Investment Thesis

Nvidia Corporation (NASDAQ:NVDA) continues its remarkable performance, approaching our previous target of $1165, underscoring its strong foothold in the booming AI and gaming industries. Our reassessment of Nvidia’s stock, prompted by ongoing technical analysis, introduces new price projections, reflecting the company’s sustained upward momentum and robust market positioning.

We maintain our strong buy rating for NVDA, with updated price targets to reflect the growing investor enthusiasm and strategic advances in key technology sectors. This dynamic outlook prompts regular updates to adapt to Nvidia’s evolving market impact and investment potential.

Another quarter of earnings beat and solid guidance underlines why Nvidia is the center of attention amid the AI boom. After rallying by more than 500% over the past year and dwarfing the S&P 500 (SP500) 36% gain, it remains the go-to stock in the burgeoning semiconductor sector despite boasting a premium valuation.

The company’s earnings and cash flows continue to shutter records despite growing concerns that AI chip demand will wane soon. The Chief Executive Officer, Jensen Huang, insisting that the market is too strong, affirms the company’s long-term prospects and growth metrics.

The stock broke the $1000/share psychological level as the executive reiterated that more people and companies want to deploy Nvidia’s powerful chips in data centers to start making and saving money. True to the executive’s words, Nvidia beat all estimates after delivering another record-breaking first quarter.

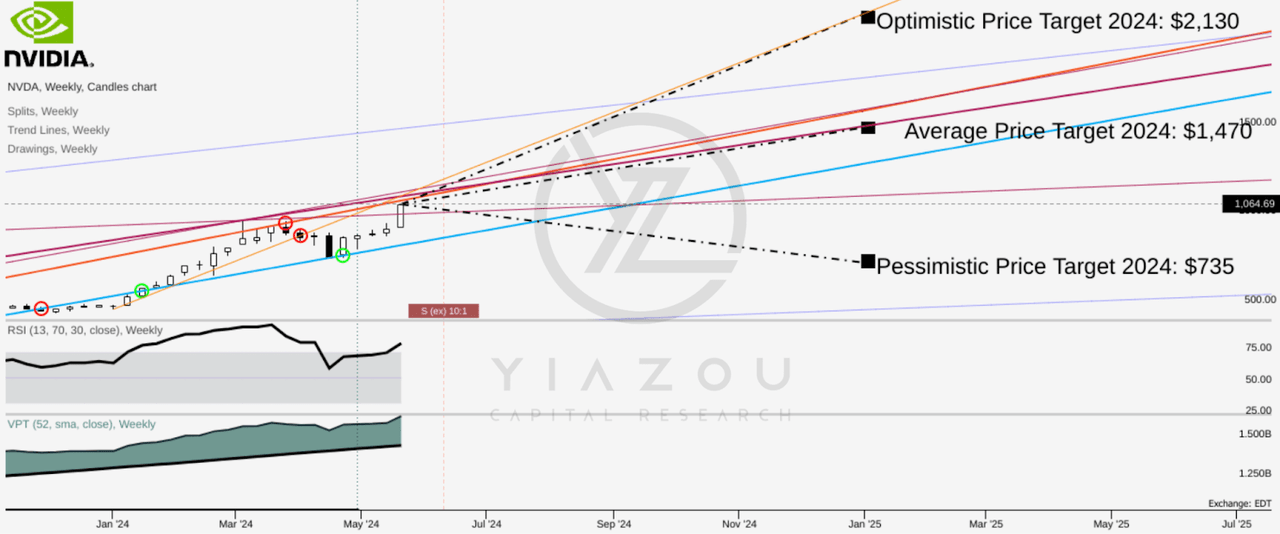

NVDA Targets $2130 Pre-Split Amidst Momentum Surge and Upcoming 10:1 Split!

Nvidia’s stock is currently trading at $1065 with solid bullish momentum. As a critical note, the announced June stock split (10:1) will significantly impact (positive) affordability and the stock’s average trading volume. Framing trend lines over the recent swings (with red and green circles indicating breakouts) provides an optimistic price target of $2130 ($213 after split) by the end of 2024. Similarly, the average price target is $1470 ($147 after split).

