Introduction and Background

I was scanning through some high-growth and high-flying stocks and I stumbled upon GigaCloud Technologies (NASDAQ:GCT). Examining the company and stock, I was quite pleased with what I found.

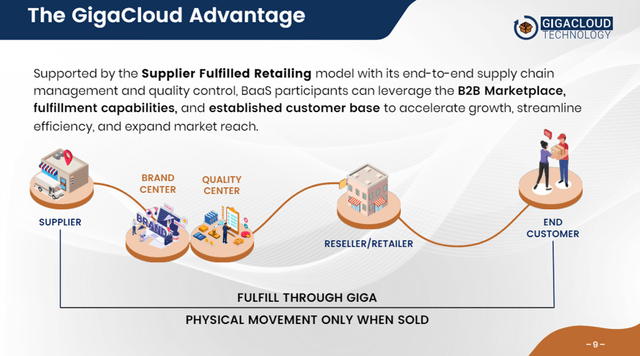

Just to give a short introduction to the business, GigaCloud runs a business-to-business technology platform. This platform called “GigaCloud Marketplace” connects suppliers and resellers worldwide (mainly China and Asia and the rest of the world with a focus on the US). The company’s key competitive advantage is in its logistics and how it seamlessly facilitates complex cross-border transactions.

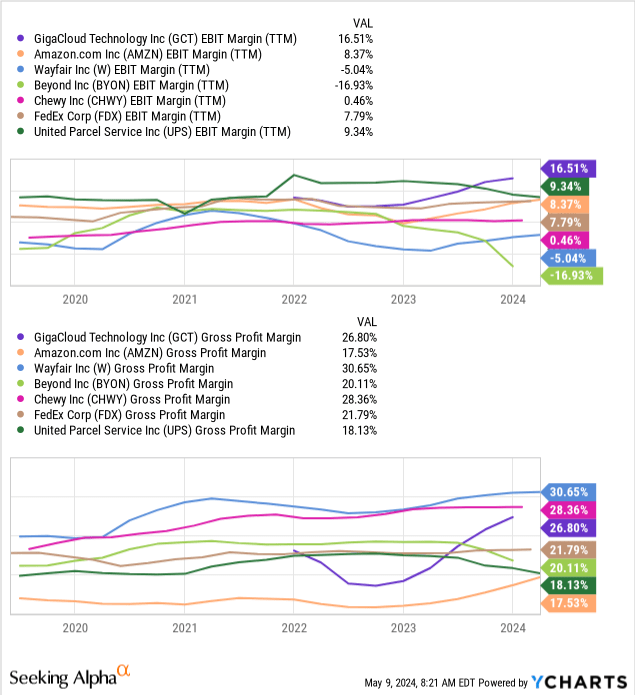

The company’s cross-border fulfillment network is optimized for “large parcel products”. Based on the company’s 10-K, GigaCloud has 33 large-scale warehouses around the world covering seven ports of destination with approximately 17,000 annual containers. The company has an “extensive shipping and trucking network via partnerships with major shipping, trucking, and freight service providers”. The company is able to enhance efficiency by virtue of controlling the end-to-end supply chain. The company claims that it can deliver end products to customers within one week at a fixed rate, cheaper than FedEx (FDX) and UPS (UPS).

Quarter Analysis

The company continues to fire on all cylinders as GigaCloud beat analysts’ expectations for revenue and earnings. For the quarter, the company had revenue of $251 million, which nearly doubled the $127.8 million paid last year and surpassed analysts’ expectations by $8.08 million. The company is expecting this growth to continue in Q2 2024 as it is forecasting revenues of between $265 million and $280 million.

This revenue growth is reflected in the continued expansion of GigaCloud Marketplace. Gross Merchandise Value (“GMV”) increased by 64.0% to $907.7 million year-on-year. Third-party sellers represented 54% of total volume, up from 51.5% the previous year, highlighting the company’s continued success in pushing GigaCloud as a “platform”. Active third-party sellers on the platform increased by 43.7% to 865. I expect this number to further increase once the company’s “BaaS” program takes off.

The company is profitable as well as it saw Net Income increase from $15.9 million the same time last year to $27.2 million, a jump of 71.1%. Diluted EPS was $0.66 for the quarter.

Net income margin was 10.8%, down 160 basis points from 12.4% in the first quarter of 2023. The company’s Net Income margin declined a bit in the quarter to 10.8% from 12.4%. I wouldn’t worry about this, though, as management has pointed out that the decline is in part due to “Strategic investments in fulfillment infrastructure“. The continued growth of which is due to in part to acquisitions discussed below. Overall, the company had a pretty good quarter and I believe that GigaCloud has laid the foundation for more growth, as highlighted below.

GigaCloud’s Strategic Moves

Logistics is the backbone of any e-commerce platform operation. Which is why GigaCloud really interests me as a platform. GigaCloud is in a prime position, having nailed the cross-border logistics to start expanding to other parts of the e-commerce value chain.

The company had made an important acquisition in the tail end of 2023. Noble House, a distributor of indoor and outdoor home furnishings and was bought by the company for $77.6 million. Noble House also owns a couple of key brands, the most prominent of which is “Christopher Knight Home” (led by namesake, who played Peter Brady on The Brady Bunch). This brand has an established presence in major retailers like Amazon, Wayfair (W), Overstock (BYON) among others.

