Thesis Summary

Palantir (NYSE:PLTR) has just reported Q1 earnings, beating expectations and raising guidance, but the stock is down 8% on the day, following an 8% rally the day prior.

I suggest investors ignore this volatility and focus on all the exciting highlights from the earnings.

Palantir is accelerating its growth, maintaining profitability, and striking key partnerships across the globe.

Quick Recap

In my last article on Palantir, I went over the Q4 2023 results and discussed key reasons why I was excited about the outlook for 2024. Following the latest earnings, I am upgrading to a strong buy rating, as Palantir has fulfilled and even surpassed the expectations I laid out.

In fact, I am more bullish now than before, given that Palantir is fast becoming a key government defense contractor in a world of escalating geopolitical conflict.

In a recent article, I called Intel (INTC) a Defense Buy of the Decade, based on the idea that its large foundry investment will make it a key strategic asset for the US.

In a similar way, I view Palantir as becoming a key government contact due to the unique capabilities of AIP. Its potential is even bigger than Intel’s.

Q1 Overview

Let’s begin by looking at Palantir’s Q1:

Q1 highlights (Investor slides)

As we can see, Palantir achieved revenue growth of 21%, struck 87 new deals, and achieved GAAP EPS of $0.04.

Net Income (Investor slides)

This is now the sixth time that Palantir has achieved positive net income.

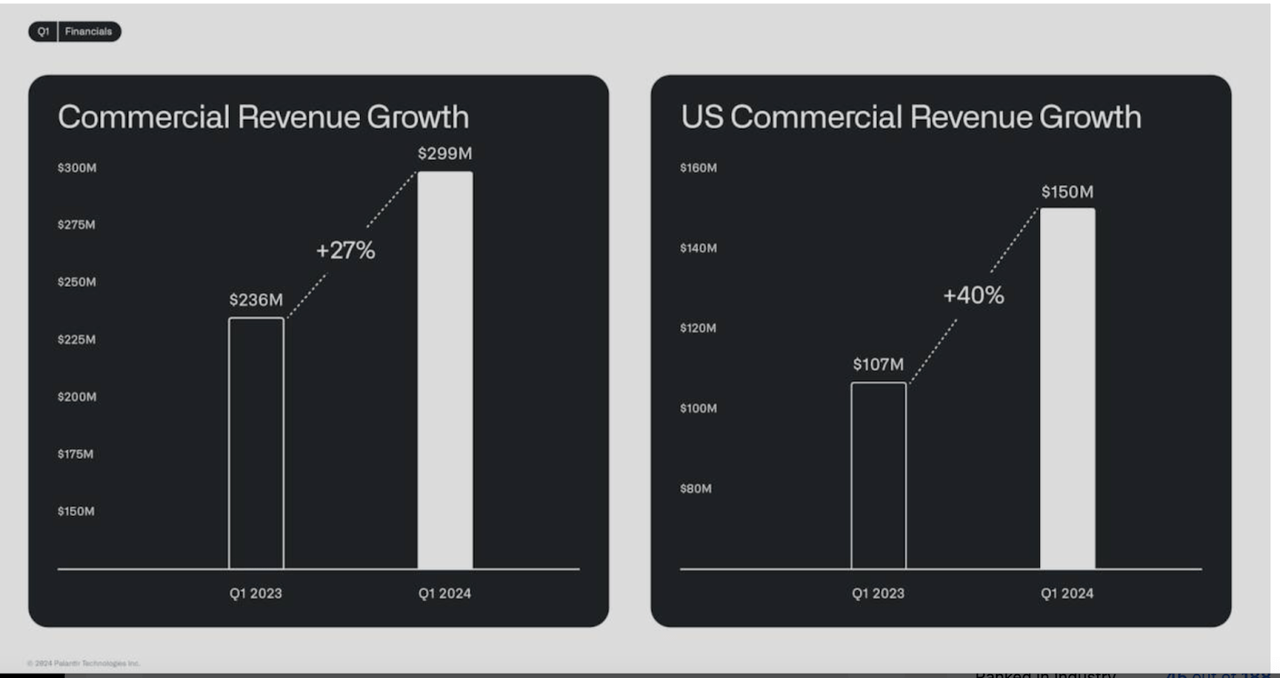

Commercial Revenue (Investor slides)

