Investment Thesis

EPR Properties (NYSE:EPR) has been hit hard during COVID-19, but has since then recovered to pre-COVID levels in terms of revenue and FFO. Today, the company provides an attractive and stable dividend yield of 8%, with some room to the upside due to its solid balance sheet and conservative debt maturity profile.

However, an objective investor must also acknowledge the risk related to the high exposure to theatres as well as the relevant market trends (e.g. increasing relevance of online streaming) in the respective industry.

Overall, an investment in EPR Properties has a wide return band that I currently see skewed to the upside. My thesis is that the market is overreacting to the negative trends in the theatre industry, providing an attractive risk/reward opportunity. I therefore initiate coverage with a buy recommendation but suggest following the company very closely to ensure the ability to react to potential changes in the quality of the tenant base in a timely manner.

Introduction to EPR Properties

EPR Properties is a leading experiential REIT player in the United States focused on building a real estate portfolio that offers stable and attractive returns to investors. The company manages USD >6.5 billion in real estate assets, with 358 properties housing 200+ tenants located in the United States and Canada.

The company is focused on the “experience trend” as consumer behavior shifts towards spending more money on experiences rather than material possessions.

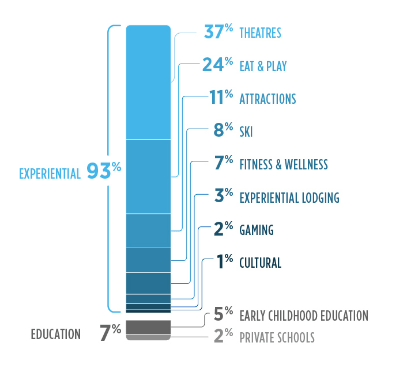

As a result, the company’s portfolio consists of the following property types (percentages are based on adjusted EBITDARE):

Portfolio Composition (EPR Properties)

The majority of the exposure is clearly related to theatres (165 properties), eat & play (58) and attractions (24) making up 72% of the total exposure.

The company’s management has indicated efforts to conduct M&A to further diversify the portfolio away from theatres. If we compare the number of theatre properties pre-pandemic in 2019 (179) versus the number of theatre properties in 2023 of 166, we can see that management has executed on this strategy thus far (-13). I believe that further diversification could allow the company to put the company’s risks related to the overall theatre market (which it is currently being heavily punished for by the market) into perspective.

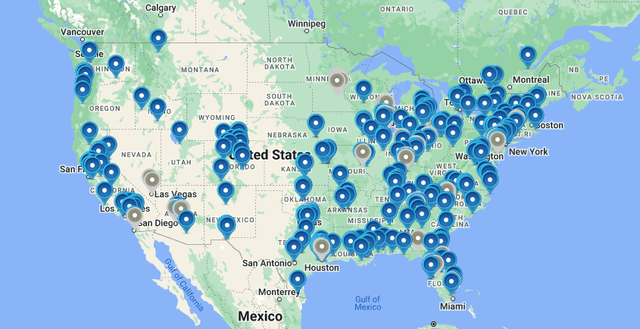

The properties held by EPR are spread all over the US with main exposure in Texas (13.7% of total rental revenue), California (12.4%) and Florida (7.2%) among other assets, of which a few are also located in Canada:

Geographic footprint (EPR Properties)

Financials

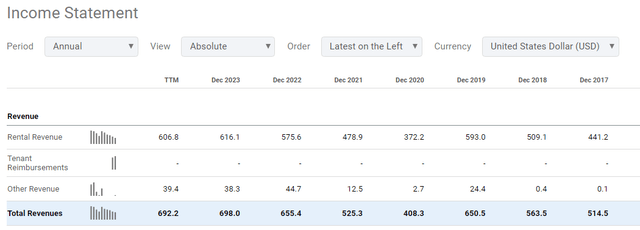

In FY23, EPR’s rental revenues have reached USD 616m and thus exceeded pre-Covid levels of 593m in FY19. On the profitability side, there is a similar picture as FFO stood at USD 395m in FY23 versus USD 339m in FY19.

Income Statement (Seeking Alpha)

As one can see in the image above, the dip in FY20 was significant and was related to COVID-19. Due to the company’s exposure to theatre properties (as well as other experiential properties), it was strongly affected by the pandemic. Specifically, its tenants Cineworld Group and Regal Entertainment filed for bankruptcy in September 2022 but emerged from the bankruptcy in July 2023.

It may also be worthwhile considering the tenant concentration, as 69% of revenue is generated by the top 10 tenants. EPR’s three largest tenants are Topgolf (15%), AMC Theatres (14%), and Regal Cinemas (13%) representing 42% of rental revenue.

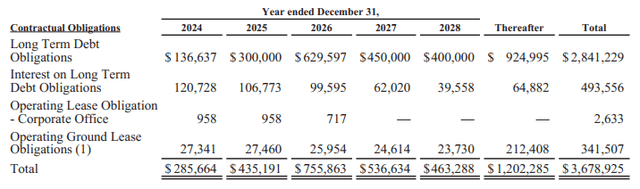

Let’s also address the debt maturities going forward. The largest amount is expected to come due in 2026 with USD 629m maturing. If we compare this to the company’s annual AFFO of roughly USD 400m, it should be in a good spot to service this debt. However, the company will have to take on new debt in order to service existing debt and also distribute dividends to shareholders (which is not uncommon). Fitch also acknowledged the company’s stable balance sheet, giving EPR a rating of BBB-.

