Real Estate Weekly Outlook

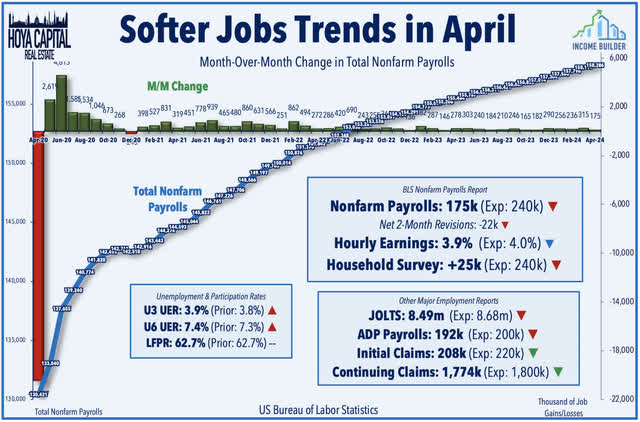

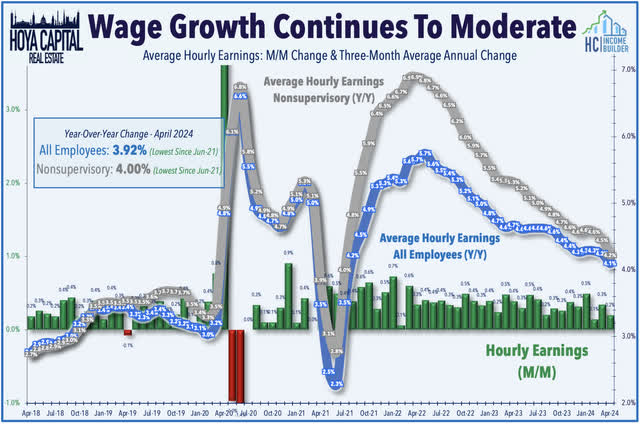

U.S. equity markets advanced for a second week, while benchmark interest rates retreated from five-month highs after a critical slate of employment data showed perhaps the most definitive signs yet of a long-awaited cooldown in labor market trends. Foreshadowed by surprisingly “dovish” remarks from Fed Chair Powell at the conclusion of the FOMC’s policy meeting, payrolls data showed that the U.S. economy added just 175k jobs in April – the smallest gain in six months – while wage growth cooled to three-year lows, which together revived the prospects for multiple interest rate cuts this year.

