Fortinet Stock Fell Into A Bear Market

Fortinet, Inc. (NASDAQ:FTNT) investors have witnessed another steep pullback in FTNT stock after its buying momentum stalled in April 2024. As a result, we revisited lows last seen in January 2024, as FTNT underperformed the S&P 500 (SPX) (SPY) YTD. Recent selloffs in cybersecurity stocks have likely worsened buying sentiments on the leading SASE leader as Fortinet navigates growth normalization headwinds in its product sales market. Fortinet’s Q1 earnings release in early May didn’t inspire confidence as Fortinet’s billings growth performance disappointed. Notwithstanding the bear market decline from FTNT’s April 2024 highs, I assess the possibility for Fortinet’s performance to improve moving ahead, as the slowdown in its firewall sales potentially bottoms in the first half.

I presented a bullish thesis on FTNT stock in my early February article. However, FTNT’s relative underperformance suggests the market wasn’t convinced of Fortinet’s recovery. Given the billings’ disappointment and guidance promulgated in Fortinet’s recent earnings release, I assess the market’s pessimism as justified. Fortinet’s Q1 performance was mixed. However, the market is right to focus on what’s next and not what has already occurred. Therefore, Fortinet’s sub-optimal execution in its product revenue cadence highlighted increased execution risks through FY2024, justifying circumspection.

Fortinet’s Weak Billings Growth Should Improve

Notwithstanding the caution, I have assessed that FTNT stock has remained in an uptrend bias, underpinning the opportunity to buy significant dips on FTNT stock. Fortinet management presented a timely update at a recent May conference, underscoring its confidence in the bottoming potential of its forward revenue. Fortinet anticipates “easing backlog impact throughout the year, with Q4 expected to have no backlog headwinds.” Consequently, it should provide “easier backlog comparison” in the second half, as Fortinet’s billings growth hits its expected trough. Management observed an acceleration in the “pace of customers registering security contracts, indicating healthy signs in business activity.” Therefore, the increased optimism in an improved sales cadence in the second half should provide more clarity over its product revenue performance, even as Fortinet expands in Unified SASE and AI-driven SecOps.

Fortinet revenue segments (Fortinet filings)

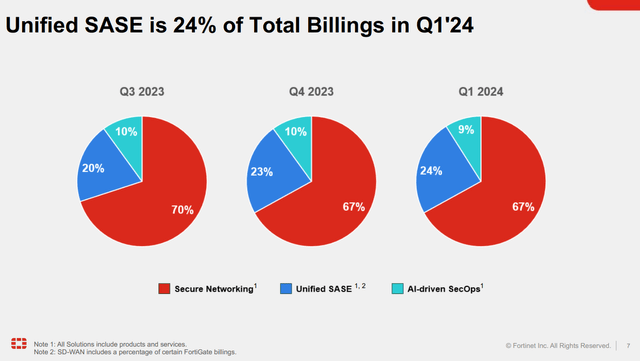

Fortinet investors should be aware that Secure Networking is still the primary billings driver in Fortinet’s overall business segments. Accordingly, its networking business accounted for almost 67% of its billings in the first quarter. However, Fortinet’s networking business is assessed to be more cyclical than its Unified SASE and SecOps businesses.

Fortinet management highlighted the CapEx-driven nature of Secure Networking compared to the OpEx-driven opportunities in Unified SASE. Therefore, Fortinet investors should anticipate growth normalization headwinds as CapEx spending cycles peaked. However, Fortinet also assured investors that it’s making progress in cross-selling across its SASE business, leveraging on its highly valued enterprise base.

