Elevator Pitch

Freshpet, Inc. (NASDAQ:FRPT) shares are rated as a Buy.

I previously performed a preview of FRPT’s results for the second quarter of the prior year with my August 3, 2023 write-up. The current article touches on Freshpet’s top line growth prospects and profitability improvement potential.

I expect Freshpet to record robust revenue expansion at the mid-twenties percentage level and achieve positive earnings this year. The company’s top-line performance should benefit from an easing of inflationary pressures for consumers, while it has done a good job in controlling product costs. The positive financial prospects for FRPT have prompted me to upgrade the stock’s rating from a Hold to a Buy.

Positive Revenue Growth Momentum

FRPT’s recent top-line performance has been good. The company’s actual revenue beat the market’s expectations in six of the past seven quarters, and the sole disappointment was a marginal -0.8% top-line miss in Q2 2023. In the same time frame between Q3 2022 and Q1 2024, Freshpet achieved a YoY revenue growth rate of at least +25% in every quarter.

Moving forward, the Wall Street analysts see Freshpet registering a +25.2% top-line growth for full-year 2024. I believe that FRPT can meet or exceed the sell side’s expectations pertaining to its revenue outlook.

One factor is that inflationary pressures are no longer a major headwind.

At the Deutsche Bank (DB) Global Consumer Conference in June this year, FRPT acknowledged that “it was harder to bring consumers into the franchise” in “the periods where we had really rapid inflation” and “they were adjusting to the higher pricing.”

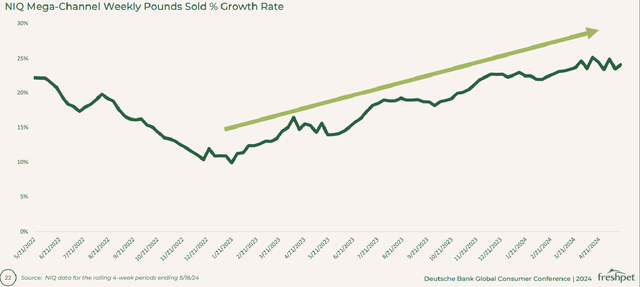

Freshpet’s Volume Expansion Rate For Rolling Four-Week Periods Until May 18, 2024

Freshpet’s Deutsche Bank Global Consumer Conference Presentation Slides

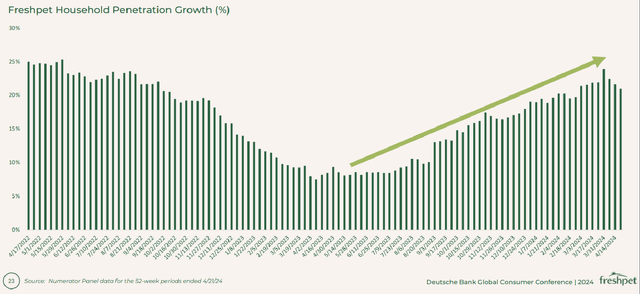

FRPT’s Household Penetration Rate Increase For The One-Year Time Frame Ending On April 21, 2024

Freshpet’s Deutsche Bank Global Consumer Conference Presentation Slides

As per the charts presented above, Freshpet has begun delivering volume expansion and household penetration rate increases of 20% or better again in recent times. This suggests that FRPT is now past the phase when the company’s growth was constrained by inflationary pressures that affected consumers’ or pet owners’ purchasing power.

Another factor to consider is that Freshpet has found success in penetrating its key client segment.

With my earlier March 13, 2023, initiation piece, I highlighted that “FRPT is targeting a very specific segment of pet owners whose household income exceeds $80,000 and spend twice or more on pet foods as compared to the average US pet owner.” This particular customer segment is described by Freshpet as “High-Profit Pet Owning Households” or “HIPPOHs.”

FRPT revealed in its June 2024 investor presentation slides that approximately 38% of the households the company penetrated were HIPPOHs for the 52-week time frame up to end-April 2024. This was better than the 35% HIPPOHs penetration rate that Freshpet achieved in the one-year period until end-April 2023. Freshpet indicated at the June 2024 DB Global Consumer Conference that the company’s “advertising is targeted towards HIPPOHs” which is “the focus of the brand” and this explains why the HIPPOHs penetration rate is “growing fast.”

In a nutshell, Freshpet has exhibited positive growth momentum in the past couple of quarters, and I expect FRPT to report strong top-line expansion for the full year.

Profitability Turnaround Is In Sight

Freshpet is at an inflection point regarding the company’s profitability.

FRPT has suffered from GAAP net losses in each year since its public listing in 2014. But the market anticipates that Freshpet will achieve positive GAAP and non-GAAP adjusted EPS of $0.67 and $0.65, respectively for 2024 as per S&P Capital IQ consensus data.

The company’s profitability improvement in the most recent quarter has favorable read-throughs for its full-year bottom-line performance. FRPT’s EBITDA margin expanded by +11.9 percentage points YoY from 1.8% for Q1 2023 to 13.7% in the first quarter of 2024. This was +770 basis points ahead of the sell-side analysts’ consensus EBITDA margin estimate of 6.0% (source: S&P Capital IQ). Looking ahead, Freshpet’s full-year FY 2024 guidance implies a potential expansion of the company’s EBITDA margin from 8.7% last year to 12.6% this year.

Freshpet noted at the Deutsche Bank Global Consumer Conference in June 2024 that the company is working hard at “perfecting the (fresh pet food manufacturing) technology” and has “stabilized the production workforce.” The company’s efforts have paid off, as evidenced by its cost trends. FRPT’s input expenses as a proportion of sales decreased from 36.1% in Q1 2022 to 31.2% in Q1 2024, while its quality costs-to-revenue ratio declined from 6.1% to 2.8% in the same time frame. The company explained at the recent DB investor event that the quality costs-to-revenue ratio refers to “the percentage of our products that has to go for secondary processing or be disposed.”

To sum things up, FRPT’s product cost optimization efforts have put the company in a good position to record positive earnings this year.

Risk Factors

Investors should be aware of certain key risks for FRPT.

A potential uptick in inflation could possibly adversely impact pet owners’ spending power, and this poses downside risks to Freshpet’s future revenue growth.

A failure to execute well on product cost control initiatives might lead to higher-than-expected expenses and weaker-than-expected profitability for FRPT.

Concluding Thoughts

Freshpet, Inc. is currently trading at 6.3 times (source: S&P Capital IQ) consensus next twelve months’ Enterprise Value-to-Sales or EV/S, which is 19% lower than its historical five-year average EV/S multiple of 7.8 times. Also, the stock’s growth-adjusted Enterprise Value-to-Revenue metric is a reasonably attractive 0.27 times (6.3/23) based on its consensus forward EV/S ratio of 6.3 times and the company’s consensus FY 2023-2028 revenue CAGR forecast of +23% as per S&P Capital IQ data.

Considering Freshpet’s favorable outlook relating to solid revenue expansion and profitability turnaround, the stock is deserving of a higher EV/S valuation multiple closer to its historical average in my view. As such, I rate Freshpet, Inc. stock as a Buy.

Read the full article here