Barrick Gold Stock Outperformed

Barrick Gold Corporation (NYSE:GOLD) investors have finally felt vindicated. Since my last bullish GOLD update in March 2024, GOLD stock has significantly outperformed the S&P 500 (SPX) (SPY). I reminded GOLD investors that more robust price realizations are expected to support buying sentiments, underscoring my conviction that GOLD’s “pessimism won’t last forever.”

Therefore, I’m unsurprised with GOLD’s relative outperformance, as underlying gold futures surged toward a new high in early April 2024. Although buying momentum has stalled since then, robust central bank buying demand and China’s reallocation toward gold’s shiny thesis should bolster its potential bullish breakout. Moreover, with the Fed’s rate hikes likely peaked, it lends credence to a more favorable macro backdrop for a further valuation re-rating of well-battered leading gold miners like Barrick Gold.

Barrick Gold Should Do Better In The Second-Half

Barrick Gold’s Q1 earnings release in early May 2024 underscored the gold miner’s improved execution as Barrick Gold’s performance surpassed Wall Street’s estimates. While gold production fell 12K ounces YoY, Barrick Gold anticipates a production ramp-up in the second half as it completes the “planned maintenance at the Nevada gold mines.” Accordingly, Barrick Gold’s upbeat production guidance suggests a higher production weightage (54%) in H2, potentially pointing to “a strong finish to the year.” Therefore, investors should carefully monitor Barrick Gold’s production cadence from Q3 as the gold miner looks to fulfill an FY2024 gold production guidance of between 3.9M and 4.3M ounces.

In addition, Barrick Gold also anticipates more robust copper (HG1:COM) production in the medium term. The secular growth in copper demand is undergirded by the “worldwide transition to renewable energy, highlighting the metal’s critical importance in greening the global grid.” As a result, Barrick Gold underscored the criticality of its efforts in designating the “expansion of its copper portfolio a strategic priority following the merger with Randgold five years ago.”

Despite that, copper remains a relatively small portfolio currently. Barrick Gold’s “globally significant organic copper growth project” in the Lumwana copper mine is only expected to reach its first production in 2028. While it’s expected to be a long-lasting copper asset base for Barrick Gold (with an expected lifespan of over 30 years), the market will likely assess Barrick Gold for its gold mining portfolio in the near term.

Barrick Gold anticipates a further recovery in its gold production in H2 following the “delayed ramp-up at Pueblo Viejo following conveyor reconstruction.” In addition, the gold miner has also made progress in “four major organic growth projects.” Therefore, I assess it’s reasonable to expect Barrick Gold’s production to continue trending higher, improving its operating leverage and free cash flow profitability.

Inflation headwinds and labor challenges have hampered Barrick Gold’s production efforts in recent years. Despite that, management remains confident in some aspects of reducing price levels “back down to 2021 levels.” However, Barrick Gold also cautioned that pricing in “certain commodities remain stubbornly high.” As a result, I assess that the market will likely remain cautious over a sharp profitability growth inflection in GOLD and its mining peers in the near term.

Notwithstanding my caution, investors must also assess whether GOLD’s pessimism has been baked into its valuation, suggesting that expectations of a further valuation re-rating aren’t unreasonable.

Monitor Barrick Gold’s Free Cash Flow Profile

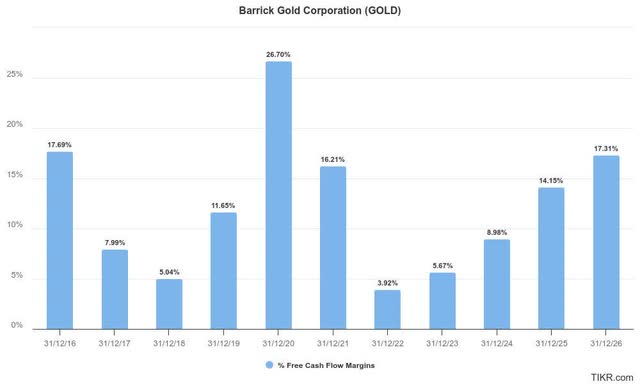

Barrick Gold free cash flow estimates (TIKR)

Being a gold miner, investors must watch Barrick Gold’s free cash flow dynamics very carefully. As seen above, GOLD’s FCF profile has tended to be cyclical and surged during the previous highs seen in underlying gold futures in 2020. Notwithstanding the new highs experienced recently in gold futures, Barrick Gold’s FCF profile isn’t expected to surpass its 2021 levels until FY2026.