Hoya Capital

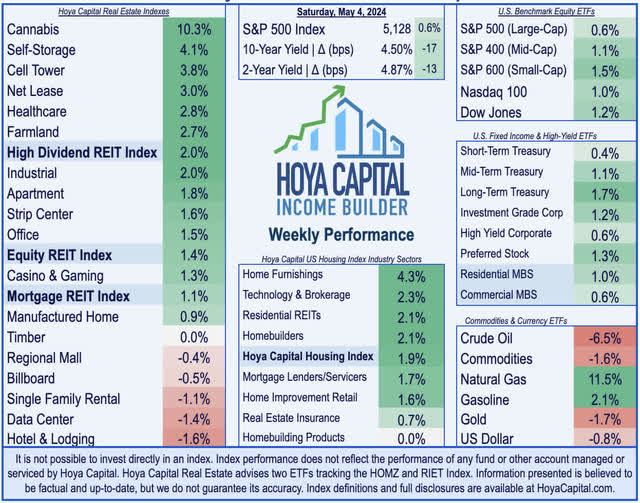

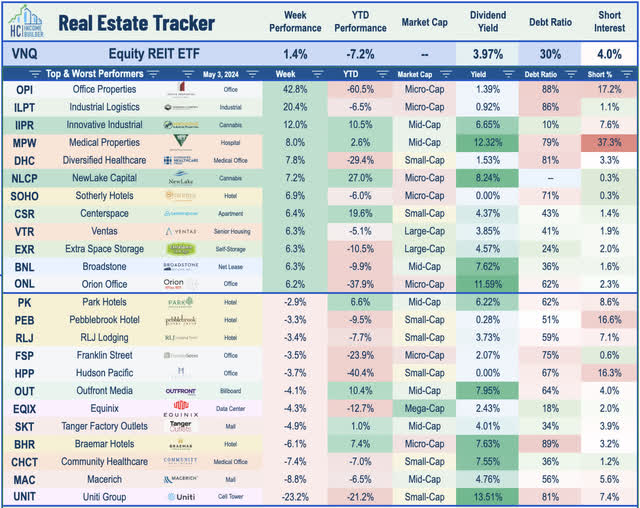

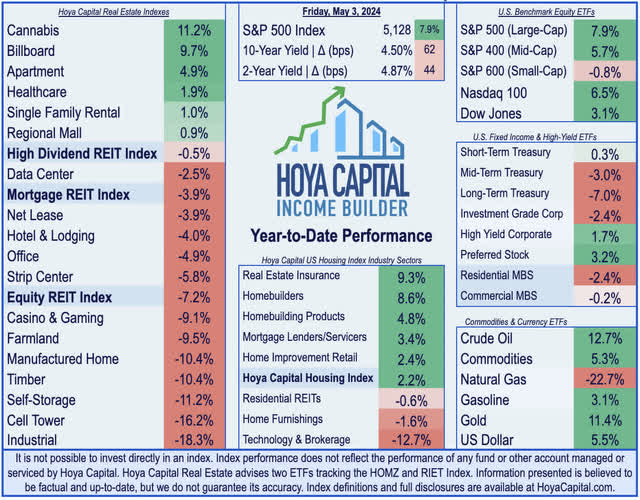

Following its best week since November, the S&P 500 advanced 0.6% in a volatile week, lifted by an end-of-week recovery sparked by downbeat jobs data and dovish Fed commentary. Gains were broad-based this week, with the Small-Cap 600 leading the way with gains of 1.5%, while the Mid-Cap 400 advanced 1.1%. Technology stocks continued their rebound as well following a brief “mini-correction” in late April, with the Nasdaq 100 adding 1% this week to push its two-week rebound to over 5%. Buoyed by the rate retreat and by a relatively solid slate of REIT earnings reports, real estate equities were among the leaders for a second-straight week, which follows a sharp three-week slide in early April. The Equity REIT Index advanced 1.4% on the week, with 13-of-18 property sectors in positive territory, while the Mortgage REIT Index advanced by 1.1%. Homebuilders and the broader Housing 100 Index also posted strong gains after home price data and REIT reports indicated continued tightness and resilient demand across housing markets.

Hoya Capital

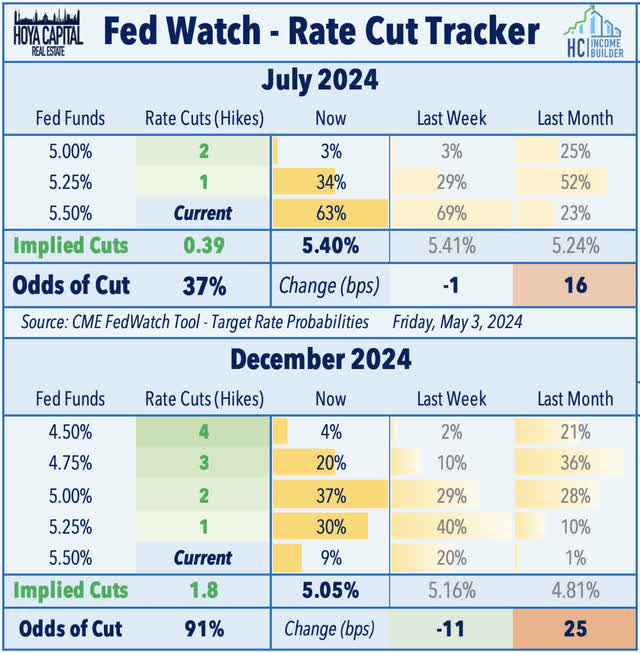

As anticipated, the Federal Reserve held benchmark interest rates at a 5.5% upper-bound, but unexpectedly kept its policy statement from March largely intact, maintaining several key “dovish” phrases including that “inflation has eased” and maintaining the framework bias towards cutting interest rates. Subsequent commentary from Fed Chair Powell was also generally viewed as more “dovish” than feared, pushing back strongly on the notion that the next move could be a hike rather than a cut. Combined with a softer-than-expected slate of employment reports later in the week and a sharp decline in Crude Oil prices, bonds caught a bid this week across the yield and maturity curve. Pulling back from five-month highs in the lead-up to the Fed’s meeting, the 10-Year Treasury Yield plunged by 17 basis points this week to 4.50%, while the policy-sensitive 2-Year Treasury Yield dipped 13 basis points to 4.87%. Swaps markets are now pricing in a 37% probability that the Fed will cut rates in July – up from 30% at the end of last week and up from mid-week lows of 15%. Markets now expect 1.8 rate cuts in 2024 – up from 1.4 last week.