EPR Debt Outstanding (EPR Properties 2023 annual report)

Market & Key Trends

As mentioned above, EPR Properties’ tenants are all active in the leisure market, focusing on providing extraordinary experiences to customers.

While the shift of consumer behavior towards experiences is evident, there are some limiting factors specifically related to EPR’s portfolio. Those factors are (1) inflation, which lowers the purchasing power of low and middle-class households and (2) the slower than expected post-Covid ramp-up in the theatre industry measured by number of tickets sold.

1. Lower Consumer Purchasing Power

A survey done by Oliver Wyman done in June 2023 suggests that consumers still have significant concerns about their ability to pay for essential goods and services. As a result, consumer behavior is changing. In fact, the #1 measure mentioned by consumers is to reduce spending by “stopping to eating out” which is not advantageous for EPR’s eat & play segment in particular. Furthermore, EPR’s Ski (which has become very expensive for small to middle-class households) and attractions segment will likely also be negatively impacted by this trend.

I therefore believe that consumers have less and less money to spend on discretionary experiential products as provided by EPR’s tenants, a development that has mostly been driven by inflation and price increases for housing and food.

2. Slow theatre ramp-up

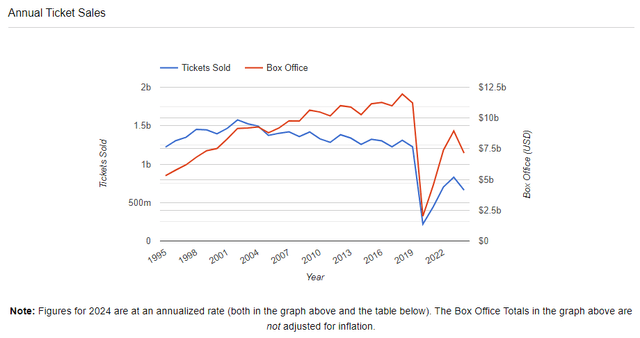

As per the figure below, ticket sales for movie theatres are still significantly below pre-Covid levels and are not expected to increase significantly in 2024 versus 2023. This is mostly related to the low number of movies released each year.

Ticket sales (the-numbers.com)

In fact, more and more movies are being launched directly on streaming platform (e.g. Netflix productions) destroying the incentive for customers to go see a movie in the cinema. This development has been accelerated with COVID and as of now, data suggests that this development is unlikely to be reversed anytime soon. This is underlined by the fact that rent coverage for theatres remains lower than the pre-pandemic level at 1.4x (vs 1.7x for 2019) with some upside potential depending on the stabilization of the film industry. In my view, EPR Properties could see additional upside if the theatre industry keeps recovering in the following years.

Valuation

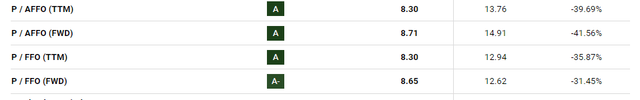

When looking at P/FFO, EPR Properties is valued significantly below its benchmark. Current P/FFO (TTM) stands at 8.30 versus 12.94 for the industry benchmark (-35.87%).

Valuation analysis (Seeking Alpha)

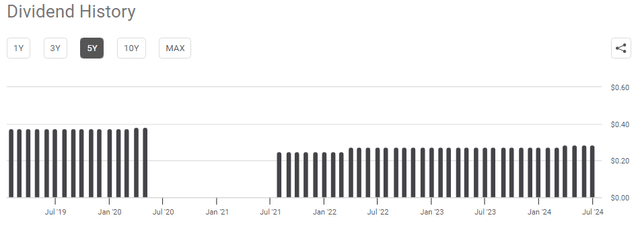

The low valuation also leads to an attractive dividend yield of 8% where the absolute amount of dividends paid out to investors still has not been increased to pre-COVID levels. As can be seen in the graphic below, the company halted any dividend payouts after COVID in 2020 and only started distributing dividends again in mid-2021. Despite the company’s financials recovering to pre-covid levels, the dividends have not been increased to pre-covid levels as of today.

Historical Dividends (Seeking Alpha)

I therefore see significant potential for EPR to raise dividends to pre-pandemic levels, which would allow a higher yield for investors, potentially in combination with some price increases.

Investment risks

However, this upside potential does not come without risks. As discussed above, I believe the main risks related to my investment thesis are (1) increasing competitive pressure from online streaming for theatres, (2) diminishing quality of tenants (e.g. inability to pay rent) and (3) execution risk from reshuffling the portfolio away from excessive exposure to theaters.

Conclusion

Looking at this investment objectively, one has to admit that investing in EPR Properties does not come without risks. Clearly, the majority of the portfolio is related to theatres (37%) which have a hard time recovering from COVID, affected by some serious competition from online streaming. However, given the extremely attractive valuation of EPR in combination with the large headroom to service debt in the next years, it seems like investors are overly punishing the stock. The company still has the potential to increase dividend payouts going forward, which will likely also affect its price towards the upside. Future interest rate cuts (as indicated by the FED) hold additional potential.

Therefore, being very conscious of all the risks mentioned above, I initiate coverage on EPR Properties with a Buy rating and intend to watch this company like a hawk going forward.

Read the full article here