A while ago, I wrote a cautious article on the abrdn World Healthcare Fund (NYSE:THW) (formerly known as the Tekla World Healthcare Fund), noting that it appeared to be an amortizing ‘return of principal’ fund that should be avoided by investors. While some analysts claimed that the THW fund is an investment for the next decade, I was not so sure about the THW fund and preferred the abrdn Healthcare Opportunities Fund (NYSE:THQ), which has a much more sustainable distribution policy.

Although I don’t know how the rest of the decade will unfold, judging from their respective returns so far, my preference appears to be correct. Since my article in January 2023, the THQ fund has delivered double-digit total returns while THW has delivered negative total returns (Figure 1).

Figure 1 – THW has underperformed THQ since January 2023 (Seeking Alpha)

However, as significant time has passed since my last article, I wanted to take a fresh look at THW and THQ to see if my recommendation remains the same.

Unfortunately, a recent distribution increase by the THQ fund has raised its distribution yield to a likely unsustainable level. Over time, I believe the THQ fund will suffer an amortizing NAV like the THW.

Instead of the THW and THQ funds, investors can create their own ‘high-yielding’ fund by buying a low-cost sector ETF and periodically selling units to pay themselves a high ‘cash flow’. As long as total returns are sufficient to fund the cash flow, this may be a better alternative.

Brief Fund Overviews

Tekla Capital Management is a healthcare investment specialist managing both the abrdn World Healthcare Fund (“THW”) and the abrdn Healthcare Opportunities Fund (“THQ”). Tekla was acquired by the British asset manager abrdn in 2023, leading to the name change in the funds.

In addition to THW and THQ, Tekla/abrdn also manages the abrdn Healthcare Investors (HQH) and abrdn Life Sciences Investors (HQL) closed-end funds (“CEFs”).

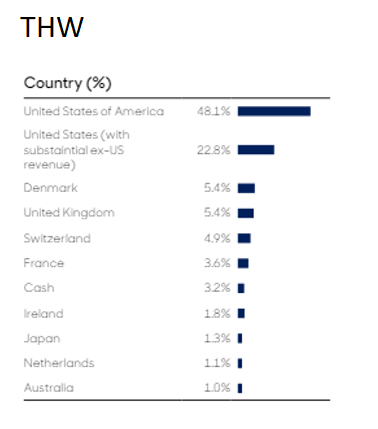

Both the THW and THQ funds are broad healthcare funds that invest in mostly public healthcare companies. The main difference between THW and THQ is that THW is a global fund, while THQ is mainly focused on U.S. equities (Figure 2).

Figure 2 – THW geographical allocation (abrdnthw.com)

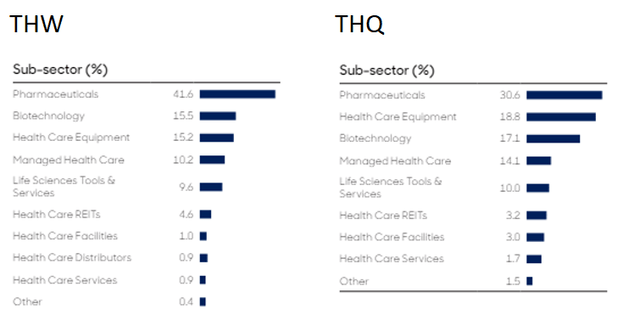

Figure 3 compares the sub-sector allocations between the two funds. The major difference here is that the THW fund has a higher allocation to Pharmaceuticals (41.6% vs. 30.6%), while the THQ fund has higher allocations to other healthcare sub-sectors like Health Care Equipment (18.8% vs. 15.2%), Biotechnology (17.1% vs. 15.5%), and Managed Health Care (14.1% vs. 10.2%).

Figure 3 – THW and THQ sub-sector allocations (abrdnthw.com and abrdnthq.com)

Beware Return of Principal Funds

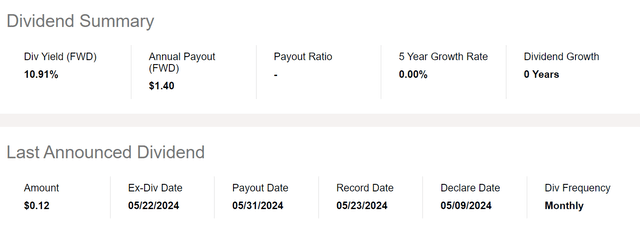

The main issue I have with the THW fund was that its distribution rate, currently set at $0.1167 / month or a forward yield of 10.9% on market price, is above the fund’s total returns since January 2023 of -2.9% (Figure 4).

Figure 4 – THW pays a very high distribution yield (Seeking Alpha)

Funds that do not earn their distributions are commonly called ‘return of principal’ funds and are characterized by amortizing net asset values (“NAV”). This is because ‘return of principal’ funds usually fund their distributions by liquidating NAVs; i.e. the fund’s high distribution yields are funded from the investor’s own capital.

