Sea Limited (NYSE:SE) recently reported a strong 1Q24 quarter, further supporting the thesis of a turnaround.

Specifically, we could be at the start of Free Fire returning to growth, helping drive profitable growth to Sea Limited.

Shopee’s competitive dynamics are also stabilizing, with the company growing revenues strongly while also potentially reaching breakeven earlier than expected.

I have written extensively about Sea Limited on Seeking Alpha, which can be found here. In my previous article, I stated that an inflection point has been reached, and since then, we have seen the financials support this thesis and the stock has outperformed the S&P 500 by 30 percentage points. I remain more optimistic about Sea Limited than before because I think we are only at the beginning of the recovery story for the company.

1Q24 review

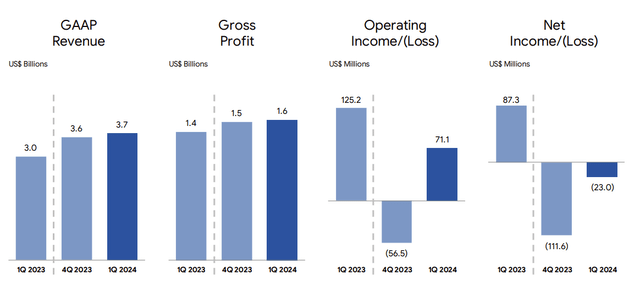

1Q24 results came in well ahead of consensus expectations.

Total revenues for 1Q24 came in at $3.7 billion, up 23% from the prior year. This beat consensus expectations by 3%.

1Q24 highlights (Sea Limited)

The strength in total revenues was driven by both the strong GMV growth in the e-commerce business along with strong growth in the credit business.

E-commerce revenues for 1Q24 came in at $2.7 billion, up 33% from the prior year, and beating expectations by 11%.

In addition, e-commerce GMV grew 36% from the prior year to $23.6bn, beating expectations by 8%.

Digital Entertainment revenues came in at $458 million, which was below expectations by 13%, but bookings for 1Q24 came in strong.

Digital entertainment bookings grew 11% from the prior year to $512 million, beating expectations by 7%.

Strong growth across all three segments (Sea Limited)

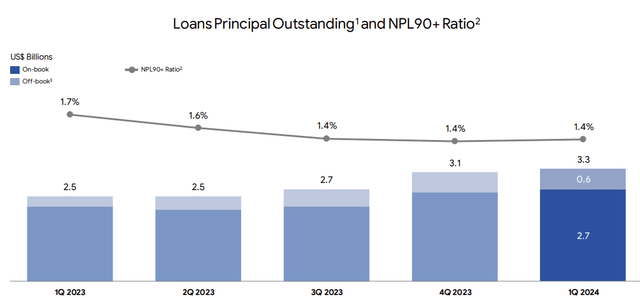

Digital financial services grew revenues by 21% from the prior year. In particular, the loan book reached $3.3 billion, increasing 29% from the prior year. The Consumer and SME loan active users grew 42% from the prior year to more than 18 million this quarter.

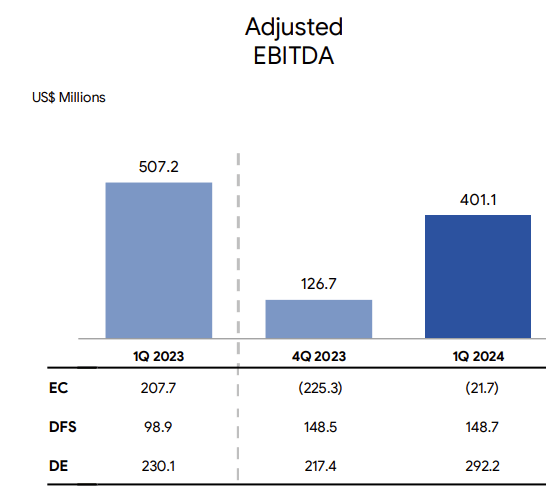

Total adjusted EBITDA for 1Q24 came in at $401 million, beating consensus by 85%, largely due to the beat in the e-commerce segment.

Adjusted EBITDA breakdown (Sea Limited)

Digital entertainment adjusted EBITDA grew 27% from the prior year to $292 million, beating expectations by 35%.

