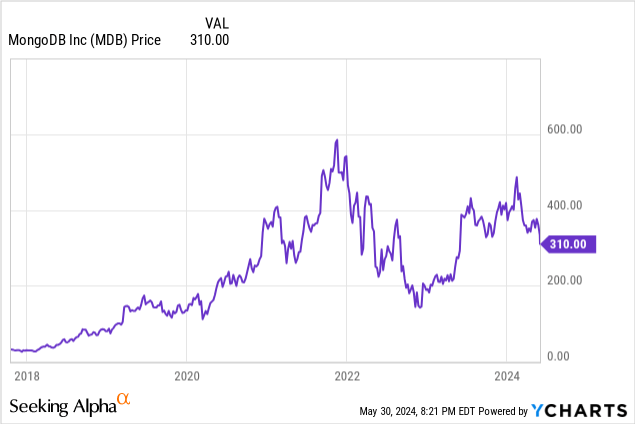

A pessimistic earnings season for tech stocks continues in full force, and the latest victim is MongoDB (NASDAQ:MDB). The non-relational database software company suffered one of its largest one-day declines on record after releasing Q1 results and lowering its full-year outlook.

Blaming a soft macro environment for a slower-than-expected pace of new customer adds plus consumption rates, MongoDB showed a sharp deceleration in its growth rates – which isn’t a good look when the company has also invested heavily into opex to prepare for growth, cutting margins in the process. The stock fell more than 25% in after-hours trading to the ~$230 levels after reporting Q1 results, bringing year-to-date losses to nearly 40%.

With the post-earnings share decline, I see a mixed bull and bear case

I last wrote a bearish article on MongoDB in March, when the stock was trading closer to the ~$350 levels. At the time, I had cited both possible deceleration and margin compression as core downside drivers for MongoDB, plus an incredibly rich valuation that already priced in all of MongoDB’s strengths – and then some.

All of these downward drivers materialized in the company’s Q1 earnings, and yet I had also quoted a $262 year-end price target for the company. Given the stock’s post-earnings slide to below these levels (which I view to be a bit of an overreaction to a reasonably bad quarter), I’m upgrading my viewpoint on MongoDB to neutral.

At newer, post-earnings share prices, I’m more inclined to see a balanced bull and bear case for MongoDB. On the bright side for the company:

- Unstructured data is growing and benefits from AI tailwinds. More and more these days, companies and brand marketers want to capture consumer data coming from “unstructured” sources – Tweets, social media posts, and the like. Traditional databases which store data in a columnar format are not equipped to handle this. As companies look to leverage this data for AI large-language models, databases like MongoDB are essential to house this data.

- Large gross margin profile – MongoDB’s mid-70s gross margins create plenty of headroom to scale in the future, even though it’s not profitable currently.

At the same time, however, a number of risks still remain:

- Decelerating revenue growth, weaker usage trends – Once thought to be a company that could grow at a 40%+ clip indefinitely, MongoDB has surprisingly released a FY25 outlook that calls for a slippage to just low-teens growth rates. It has cited weaker customer consumption levels as one of the core drivers here, as IT departments tighten their belts in response to a softer macro picture.

- Competition – MongoDB may have called itself an “Oracle killer” at the time of its IPO, but Oracle (ORCL) is also making headway in autonomous and non-relational databases. Given Oracle’s much broader software platform and ease of cross-selling, this may eventually cut into MongoDB’s momentum.

Valuation update

Now, from a valuation standpoint – at current post-earnings share prices near $230, MongoDB trades at a market cap of $17.27 billion. After we net off the $2.07 billion of cash and $1.14 billion of debt on MongoDB’s most recent balance sheet, the company’s resulting enterprise value is $16.34 billion.

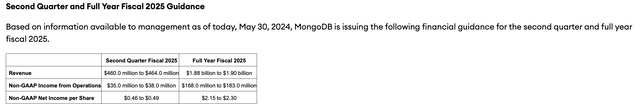

Meanwhile, for the current fiscal year, MongoDB’s latest outlook calls for $1.88-$1.90 billion in revenue, or 12-13% y/y growth.

MongoDB guidance (MongoDB Q1 earnings release)

This is a two-point growth cut relative to a prior outlook that called for 13-15% y/y growth. But again, we have to ask ourselves: does two points of growth merit a quarter of MongoDB’s market cap getting wiped off the map? Of course, the stock was overvalued to begin with, but I think there’s some room on the upside now.

Taking the midpoint of this guidance outlook at face value, MongoDB trades at 8.6x EV/FY25 revenue.

And if we look ahead to FY26 (the fiscal year for MongoDB ending in January 2026), Wall Street analysts are expecting MongoDB to generate $2.33 billion in revenue (+23% y/y) as the company laps a weaker consumption year and starts to pick up tailwinds from AI demand. Against FY26 estimates, MongoDB trades at 7.0x EV/FY26 revenue.

I’m resetting my price target slightly lower to reflect MongoDB’s lowered outlook. By year-end, I expect MongoDB to recover to $251, which is 9.5x FY25 revenue and ~9% upside from post-earnings share prices.

My strategy here: I view longer-term risks for MongoDB as it continues to digest weaker demand in the current year. However, I do think there’s an opportunity for investors to pick up the stock for short-term gains, as I believe MongoDB will continue to trade in volatile patterns over the next few weeks. Maintain caution here, but a lot of the downside for MongoDB has been removed with the post-earnings drop.