The pessimistic price target was $735 ($73.5 after the split). These price targets are projected over Fibonacci retracement (pessimistic) and extension (optimistic and average) levels. Looking at the relative strength index (RSI), at 67.43, signifies prevailing bullish momentum in the stock that would persist until the indicator hits 90. However, once the indicator reaches above 70, selling pressure may resume to build again on the stock.

Lastly, the volume price trend in the weekly time frame is moving aggressively above its 1-year moving average, suggesting massive room for the stock to progress in the short term.

Author (trendspider.com)

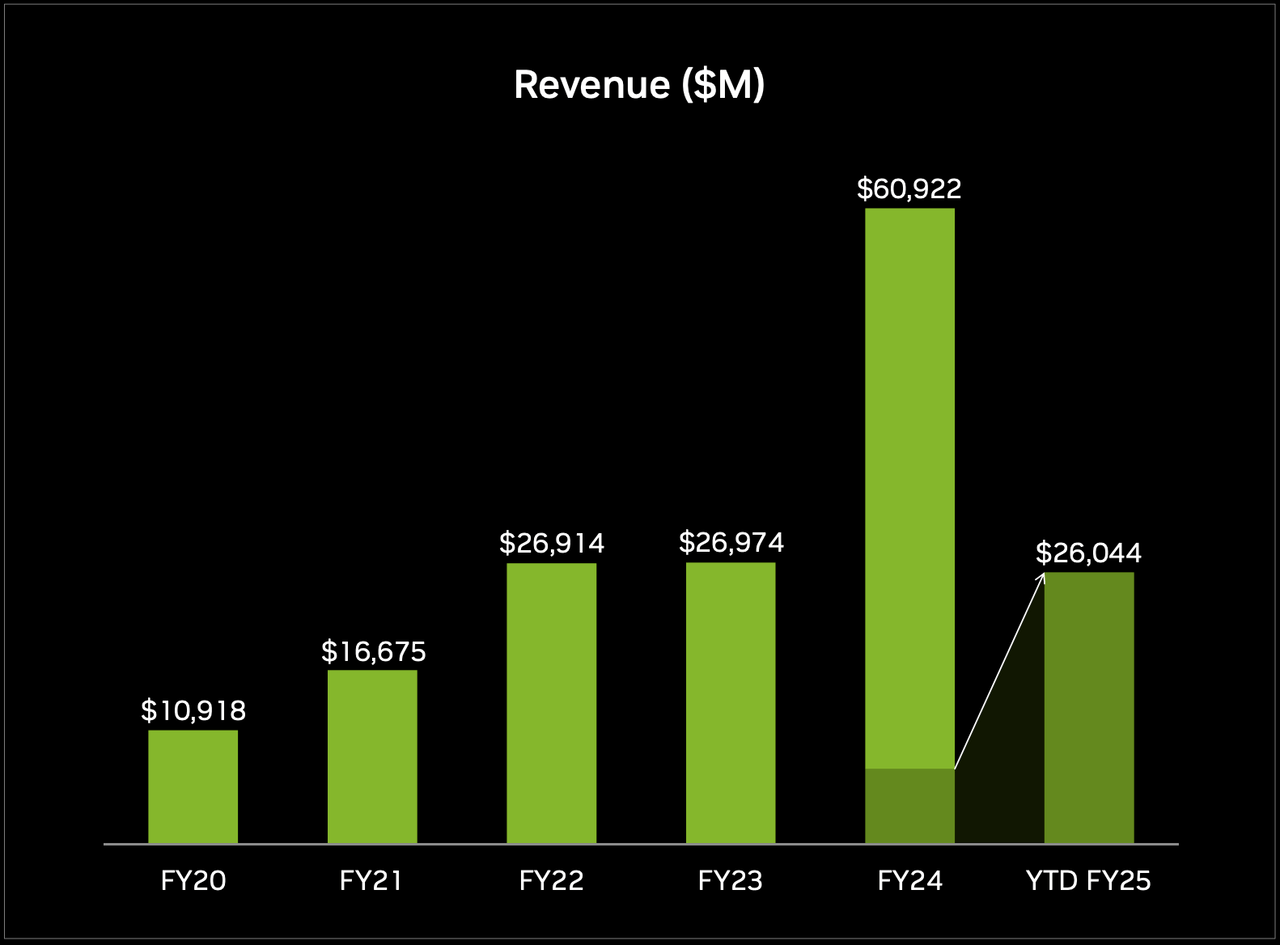

Q1 Revenue Skyrockets 262% to $26B, Driven by Explosive Data Center Sales and Hopper GPU Demand