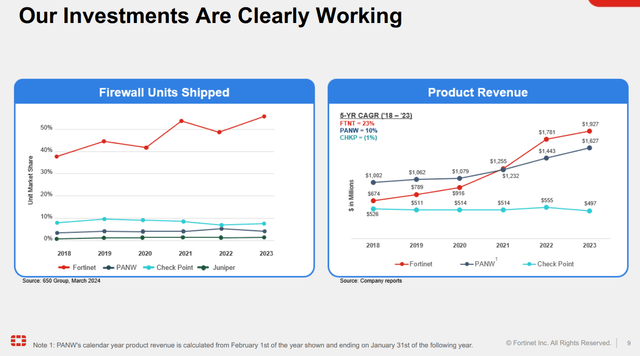

Fortinet firewall leadership (Fortinet filings)

While more intense competition by next-gen cybersecurity operators should be expected, Fortinet believes its well-established market leadership in Secure Networking should provide it the edge to capitalize on these growth vectors. Therefore, Fortinet seems well-placed to manage the heightened competitive headwinds attributed to cloud-native cybersecurity companies looking to disrupt Fortinet’s networking business.

FTNT Valuation Isn’t Cheap But Justified

FTNT Quant Grades (Seeking Alpha)

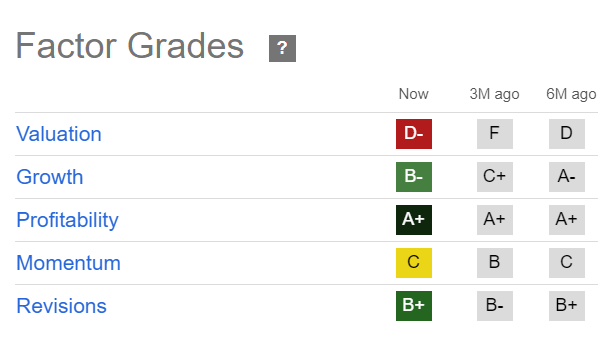

FTNT’s valuation isn’t cheap (“D-” valuation grade) relative to its tech sector peers. However, cybersecurity leaders like Fortinet typically possess a robust moat due to the significant value of their data. Bolstered by the mission-critical nature of their solutions, switching costs are assessed to be high, supported by Fortinet’s robust enterprise customer base (73% of Fortune 100 companies are Fortinet customers).

Moreover, FTNT’s best-in-class “A+” profitability grade justifies Fortinet’s business model sustainability. As the platformization drive continues to dominate the cybersecurity space, Fortinet’s fundamentally strong business and well-established enterprise base should underpin improved buying momentum.

Is FTNT Stock A Buy, Sell, Or Hold?

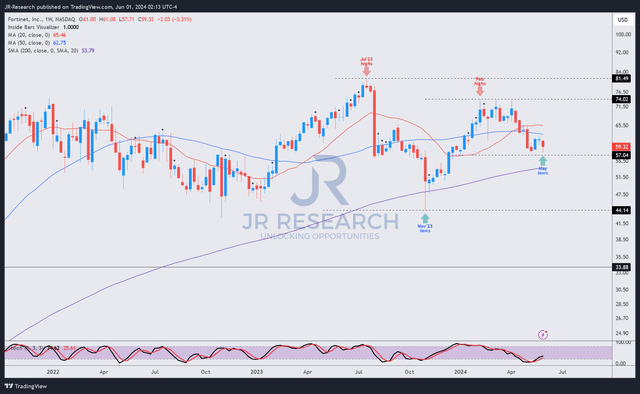

FTNT price chart (weekly, medium-term) (TradingView)

FTNT has encountered significant challenges in resuming its uptrend continuation thesis since FTNT peaked in July 2023. However, FTNT’s November 2023 low has demonstrated its resilience as dip-buyers attempted a recovery through FTNT’s February 2024 highs.

Notwithstanding the early optimism, FTNT’s buying momentum stalled, although not assessed to be disastrous. FTNT’s “C” momentum grade corroborates the lack of intense selling fervor that could cause more pain for FTNT dip-buyers. As a result, I assess that FTNT seems to be consolidating constructively above its November 2023 lows, forming a higher-low price structure.

Consequently, it has lifted my conviction that we should observe more robust buying sentiments moving ahead, as Fortinet’s billings potentially bottom in the second half. Given the market’s forward-looking tendencies, FTNT investors looking to add exposure should consider buying at the current levels, anticipating an improvement in Fortinet’s second-half performances.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here