Everyone loves a bargain. When you see signs for 75% off, you will get extra interest. With retail sale prices, you sometimes don’t know the real value. The retail price (or sometimes just the “suggested retail price”), is rarely an indicator of what anyone would pay for the item. Yet, it anchors you into believing that you are getting something for cheap, that is not actually cheap.

REIT net asset values, or NAVs, are no different.

Today we will look at Orion Office REIT Inc. (NYSE:ONL) and tell you where we stand on this one. We will also explain how our preamble relates to the valuation of this and why we are putting another Sell rating on a stock trading at 25% of NAV.

Previous Coverage

We picked this one right out of the IPO as a Strong Sell (See, Orion Tightens Its Belt, So No Big Dividend For You). With one shorter-term trading exception, the remaining 8 coverage pieces rated the stock as a Sell. So we certainly are not coming here to discover the story for the first time.

Recent Results

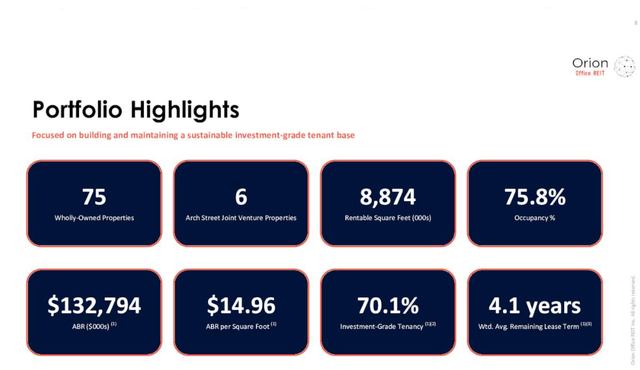

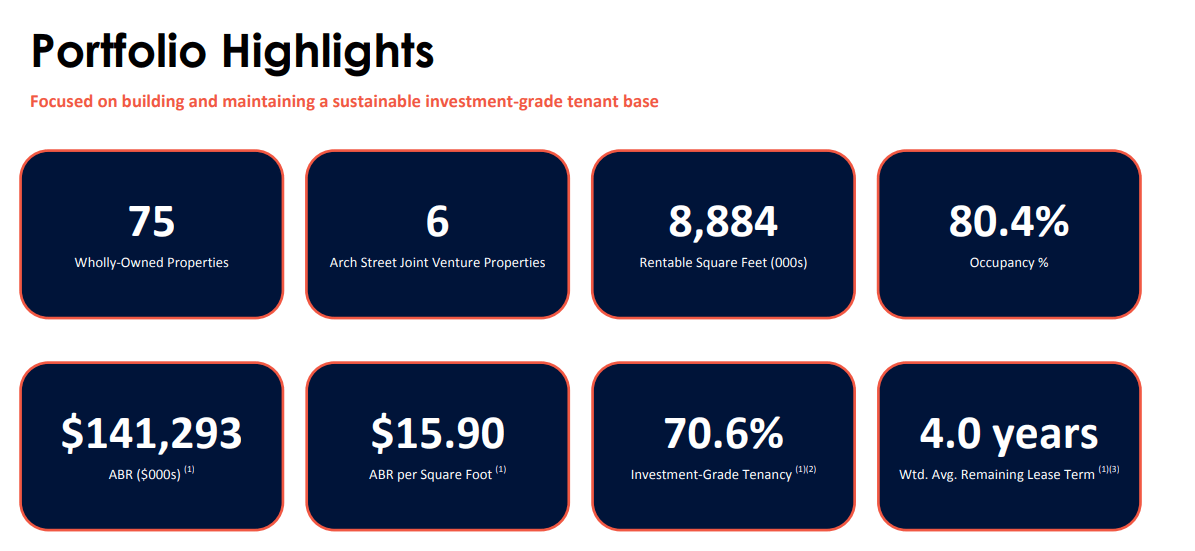

Orion’s Q1-2024 presentation showed the high levels of investment-grade occupancy on the 9 million square feet office portfolio.