Hoya Capital

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

Hoya Capital

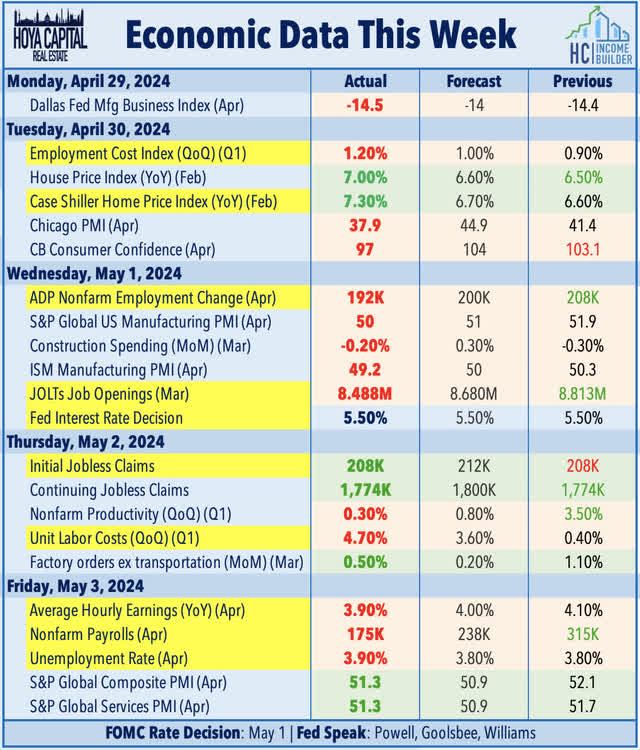

The critical BLS Nonfarm Payrolls report showed that the U.S. economy added 175k jobs in April – below consensus estimates of around 240k – providing perhaps the clearest indication yet that the long-awaited cooldown in labor markets may finally be upon us. The smallest job gain in six months, the soft print in April follows a pair of surprisingly “hot” reports in March and February – gains that were revised lower by a combined 22k in the latest report. The Household Survey – which is used to calculate unemployment metrics – showed even weaker trends with just 25k jobs added, which led to an uptick in the unemployment rate to 3.9% from 3.8%. Job growth slowed most significantly in the leisure and hospitality sector – consistent with the recent cautious tone provided by hotel REITs over the past week – and also weakened in the construction sector – also consistent with REIT earnings commentary noting a sharp industry-wide cooldown in groundbreaking.

Hoya Capital

A welcome relief to investors and the Fed on the heels of data earlier in the week showing a reacceleration in wage pressures in quarterly GDP and productivity reports, wage growth metrics were also cooler-than-expected across the board. Average hourly earnings (“AHE”) – a key inflation indicator – moderated to a 3.9% year-over-year increase in April – the softest since June 2021 – and moderated to 4.0% for nonsupervisory workers, down sharply from the peak of around 7% in early 2022. Earlier in the week, the Labor Department reported that the Employment Cost Index (ECI) increased 1.2% in Q1 – above the 1.0% increase expected – and rose by 4.2% on a year-over-year basis. A separate quarterly productivity report showed that unit labor costs jumped at a 4.7% annual rate in the first quarter – the most in a year – while productivity slowed to a 0.3% annualized rate – the weakest in a year.