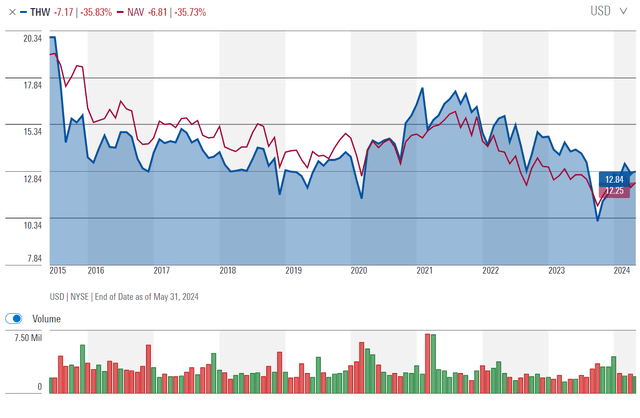

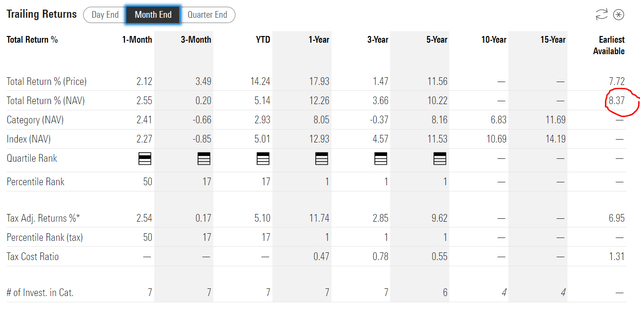

Since the market prices of closed-end funds tend to track their NAVs, ‘return of principal’ funds also tend to have amortizing market prices. Since its inception, the THW fund’s NAV has declined by 35.7% and its market price has fallen by 35.8% (Figure 5).

Figure 5 – THW has an amortizing NAV issue (morningstar.com)

While income-oriented investors usually claim they have not ‘lost money’ since the market price declines are ‘unrealized’, the reality is that these unrealized losses are unlikely to be regained, since the assets of the fund has already been liquidated and paid out to investors in the form of distributions.

For example, imagine a retired investor who bought the THW fund at $16/share in May 2021 but now needs to sell the investment to fund a big purchase or expense. At the time of his investment, the investor was looking at an attractive forward yield of 8.75% ($1.40 / $16).

Fast forward to today, the fund is only worth $12.85 in the public markets with a NAV/share of $12.25. While it is true the investor has earned ‘distribution income’ of $1.40/year for three years or a total of $4.20 in distributions, the value of his investment has declined by $3.15/share in the public markets. The market does not care the investor bought his shares at $16/share. The market only pays what the shares are worth at the current moment in time. Hence total returns for the investor for holding the THW fund for three years is only $1.05 / share, or ~2.2%/year.

THQ Is Now Unsustainable As Well

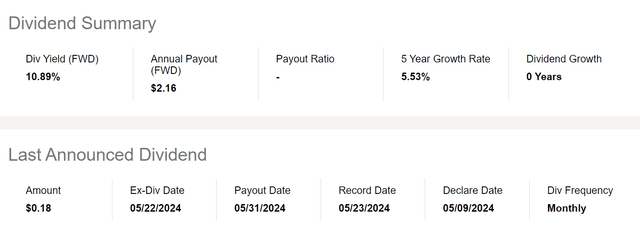

Unfortunately, since coming under the management of abrdn, the THQ fund has recently raised its monthly distribution from $0.1125/share to $0.18/share (Figure 6).

Figure 6 – THQ has raised its distribution (Seeking Alpha)

On the surface, this looks like a great deal for investors, as the forward yield on the THQ fund has now been boosted to 10.9% on market price (Figure 7).

Figure 7 – THQ is yielding 10.9% (Seeking Alpha)

Unfortunately, I believe the $2.16/year forward distribution on the THQ fund may be setting up the THQ fund to become yet another amortizing ‘return of principal’ fund from abrdn.

Since inception, the average annual returns on NAV for the THQ fund have only been 8.4% per annum (Figure 8). Based on a recent NAV of $21.45, the THQ fund is paying a forward yield of 10.0%. The gap between long-term returns and forward yield will be funded by a gradual erosion of THQ’s NAV.

Figure 8 – THQ historical returns (morningstar.com)

What To Do For Income-Oriented Investors?

With the THQ fund also fast becoming an amortizing ‘return of principal’ fund, what should long-term investors do? First, investors should not panic. The NAV amortization mentioned above is a long and gradual process and does not happen overnight. So investors should not panic-sell their investments in THW or THQ. Instead, they should start to look for alternatives.