Therefore, I assess the pessimism in GOLD stock over the past year as justified, as the company struggled with production, inflation, labor, and commodities costs challenges. However, with Barrick Gold’s FCF growth expected to have bottomed, can GOLD be re-rated higher based on its valuation assessment?

GOLD’s Valuation Is Attractive

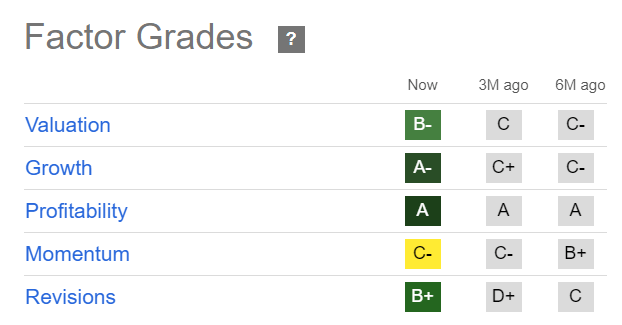

GOLD Quant Grades (Seeking Alpha)

GOLD’s valuation has improved to “B-” over the past six months. Barrick Gold’s ability to surpass Wall Street’s estimates has also led to higher optimism about Barrick Gold’s execution capabilities. As a result, GOLD’s valuation bifurcation (“A-” growth grade compared to its “B-” valuation grade) is pretty distinct, suggesting there’s potential for a further valuation re-rating.

Therefore, I assess that Barrick Gold needs to continue outperforming in the second half to justify GOLD’s recent optimism. The market is likely still concerned about adverse inflation dynamics that could hamper its FCF profile.

A higher H2-weighted production profile also increases the potential execution risks in Barrick Gold’s ability to meet its FY2024 production outlook. Moreover, the surge in copper prices is not expected to be a material near-term valuation driver, given the current production size of its asset base.

Is GOLD Stock A Buy, Sell, Or Hold?

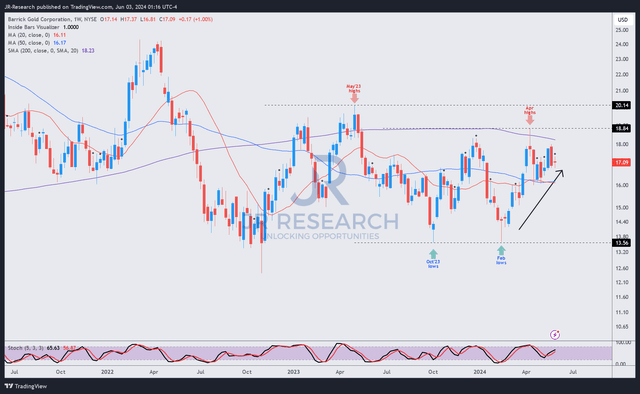

GOLD price chart (weekly, medium-term, adjusted for dividends) (TradingView)

Despite that, improved buying momentum in GOLD is expected to continue. GOLD’s lack of selling intensity (“C-” momentum grade) underscores my confidence in the market’s recent optimism.

In addition, Barrick Gold boasts a highly robust balance sheet with an estimated adjusted EBITDA leverage ratio of just 0.1x for 2024. Therefore, it should provide substantial assurance for possible M&A activities to bolster its portfolio. It should also offer income investors clarity in Barrick Gold’s ability to sustain its forward dividend yield of 2.3%, bolstered by its potentially improving FCF profile.

GOLD’s price action is also nearing a potentially decisive breakout above the $19 level. That level was re-tested in April 2024, but the selling intensity quickly fizzed out in May 2024 as it bottomed above the $16 level. Therefore, I assess more robust dip-buying sentiments should help stem a further decline toward GOLD’s 2023 lows and bolster a subsequent breakout above the $19 resistance zone.

With that in mind, GOLD investors should continue holding on to their positions as they anticipate a more robust second-half production performance.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here