Hoya Capital

Equity REIT & Homebuilder Week In Review

Best & Worst Performance This Week Across the REIT Sector

Hoya Capital

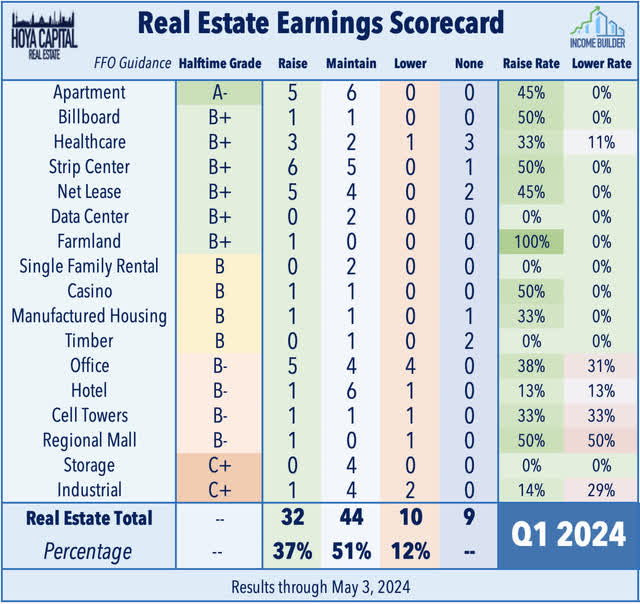

We’ve just completed the busiest week of REIT earnings season, with results from over half of the U.S. real estate sector this past week. As we push past the halfway way point of REIT earnings season, results have thus far been roughly in-line with historical averages. Of the 86 REITs that provide guidance, 32 (37%) raised their full-year FFO outlook, 44 (51%) maintained, while 10 REITs (12%) lowered their guidance – a “raise rate” that is roughly in-line with the historical first-quarter average of around 40%. Consistent with many of the trends discussed in our Earnings Preview, earnings results over the past week showed a surprising firming in residential rents despite ample multifamily supply, steady positive momentum in retail fundamentals, tempered optimism on leisure on hospitality demand, a much-needed rebound in office leasing activity, a long-awaited cooldown in logistics demand, and an overall slowdown in construction activity. On the debt-side, results from mortgage REITs have been hit-and-miss, with loan distress still limited to the office sector. Homebuilder reports have confirmed that there remains a base-level of “nondiscretionary” demand for new homes despite renewed interest rate headwinds. Below, we discuss some highlights from the past week.

Hoya Capital

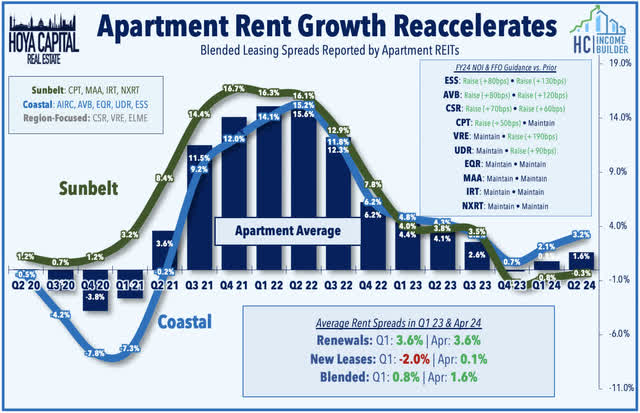

Apartment: The rather impressive earnings season from multifamily REITs continued this week, as results from a half-dozen apartment operators showed a surprising reacceleration in rent growth following a two-year slowdown. Midwest-focused Centerspace (CSR) rallied 6% after it raised its full-year outlook, noting that blended rent spreads accelerated to 1.5% in Q1 and accelerated further into April with lease spreads of 3.4%. Sunbelt-focused Camden (CPT) gained 5% after reporting a similar reacceleration in rent growth, while also lifting its same-store NOI outlook driven by lower insurance and property tax expectations. CPT had expected an 18% increase in insurance costs but now expects premiums to be flat year-over-year after a recent successful renewal. Mid-America (MAA) gained 3% after maintaining its full-year outlook, while indicating that it expects to be more aggressive on the acquisition front in coming quarters. Like Camden, MAA noted that supply headwinds in Sunbelt markets remain significant, but both managed to record a sequential acceleration in leasing spreads in Q1 and into April – snapping a streak of seven quarters of deceleration. NexPoint Residential (NXRT) gained 3% after maintaining its full-year outlook while reporting similar improvement in Sunbelt fundamentals in early 2024. West Coast-focused Essex (ESS) gained 1% after it reported strong results and raised its full-year FFO and NOI growth outlook. Citing “favorable revenue growth driven by lower delinquency,” ESS boosted its full-year NOI outlook to 1.4% – up from 0.7% previously – and now sees FFO growth of 1.3% – up from 0.0%.

