Fulton Financial (NASDAQ:FULT) is a company founded back in 1882 and is headquartered in Lancaster, Pennsylvania. The last time I discussed it was two quarters ago, and the main issues were stabilization of the net interest margin and unrealized losses in AFS securities. Since then, management has not been able to avoid further deterioration in profitability, but there seems to be light at the end of the tunnel today.

Repricing CDs is the key to returning to growth since the loan portfolio is almost stagnant. Also, unlike months ago, AFS securities will play a major role in boosting the net interest margin. Their unrealized losses are still high, but the desirability of new securities in the market may be a way to offset the problems in the loan portfolio.

Prospects and Challenges Ahead

Before turning to growth drivers, I think it is useful to understand what the main challenges for Fulton are in the short to medium term.

Q1 2024 Fulton

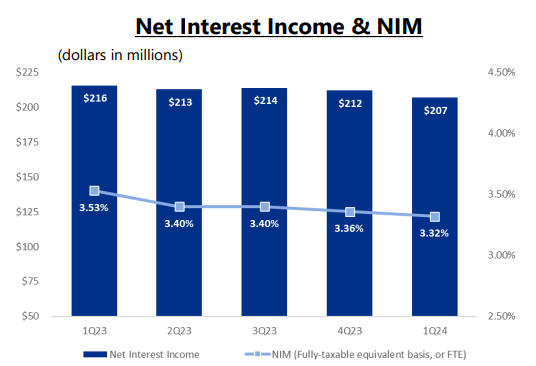

The first thing is to stop the decline in the net interest margin, now at 3.32%. When I discussed this in Q3 2023, there was optimism that this would be achieved; in fact, the net interest margin was unchanged from the previous quarter, and net interest income had even shown improvement. However, as the quarters passed, the market increasingly discounted a “higher for longer” rate scenario, and this resulted in unexpected upward pressure on the cost of funds.

Q1 2024 Fulton

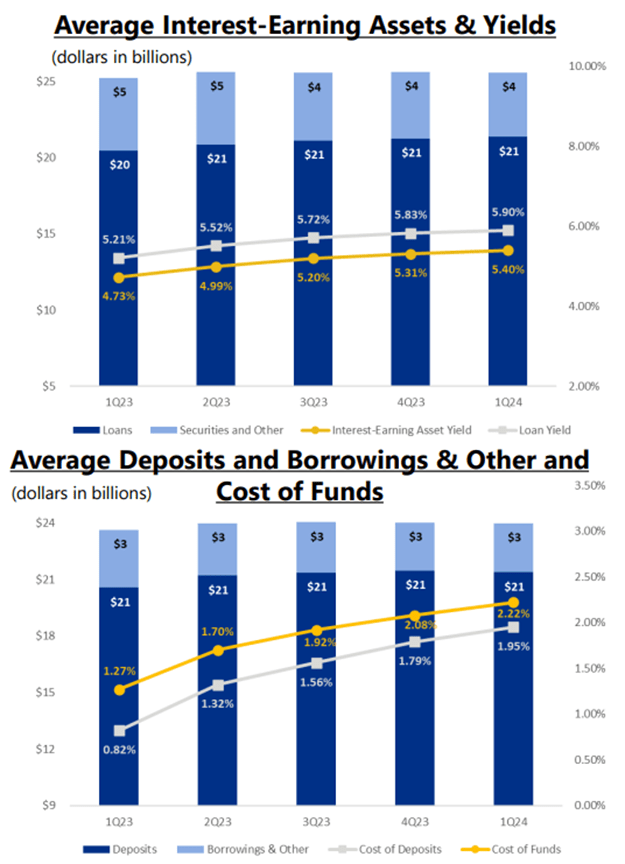

Money market yields stayed high, and depositors demanded higher and higher yields to park their cash at Fulton. The increase in the cost of funds has not been offset by the increase in asset yields, and this is the first crucial issue to be resolved.

Q1 2024 Fulton

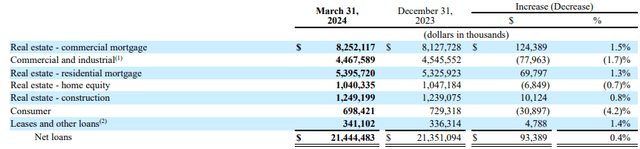

The second problematic aspect is that the loan portfolio has almost stalled. Compared to the previous quarter, there was an increase of only $93 million, or about 2% annualized. This is too modest a growth and not in line with management’s medium- to long-term goal of 4-5% per year: it is likely that in FY2024 the lower limit will not be reached either. The reasons for this disappointing result are three in my opinion:

- The first and most important of all is that demand for loans has deteriorated significantly from a few years ago. Businesses and households are not interested in borrowing at such high rates. Those who want to buy a new home are probably postponing their mortgages, hoping that in 1-2 years the rates will be more affordable. Similar reasoning for a business that does not have the cash on hand to carry out a new project.