E-commerce adjusted EBITDA came in at -$22 million, significantly beating expectations of -$156 million. This also marks a significant improvement from the prior quarter’s e-commerce adjusted EBITDA of -$225 million, suggesting significant improvements to the cost structure and efficiencies.

Within the Asia markets, adjusted EBITDA came in at $11 million.

In its other markets, adjusted EBITDA came in at -$33 million, significantly narrowing losses from the prior year when adjusted EBITDA was -$68 million. Specifically, contribution margin loss per order improved by 88% from the prior year to reach $0.94.

Digital financial services adjusted EBITDA came in at $149 million, which represents a 50% growth from the prior year, and it is largely in-line with expectations.

Net profit for 1Q24 came in at $157million, beating consensus expectations by 69%.

All in all, we saw that Sea Limited executed well in the 1Q24 quarter, with the e-commerce segment making faster than expected progress towards break-even while continuing to report strong growth.

This is important because part of the market worries was that the pivot to profitability would sacrifice growth, and Sea Limited showed that it could balance between the two priorities.

Guidance

The 2024 guidance was reiterated, but I got some sense that the market was expecting guidance to be raised.

I think it is worthwhile to note that management has seen competition in the market been relatively stable.

The management team is encouraged by the numbers they see in 1Q24 and are confident in achieving the full year 2024 guidance.

On the strength of 1Q24, particularly in the e-commerce segment, part of that was due to seasonality (Lebaran moving earlier), but a larger part of it was due to the company’s continued investments in three key areas.

These include lowering its cost to service, providing competitive product pricing, and enhancing user experience, including around logistics.

With what Sea Limited has reported in 1Q24 and what the management team has been seeing about one and a half months into 2Q24, there is a chance that the 2024 guidance could be revised upwards after reported 1H24.

Operational improvements and focus

Shopee

The focus on Shopee remains to be to improve service quality, enhance price competitiveness and strengthen its content ecosystem.

To enhance price competitiveness, Shopee continues to help sellers with upstream supply chain access to sell more easily on Shopee.

To improve its content ecosystem, Shopee has been focused on live streaming as a new format for engagement and conversion within e-commerce.

In fact, Shopee is now the largest live streaming e-commerce platform in Indonesia based on average daily live streaming orders as of 1Q24.

While Shopee is growing the scale of its live streaming, the unit economics for e-commerce live streaming improved sequentially.

One of the key investment areas for Shopee is SPX Express, which brings an integrated logistics capability to Shopee.

Shopee has grown SPX Express to become one of the fastest and largest logistics operators in its markets.

The goal of SPX Express is really to improve customer experience while lowering the cost to serve.

In 1Q24, 70% of SPX Express orders in Asia were delivered within three days of order placement.

With scale in the Shopee business, SPX Express has also managed to reduce the cost per order by 15% for Asia and 23% for Brazil on a year-on-year basis.

SPX Express has also enabled Shopee to bring new features like the on-time guarantee program that was launched in Southeast Asia. By having SPX Express, Shopee is now able to guarantee a delivery time for orders to further improve customer experience.

Another new effort by Shopee to improve the user experience is to directly manage the return and refund process.

As a result, resolution times have improved 30% and in 1Q24, 45% of cases were resolved within one day.

All in all, I expect Shopee’s investments to not only lower its cost to serve and improve efficiency as it scales, but also improve its customer experience and offer a differentiated e-commerce experience to its users.

Digital entertainment segment

The digital entertainment segment returned to positive growth in the 1Q24 quarter.

This is a huge deal because Garena has seen bookings decline for 8 consecutive quarters.

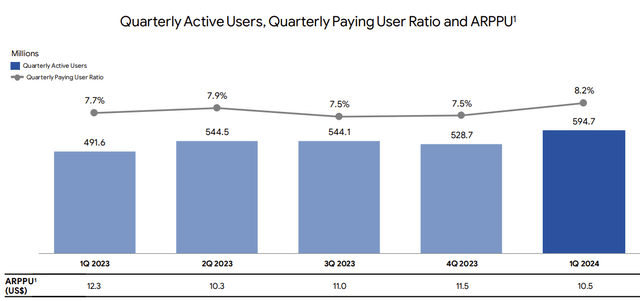

Garena metrics (Author generated)

As mentioned above, bookings were up 11% year-on-year, and this was led by Free Fire’s strong performance across markets.