Now, a big part of the focus has been on US Commercial revenue growth, which increased 40% YoY, while overall commercial growth came in at 27%. However, in the last quarter, commercial revenue growth was 32%, while US commercial revenue growth came in at 70%.

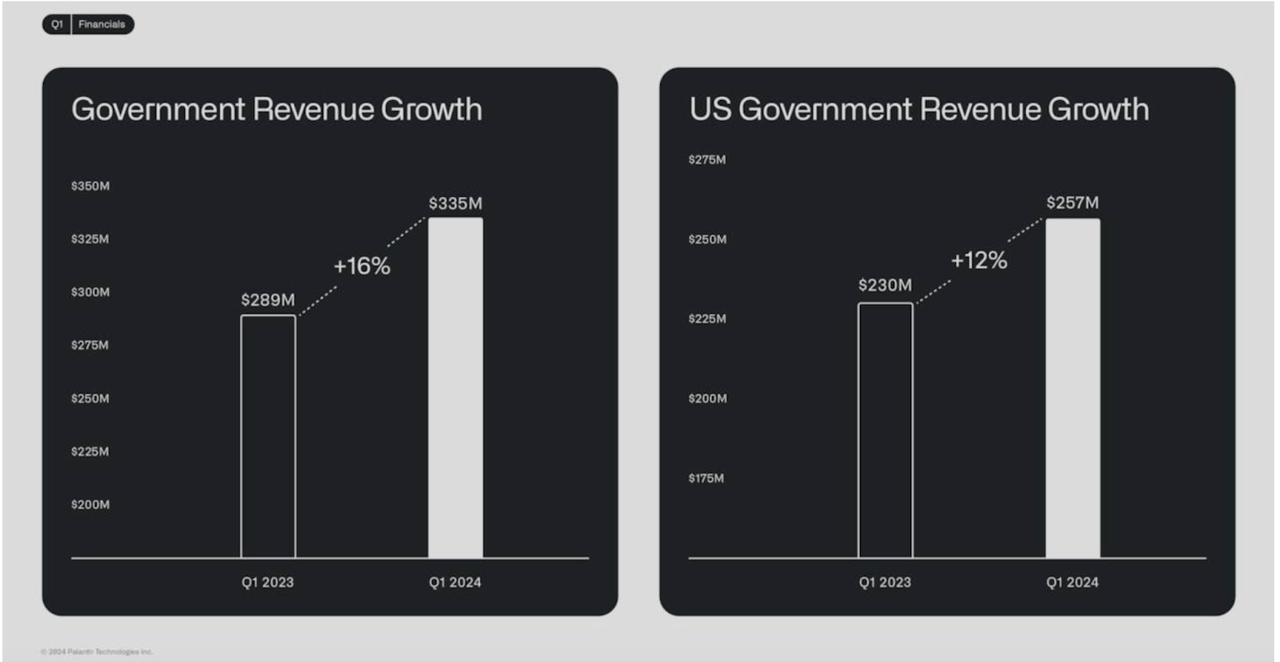

Government Revenue (Investor slides)

The company did increase its YoY growth in terms of both domestic and international government revenues when compared to the last quarter.

Operating Income (Investor slides)

Adjusted operating income has kept increasing, reaching 36% in Q1.

Guidance (Investor slides)

For the full year, the company expects revenue of up to $2.689 billion, US commercial revenue growth of 45%, and adjusted free cash flow of up to $1 billion. This is more optimistic than analysts had previously anticipated.

