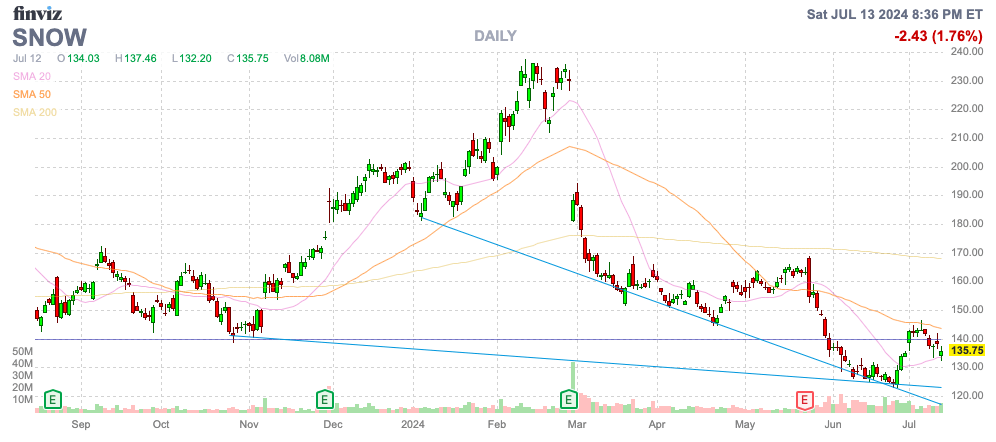

Snowflake, Inc. (NYSE:SNOW) has fallen to yearly lows and the company is starting to show some major cracks in the armor. The data cloud company is poised to benefit from AI, but the transition to incorporate AI features has led to uncertainty in future sales while costs rise. My investment thesis is Bearish on the stock, with other cracks forming in the armor due to cybersecurity issues and richly valued stock.

Source: Finviz

Major Cracks

Snowflake reported weak FQ1’25 results back in late May, with the company missing EPS targets. The AI data cloud company is investing aggressively to build AI features, leading to the higher costs from increased GPU-related costs for the AI initiatives, while the revenue benefits aren’t arriving now.

The AI enterprise software sector has seen numerous companies with expected benefits from AI not necessarily materializing as expected. From IBM (IBM) to Palantir Tech. (PLTR) to C3.ai (AI), the stocks soared on AI hype, but these companies haven’t actually seen much in the way of related revenue growth.

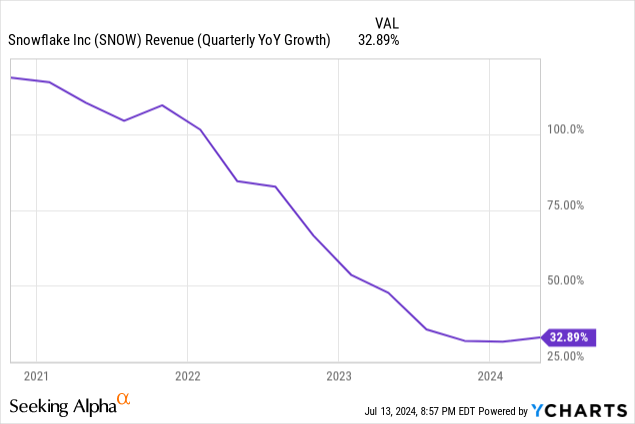

Snowflake appears to be seeing the reverse. The company has seen growth rates naturally dip from rates topping 100% back in FY22 to now the forecast for FQ2 sales growth to collapse all the way to 26% from the just reported solid 34% clip.

The company guided to FQ2 product revenue of $805 to $810 million for only 26% growth. Even worse, the FY25 product revenue was guided to just $3.3 billion for 24% growth, suggesting additional slowdown for the rest of the year after a 36% product growth rate in FQ1.

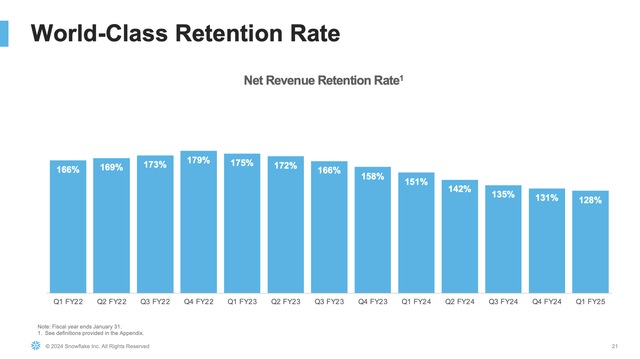

Also note, Snowflake only guides to the product revenue with fast growth, while ignoring the additional professional services revenues that cut the total growth rate to slightly lower levels. The net retention rate had already slumped to 128% in the last quarter, in a clear sign of the deceleration in sales growth.

