Elevator Pitch

POSCO Holdings Inc. (NYSE:PKX) [005490:KS] stock is awarded a Buy rating. My earlier May 1, 2024 update reviewed PKX’s Q1 2024 financial results.

The current article analyzes POSCO Holdings’ recently announced capital return and growth plans. The stock’s potential shareholder yield for 2024 is now at a mid-single digit level after considering the company’s latest treasury share cancellation plan. Also, PKX aims to expand the top line for its battery materials business by an impressive +32% CAGR for the 2023-2026 time frame.

I upgrade my rating for POSCO Holdings from a Hold to a Buy, with the stock offering a favorable combination of yield (mid-single digit percentage shareholder yield) and growth (battery materials business’ long-term or 2026 revenue goal).

Share Repurchase and Cancellation of Treasury Stock Will Boost Shareholder Yield

Last Friday, POSCO Holdings published an announcement disclosing that the company will “buy back and cancel all newly purchased treasury shares worth KRW100 billion” this year. In the July 12, 2024 announcement, PKX also highlighted that it is targeting to “cancel treasury shares” worth KRW1.9 trillion or equivalent to “6% of outstanding shares” in the 2024-2026 time frame.

In other words, PKX aims to cancel roughly KRW2.0 trillion worth of its own shares in the coming three years. As such, POSCO Holdings’ potential forward annualized buyback yield is 2.3%. This is calculated by dividing the KRW2.0 trillion worth of shares targeted for buybacks and cancellation by the stock’s market capitalization, and then averaging it for the three-year period.

It is reasonable for the buyback yield metric to include the cancellation of treasury stock, as it isn’t the norm for Korean companies to cancel their treasury shares. A June 5, 2024 Korea Times news commentary indicated that “only 2.3 percent of companies in Korea retired their treasury stocks” unlike their US counterparts. This means that it is more appropriate to consider capital as being returned to shareholders when the repurchased shares are actually cancelled.

POSCO Holdings’ dividend policy assumes a “base dividend of KRW 10,000 per share” as indicated on the company’s investor relations page. Therefore, the sell-side analysts’ consensus FY 2024 dividend per share forecast of KRW10,075 (source: S&P Capital IQ) or slightly above the base dividend is realistic.

The stock’s consensus FY 2024 dividend yield is 2.6% based on the KRW10,075 per share dividend estimate, while its potential buyback yield for the current year is 2.3% as mentioned above. This translates into a reasonably appealing mid-single digit percentage shareholder yield (sum of dividend yield and buyback yield) of 4.9% for POSCO Holdings.

Lithium-ion Battery Materials Business’ Top-Line Expansion Goal

On July 12, 2024, PKX also issued a 6-K filing outlining its goal of realizing a KRW11 trillion top line for the company’s lithium-ion battery materials operations in 2026.

The company’s lithium-ion battery materials unit known as POSCO Future M [003670:KS] registered a revenue of KRW4.76 trillion in the most recent fiscal year or FY 2023. As such, POSCO Holdings’ KRW11 trillion top-line targets for its battery materials business is equivalent to a potential revenue CAGR of +32% for the FY 2023-2026 period. It will be fair to say that the battery materials unit will be a key medium-term growth engine for PKX.