- The second reason is that Fulton’s management is very focused on the creditworthiness of its clients. This is certainly a positive aspect, but at the same time, it cuts off several potential customers.

- The third and final reason is that Fulton’s Loan-to-Deposit ratio is high, about 98.60%. The shortage of deposits limits the ability to take advantage of potential market opportunities, including the issuance of new loans. In any case, what surprises me the most is that management is not worried at all; in fact, they believe the current value is within the ideal target of 95-105%.

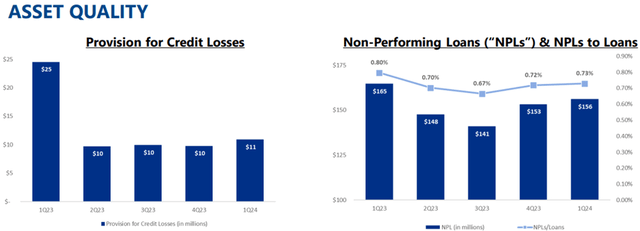

In light of these considerations, the modest performance of the loan portfolio is not surprising. At the same time, as anticipated, its reliability remains high.

Q1 2024 Fulton

NPLs represent only 0.73% of total loans, and the current figure is better than last year’s. Theoretically, rising interest rates should put borrowers on edge, but in Fulton’s case, the situation has been stable despite CRE loans accounting for 38% of total loans.

Having seen the main challenges, let us now take a look at how the company is trying to recover and what the possible future scenarios may be.

Q1 2024 Fulton

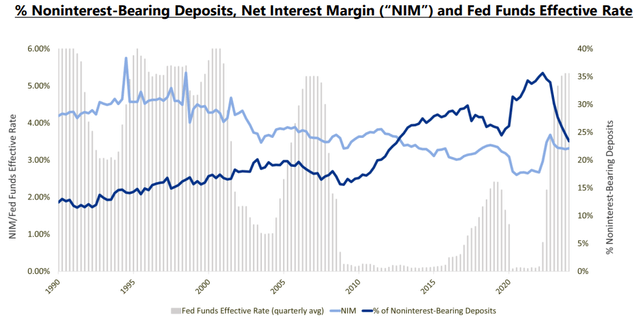

Starting with liabilities, the rapid collapse in non-interest-bearing deposits was offset by the increase in expensive CDs. This was the main driver of the decline in profitability and remains the main factor for a potential rebound:

We really see a stabilizing on the deposit as we get to CD rolls. As we look forward, the pressure of pricing up on CD rolls it’s not as significant, begins to stabilize. So I think there’s a lot of stabilizing forces as we kind of look forward. The biggest impact is going to be mix shift non-interest bearing to interest-bearing. And that is moderating but is continuing.

CEO Curtis Myers, conference call Q1 2024.

By the end of 2024, CDs worth about $1.90 billion will mature and probably be refinanced at a lower rate, or at least not higher. In fact, the current weighted average is very high, 4.40%.

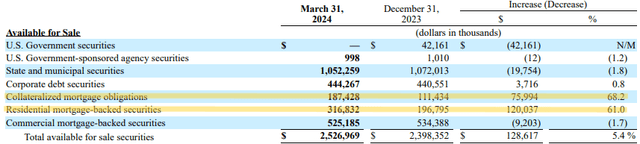

Having a lower pressure on the cost of deposits would be an important first step, but it is also necessary to focus on the other side of the balance sheet. To offset the slow growth of the loan portfolio, management is buying new AFS securities.

Q1 2024 Fulton

Compared to the previous quarter, there has been a 5.40% growth, and the composition of this portfolio has changed significantly.

Basically, risk-free securities guaranteed by the U.S. government were let to expire, and Municipal Bonds were also put on the back burner. In contrast, Residential MBS and CMOs have increased by $120 million and $76 million, respectively. Personally, I believe that management’s willingness to buy these securities is a way to offset sluggish demand for residential real estate loans. The latter, being less risky than CRE loans, would benefit Fulton’s balance sheet.

In addition, residential MBS typically have a fixed rate and monthly remuneration, two ideal components to give stability to net interest income.

Q1 2024 Fulton

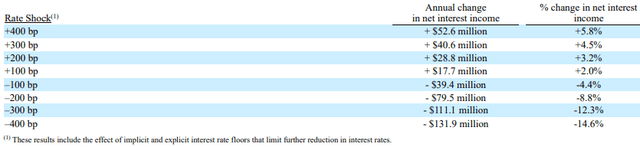

As you can see from this rate shock test, Fulton is mainly sensitive to interest rate reductions; therefore, by exposing itself more to the fixed rate, it will be able to mitigate this weakness.

