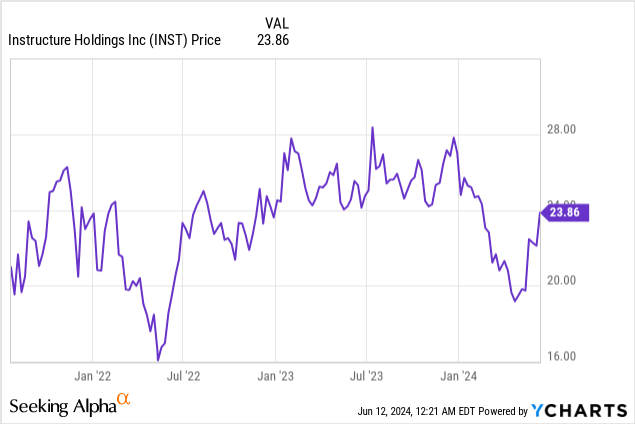

Instructure Holdings (NYSE:INST), the educational software company, has long been a private equity fan-favorite. The stock initially went public in 2015 and got taken private by Thoma Bravo in 2020. In 2021, the company underwent its second IPO (performance has lagged other software companies since then, with a ~20% cumulative gain), and now there are reports that Thoma Bravo is looking to sell the company off to private buyers again.

Amid the constant changing of hands, however, it’s important to recognize that this is a company that has fantastic fundamental chops that is worth investing in, at a fair price. Year to date, shares of Instructure have dropped nearly 10%, creating a buying opportunity (especially if there are potential acquirers waiting in the lurch).

The bull case for Instructure

I’m initiating Instructure at a buy rating. My enthusiasm for the company has very little to do with its acquisition potential: I’m excited about the company’s growth prospects as well as its profitability profile even as a standalone company.

For investors who are newer to this stock, Instructure is the maker behind Canvas, widely recognized as the leading LMS (learning management software) platform in the U.S. This is a digital platform that helps to organize course content, administer tests and grades, and facilitate classroom/teacher discussions. Canvas’ LMS is segmented by education level, but it is available to both K-12 schools as well as universities.

Canvas is hardly the only player in the LMS space – competitors include private companies like Moodle and Blackboard (also owned by private equity). But Canvas’ reach is massive, with nearly $0.7 billion in revenue expected this year.

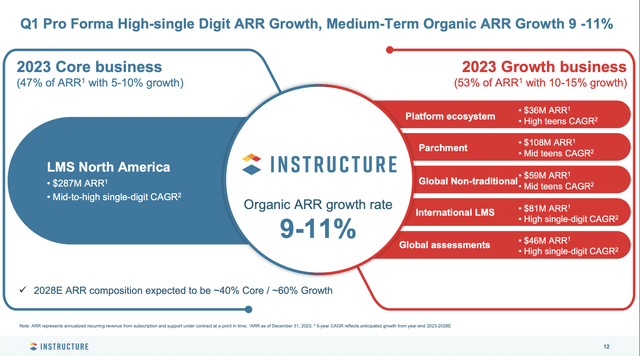

Instructure ARR and product platform (Instructure Q1 investor deck)

The slide above shows both Instructure’s product platform and its scale. Its core North American LMS business has ARR (annual recurring revenue) just shy of $300 million, with a steady-state organic growth rate of 5-10%. On the right side of the chart, meanwhile, the company showcases its growth businesses, including international LMT (which is currently lower than $100 million in ARR).

One tremendous growth opportunity for Instructure is its recent February acquisition of Parchment for $795 million. Right now, Instructure’s reported growth rates are over 20% y/y (relative to ~7% organic growth, excluding the acquisition of Parchment).

Parchment is a secure platform for universities to exchange student records and credentials. We often think of the healthcare records system as messy and having no centralized platform to exchange medical records between doctors and other care providers – but educational systems are the same, with many universities still relying on paper transcripts. Instructure’s purchase of Parchment, though large relative to its own scale, gives it a huge distinguishing point versus competitors like Blackboard with $108 million of existing ARR (per the chart above) that is growing at a mid-teens clip.

With double-digit growth rates for Parchment as well as a burgeoning platform ecosystem (third party apps built onto the Instructure platform; which is an important tertiary and “free” revenue opportunity for software companies large and small, including the likes of Salesforce.com (CRM)), there’s a case to be made for accelerating growth in Instructure as it builds on top of its already-successful LMS platform.

Massive profit margins

We don’t need to look far into the future to bank on profitability for Instructure – it’s already massively profitable today.