Source: Snowflake FQ1’25 presentation

Snowflake didn’t help investors with the June Analyst Day where the company again pumped up AI product development, but management didn’t provide a lot of financial details. Analysts covering the event seemed to push off the new AI features as not beneficiary to the business until FY26/FY27.

Even more concerning, the report from AT&T (T) of a cyberattack related to data stored with Snowflake won’t help sales during this AI pause. The hack appears related to the previously disclosed cyberattack from Snowflake where customers from LendingTree (TREE), Advance Auto Parts (AAP) and Ticketmaster operator Live Nation (LYV) were previously disclosed.

In this case, AT&T had call and text records from a 6-month period in 2022 stolen from data held at Snowflake. According to reports, the wireless giant will have to notify 110 million customers of the data breach.

Previous reports have suggested the data hacks were due to the lack of Snowflake customers using multi-factor authentication to prevent data breaches. The reports steer away from the data cloud company having vulnerable systems.

Either way, cloud services providers with an estimated 165 customers with data getting stolen is likely to slow down sales cycles, whether the fault of Snowflake or not. In addition, the data cloud company highlighted key growth opportunities in expanding customer usage beyond the “business analyst” and providing the avenue for customers to collaborate with their customers to share data, but this data security issue likely halts any plans to expand usage to additional usage.

The company reported FQ1 earnings on May 22 and the data breach was officially reported on May 30 with subsequent reports from Mandiant in June regarding the size and scope of the data breach. The issue with AT&T just came to light last week and the mounting negative security news all comes following the FQ1 guidance with expected sales slowdowns.

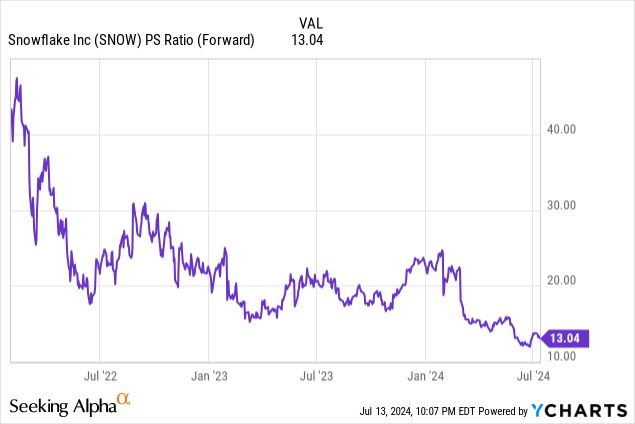

Still Richly Valued

Snowflake hit a stock price of $400 back in both 2020 and towards the end of 2021, so naturally a lot of investors are going to see the stock as cheap at $135. The data cloud company still has a massive market cap of $49 billion (363 million shares outstanding) despite the decelerating growth rates and data breaches.

The stock still trades at 13x forward sales estimates. Snowflake was already facing sales growth dipping to 20% and these ongoing data leaks on top of a shift to AI data will only make customers rethink processes for storing data on third-party cloud platforms.

Snowflake needs to maintain 30%+ growth in order to justify a 10x forward sales valuation. Not to mention, the profit picture is even worse.

Snowflake still trades at 215x the FY25 EPS targets of $0.63. The cash flow picture is better due to a lot of customers prepaying for data consumption services, but either metric outlines a stock with a rich valuation despite troubling cybersecurity concerns from customers.

Takeaway

The key investor takeaway is that Snowflake is an outstanding company with a likely bright future in AI, but investors have to pay the right price for the stock. Snowflake trades at very expensive valuations, and the major cracks in the armor of slowing growth rates and cybersecurity attacks hitting customers suggests the stock is likely headed lower. The recent failure to reclaim the $140 support level is further evidence of even more downside risk.

Investors should wait for the current hiccups to dissolve before the long-term AI story plays out.

Read the full article here