Summer holidays are here, and it could be a very profitable few months ahead for online travel agencies. Out of the “big 3” – Booking (BKNG), Expedia (NASDAQ:EXPE) and Airbnb (ABNB) – this article argues EXPE has the most potential to rally.

Why EXPE?

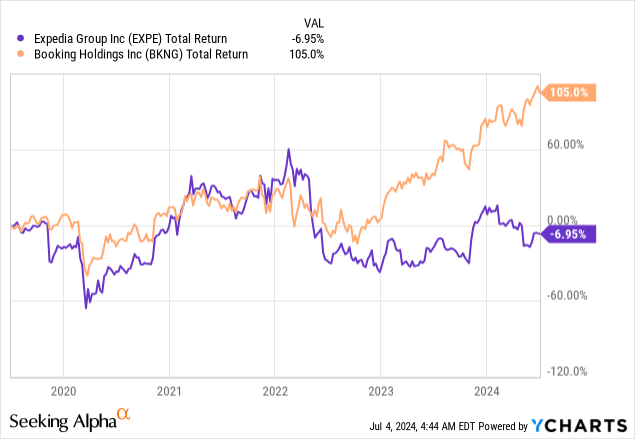

I actually think BKNG is a better company than EXPE, but so does the market, and this is reflected in its performance and valuation.

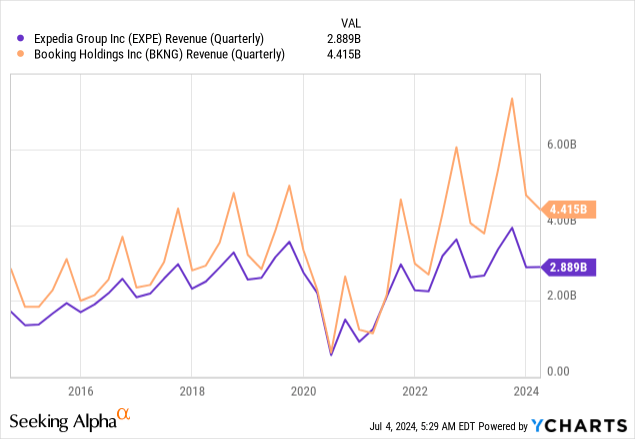

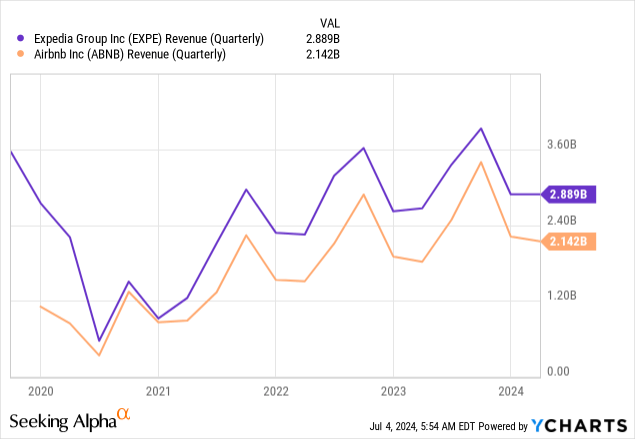

BKNG has always had a lead in terms of revenues, but BKNG growth has accelerated in the post-Covid era, while EXPE revenues have only recovered to around the same levels as pre-Covid.

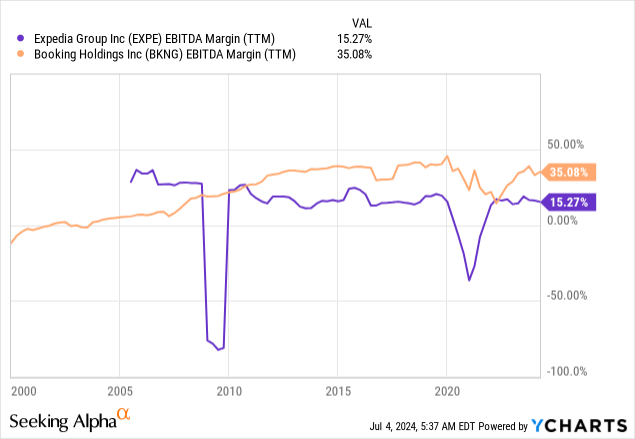

BKNG has consistently better margins, something EXPE seems to be addressing by laying off 1,500 employees (around 9% of its workforce).

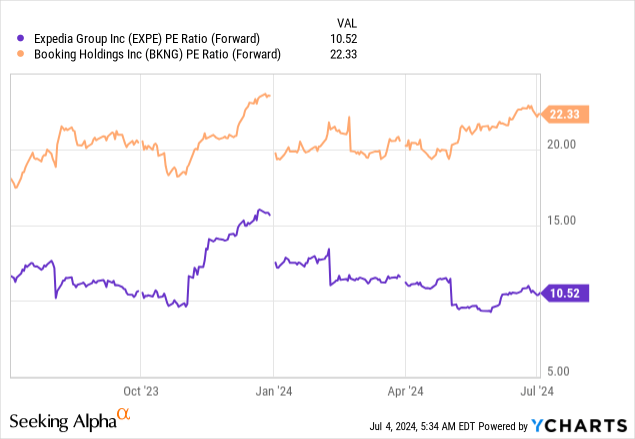

There’s a lot to like with BKNG, apart from its hefty price tag and valuation. A forward P/E ratio of 22.33 in this sector does not leave much room for multiple expansion. EXPE, on the other hand, has a forward P/E ratio of just 10.52, which is arguably too low.