Q1-2024 Presentation

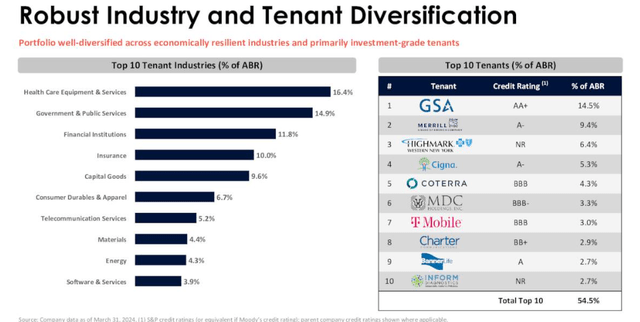

The tenants are well-diversified, and rent collection should never be an issue.

Q1-2024 Presentation

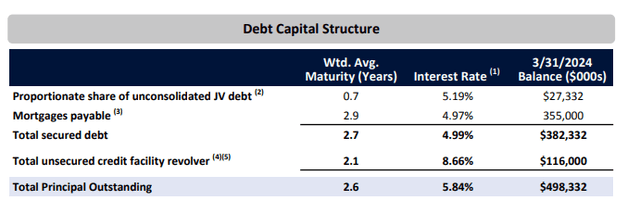

The balance sheet looks okay if you only look at debt to gross book value. The term to debt maturity is also rather short, and the weighted average interest rate has crept up towards 6%. This shows rather poor planning, as that term is too small to navigate economic headwinds.

Q1-2024 Presentation

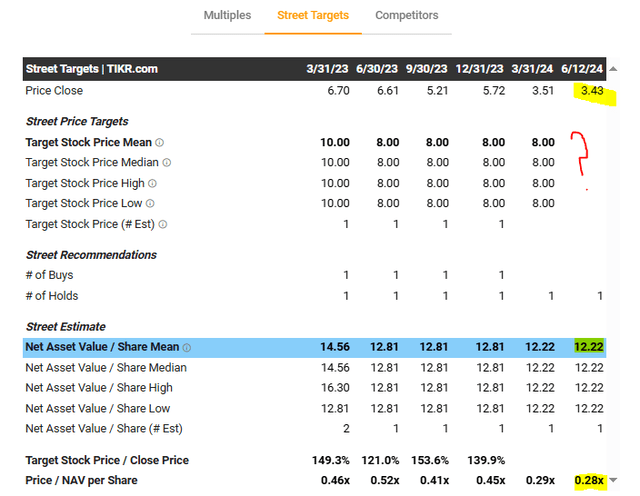

But coming back to our introduction and title, here is what TIKR shows as the NAV on this stock. $12.22. We will note here that the analyst has pulled the price target, but that NAV number remains.

TIKR

At the current price of $3.43, we are putting a Sell rating at 28% of NAV.

Bold Move Cotton, Let’s See If It Pays Off For Them

The first key reason here is that the occupancy continues to go down. As we showed above, it was 75.8%. The mall REITs that bit the dust over the last few years, did so with a mid-80s (ironic, as that is the era their malls looked like they were stuck in) occupancy rate. So 75.8% is really bad. It also shows the damage a single quarter can wreck on this company. Last quarter occupancy was 80.4%.

Q4-2023 Presentation

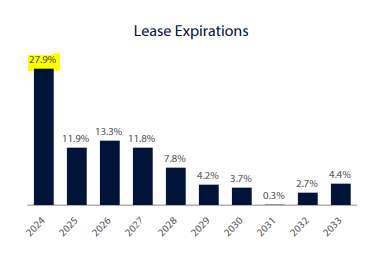

Sure, leasing activity was not the worst we have seen from this company.

Q4-2023 Presentation

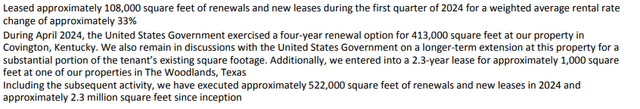

But it needs that torrid pace just to keep its occupancy rate from dropping even further. About one quarter of total leases come for renewal in 2024. The lease expiration slide is missing in the latest presentation, so we will just use the one from Q4-2023.