Hoya Capital

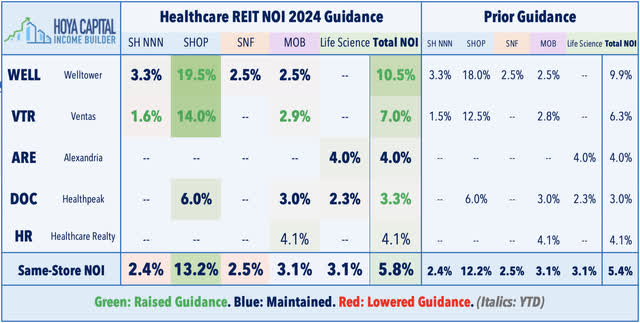

Healthcare: Senior housing REITs were also upside standouts this week. Ventas (VTR) rallied 6% after reporting strong results and raising its full-year NOI and FFO growth outlook. Driven by continued outperformance in its Senior Housing Operator Portfolio (“SHOP”), VTR now expects FFO growth of 5.0% this year, up from 4.5% previously. Robust rent growth and improving occupancy rates fueled an upward revision in its SHOP outlook, with VTR now expecting 14.0% NOI growth, up from 12.5% previously. Welltower (WELL) gained 2% after similarly strong SHOP trends and also raising its full-year outlook. Citing “robust occupancy growth and strong rate increases,” WELL now expects full-year NOI growth of 19.5% in its SHOP portfolio – up from 18.0% previously – and maintained its outlook for its other three segments. Incremental upside in its SHOP segment was driven by lower expenses resulting from “further normalization of agency labor and continued abatement of broader inflationary pressures.” WELL also raised its full-year FFO growth outlook to 12.2% – up from 10.4% previously – which would be about 4% above its pre-pandemic FFO in full-year 2019. Results from skilled nursing REITs, meanwhile, showed a steady improvement in tenant financial health following a period of increased distress and missed rent payments in 2023. Skilled Nursing REIT Omega Healthcare (OHI) gained 1% after reporting in-line results and maintaining its full-year outlook. Its smaller peers, LTC Properties (LTC) and CareTrust (CTRE), each gained 3% on the week after reporting rent collection of 100% and 98%, respectively.

Hoya Capital

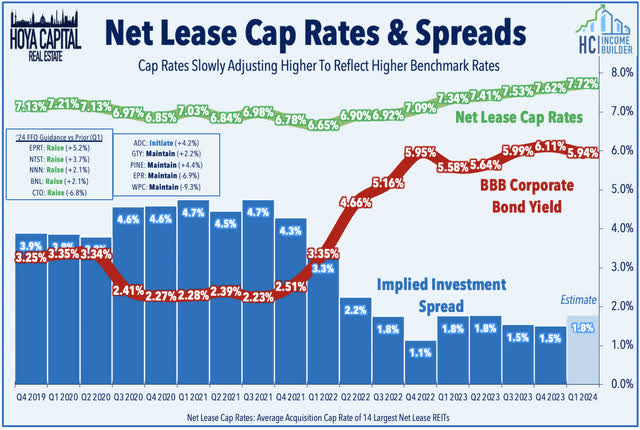

Net Lease: Results from a half-dozen net lease REITs this week showed a notable uptick in acquisition cap rates after several quarters of “stickiness” in private market valuations. Broadstone (BNL) rallied 6% after reporting strong results and raising its full-year guidance, citing progress in its “healthcare portfolio simplification strategy.” Reducing its healthcare exposure from 17.6% to 13.4% of ABR, BNL noted that it sold 38 properties in Q2 for $262.2 million at a 7.8% average cap rate. W.P. Carey (WPC) – which has stumbled since initiating a “strategic exit from office” last September – gained 3% after maintaining its full-year outlook and noted that it’s “80% complete” with its office exit, leaving WPC with 7 office assets comprising 1.3% of rent. For WPC, a broader slowdown in the “goods economy” in recent quarters has added to the complexity. WPC provided updates on a handful of struggling industrial tenants, noting that it restructured leases with manufacturer Hellweg – its fourth-largest tenant – which resulted in a 14.6% rent reduction – an outcome that was “completed on the terms we expected.” Elsewhere, NETSTREIT (NTST) gained 3% after marginally raising its full-year FFO outlook and, like its peers, reported a meaningful uptick in acquisition cap rates in Q1. NTST noted that it acquired $129M in properties in Q1 at a blended cash yield of 7.5%, which compares to its pandemic-era low of 6.2% in late 2021. EPR Properties (EPR) gained 2% after it maintained its full-year outlook, and provided positive updates on the operating status of its movie theater tenants.