Revenue in the first quarter of fiscal 2025 increased by 262% to record highs of $26 billion and beat consensus estimates of $24.7 billion. The robust revenue growth was fuelled by a 427% increase year-over-year (YoY) in data center revenue, totaling $22.56 billion. Management attributed the increase to higher shipments of the company’s Hopper graphics processing unit, which continues to elicit strong demand from cloud providers for data centers.

The Nvidia Hopper GPU computing platform also generates strong interest in large language models (LLM) and generative ΑΙ applications. Buoyed by this demand, management expects Q2 revenue to hit a new milestone of $28 billion, affirming continued growth.

Amid the robust revenue growth, Nvidia delivered a 461% increase in adjusted earnings to $6.12 a share, topping consensus estimates. On the contrary, the operating expenses increased by 43% but were insignificant in affecting the net income run rate, as net income grew by 461% to $15.24 billion.

Nvidia

Nvidia Pivots to AI Dominance: Data Center Sales Surge 427%, Powering Tech Giants’ AI Expansion with Hopper GPUs

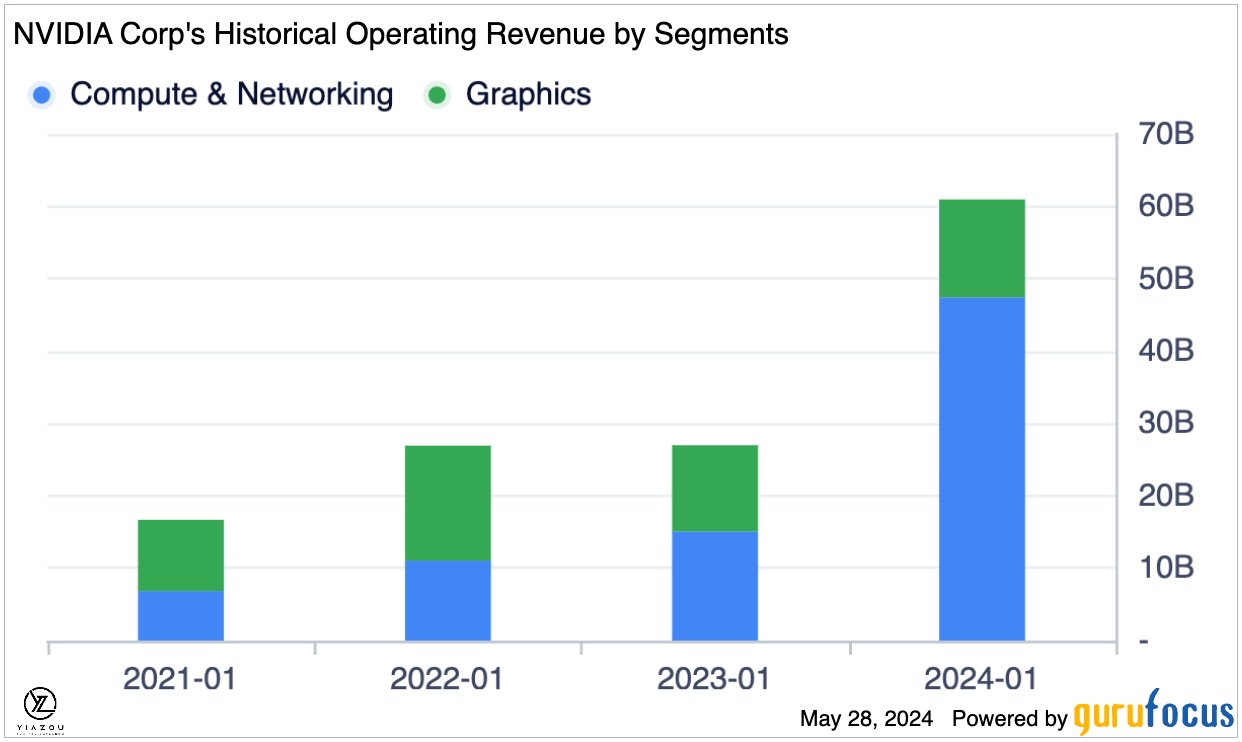

In previous years, Nvidia was best known for manufacturing chips and hardware used in gaming consoles. Gaming revenue accounted for a significant chunk of the company’s total revenue. However, with the advent of AI, data centers have emerged as the core business segment, accounting for more than 86% of total revenues in the last quarter.

In the first quarter, the GPU superstar recorded a 427% increase in data center and computing revenue, attributed to solid demand for the company’s Hopper graphics processor, which is increasingly used in data centers. Likewise, the company benefits as large cloud providers such as Amazon (AMZN), Microsoft (MSFT), and Google (GOOGL) tap into its AI chips to ramp up their AI infrastructure at scale. Further, Meta Platforms (META) plans to add another 200k H100 GPUs for its latest LLM, pushing the target to 350k GPUs in 2024, underscoring the strong demand in the market.