Christopher Knight (Investor Presentation)

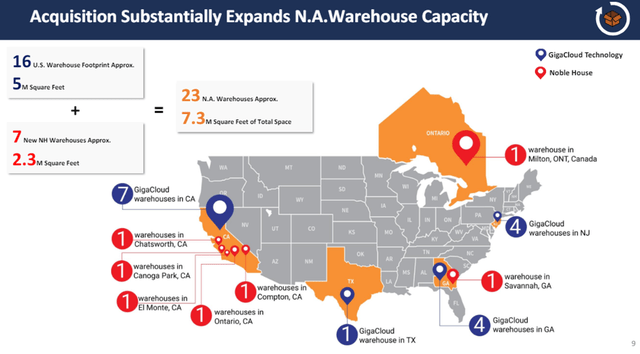

Bringing in some “in-house products” into the GigaCloud marketplace is important to the platform’s health and could improve margin and revenue. However, it is, in my view, that the true value of Noble House lies with its brands and logistics reach. The Noble House acquisition grew by nearly 50% the company’s North American warehouse capacity overnight. Noble House added seven warehouses with approximately 2.4 million square feet of warehouse space to the Network, compared to the 5 million square feet originally. GigaCloud also aims to leverage the former’s supply relationships in India to diversify its supplier base and ultimately add more participants to its Marketplace.

NA Warehouse (Investor Presentation)

In connection with the brands obtained through the Noble House acquisition, GigaCloud has also recently launched a “Branding as a Service” or BaaS program. This allows manufacturers in the GigaCloud Marketplace to sell products under the “Christopher Knight Home” label. Building a brand is a difficult process for manufacturers, so “renting” one for a fee allows them to gain better margins. GigaCloud will use its operations capability to handle quality control and fulfillment duties.

In truth, BaaS isn’t too different from what is currently happening. Many leading furniture providers outsource manufacturing to third parties or license out their brand and image. What could make this unique are two major considerations. The first is that, unlike other furniture brands, GigaCloud also makes money from its logistics service, and thus more products mean greater economies of scale.

GigaCloud Advantage (Investor Presentation)

The second is the platform aspect, where 3rd party brands could approach GigaCloud to lend their brand. This could be a perfect “one-stop” shop for an influencer with a large following. Steve Silver Company was one of the onboarding 3rd party participants of the BaaS Program. I believe that the BaaS program, coupled with the increased logistics capability, will drive growth even further. I believe in the next few quarters we will see more and more brands start to sign on this program. This is something I will be looking out for in the following quarters. The sentiment was echoed by founder Larry Wu during the earnings press release.

The introduction of our Branding-as-a-Service, or BaaS, marked a pivotal moment for GigaCloud and the furniture industry as a whole, especially within our marketplace where furniture is a key category…. We are observing widespread enthusiasm from Marketplace sellers as we prepare for inaugural transactions under the program in the second quarter. This strategic move underscores our commitment to empower Marketplace buyers and sellers and is an example of yet another addition to our service toolbox designed to foster stronger loyalty and engagement among Marketplace buyers and sellers.

Valuation and Growth

In terms of valuation, I was surprised to see that GigaCloud is decently valued. Looking at the company’s P/E ratio, the company is trading at an earnings multiple of 17.4x for TTM and 13.7x forward. These are great numbers for a high-growth company and is thus reflected in the company’s PEG ratio (Price, earnings, and Growth) being 0.06 which is much lower than the sector median of 0.53. The company’s P/E ratio is below the sector’s median of 17.8x TTM and 16.6x forward.

GigaCloud also has a pretty solid balance sheet. The company has Cash and Investments totaling $196.2 million as of the end of Q1 2024, ensuring ample liquidity. Furthermore, the company is virtually debt-free, with most of its long-term liabilities being $343.5 million of operating lease liabilities. Having a lot of operating leases shouldn’t be a surprise for a logistics company.

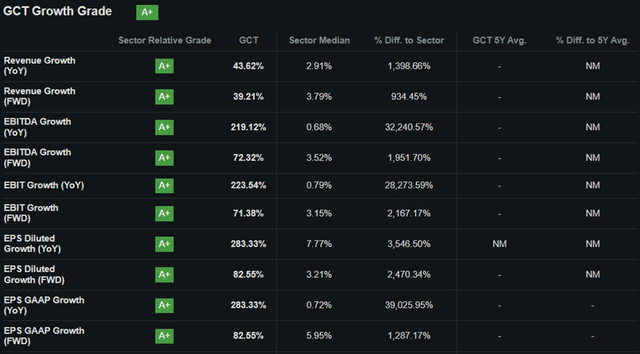

Apart from decent valuations, the company is growing at a rapid rate. Year-over-year revenue was 43.6% well above the Sector Median of 2.9%. Forward revenue growth projections are 39.2%. On top of that, GigaCloud has decent Gross Margins and EBIT margins of 26.8% and 16.5% respectively. The company well deserves its growth quant rating of “A+”.

Growth Score (Seeking Alpha)

The company’s expansion plans seem to have shown no signs of slowing down. The company recently announced that the total space of its global fulfillment network has surpassed 10 million square feet following the signing of a new 562,100-square-foot fulfillment center. The center in Ontario, California is set to open in July 2024.

Putting this all together, we can estimate the value of GCT stock. Analyst estimates that EPS should reach $3.65 by 2025. I find no reason to doubt this, as the company has historically met or beat analysts’ expectations. Using the sector median earnings multiple of 18x, I believe that GCT stock could be valued at $66 within two years’ time. Nearly double current prices.

The key risk to GigaCloud’s growth story though are geopolitical risks from China and US relations. As most of its sellers are from China, any additional barriers to trade or tariffs could negatively impact the GigaCloud marketplace. GigaCloud is aware of this though and is attempting to reduce this risk. The company has signed up new product suppliers from Colombia, Mexico, and Turkey in order to diversify its supplier network and reduce its reliance on China.

Closing Thoughts

From December to current day, GCT stock has risen nearly 4x, from roughly $10 to $39. I believe that this run-up is justified given the company’s performance and future growth prospects. Even after its stock price has risen so much, the company is still decently valued. I think GigaCloud is a solid investment choice.

Read the full article here