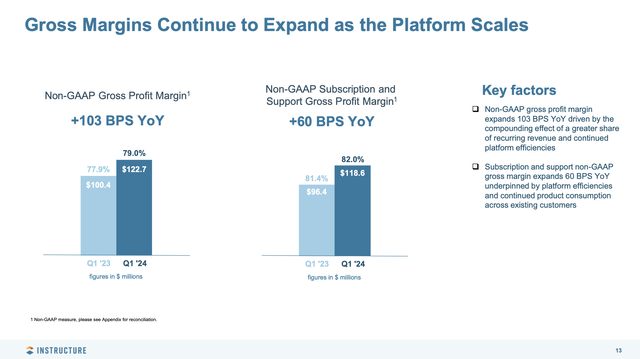

One of my core requirements in investing in strong software companies is a large gross margin. Healthy gross margins allow software companies to scale nicely at maturity, as the initial outlays on sales and marketing to land new clients eventually turn into a high-margin, recurring revenue base. Such is the case for Instructure, which reported a 79.0% pro forma gross margin in its most recent quarter, up 103bps y/y:

Instructure gross margins (Instructure Q1 investor deck)

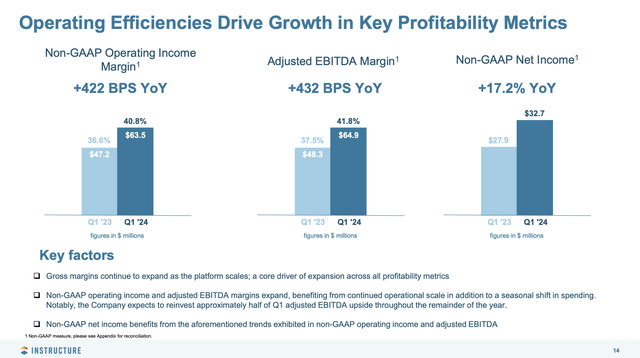

Similarly, pro forma operating margins in Q1 also hit 40.8%, while adjusted EBITDA margins hit 41.8% – each rising more than 4 points y/y.

Instructure adjusted EBITDA margins (Instructure Q1 investor deck)

It’s important to note that with over 40% pro forma operating margins and 6.6% organic revenue growth in Q1, Instructure passes the so-called “Rule of 40” test (a common measure of growth/profitability balance for software companies, measured by adding revenue growth to pro forma operating margins and where a score above 40 is considered healthy).

Risks, valuation and key takeaways

This being said, Instructure is not without its risks.

One of the core things to note: as is typical of a company formerly held by a private equity firm, Instructure is saddled with debt. Its most recent balance sheet has $1.148 billion of total debt against it, which is a fairly high ~4x leverage ratio against ~$270 million of adjusted EBITDA expected for this year.

Valuation is the other core risk, especially with the rally that the company has sustained after recent take-private rumors. At current share prices near $24, Instructure trades at a market cap of $3.48 billion. After we tack on the $1.148 billion of debt and net off $83.0 million of cash on the company’s most recent balance sheet, Instructure’s resulting enterprise value is $4.54 billion.

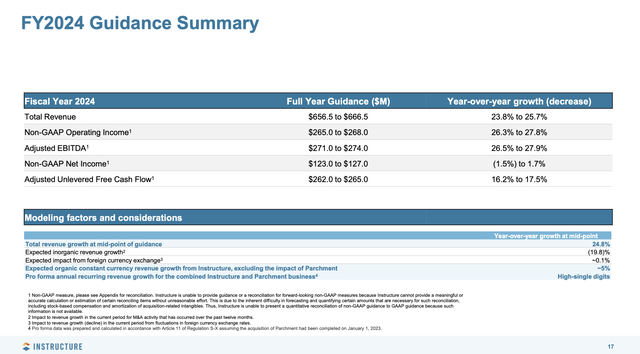

Meanwhile, for the current year, Instructure has guided to $656.5-$666.5 million in revenue (24-26% y/y growth, including the impact of the Parchment acquisition) and $271-$274 million of adjusted EBITDA, with unlevered free cash flow closely mirroring adjusted EBITDA.

Instructure FY24 outlook (Instructure Q1 earnings deck)

This puts Instructure’s valuation multiples at:

- 6.8x EV/FY24 revenue

- 16.7x EV/FY24 adjusted EBITDA

For a company with only single-digit organic growth rates, a high single-digit revenue multiple and a high-teens adjusted EBITDA multiple certainly don’t scream value.

Still, I view Instructure as richly laden with opportunity: whether as a standalone company from fundamental expansion via Parchment and increased LMS penetration overseas, or via a possible take-private deal, I think now is a great time to invest in Instructure while it’s still down YTD.

Read the full article here