In the short to medium term, I expect that Fulton may continue with this strategy, i.e., buying residential MBS and CMOs should demand for loans remain weak. In addition, refinancing CDs – probably at lower rates – will likely reinvigorate the bank.

Valuation and Dividend

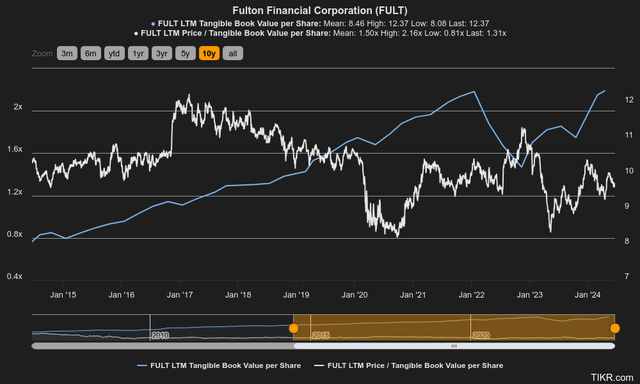

By working on both assets and liabilities, Fulton’s profitability can return and improve, consequently fueling TBV per share.

TIKR

After two years in which TBV per share could not break through the 2022 high, it finally broke through that wall in Q1 2024: AOCI continues to weigh heavily on its growth.

Over the past 10 years the Price/TBV per share has averaged 1.50x, today it is 1.31x. Multiplying the average by the current TBV per share ($12.37), Fulton’s fair value results in $18.55, a difference of 14.50% from the current price.

Based on this calculation, Fulton seems undervalued but not by that much; in fact, I do not consider it a buy. There is not a large enough margin of safety, and I personally tend to avoid banks with a very high Loan to Deposit ratio. Management does not seem concerned about that, but I remain cautious. While it is true that CDs could be refinanced at lower rates, we do not yet know how long non-interest-bearing deposits will continue to decline.

Overall, I consider Fulton a solid bank but not sufficiently cheap for the risks involved, which is why my rating is a hold. However, the argument might be different for a dividend investor; in fact, Fulton has proven to be a reliable company from this point of view.

The current dividend yield is quite high, 4.19%, and the payout ratio is 40.74%, so largely sustainable.

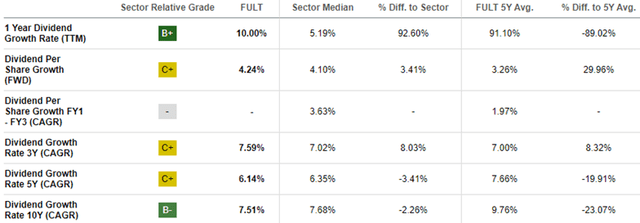

Seeking Alpha

The dividend growth rate 10Y CAGR was 7.51%, in line with the sector median. However, in the past 12 months, there has been a larger increase of 10%, about double the sector median.

Seeking Alpha

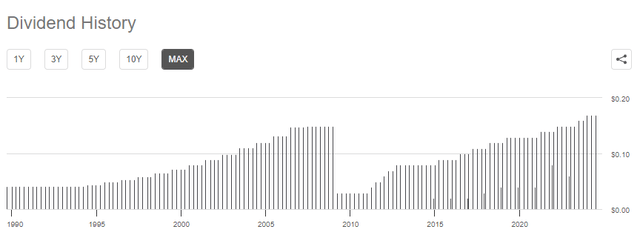

Historically, Fulton has always been quite reliable with dividends, except for the Great Financial Crisis. In that case, the dividend was cut significantly, and only recently reached 2008 levels. Since then, it has been 16 years, and I doubt that we are facing a similar scenario: Fulton is more solid and there is no premise for going into a recession of that magnitude.

Conclusion

Fulton is a company with a long history behind it and is facing a complex time. The loan portfolio is growing very little, deposits are still very expensive, and AOCI still weighs heavily on TBV per share. In any case, credit risk is largely under control, as is the bank’s soundness from a financial perspective.

The growth drivers are there, but much will depend on deposit inflows in the coming quarters. An increase in non-interest-bearing deposits will be crucial, something that is already visible in some banks. Certainly, compared to the situation in early 2023, the macroeconomic environment is less uncertain.

At the moment, I don’t think this bank is a buy as the market has already discounted much of the potential upside, but its dividend may be attractive in the eyes of those looking for a passive yield: At the current price, it is not a terrible deal.

Read the full article here