It has been just over six months since our last look at Fulgent Genetics, Inc. (NASDAQ:FLGT). This diagnostic company, like so many others in the space, is navigating through a rough patch triggered by Covid going from being a pandemic to being endemic. The company fortunately has a rock-solid balance sheet rich in cash to get through this challenge. The company reported its first quarter results in early May. Therefore, it makes it a good time to take our first look at Fulgent in 2024. An updated analysis follows below.

May 2024 Company Presentation

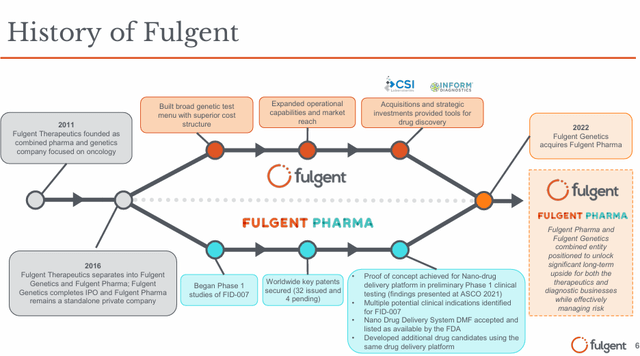

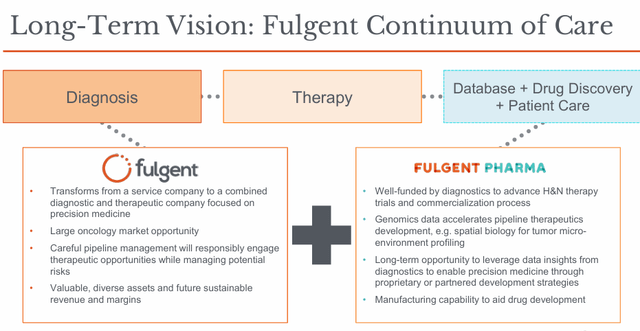

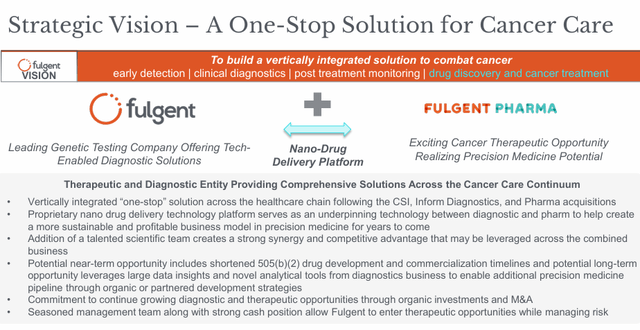

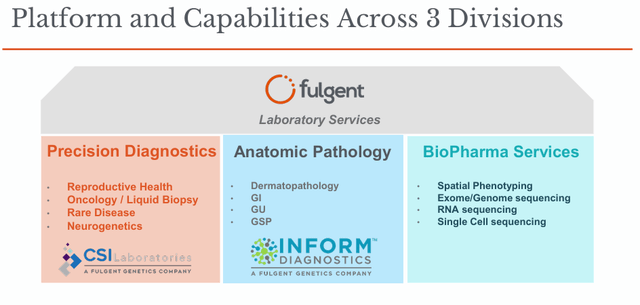

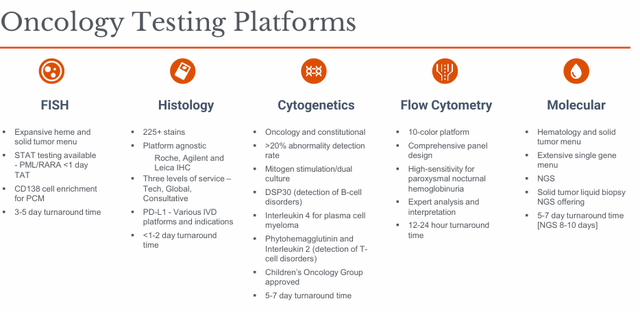

Fulgent Genetics, Inc. is headquartered in El Monte, CA. The company’s business consists of an established laboratory services business and a therapeutic development business. The company offers numerous clinical diagnostic solutions. These include molecular diagnostic testing; genetic testing; anatomic pathology laboratory tests and testing services. The stock currently trades around $21.00 a share and sports an approximate market capitalization of $630 million.

May 2024 Company Presentation

The company was founded in 2011 and its current vision is to be a “One-Stop Solution” for cancer care and diagnostic testing.

