Do the data really matter?

If you are at the Fed these days you just can’t win. The political pressure on the Fed has become more intense. Outsiders may not recognize it, but Jay Powell begins every single press conference by saying “we are pursuing our joint goals of price stability and maximum employment,” so….

This is a very defensive way to start any, let alone every, press conference. Powell wants to be sure that everyone knows that the dual mandate is the focus- both inflation AND unemployment. But that does not really clarify anything. When Powell testifies this week before the Senate Banking Committee and the House Financial Services Committee, he will face more intense scrutiny. With the election coming, Democrats want rate cuts. One way to get them is to declare a victory on inflation. That has been done/tried by putting price data in the best possible light. One way to do that is to extract and discard the high-flying stubborn inflation categories. Housing has been identified as the category that, once removed, could bring inflation back into the target now. While some support that process many do not.

On the unemployment side things are getting even dicier. The unemployment rate has already risen by more than 0.5 percentage points from its cycle low, a very reliable recession signal on data since the late 1950s. By ‘reliable’ I mean it has never been wrong on that timeline.

This puts unemployment front and center, and, as with the inflation rate, there are many ways to look at unemployment. The headline rate is the ‘U3’ overall rate; it is up by 0.7 percentage points from its cycle low. But, in addition, there are many other unemployment rate cohorts of interest.

The many faces of unemployment

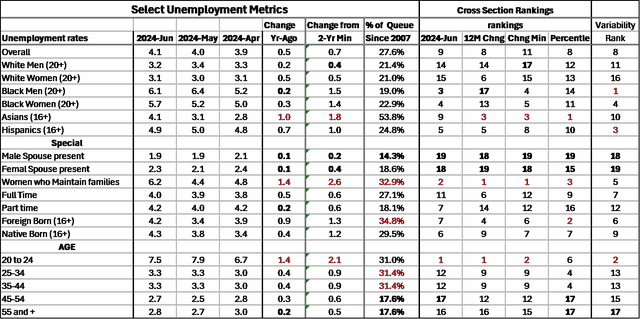

In the table below I present the overall U3 rate along with 18 other unemployment metrics. You can bet that these are going to be scrutinized by House and Senate members questioning the Fed Chair this week and looking to gain some leverage on the Fed in a highly disputed election year. Elizabeth Warren is famous for going after Chair Powell on any number of topics in these testimonies. This time with unemployment rates already moving up off 50-year lows, there are going to be political points to be made; screws to be turned.

To cut to the chase, I present three recent months of each unemployment metric. I present the change from one year ago; the change in the current rate from its two-year low (cycle low). I also calculate where the current unemployed rate stands on each definition relative to its queue of values back to 2007. The table provides a breadth of perspective as well as depth.

In the final five columns, I rank the unemployment rates or changes and percentile standings as well as variability across categories. The ranking has the advantage of showing which rates are lowest which are highest and therefore which groups’ unemployment experiences are benefiting as well as which are suffering the most. And this is exactly where the politics will go when Powell testifies this week. The chart below is more about politics than economics.

Unemployment concepts in action (HaverAnalytics, FAO Economics)

Rankings identify and position ‘the Players’

The rankings in the final four columns are high to low – #1 is the highest unemployment rate; #19 is the lowest. Since this is unemployment, the high unemployment numbers (highest rank values) are the most desirable. The low-ranking numbers refer to the highest unemployment or the largest unemployment increase and are the least desirable.

The headline or U3 rate, is at the top of the table. It ranks in the middle (as it must) among the 19 observations, at rankings between 8 and 11 on the various criteria.

Where unemployment is low and staying there

The lowest unemployment rates and smallest increases in unemployment are not a surprise. They are not for any particular racial group and while they are gender-identified the two least volatile measures are for unfractured families(!) Married, male, spouse present, and married female, spouse present. These are the two strongest categories (lowest unemployment rates smallest increases). These two unemployment metrics are up only by 0.1 pct points or 0.2 pct points from their respective lows, and each is up by just 0.1 pct points from its year ago value. Compare those numbers to the headline. In every recent recession, these rates also rise by more than 0.5 percentage points (not yet happened in this cycle). But both -especially for Female unemployment- there are false signals. For males only one false signal since 1970; for females more.

Where trouble lurks

The most affected category by far is by age- not by gender or race, it’s workers aged 20 to 24. Their categorical ranks are first and second; on a cross-sectional percentile standings, the category ranks as the sixth highest among all 19.

Other ages…

Other age cohorts have more ‘middling ranks’ until the top age cohorts are reached. Those higher age categories have much lower ranks (smaller unemployment gains and lower levels) indicating relatively less unemployment impact on older workers compared to the youngest (non-teen) group.

It is well known that some groups tend to have lower unemployment rates than others. I have left out unemployment stats by education. But more education has long led to lower rates of unemployment. The first rank column basically makes the case for these categories. It flags that age 20-24 has a higher unemployment cohort as well as Women who maintain families, Black men, black women, and Hispanics, in that order. Who is safest? Intact families and the two most senior age categories. That is structural beyond the reach of monetary policy.

The far-right column shows ranking by variability. The most variable is unemployment for Black men, followed by age 20-24, followed by Hispanics, Black women, and women who maintain families; they are fifth on this scale.

Because of their variability ranking when unemployment rates start rising, we expect the most variable categories to rise the most. There is a strong correlation between variability rank and change in unemployment from its 2-year low in this cycle.

