Chevron Stock Outperformed Amid Recent Worries

Chevron Corporation (NYSE:CVX) investors have endured a challenging few weeks as underlying crude oil futures (CL1:COM) (CO1:COM) have continued to suffer from bearish market sentiments. OPEC+’s extension of its voluntary cuts also sent mixed signals to the market, with plans to “start unwinding output cuts as early as October.” As a result, it has justified the caution seen among oil investors as WTI crude oil futures topped in early April 2024. Accordingly, oil futures have declined more than 15% since then, threatening to enter another bear market.

Notwithstanding the palpable negative sentiments percolating throughout the energy sector (XLE), CVX stock has outperformed the S&P 500 (SPX) (SPY) since my previous bullish CVX update in March 2024. Therefore, it’s arguable that Chevron investors have not been unduly concerned with the weakness observed in the oil futures.

Investors are likely assured of Chevron’s robust production performance in the first quarter and confident production outlook in the medium term. Furthermore, Hess Corporation’s (HES) recent shareholder approval of Chevron’s acquisition has reduced one of the remaining stumbling blocks in expanding Chevron’s ambitions in Guyana. Despite that, clarity over Chevron’s arbitration with Exxon Mobil Corporation (XOM) isn’t anticipated until at least Q4. Still, Chevron management is confident that Exxon’s “preemption rights do not apply to the Hess deal.”

As a reminder, Chevron’s Q1 earnings release was a mixed report. Chevron recorded a substantial 12% YoY increase in total average production. However, lower realizations in Chevron’s upstream natural gas segment and downstream refining margins affected CVX’s adjusted EPS of $2.93. Despite that, Chevron’s ability to surpass Wall Street’s estimates suggests the market had already reflected sufficiently lowered expectations.

Chevron’s Robust Production Growth Outlook

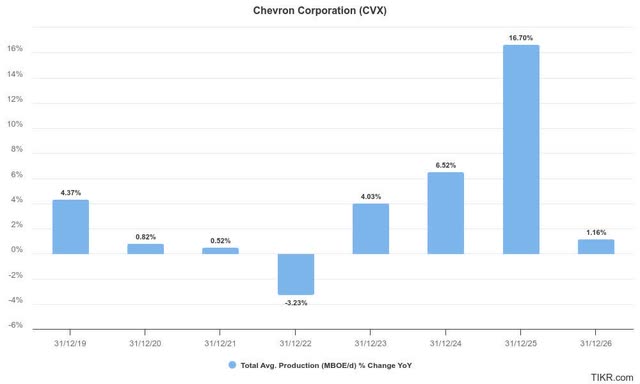

Chevron’s total average production estimates (MBOE per day) (TIKR)

As seen above, Chevron’s production is expected to remain in a growth phase, mitigating the downside volatility in commodity pricing fluctuations. Despite that, Chevron management has pledged to remain disciplined in capital allocation, pursuing profitable growth in its higher-value asset portfolio.

Therefore, Chevron is well-positioned to leverage its assets base in the Permian Basin and DJ Basin. Production has remained resilient in the Permian Basin, accounting for 859K BOE per day in Q1. In addition, DJ Basin also contributed a robust quarter, delivering 400K BOE per day last quarter. These are high-quality assets in Chevron’s low-cost portfolio, helping to deliver “high cash margins and low breakeven barrels.”

Positive Outcome On Hess Could Drive A Rally

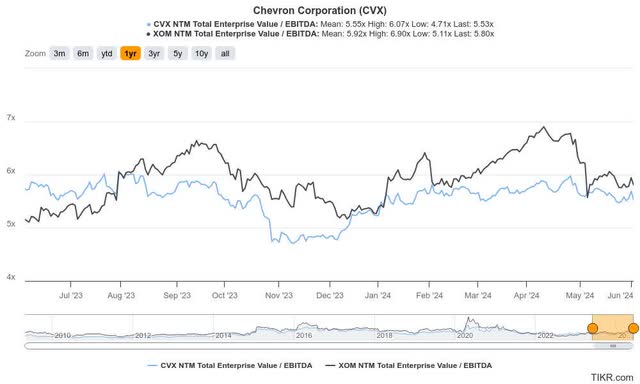

CVX Vs. XOM valuations comparisons (TIKR)

Given the current uncertainties surrounding Chevron’s acquisition of Hess, I assess that the market could re-rate CVX higher if the arbitration outcome is in favor of Chevron. In addition, the valuation bifurcation between CVX and XOM has closed markedly over the past month, suggesting buying sentiments on CVX have remained resilient.

Therefore, CVX’s “C-” valuation grade suggests it isn’t valued expensively, with the potential for a re-rating if we obtain a favorable outcome on its arbitration with Exxon.

Notwithstanding my optimism, I must stress that underlying oil futures have failed to hold their consolidation zone above the $75 support level. Accordingly, WTI futures fell to $73.4, as the market has turned increasingly concerned with potentially increased supply risks as OPEC+ is expected to roll back its production cuts. Hence, if oil futures fall into a bear market subsequently, it could cause downside volatility in CVX. As a result, it could intensify execution risks for Chevron to raise its production more aggressively to mitigate pricing declines if Saudi’s influence on OPEC+ potentially weakens, leading to anticipation of a potential over-supply situation.

In addition, a long-term investment in Chevron needs to be balanced against a potential long-term decline in oil demand as the world transitions into renewable energy technologies. Chevron highlighted that it expects to “allocate approximately $10 billion towards its New Energies business.” However, ROI in these endeavors is likely to remain uncertain given the nascent developments. Despite that, Chevron’s commitment toward resuming its annualized $17.5B share repurchase buyback cadence following the completion of the Hess acquisition should assure investors of its financial discipline.

Is CVX Stock A Buy, Sell, Or Hold?

Chevron investors have remained resilient, as observed in its relative outperformance over the past two months. The narrowing of CVX’s valuation bifurcation with XOM suggests CVX isn’t valued expensively, corroborated by its “C-” valuation grade.

A positive outcome from Chevron’s arbitration with Exxon should provide the impetus for a further valuation re-rating as Chevron bolsters its asset portfolio with a potentially high-growth, low-cost asset.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here