Hoya Capital

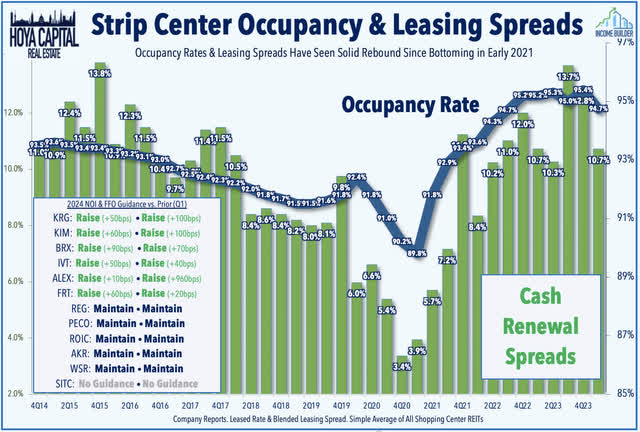

Strip Center: Results from strip center REITs have also been quite impressive. Kimco (KIM) – the largest strip center REIT – rallied 4% after raising its full-year NOI and FFO outlook, citing “robust demand that continues to permeate our open-air, grocery-anchored shopping center portfolio.” Brixmor (BRX) gained 2% after it also raised its full-year outlook driven by impressive leasing activity. Occupancy rates climbed to record-highs across several of its metrics, including total occupancy (95.1%), anchor occupancy (97.3%), and small shop occupancy (90.5%). On the leasing front, BRX noted that it signed 1.3M square feet of new and renewed leases, achieving 19.5% rent increases on these leases, which marked its 12th straight quarter of double-digit leasing spreads. Kite Realty (KRG) was little-changed after reporting similarly strong results and also raising its full-year NOI and FFO growth outlook, driven by another quarter of robust leasing activity. Sunbelt-focused InvenTrust (IVT) also raised its full-year outlook – one of six strip center REITs to raise guidance this quarter. Whitestone REIT (WSR) – which has been in focus amid an ongoing proxy battle with activist Erez Asset Management – gained 2% after reporting in-line results and maintaining its full-year outlook, which calls for 11.0% FFO growth.

Hoya Capital

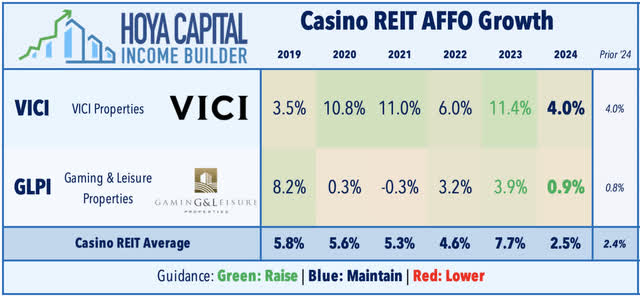

Casino: Casino-focused net lease REIT VICI Properties (VICI) gained 1% this week after it reported in-line results and maintained its full-year outlook calling for FFO growth of 4.0%. VICI – which was among the most active consolidators before the Fed’s tightening cycle – noted that the transactions environment remains quiet for traditional gaming assets, but did announce a debt financing deal with The Venetian Resort Las Vegas for extensive reinvestment projects. VICI agreed to provide up to $700 million of financing – comprised of $400 million in 2024 and a $300 million option by November 2026. In exchange, annual rent under the existing Venetian Resort lease will increase on the first day of the quarter immediately following each capital funding at a 7.25% yield. On the earnings call, VICI commented that the deal “may be VICI’s best acquisition to date… there’s nowhere else in today’s triple net lease market where you can put that amount of money to work at a 7.25% cap rate” and quoted a recent analyst note, “delusional sellers are still looking for sub-seven cap rates on their poorly located Red Lobsters.”