However, the largest impact on the rise in unemployment rates from their two-year low is for women who maintain families, followed by the age group 20-24, Asians, Black men, and Black women. These are not surprises based on their variability rank and the fact that unemployment rates are rising. But these facts could prove to be political issues for Powell. Since there has been pressure from Democrats on Powell to not let the unemployment rate rise with a particular focus on the groups that have the biggest unemployment issues he could get more pushback from Democrats who might be more willing to call inflation conquered and take that risk in order to push rising cohort unemployment rates back down. Of course, that is a policy call and also quite subjective.

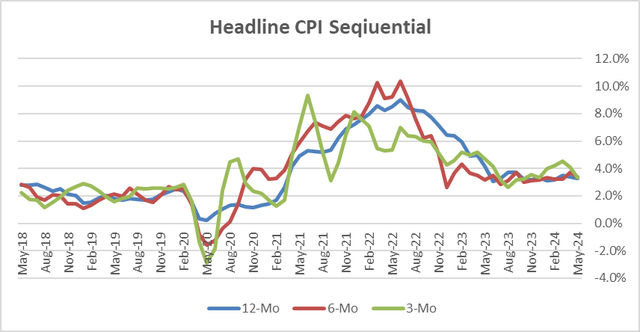

CPI trends (HaverAnalytics, FAO Economics)

Add in the inflation picture and an already complicated situation becomes more complicated. Inflation has fallen a lot from its peak but (1) it is not back to 2%, (2) the pace of decline has slowed, and (3) the pace of decline may even be backtracking to a moderate rate of increase.

Take your facts for a ‘spin’

But these are not days in which facts hold sway, especially in economics where ‘facts’ are malleable. But the problem runs deeper than that.

The vaccines, we were told- assured- would stop the spread and give you immunity (they did neither). And, in other instances, we were told things that later we ‘discovered’ simply were not true. There has been an epidemic of spin – no vaccine for that, sorry… Despite this being an ‘age of information’ so that politicians cannot say one thing in Michigan and something else in New York, they find that can say what they like and assert that it’s true – anywhere. And I could add many, many, more embarrassing things to that list above – but it will do. My only point here is that just because something is an actual fact don’t expect that it will be the thing that will carry the argument. Facts do matter but spin carries the day.

It has always been this way with the Fed. I named my firm ‘Fact and Opinion Economics’ precisely because the Fed is so prone to take charge and twist the facts to where it wants them to justify what the Fed wants to do. Think that is cynical, opinionated, and exaggerated? Well, it may be, but read on, because it is also true.

Remember in later 2021as inflation rose, the Fed argued it could not hike rates because there was a ‘taper’ in pace that would not end until March of the next year. The Fed began and was continuing to buy securities in the market ‘stimulating the economy’ but the taper meant it was also on a program to reduce purchases and stop. Still, the Fed argued, it could not be stimulating and tightening by hiking rates at cross purposes at the same time tapering…The Fed waited until March 2022 when the taper ended to start hiking rates. Well, now, fast-forward to this year. This ‘view’ has now flipped 180 degrees. Why? Because now the Fed wants to do it. The Fed has been preparing to cut rates but it is also has been shrinking the balance sheet. So, it recently announced that it could do both at the same time shrink the balance sheet (tighten) and cut rates (ease). So much for consistency.

The data game

The Fed plays its own data-interpretation game. Congress plays its game with the Fed. Around it goes. The Fed, however, is ‘independent.’ Oops, maybe not… The Fed must be careful with Congress since the Fed was created by an act of Congress (I am your Father, Luke… On his way out, Ben Bernanke allegedly reminded Janet Yellen that the Fed has to be responsive to Congress since Congress is the ‘Fed’s Boss’ as Bernanke put it. All that puts Fed independence in a totally different light). Many focus on a president that is publicly critical of the Fed as pressure. But that confuses real pressure with bombast. Little influence there – in fact, the Fed is more likely to lean against that ‘advice.’ But Congress is a different story. And the Fed Chair testifies before Congress (each chamber) twice a year. And the midyear episode is coming up.

You may be aware that the Supreme Court is on a warpath over Congress having delegated rule-making authority to other institutions. The SEC is under pressure from these rulings and has had its powers reduced. Some think this process could be extended to the Fed itself. The Fed is feeling very put upon these days and it’s not just from the Democrats on the committee; some Republicans are not fans of the Fed and not fans of central banking in general. Times and pressures change.

What goes around, comes around

When Powell testifies this week, all that will be in play. The Fed has a muddy morass of statistics to get through that it cannot say fully support what it is doing. The unemployment rate is still ‘low’ but it is rising and it is rising most in exactly the groups Democrats have identified most as ‘friends’ and in need of special assistance by policy. But the Fed’s tools are simply not that refined. And interest group unemployment rates got so low partly because the Fed turned a blind eye to inflation for too long. But that had to stop and when it did, the extra progress backtracked as well. As for inflation, that trend can be set and redefined in endless ways. Once the Fed turned away from only looking at year-on-year inflation and began allowing subtractions other than for food and energy, it opened a can of worms. It has more than 18 different inflation metrics that can be invoked. And you thought Arthur F Burns with FIVE monetary aggregates, had a picnic. The Powell Fed has a regular smorgasbord of choices. Burns was a piker compared to Powell. But with Powell it works both ways; if the Fed has ‘flexibility to choose’ its critics do too. Powell is now caught in his own trap as people are playing political football with unemployment rate statistics as well. It could be an interesting week. Powell is going to be tested, prodded, and made to defend Fed policy- not just explain it.

Read the full article here