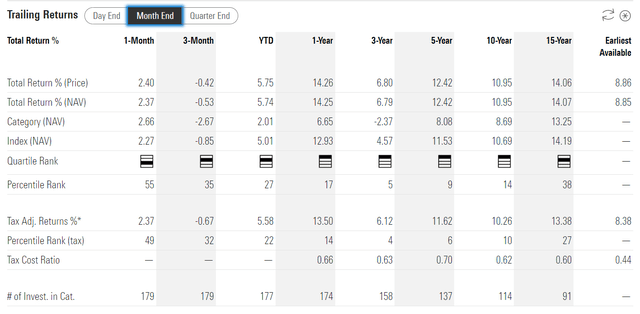

One possible alternative is to consider the Health Care Select Sector SPDR ETF (XLV). The XLV is a low-cost passive ETF focused on the healthcare sector. Historically, the XLV is a 1st quartile fund that has outperformed most dedicated healthcare investment funds like THW and THQ (Figure 9).

Figure 9 – XLV historical returns (morningstar.com)

The main drawback with the XLV ETF is its low distribution yield, which is only 1.5% currently. However, investors can create their own ‘high-yielding’ fund out of the XLV by liquidating a fixed amount of the investment every quarter to match their cash flow requirements.

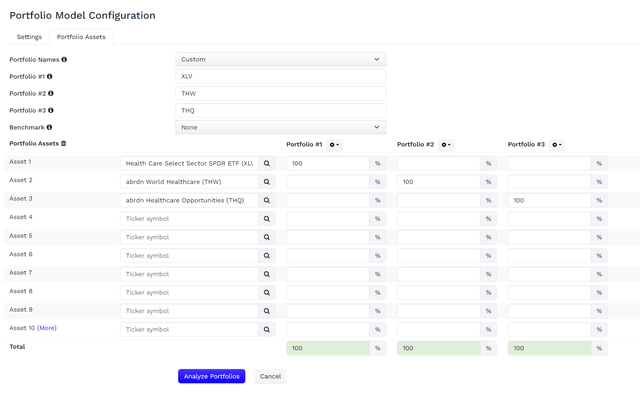

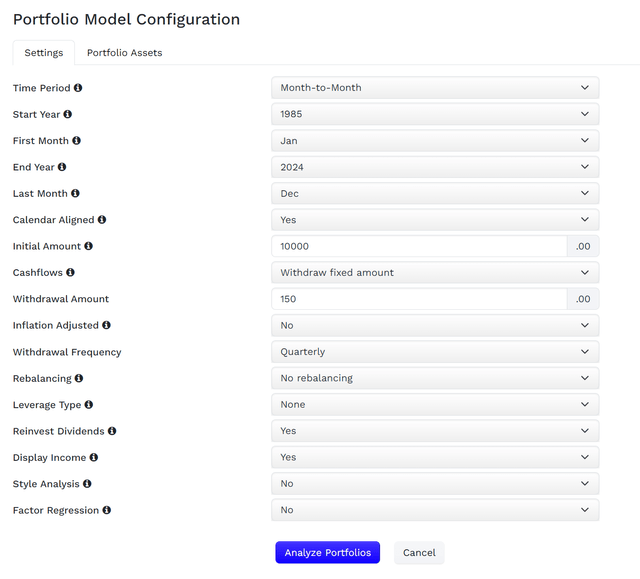

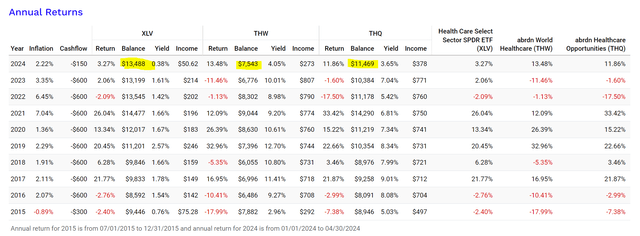

For example, consider a hypothetical comparison between the XLV, THW, and THQ (Figure 10). An investor invests an initial $10,000 into each fund and withdraws a quarterly $150 or an annualized ~6% yield (Figure 11).

Figure 10 – Hypothetical comparison between XLV, THW, and THQ (Author created using portfoliovisualizer) Figure 11 – Analysis assumes a fixed cash withdrawal of $150 / quarter (Author created with portfolio visualizer)

Over the long-run, we can see that the XLV portfolio ends up with a higher ending balance because its total returns are higher (Figure 12).

Figure 12 – XLV portfolio ends up with a higher ending balance (Author created using portfoliovisualizer)

When comparing securities, investors should always consider total returns and not just distribution yields.

Conclusion

Since January 2023, the THW fund has delivered negative total returns and underperformed my preferred healthcare fund, the THQ fund. Unfortunately, the THQ fund has recently boosted its distribution rate after abrdn’s acquisition of the fund manager, Tekla. I believe this will turn the THQ fund into a long-term amortizing ‘return of principal’ fund like the THW.

I recommend that income-oriented investors looking for healthcare exposure may be better served by investing in a low-cost ETF like the XLV and creating their own ‘high-yielding’ fund by periodically selling units to deliver high cash flows.

Read the full article here