Introduction

As part of my fund-based approach to build a reliable high-yield income portfolio, CEFs often have my attentions and running high on my watch list because many CEFs still have the NAV discount at the historical wide level. 2024 looks promising for some of those CEFs to stage a recovery run in narrowing the NAV gap.

PGIM Short Duration High Yield Opps (NYSE:NYSE:SDHY) is one such great opportunity. Its NAV discount is very juicy at 12.55% as of 5/2/2024. Better yet, SDHY is a term fund with a term shelf life designed to liquidate at NAV in 2029. Meanwhile, the fund pays a high dividend with a yield at 8.6%, so I’m getting paid to just sit and wait for my SDHY shares to revert to NAV through the termination date in 5 and a half years. I recommend it as a strong buy for income investors, and buy it now before the reverting gets a full swing. SDHY term fund might be at a sweet spot for the next 5 years or so.

SDHY Fund Primer

SDHY is a CEF managed by PGIM, a Prudential Financial company. According to its official site:

The Fund seeks to provide total return, through a combination of current income and capital appreciation by investing primarily in below investment‐grade fixed income instruments. The Fund seeks to maintain a weighted average portfolio duration of three years or less and a weighted average maturity of five years or less.

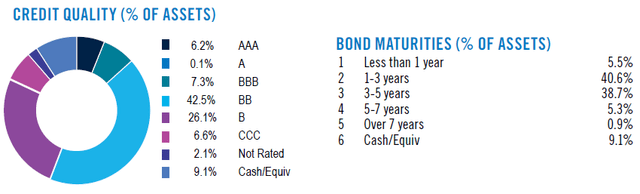

The fund focuses on short duration corporate bonds with lower credit quality, mostly (over 85%) graded below BBB as shown below from SDHY factsheet:

SDHY Credit and Maturities

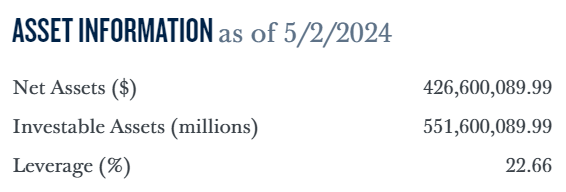

The fund was created in November 2020. It has net assets of about $426 millions. It uses leverage like many other CEFs. The leverage of 22.66%, however, is a notch below the CEF average level around 31%.

SDHY Asset Info

It has paid a steady monthly distribution $0.108 since interception. The yield is 8.57% based on the current share price of $15.18.

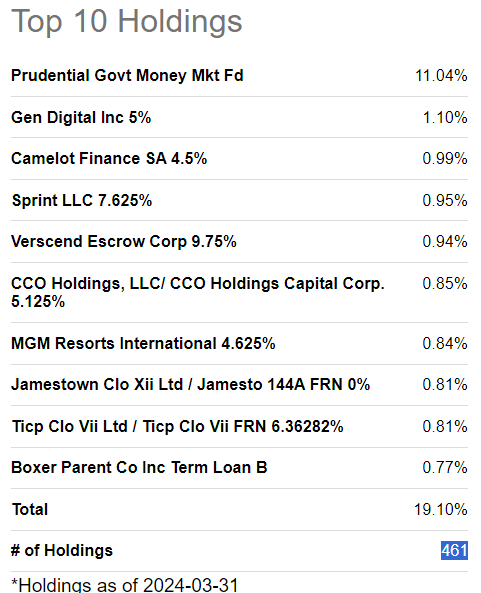

SDHY is a reasonably diversified fund with 461 bonds from many industry segments. Concentration is low, with top bond holdings mostly less than 1% of the portfolio.

SDHY Top Holding from SA

Term Fund offers a great opportunity for lifting share price to close the NAV discount gap.

As mentioned earlier, SDHY price is cheap because the NAV discount is sitting at 12.55% as shown in the following chart:

SDYH NAV Discount

From my own CEF investment experience, cheap CEF may stay cheap for long enough, it could become a world of hurt in the portfolio. In theory, CEFs can stay cheap forever. This is where SDHY shines because it has a kicker – SDHY is designed as a term fund with a term shelf life of 9 years. The following is an official description from the fund Prospectus

Limited Term and Eligible Tender Offer. In accordance with the Fund’s Declaration of Trust, the Fund intends to terminate as of the close of business on the ninth anniversary of the effective date of the Fund’s initial registration statement, which the Fund currently expects to occur on or about November 30, 2029 (the “Dissolution Date”)

So with about 5.5 years left to liquidate a NAV discount of 12.55%, I’ll get the extra about 2.3% each year if I buy the shares now. Keep in mind I will get 8.57% yield to wait for things to happen. It is a great deal in my opinion.

SDHY term fund might be hitting a sweet spot after a major leverage hit in rate hiking cycle

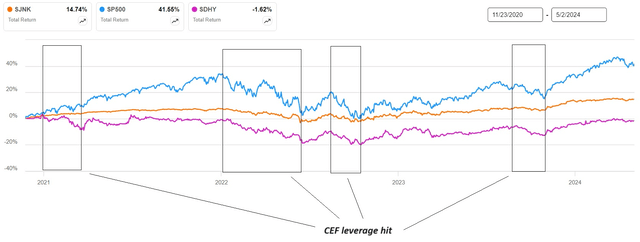

CEF leverage hit is the major dragger during the rate tightening cycle. As shown below, SDHY with leverage 22.71% experienced a few price hits due to the rapid rate hiking from 2022 to 2023. As the interesting rate is peaked right now, it could also go down from here. CEF leverage expense is getting stabilized and potentially reduced in 2024. This trend will make it possible for the leverage to be able to contribute positively to the returns of the fund.

SDHY Price Chart Analysis

In 2024, I expect FED rate cut to be small if any at all. In 2025 more rate cuts are likely but the cut amount should be moderate. This should work well with SDHY. Lower rate will help with reducing the leverage cost. On the other hand, I believe the US economy should continue to stay resilient and healthy for next a few years and there is not much need to have interest rate to go much lower from where we are now. So the high yield from the bond holdings may be down a little bit but should be kept at a similar level. The default rate should stay low as well. All things considered, I believe SDHY might be hitting a sweet spot for the next 5 years or so, along the way to its designed term end. Therefore, I rate SDHY as a strong buy at the moment.

Risks and Caveats

The low credit quality is the main risk. These are so called “Junk” bonds in the fund portfolio. Default rate could go higher with FED rate staying “higher for longer”. Defaults cause less income and shrinking assets for the fund.

Significant rate cuts would almost certainly lead to fund underperformance, as the macroeconomy could be slipping into a recessionary hard landing. A recession is why the big rate cut could happen.

Conclusion

SDHY is a term fund with a term shelf life to be ended in Nov 2029. This will help expedite the revert to NAV with a deep discount of 12.56 at the moment. The short-duration low-credit bonds will continue to hold steady and provide the high yield (8.57%) to the investors. With the moderate rate cut, the fund’s leverage could also help contribute to the return. SDHY is an excellent buy for the high yield income investors who is seeking for double digit annual growth rate of the total return in next 5 year or so.

Read the full article here