We previously covered Opera Limited (NASDAQ:OPRA) in March 2024, discussing why we had maintained our Buy rating, as the management increasingly monetized its gaming platform, advertising, and search engine capabilities.

Combined with the management’s use of robust cash flow for shareholder returns, we believed that it continued to offer both value and growth opportunities at current levels.

Since then, OPRA has retraced by -9.4% well underperforming the wider market at +6%, or rallied by +28.2% from our previous fair value estimate of $11s.

We believe that much of the tailwinds are attributed to its improved monetization prospects, as its browser increasingly become AI-native with its global/ gaming ARPUs growing and advertising/ search opportunities expanding.

As a result of its still robust dividend and capital appreciation prospects, we are maintaining our Buy rating for the OPRA stock.

OPRA’s Investment Thesis Remains Impressive, Thanks To Improved AI Monetization

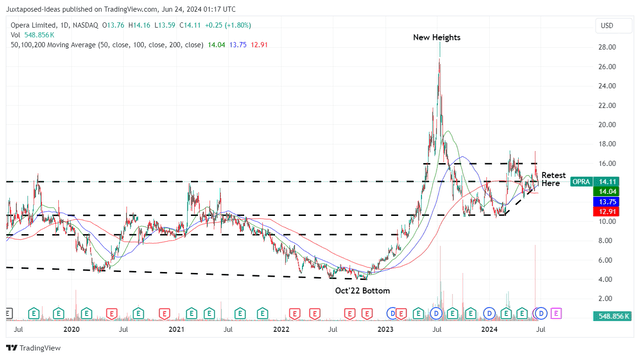

OPRA 5Y Stock Price

Trading View

For now, as OPRA continues to announce key updates in its AI capabilities, we are starting to see bullish support materialize in its stock prices since the February 2024 bottom.

For example, the Opera browser has added support for 150 Large Language Models, including those from Meta (META), Google (GOOG), and Mistral AI, with the interesting choice of keeping data on device instead of on server.

This strategy allows users to keep data locally – inline with its browser policy with built-in Ad Blocker and Tracker Blocker, helping users to browse/ work “privately and securely.”

This is on top of the multi-modal capabilities across text, voice, and pictures, thanks to its expanded partnership with GOOG, building upon its in-house Aria model.

It is apparent from these developments that the market and shareholders are increasingly optimistic about OPRA’s monetization prospects, aided by AI – as observed in the growing overall ARPU of $1.34 (+24% YoY) and advertising revenues of $58.64M (+20.8% YoY) in FQ1’24.

At the same time, with the company recently extending their search distribution agreements with Google (GOOG) through 2025 – in place since 2001, we believe that the former remains well positioned to continue generating robust growth ahead, as observed in the expanding search revenues of $43.13M (+14.1% YoY).

These successes prove that OPRA’s strategy of focusing on higher ARPU regions since FQ2’21 has been extremely successful, as observed in the expansion in its adj EBITDA margins to 24.5% (-0.1 points QoQ/ -0.5% YoY/ +13.4 from FY2021 levels of 11.1%).

This feat is impressive indeed, despite the mixed global browser market share gains to an average of 2.51% in Q1’24 (-0.59 points QoQ/ +0.18 YoY).

At the same time, readers must note that OPRA has already recorded a higher global market share of 2.54% as of May 2024 (+0.04 points MoM/ -0.28 YoY/ +0.38 from Q1’21 average of 2.16%), with it likely to trigger further growth tailwinds.

Lastly, the management continues to report robust gaming opportunities, with the Opera GX recording 29.5M of users (+1.7M QoQ/ +7.5M YoY) with higher ARPU of $3.49 (-0.5 QoQ/ +10% YoY) in the latest quarter.

The strategic combination of improved AI monetization, growing advertising/ search revenues, and gaming opportunities have contributed to OPRA’s raised FY2024 revenue guidance to $459.5M at the midpoint (+15.7% YoY) and adj EBITDA margins of 24% (+0.4 points YoY), compared to the original guidance of +15.2% YoY and inline YoY, respectively.

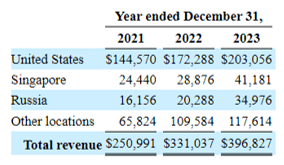

OPRA’s Revenue By Geography

Seeking Alpha

Even so, we believe that readers may look forward to improved numbers ahead, as OPRA invests in a new $19M AI data center in Iceland in FQ1’24, with it likely to bring forth incremental growth in the EU and Asia ahead as it leverages its new AI multi-modal capabilities.

This development matters indeed, since Singapore and Other Locations (including the APAC, UK, EU, and EMEA) comprise 40% of its FY2023 revenues (-1.8 points YoY), with FQ1’24 data not disclosed.

At the same time, the recently implemented Digital Markets Act has triggered further tailwinds, as observed in OPRA’s incrementally growing market share to 2.93% in the EU (+0.12 points MoM/ -0.06 YoY) and to 1.31% in the UK as of May 2024 (+0.09 points MoM/ +0.15 YoY).

This also builds upon the “+63% MoM increase in new iOS users in the EU from February to March 2024,” as reported by the management in the recent earnings call – implying further growth opportunities in the EU and UK.

Growing adoption has also been observed in Asia at 1.94% (+0.06 points MoM/ +0.39 YoY) and Singapore at 2.41% as of May 2024 (inline MoM/ +1.47 YoY), further underscoring why we believe that OPRA is likely to record another raise quarter in FQ2’24, thanks to these incremental growth opportunities internationally.

So, Is OPRA Stock A Buy, Sell, or Hold?

OPRA 1Y Stock Price

Trading View

As a result, readers need not be concerned about the OPRA stock’s pullback observed over the past week, since it is only attributed to the natural adjustment by the amount of dividend paid out in July 15, 2024.

Otherwise, despite the growing bullish support observed since the February 2024, the stock continues to offer a relatively rich forward yield of 5.81%, compared to the sector median of 1.48% and the US Treasury Yields of between 4.24% and 5.37%.

For context, we had offered a fair value estimate of $11 in our last article, based on the FY2023 adj EPS of $0.69 (+180% YoY) and the FWD P/E of 16x.

Based on the LTM adj EPS of $0.75 (+47% sequentially) and the same FWD P/E of 16x (inline with its 1Y P/E mean of 16.1x), that fair value estimate has been moderately lifted to $12, implying that OPRA is trading at a slight premium at the time of writing.

Even so, we are reiterating our long-term price target of $23.10, as per discussed in our previous article, suggesting an excellent upside potential of +63% ahead.

With OPRA still offering an impressive dual pronged prospective returns through dividend payouts and capital appreciation, we are maintaining our Buy rating.

With the stock appearing to be well supported at $13s over the past two months, investors may consider dollar cost averaging at those levels for an improved margin of safety.

Read the full article here