During the quarter, Nvidia expanded its strategic collaborations with Amazon Web Services, Google Cloud, Microsoft (MSFT), and Oracle (ORCL). The strategic partnership will see the company offer advanced generative AI chips that they should use to enhance the capabilities and processing powers of their data centers, which are at the center of their multi-billion cloud computing operations.

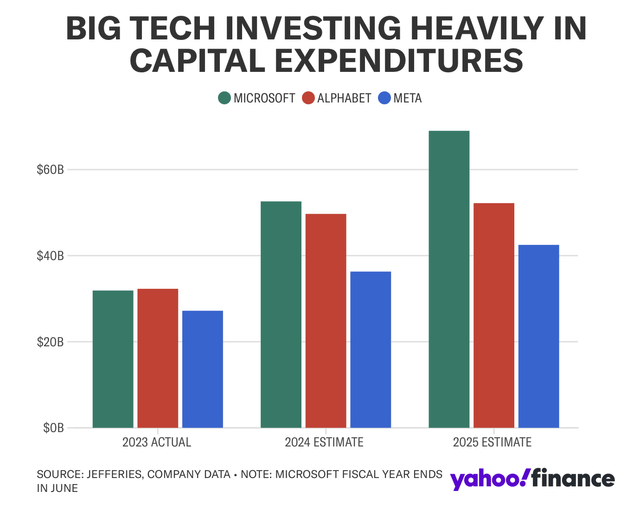

The strong demand for AI cloud services is evident from the large CapEx of big tech companies. For example, Microsoft increased its capital expenditures to $14 billion in Q1, Alphabet increased to $12 billion, and Amazon spent $14 billion. Nvidia is one of the primary beneficiaries of this trend, as large technology companies continue to increase their spending in response to their Big Tech peers’ implementation of AI.

Lastly, in addition to pursuing growth opportunities around the cloud, Nvidia has partnered with Johnson & Johnson (JNJ) to test AI capabilities on a connected digital ecosystem for surgery. This strategic partnering is about quickening the delivery of real-time insights to aid medical professionals during or after procedures.

Yahoo Finance

NVIDIA’s “Blackwell” GPU Counters Apple

The chip giant is also looking to strengthen its competitive edge as more companies look to eat into its market share by providing chips for powering data centers. Apple (AAPL) has announced plans to leverage its years of chip design experience to produce chips as it also looks to benefit from the tremendous opportunities in the data center sector.