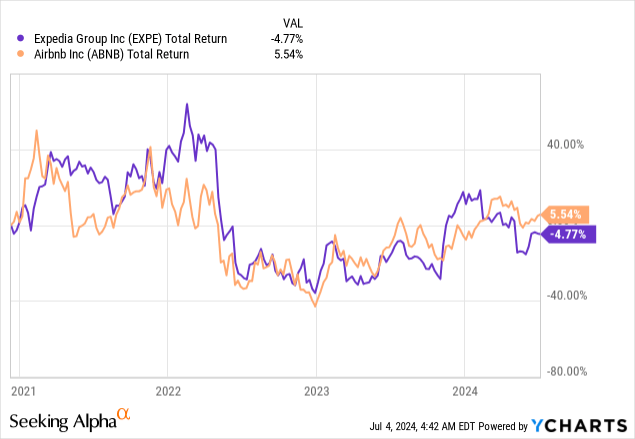

EXPE is being treated very differently to BKNG, which makes perfect sense. However, it is being treated almost exactly like ABNB, which makes less sense; the two stocks are moving almost in tandem.

I think EXPE should outperform ABNB. In fact, I think it should inhabit a space between BKNG and ABNB and should rally to reflect this. ABNB may be growing at about twice the rate of EXPE, with 17.6% YoY revenue growth compared to EXPE’s 8.11%, but ABNB’s forward P/E ratio is 33.79, over 3 times EXPE’s. Its market cap is $100B, compared to EXPE’s $16B. And yet, its revenues are still consistently lower.

Of course, there are other metrics to consider. EXPE has a higher debt load and much worse free cash flow. On the other hand, it has less industry headwinds. ABNB is facing backlash in many popular cities, and Barcelona is planning on banning short-term rentals by 2029. Other European cities overrun with tourists are likely to make similar moves. This could hurt EXPE’s Vrbo business, which is already struggling, but will impact ABNB much more. In fact, as EXPE is primarily involved in hotel bookings, it could benefit in the long-run as hotel occupations should increase significantly.

In short, ABNB is struggling to rally due to a high valuation and short-term rental headwinds, but neither of these apply to EXPE which is being treated exactly the same way.

Technical Analysis

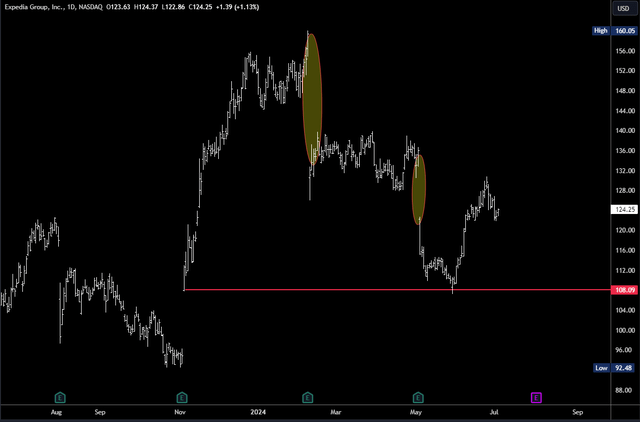

EXPE has dropped sharply on the last two earnings releases, but held higher lows with the October ’23 low and actually held the earnings gap from the 2nd November ’23. This support level propelled EXPE higher again and it has completely recovered the last earnings drop.

EXPE Daily Chart (Tradingview)

The recovery from the May low suggests the preceding earnings drop was an overreaction. This move was primarily driven by concern with Vrbo, and the “slower than expected ramp-up for Vrbo post its technical migration,” according to the earnings call. Lower guidance weighed, but this was also seen in ABNB’s Q1 earnings, and ABNB made a similar gap down. There could well be a slowing in short-term rental growth, but as outlined earlier, this should impact ABNB more than EXPE. Indeed, EXPE’s recovery over the last month has been stronger and this could continue.

EXPE v ABNB (Seeking Alpha)

EXPE’s chart has made a strong bottom at the May low of $107.25 and looks set to continue higher. The next resistance is around $140, and after that, the $160 high.

Conclusions

Consumer trends have weakened slightly, but the summer holidays should still prove very profitable for online travel agencies. EXPE is my preferred pick from the big 3 companies, as its valuation and focus on hotels gives it the most potential to rally and margins should improve. EXPE should inhabit a space between BKNG and ABNB and prices should rise to reflect this.

Read the full article here