Today, we are putting non-lethal munition and arms manufacturer Byrna Technologies Inc. (NASDAQ:BYRN) as the stock has sold off just over 10% despite the company posting a solid quarterly earnings report on Tuesday. The company improved margins, swung to a quarterly profit from a loss in the same period a year ago, and increased its production capacity to meet a surge in demand. This could mean it might be a good time to buy a few shares on the dip.

Seeking Alpha

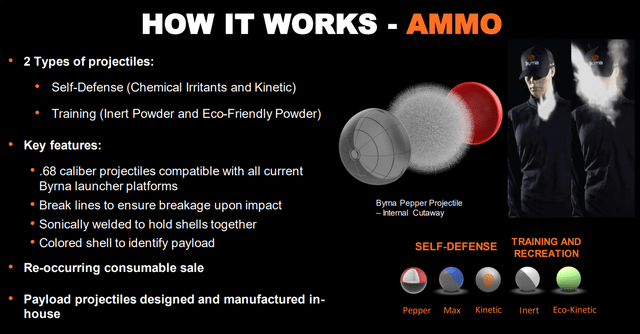

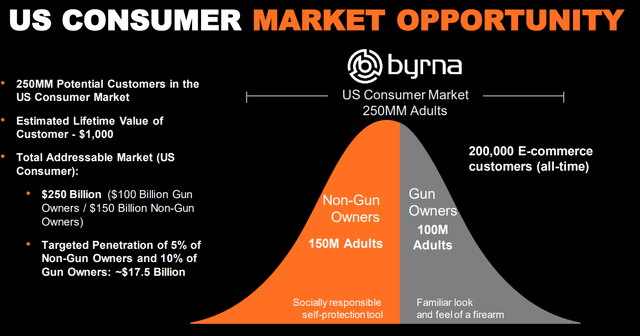

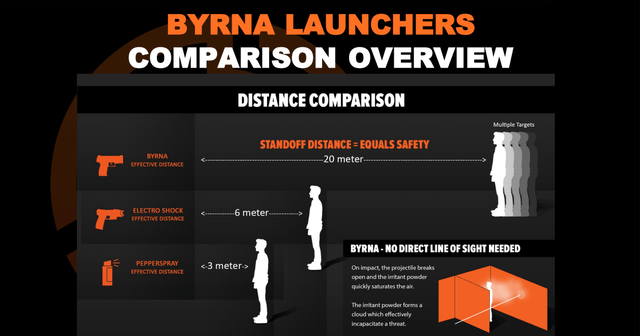

Byrna Technologies Inc. is headquartered in Andover, MA. The company’s fiscal year starts on October 1st. The company provides non-lethal solutions to police and security forces. These include handheld personal security devices and shoulder-fired launchers as well as non-lethal projectiles including chemical irritant, kinetic, and inert rounds. The company also sells a variety of non-lethal defense products and accessories. The stock currently trades at just north of nine bucks a share and sports an approximate market capitalization of $225 million.

May 2024 Company Presentation

Second Quarter Results:

Byrna Technologies posted its Q1 numbers Tuesday morning just before the market opened. The company’s decision to move to more of a direct advertising model started last summer with more celebrity endorsers like Dan Bongino. This initiative seems to be paying off judging from quarterly results. Byrna Technologies posted GAAP earnings of nine cents a share in the quarter and had a net income of $2.1 million. This compares to a $1.1 million and five cents a share net loss in the same period a year ago. Gross profit margins also improved to 62% from 54%. This was powered by growth in the DTC market (see more below) which had margins of 69.5% for the quarter.

May 2024 Company Presentation

Revenue rose 76% on a year-over-year basis to just under $20.3 million. The shift in marketing strategy enabled a $7.9 million increase in direct-to-consumer revenues to $14.6 million through the company’s website and via Amazon. While the company still sells to law enforcement agencies, it is now more focused on its DTC efforts and starting to open retail stores where margins are higher. The company produced 46,800 units during the quarter and now has a production capacity of 18,000 units a month, up from 10,000 a month at the beginning of 2024. The company is also building an ammunition production facility that will be located just a few miles from their launcher production facility in Fort Wayne. The company is currently selling 12,000 to 13,000 launchers a month.

May 2024 Company Presentation

Analyst Commentary & Balance Sheet:

In early April, Ladenburg Thalmann reiterated its Buy rating on BYRN and bumped its price target to $16.25 a share from $12.75 previously. Two months later, B. Riley Financial also reissued its Buy rating on the equity and raised its price target three bucks a share to $20. Those are the only two analyst firm ratings I can find on Byrna Technologies so far in 2024.

The company ended the first quarter with just under $25 million in cash and marketable securities on its balance sheet against no long-term debt. The company generated $4.3 million in cash during the second quarter, it should be noted. Operational cash flow came in just a tad below $6 million for the quarter. Several insiders sold approximately $500,000 collectively of the stock in the first half of the year but retained the vast majority of their stakes, and the average selling price was just under $12.00 a share.

Conclusion:

Byrna Technologies lost a dime a share in FY2023 on $42.6 million in revenues. The current analyst consensus sees a profit of 36 cents a share in FY2024 as sales rise to $76.2 million. They project earnings of 50 cents a share in FY2025 on revenue growth of 25%. Estimates for both FY2024 and FY2025 could be revised higher in the weeks ahead based on this quarter’s results.

May 2024 Company Presentation

Byrna Technologies is making progress on several fronts including ramping up production capacity, enabling significant revenue growth, and moving toward profitability as well as becoming free cash flow positive. The company also has a potentially large market it is well-suited to address. Given this, I added some more shares to my stake in BRYN during this week on the dip in the shares after a solid quarter.

May 2024 Company Presentation

Read the full article here