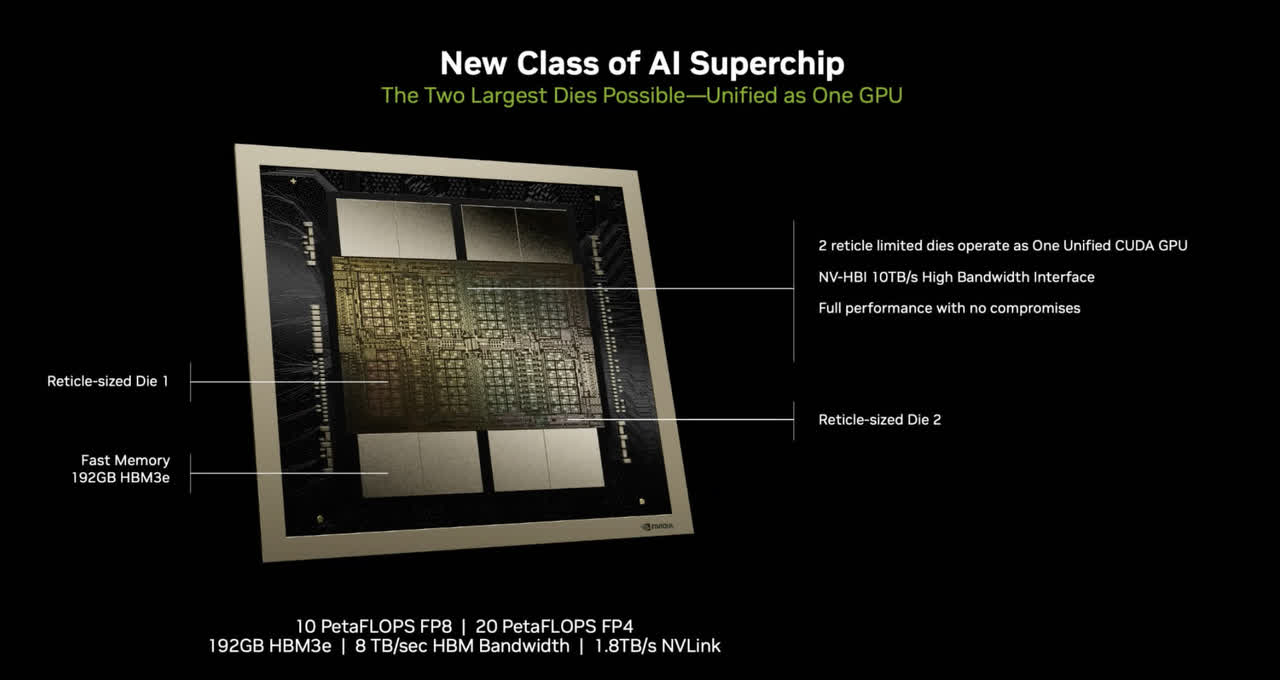

Consequently, Nvidia has confirmed the launch of its next-generation AI GPU, Blackwell, before the end of the year. The new AI-powered chips are expected to strengthen further and diversify the company’s revenue stream in the segment. Blackwell is designed to be “backward compatible” with Hopper systems. Lastly, the design aims to make the transition straightforward for Nvidia’s customers and attract more customers.

Blackwell AI GPU (Nvidia)

Diversification Beyond Gaming: Leads in Networking and Revolutionizes Auto Industry with Advanced Chips

In addition to pursuing growth opportunities in providing chips for data centers, Nvidia is diversifying its revenue streams into other segments. The company continues to register strong sales in selling networking parts. The $3.2 billion in networking revenue that the company generated came as more companies built clusters using tens of thousands of its chips.

While gaming no longer accounts for the largest share of the chip giant’s revenue base, it is still an essential aspect of the puzzle. Revenue in the segment grew by 18% YoY, despite a drop of 8% in the recent quarter, underlining that Nvidia gaming chips and hardware are still in high demand from gaming companies and developers.

GuruFocus

Additionally, the chip giant has already unveiled new AI performance optimizations for Windows that will allow it to deliver optimum performance on Nvidia GeForce RTX AI PCs and workstations as it continues strengthening its prospects in the gaming world.

More games increasingly integrate Nvidia’s RTX technology, including Star Wars, outlaws, and Black Myth Wukong. Similarly, the award-winning AI rendering technology Nvidia DLSS has already proved to increase graphics performance in games and apps; thus, there is a strong demand.