Quarterly active users were up an impressive 21% in the quarter, while the quarterly paying user ratio grew from 7.7% to 8.2%. Quarterly active users returned to positive growth last quarter, while paying active users returned to positive growth this quarter.

In addition, the monthly active users also grew 24% in the first quarter, which is also very strong.

All these positive metrics suggest two things.

Firstly, the efforts to improve engagement and retention is definitely paying off.

Secondly, with more active users and paying users, there is room for average bookings per paying user (“ARPPU”) in subsequent quarters.

Digital entertainment segment (Sea Limited)

Another positive news is that management has been working with different stakeholders in India like regulators and local partners to relaunch Free Fire in India.

If the relaunch is successful, management expects there will be a meaningful upside on bookings given the large market size in India.

For the current expectation on double-digit growth on Free Fire, management has not taken into consideration the relaunch in India.

Free Fire is now in its seventh year and remains one of the largest mobile games in the world by the number of users.

It remains highly effective in attracting new users, as seen by Sensor Tower, where Free Fire was the most downloaded mobile game globally in the first quarter of 2024.

The priority for management continues to be to improve user acquisition, engagement and retention, and the end goal is to build Free Fire into an ever-growing franchise.

Digital financial services

For the digital financial services segment, the credit business is still the largest driver for revenue and profit growth.

One thing to note is that a large majority of the loan book comprise of off-book loans. These are mainly channeling arrangements, where the lending is done by other financial institutions on the company’s platform.

Another thing to note is the prudent approach to risk management for the credit business that Sea Limited is taking. The company first starts off by granting a low credit limit and short tenure loans to users for them to build their credit history with the company before increasing the credit limit and loan tenure gradually.

With this prudent risk control and more data to fine-tune the risk model for each market, we have seen the non-performing loans of more than 90 days as a percentage of total Consumer and SME loans remain stable at 1.4%

NPL ratio (Sea Limited)

I expect that Sea Limited is still very early in its digital financial services segment where it is still growing its user base in a sustainable manner, while positioning itself for future growth as it is able to offer a larger range of financial services to these users.

Valuation

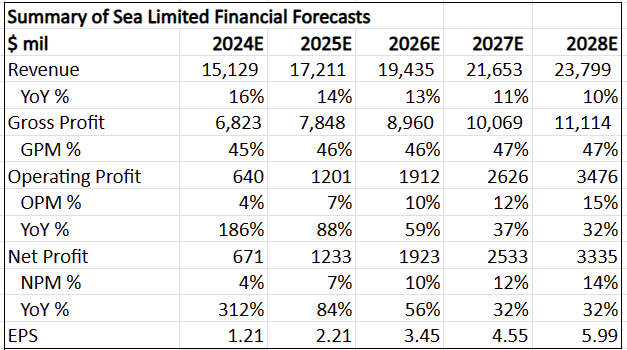

Given the strong 1Q24 results in all three segments, I have revised my financial forecasts for Sea Limited accordingly.

Summary of my 5-year financial forecasts (Author generated)

My intrinsic value goes up to $78, largely due to the revision in the financial forecasts and an increase in the terminal multiple to 25x, from the earlier 20x. This is to reflect the increasing differentiation and improving execution and profitability of the company.

My 1-year and 3-year price targets are $87 and 121 respectively. The 1-year price target is based on 45x 2025 P/E discounted back, and the 3-year price target is based on 35x 2026 P/E. Both assumptions are as per the earlier article.

Conclusion

I think we are only at the beginning of the recovery story for Sea Limited.

In the 1Q24 quarter, Sea Limited executed well with the e-commerce segment making faster than expected progress towards break-even while continuing to report strong growth.

Free Fire reported its first-ever positive bookings growth quarter, highlighting that the business is not only stabilizing, but also growing.

Given that this is already Free Fire’s seventh year, and that it remains one of the largest mobile games in the world by the number of users, is testament to its strong franchise value.

Management working with different stakeholders in India like regulators and local partners to relaunch Free Fire in India is also positive news for Free Fire.

Lastly, with the digital financial services segment, Sea Limited remains very early and it is focused on growing its user base in a sustainable manner, while positioning itself for future growth as it is able to offer a larger range of financial services to these users.

Read the full article here