automatize ticket resolution as well as the growth of the IT section, aiming to cut 35% of the downtime and the raise in the satisfaction of the employee by 20%.Moreover, SolarWinds has adjusted the Database Performance Analyzer to have more advanced PostgreSQL support. This will help companies optimize and adjust their databases, so that they can enjoy query performance that is up to 30% faster. However, the vulnerabilities in the system are one of the cons of this technology. According to Business Wire reports, the adoption of advanced AI technologies may bring risks to data privacy and security, particularly in the management of sensitive customer data, as well as the possibility of AI-driven decisions being subjected to possible attacks. In spite of SolarWinds’ AI by Design framework that contains characteristics like multi-factor authentication and role-based access control, there are concerns about data breaches and unauthorized access to sensitive information associated with the use of generative AI in IT service management. The implementation of security technologies together with continuous monitoring is the key to controlling such issues and keeping customers’ confidence at the right level. This is important because cyber criminals often utilize highly complex methods to attack AI-powered systems.

Stock price change

In Q1 2024, the SolarWinds earnings call is a great opportunity to illustrate SolarWinds’s financials trends. In Q1 2024, the company achieved a total revenue of $193.31 million, which represents a 4% increase compared to the previous year. The leading product segments were the drivers of sales, along with the shift to subscription models. The emphasis on shifting to subscription models and achieving a minimum conversion rate of 1.6x has significantly increased revenues while promoting customer retention and satisfaction. I see that despite the optimistic overall revenue results, SolarWinds’ net profit faced challenges, with net income fluctuating over the quarters. For instance, net income went from a loss of $5.62 million in Q1 2023 to a profit of $15.56 million in Q1 2024, indicating significant impacts from strategic investments and the fluctuating nature of income.

Seeking Alpha

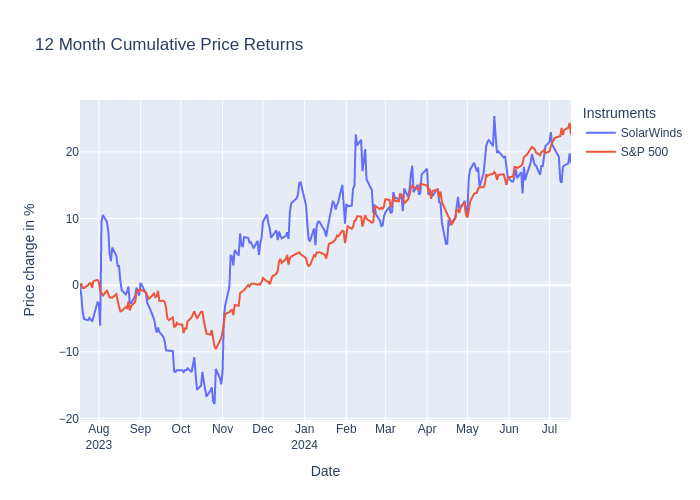

SolarWinds’ stock price change over the past 12 months is a true reflection of the company’s financial performance and strategic initiatives. There was a lot of volatility, with a price decrease from August to November, which was strengthened by a positive change and corrective action in December that resulted in the company finishing higher. This pattern signals the market’s reaction to SolarWinds’ decisions, which is consistent with the company’s improved profitability and revenue growth.

Rivals

SolarWinds competes in a market with many significant rivals such as Progress Software, Rapid7, and Appian, all of which hold strong positions in the industry, thus creating diverse competitive dynamics. Rapid7, a leading cybersecurity solutions provider, poses a serious challenge by focusing on security and IT operations, which are critical priorities for some of SolarWinds’ potential customers. Appian, known for its low-code automation solutions and sleek design, also competes directly with SolarWinds’ low-code platform. SolarWinds has an observability and analysis area with a wide customer base including such giants as Lockheed Martin, Mastercard, and ViacomCBS. This is a firm and stable basis for further development.

Forecasts for the Coming Year

With regard to the recent improvements including the adoption of SolarWinds AI and the upgrades to the Database Performance Analyzer, I am convinced that SolarWinds will experience significant expansion next year.. As the subscribers have the tendency to move towards a subscription-based service model and the market for AI solutions is enlarging, these innovations along with the strategic partnerships will be the key drivers of this boost. Nevertheless, competition will be a challenge that SolarWinds needs to address. This with the help of rapid innovation and appropriate marketing strategies in front of powerful competitors such as Progress Software, Rapid7, and Appian.

Currently, Revenue Growth (YoY) is at a level of 5.16% while Profit Growth (YoY) shows a value of -101.08%. The AI will still be able to direct cost reductions and efficiency improvements, as mentioned before in more detail. After investing in new technologies, I believe that profit growth may improve to around 9-10%. This is because, the company will not be required to reinvest such enormous sums of money as in the past, and this will influence the growth of profit in a positive way in the short term which is why I expect a reasonable positive number. Yet, some minor investments for adaptation and correction may still be required. This is why I do not expect a higher value than 10%. In light of the article’s evaluation, it is reasonable to assume that future revenue growth of the company will most likely be at the same level as it was in the past, approximately 5%.

Valuation

|

Gross Margin TTM |

PS ratio TTM |

PE Ratio TTM |

Growth revenue YoY |

Growth EPS YoY |

Revenue growth FWD (analysts estimate) |

Earnings growth FWD (analysts estimate) |

|

|

SolarWinds |

90.42% |

2.55 |

188.98 |

5.16% |

-101.08% |

4.29% |

8.53% |

|

Systems Software Industry (Median) |

49.23% |

3.11 |

32.09 |

3.26% |

1.56% |

6.77%c |

7.28% |

Source: Seeking Alpha. Retrieved on 07-18-2024.

The gross margin of SolarWinds, which is 90.42% is much higher than the industry median value of 49.23%, indicating that the firm has strong cost management and pricing strategies. At 2.55 P/S, the company’s P/S ratio indicates that the stock is undervalued against a 3.11 P/S sector median. However the high P/E ratio (188.98) compared to the sector median of 32.09 indicates that the stock is overvalued in terms of earnings. This contrasting data shows that the firm’s stock is cheap in terms of revenue but on the other hand, it is much more expensive when it comes to earnings, which may be caused by strong growth prospects or other factors that are influencing earnings. SolarWinds is foreseen by analysts as achieving a growth rate of 4.29% in revenue and 8.53 % in profit for the forthcoming year. The data included in my earlier estimations are slightly higher with these numbers. Because of this, I am foreseeing a slightly higher PS of 2.8 of and a PE of 190 as well. Therefore, I believe we should give it a “buy” status.

Closing Statement

Having said that, SolarWinds is a company that has positioned itself very well to keep on growing and being profitable due to these products, which bring innovations to the market, and to their strong emphasis on a subscription-based licensing model. Nonetheless, the company should address the difficulties that may be caused by data confidentiality and security, especially with AI technology being applied more and more. Also, it is already valued highly at the moment. However, the company is on the right path with initiatives like these, as the launch of SolarWinds AI and the provision of better database performance solutions will add a value proposition for customers and, in turn, benefit shareholders too. For this reason, my opinion is a little more bullish than neutral for now.

Read the full article here