Q1 download

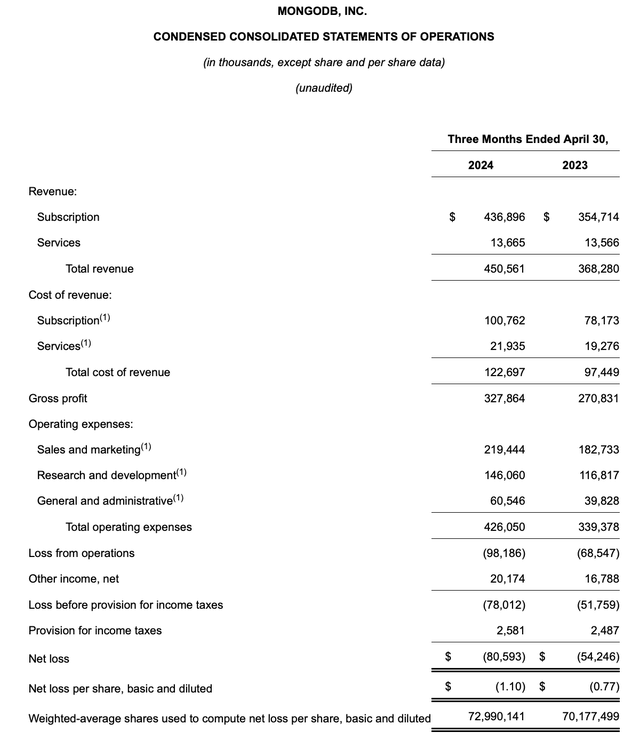

Let’s now go through MongoDB’s problematic Q1 results in greater detail. The Q1 earnings summary is shown below:

MongoDB Q1 results (MongoDB Q1 earnings release)

MongoDB’s revenue grew just 22% y/y to $450.6 million. Though this beat Wall Street’s expectations of $440.0 million (+19% y/y), growth decelerated five points relative to 27% y/y growth in Q4 – a surprise for a company that typically outperforms its outlook by a wide margin.

The company noted a “slower start to the year” for both new workload adds and consumption on MongoDB Atlas, which is a continuation of the trends that we saw in Q4.

It’s worth noting, however, potential upside from new products – especially having to do with AI. In Q1, the company launched the MongoDB AI Applications Program (which it’s abbreviating as MAAP): which gives customers pre-built reference architectures to quickly reference data residing in MongoDB to build AI-powered applications.

As this marks a foray for MongoDB outside of infrastructure and into the application layer, it’s worth noting that MongoDB will pit itself as a competitor versus the likes of C3.ai (AI) – which reported earnings the day before MongoDB and rose as sharply as MongoDB declined. C3.ai’s CEO, Thomas Siebel, noted on its Q1 earnings call that he believes more of the silicon and infrastructure layers of AI will eventually be commoditized, whereas software applications will dominate the long term of the industry. In other words, MongoDB’s expansion into the application layer gives it a differentiated growth vehicle for the future, even if it’s off to a slower start.

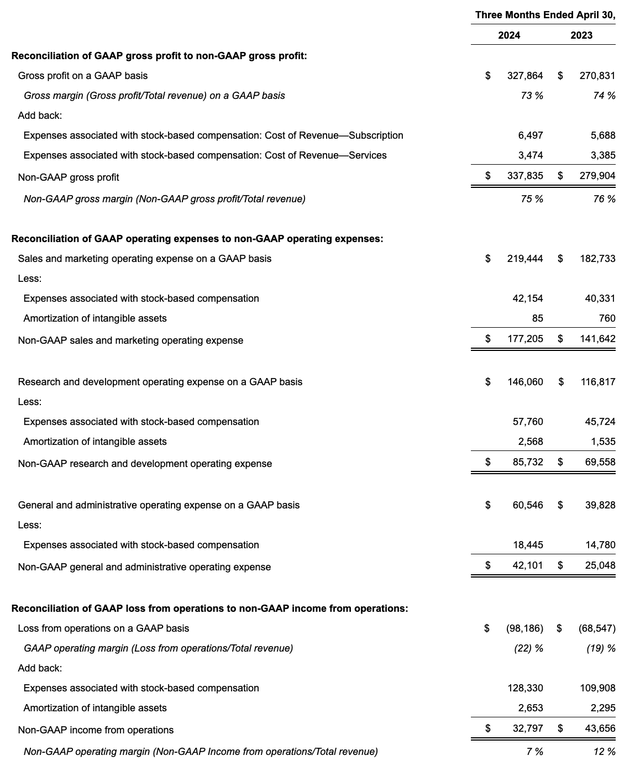

Unfortunately, the company also had disappointing news on profitability. Alongside a one-point slippage in pro forma gross margins to 75%, higher spending across all components of the company’s operating expenses (including and especially G&A, unfortunately), MongoDB’s pro forma operating margins dropped to 7%, a 5-point reduction from the year-ago quarter.

MongoDB operating margins (MongoDB Q1 earnings release)

Key takeaways

At the moment, MongoDB is a victim to ever-present short-termism on Wall Street, and in my view, is overreacting to a disappointing (but not disastrous) quarter. Because MongoDB is dependent on consumption, its quarterly trends will be lumpier than that of a subscription company, and thus it also has the capability to rebound more quickly.

Keep an eye on this stock and add opportunistically as it drops.

Read the full article here