May 2024 Company Presentation

Recent Results:

Fulgent Genetics, Inc. posted its first quarter numbers on May 2nd. The company crushed expectations with its bottom performance in the quarter, as the company had a non-GAAP loss of a penny a share. That beat the consensus that was looking for a just over 30 cents a share loss for the quarter. These better-than-expected bottom-line results were driven by Non-GAAP operating expenses falling to $32.4 million, a notable decrease from $45.1 million in the prior quarter.

Revenues declined 2.6% on a year-over-year basis to $65.4 million, which was just light of the analyst firm median estimate. Covid sales are all but gone, and “core” testing revenues grew one percent on a year-over-year basis. Only $1.3 million in sales during the quarter was due to Covid test sales.

May 2024 Company Presentation May 2024 Company Presentation

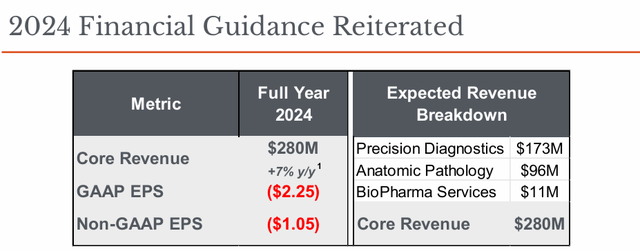

Management reaffirmed FY2024 core sales guidance of $280 million and a non-GAAP loss of $1.05 a share for this fiscal year. On a core basis around revenues, that would be up seven percent from FY2023.

May 2024 Company Presentation

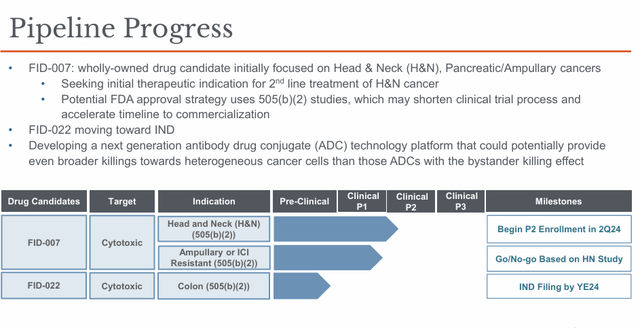

The company also continues to advance its early-stage developmental therapeutic pipeline. Management has guided expenses in this area to come in between $15 million to $17 million for FY2024.

May 2024 Company Presentation

Analyst Firm Commentary & Balance Sheet:

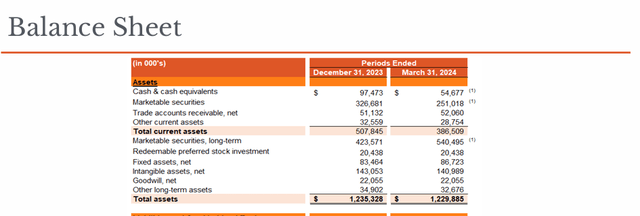

Fulgent Genetics ended the quarter with just over $845 million of net cash and marketable securities on its balance sheet. This is roughly the same amount of cash/marketable securities it closed with at the end of the third quarter of last year. Management has guided that it expects to end FY2024 with some $800 million of cash and marketable securities on its balance sheet.

May 2024 Company Presentation

Despite an over $600 million market cap and selling for less than the cash on its balance sheet, FLGT gets sparse coverage from Wall Street. Perhaps, in part, due to the fact, the company has no need to raise additional capital for the foreseeable future. Only UBS and Piper Sandler have chimed in around Fulgent Genetics so far in 2024. They both have Hold ratings with identical $25 a share price targets on the equity.

Conclusion:

Fulgent Genetics lost 41 cents a share in FY2023 on just over $289 million worth of revenue. The current analyst firm consensus is that the company’s losses will grow to 92 cents a share in FY2024 as sales fall to $280 million. The project losses of 85 cents a share, but with revenue growth of 15%.

Revenues should trough in FY2024 as the company completely weans itself from its previous Covid sales stream. While the company will continue to post losses for at least another year or two, it is going in the right direction. More importantly, the stock sells for less than its liquidation value given its net cash.

The net cash on Fulgent’s balance sheet should put a floor under the stock near current trading levels. However, there might be little upside in the shares until revenue growth returns in FY2025. Therefore, the right play on FLGT for now, seems to be to hold it within covered call positions. This provides some additional downside protection, and the option premiums provide a nice return even if the stock trades sideways over the coming quarters.

That strategy has worked well for me around FLGT, as I have been able to “roll” the options forward several times now. This also seems to be a way to own Vir Biotechnology (VIR) which is in a very similar situation in weaning off its previous Covid sales stream with a large amount of net cash on the balance sheet. I last highlighted Vir Biotechnology five weeks ago. In trading Wednesday, the shares shot up nearly 20% in trading on some positive mid-stage trial data, it should be noted.

Read the full article here