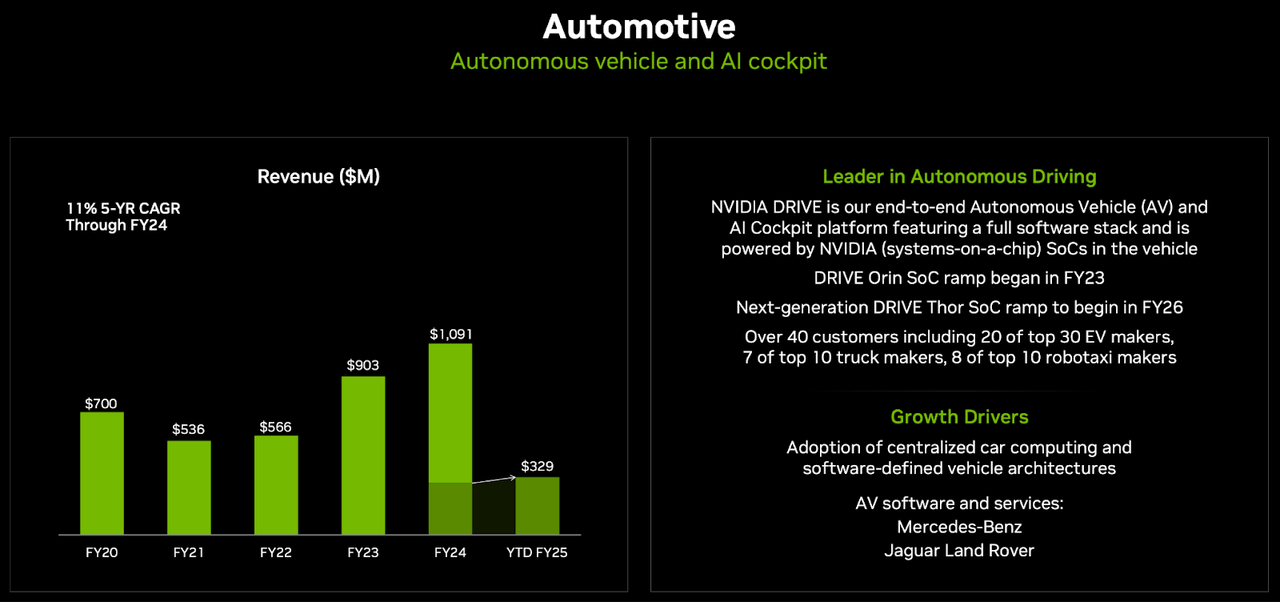

Likewise, Nvidia is also benefiting from the revolution in the auto industry with the integration of entertainment and self-driving systems. The new features require potent chips, which Nvidia has proven to be up to producing. Even though chips for cars and advanced workstations are relatively minor compared to the data center, they continue to elicit strong interest and demand from BYD (OTCPK:BYDDF), XPeng (XPEV), and Nuro, among others.

Finally, electric vehicle makers Lucid (LCID) and IM Motors are already integrating the Nvidia Drive Orin platform into their vehicles, targeting customers in the European markets. Hence, the strong demand for Nvidia solutions and products in the auto industry was the catalyst behind the 17% jump in revenues to $329 million.

Nvidia

Bottom Line

Nvidia has rallied by more than 600% since the start of last year, owing to strong and accelerating demand for its graphics processing unit used in AI models. While the company remains the poster child of the AI revolution, it remains well-positioned to benefit from the hype. The fact that tech giants led by Google, Amazon, Meta, and Oracle are increasingly buying and using its generative AI chips underscores its long-term revenue and earnings growth prospects.

With the GPU Superstar showing no signs of slowing down, with demand for AI chips outstripping supply, it remains a solid long-term investment play as we are in the early days of the AI era. Given that the AI market was valued at about $2.4 trillion in 2023 and growing at a compound annual growth rate of 32.4%, there are tremendous opportunities for growth that Nvidia can tap into with its powerful advanced GPUs, therefore generating shareholder value.

Read the full article here