Q4-2023 Presentation

Orion’s strategy so far has been to sell vacant properties, and they are not fetching much. 15% of the portfolio gave them $58.5 million. If you extrapolate that, you won’t have enough to pay the remaining debt. That is the second key reason. We don’t believe NAV is anywhere in the ballpark of $12.00.

That said, given the costs associated with owning vacancy, dispositions of those assets in the portfolio that we deem overly difficult or expensive to re-lease, or both, remain a key area of focus. We have made tremendous progress on this initiative. Since the spin, we have sold more than 15% of the portfolio with gross proceeds of $58.5 million, much of which has gone to pay down debt, which has been reduced by more than $145 million over the same period.

The sale of these 17 properties, totaling 1.8 million square feet, has materially reduced carry costs, significantly reduced forward expected CapEx and has freed up capital and human resources to focus on those properties in the portfolio where we do believe in our long-term re-leasing prospects. This process will continue as we grapple with ongoing lease rollover in this depressed selling environment.

Source: Orion Q1-2024 Transcript

Of course, these properties are still occupied, and yes, there are some attractive terms in place on some of them. But the core cash flow is deteriorating faster than you can say “ZIRP might come back”. That is not our forecast. It is the company’s forecast.

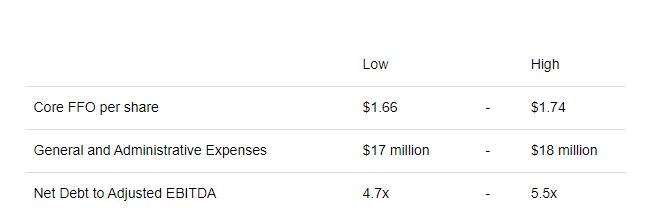

Just run some straight-line math on these two numbers, which include the funds from operations in Q1-2024 (36 cents) and what is expected for the whole year (97 cents).

Core funds from operations for the quarter were $20.4 million or $0.36 per share, as compared to $25.3 million or $0.45 per share in the same quarter of 2023.

Based on our quarterly results, and our expectations for our full year 2024, we are reaffirming our guidance for a core FFO range of $0.93 to $1.01 per diluted share.

Source: Orion Q1-2024 Transcript

How do we get from 36 cents in Q1-2024 to 97 cents for the full year? Well, we could have $0.36, $0.28, $0.20, and $0.13. Or we could hit $0.36, $0.21, $0.20, and $0.20. We bet on something close to the former. If that is accurate, then the Q4-2024 FFO annualized run rate is down 52 cents. But either way, there is a huge deterioration just dead ahead, and that is the third reason. One final piece of the puzzle (fourth reason) is that Orion projects its debt to EBITDA to be at 6.6X (midpoint) at year-end 2024. This ratio is calculated on a trailing 12 months of EBITDA, so it won’t take into account how bad the Q4-2024 will be on a standalone basis.

Verdict

We have bought a couple of value traps recently. These are two phenomenally cheap stocks which we freely admit are value traps. We estimate realistic liquidation value in both cases to be at least 5 times the current stock price. In neither case, we expect value to be realized in the medium term, as both management teams appear to be hunkering down for the twenty-fourth century. It is possible that value may never be realized. But in both cases, we see the underlying NAV equivalent to be increasing over time. That is the key difference. Here, we see the analyst NAV as plain wrong and whatever it is today, it will be lower a year from now in our view.

When Orion was spun off from VEREIT, the expectations were for an FFO of $2.40 a share. The first quarterly results reset that to $1.70.

Q2-2022 Presentation

At the end of Q4-2024, we will likely be close to 60 cents of annualized FFO. So in 3 years, your FFO run-rate travel will be from $2.40 to $0.60. It is hard to make money on the long side with that kind of deterioration. We reiterate our Sell rating.

Read the full article here