Details Of The Company’s Battery Materials Facility Expansion Plans

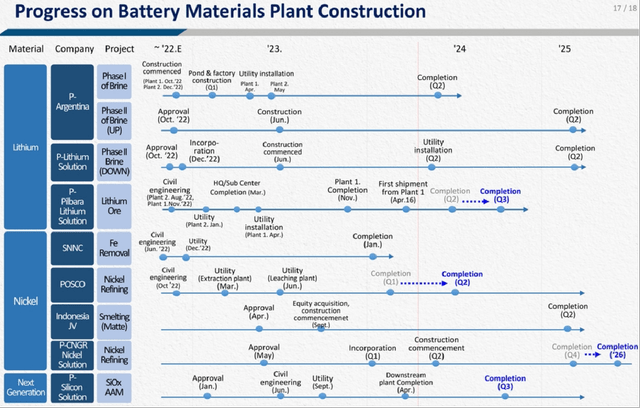

POSCO Holdings’ Q1 2024 Earnings Presentation Slides

As per the chart presented above, the company has plans in place to establish new battery materials manufacturing facilities. The targeted +32% top line CAGR for PKX’s battery materials business will be achieved by increasing the production capacity of its operations with these new facilities in the pipeline. According to a July 14, 2024 news article published in The Korea Economic Daily, the company intends to monetize “non-core assets and low-profit businesses” for KRW2.6 trillion to finance the expansion of its lithium-ion battery materials business.

The rise in revenue contribution from the lithium-ion battery materials business has two key positives for PKX.

One positive is that POSCO Holdings will become more diversified over time with a reduction in revenue concentration risks. PKX derived 82% of its FY 2023 revenue from its core steel production business. POSCO Holdings’ significant dependence on the company’s steel operations means that PKX’s overall financial performance is easily impacted by economic weakness (affecting steel demand) and oversupply in the steel market.

The other positive is that PKX is likely to command a more demanding valuation multiple with an increase in revenue exposure to the battery materials business. POSCO Future M, POSCO Holdings’ battery materials unit, is a separately listed entity that trades on the Korea Exchange with a consensus next twelve months’ Enterprise Value-to-Revenue multiple of 5.0 times (source: S&P Capital IQ). In comparison, the market currently values POSCO Holdings at a relatively lower consensus next twelve months’ Enterprise Value-to-Revenue ratio of 0.6 times. Based on the differences in valuations, it is clear that the market sees the battery materials business having better growth potential than the steel business.

Q2 2024 Results Preview

POSCO Holdings will reveal the company’s second quarter financial performance on July 25.

My view is that PKX’s Q2 results will be in line with expectations and there won’t be major negative surprises. The company’s core steel operations will most likely remain under pressure due to steel price weakness, but this is already reflected in its consensus financial forecasts.

A July 15, 2024 research commentary published by S&P Global highlighted that “China’s domestic steel prices might continue to fluctuate at lower levels, amid subdued steel demand and relatively strong steel production.” China is the biggest supplier of steel worldwide, so weak steel prices in the country will also impact the selling prices for POSCO Holdings’ steel products.

However, the negative outlook for the steel business is already reflected in PKX’s Q2 2024 consensus projections. As per S&P Capital IQ’s consensus data, POSCO Holdings’ top line and normalized EPS in KRW terms are projected to decrease by -7.4% YoY and -42.9%, respectively in Q2. This is pretty similar to the company’s actual -6.7% YoY revenue contraction and -48.4% YoY bottom-line drop for Q1 2024.

Risk Factors

There are a number of risks to watch regarding POSCO Holdings.

Firstly, the stock’s actual shareholder yield might be lower than expected, if the company doesn’t cancel its treasury shares as per its latest announcement.

Secondly, PKX could fail to meet its 2026 revenue target, assuming that it isn’t able to execute well on its asset monetization plans to finance the production capacity expansion initiatives for its battery materials business.

Thirdly, it is possible that POSCO Holdings’ second quarter results are a miss in the event that the company’s actual steel product selling prices are much lower than expected.

Concluding Thoughts

I rate POSCO Holdings as a Buy now, as the company’s shares have meaningful valuation re-rating potential. As mentioned earlier in this article, PKX’s listed battery materials business trades at a much higher Enterprise Value-to-Revenue multiple than its parent. Therefore, it is reasonable to think that POSCO Holdings’ Enterprise Value-to-Revenue metric can expand going forward with a higher top-line contribution from the battery materials operations. The recent decision to cancel KRW2.0 trillion of treasury shares, which will enhance the stock’s shareholder yield, is another valuation re-rating driver.

Read the full article here