Overall, the company has done well to keep increasing its margins while growing, and this is a testament to the value they are offering clients.

This was perhaps best highlighted in this slide, which highlights the “Rule of 40”.

Rule of 40 (Investor slides)

The “Rule of 40” states that a software company’s combined revenue growth and profit margin should be equal to or exceed 40. According to Palantir’s own calculations, this combined metric reached 57 in the last quarter.

Thinking Long Term

I would argue that in the last quarter, the company has laid the foundation for its long-term success.

I am particularly excited about the outlook for AIP and the numerous high-level deals it has closed in the last quarter.

Why is AIP so important?

The fact that it was mentioned 23 times in the earnings call would be the first clue. AIP, which I wrote about extensively already, has the power to harness LLMs and AI in a very unique way.

And as far as I can tell, we’re really the only company to figure it out how to help our customers get beyond chat, leveraging the investments that we’ve made in ontology, really harnessing this pattern of implementation where you’re taking unstructured inputs and turning them into structured actions and outputs that drive economic value in the enterprise.

Source: Earnings Call

As mentioned here, AIP serves to take LLMs beyond chat, and a key component of this is Palantir’s ontology, which serves to create a digital replica of a company. This is what then allows us to apply AI to real-world problems.

The proof of AIP’s value is in the numbers:

And I would say what you see both on AIP and on foundry is de facto customers using our product pretty much on their own. And that’s, again, why that you see a revenue growth up to 26% compared to last year on per person revenue, because we’re making more money with the same number of people roughly.

Source: Earnings Call

If it is indeed true that the company is making more money per customer, then this has some profound implications in terms of scalability.

Palantir: Making Friends

In the last quarter, Palantir has made significant strides in increasing its government contracts.

In the US, it was awarded the TITAN contract and more recently, it has been onboarded by Ukraine and Israel.

Again, the key reason why is due to its unique value proposition, best described in the earnings call by Karp:

And I would say, I don’t believe we have competitors. So, I don’t believe in the US commercial market we have competition. I don’t believe in the US government market we have competition. I don’t — I think that’s the reason Ukraine and Israel bought our product. We are differentiated because in order to actually make AI work, you need an ontology. No one has an ontology. To Shyam’s point, you have a lot of people running around saying the data isn’t ready. Of course, it’s not ready, because they don’t have foundry. If you have foundry and the ontology, it is ready. If you have foundry, or ontology in Apollo, you can actually work at the edge.

Source: Earnings Call

I am particularly bullish on the deal that Palantir has struck with Ukraine. Here, the company has the opportunity not just to aid in the conflict, but to act as a partner in rebuilding once the war is over.

Defense Buy Of The Century

In the last few months, we have seen an acceleration of geopolitical conflict and tensions.

Russia and Ukraine’s conflict continues to escalate, with the threat of nuclear war now on the table.

Tensions between China and the US are also mounting, with Janet Yellen recently paying them a visit.

And though a ceasefire is being negotiated between Israel and Hamas, it looks like the conflict in the Middle East could continue for some time, with Iran now also involved in the conflict.

As I mentioned in my Intel article, tensions are escalating and defense budgets are set to keep increasing from here on out.

However, this spending will not be concentrated on the weapons of yesterday, like missiles and planes, but rather on key technologies like the one Palantir has. AI has changed the nature of war, and if Palantir’s AIP is as valuable as it looks, this stock will become a huge government contractor for the US and its allies.

Risks

Palantir is still a risky company. It operates at the cutting edge of AI, a technology we are only beginning to understand. There’s plenty of risk from competition in the future, even if it doesn’t seem so obvious today.

Furthermore, it’s important to note that the US’s financial spending capabilities are already being tested, which could limit the revenues Palantir can generate from government contracts.

Takeaway

All in all, I am still bullish on Palantir, and see this sell-off as a great opportunity to add more shares for the long term.

Read the full article here