Hoya Capital

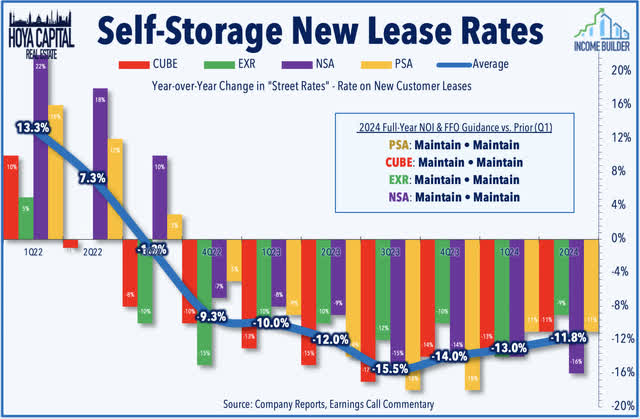

Storage: Self-storage REITs – which have been among the worst-performing property sectors this year – were among the leaders this week after results from three storage REITs showed stronger trends than indicated by CubeSmart (CUBE) in the prior week. The combination of sluggish housing turnover, record-levels of supply growth, and the ongoing effects of a post-pandemic demand normalization have put significant downward pressure on market rents, but “sticky” rent growth on existing renewal tenants has helped to offset the ultra-competitive new lease dynamic. Extra Space (EXR) rallied 6% after it maintained its full-year outlook while reporting stronger leasing activity than its peers. EXR noted that average occupancy increased to 93.1% – up 30 basis points from last year – and reported that leasing spreads improved sequentially to -34.3% from -35.7% last quarter. Public Storage (PSA) gained 3% after it maintained its full-year outlook while reporting marginally positive demand trends. Average occupancy ticked lower to 92.1% in Q1 – down 80 bps from last year – but realized rent/SF remained positive at 0.8%, despite a -16% drag from new lease rates. National Storage (NSA) also gained 3% after maintaining its full-year outlook, but provided cautious commentary, noting that its once-high-flying Sunbelt markets “continue to face many challenges due to several factors, including absorption of new supply, muted housing activity, and a very competitive pricing environment.”

Hoya Capital

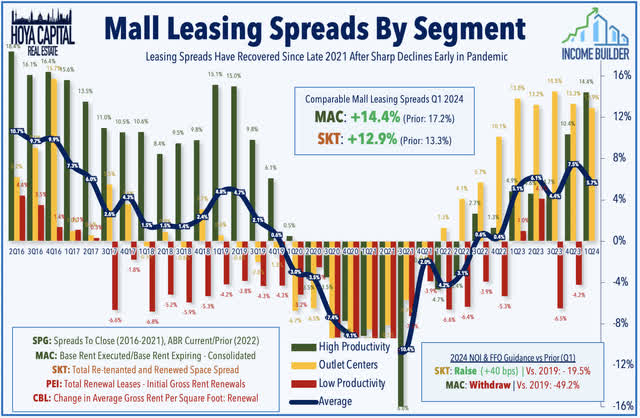

Mall: Onto the laggards this week, Macerich (MAC) – the second-largest mall REIT – dipped 9% after reporting downbeat results – negatively impacted by the bankruptcy of retailer Express – and withdrawing its full-year outlook, citing uncertainty related to its strategic debt reduction plan under its new executive leadership. MAC reported that its FFO dipped -23% in Q1 compared to the prior year, resulting from a drag from higher interest expense and a hit to rental revenues resulting from the Express bankruptcy. Aside from Express, property-level fundamentals remained relatively solid in early 2024, as store openings continued to marginally outpace store closing. Comparable occupancy stood at 93.0%, which was down 40bps from last quarter, but up 60bps from a year earlier. Leasing spreads remained relatively impressive as well, with MAC recording double-digit increases for the fourth consecutive quarter. Tanger (SKT) dipped 5% despite reporting relatively solid results and raising its full-year outlook. Citing “solid operating growth along with the contributions from three new centers,” SKT now expects full-year FFO growth of 5.6% – up from 5.1% previously. SKT provides leasing metrics on a twelve-month (“TTM”) basis, noting that it leased 2.3M SF on a TTM basis – steady with last quarter – and achieved rent spreads of 12.9%, a slight deceleration from the 13.3% TTM increase reported last quarter. SKT has now recorded nine straight quarters of positive rent spreads, which follows a dismal stretch of nearly four-years of rent declines from 2018-2022. Occupancy ticked lower to 96.5% – flat from a year earlier and down from 97.3% in Q4. SKT noted that foot traffic was up slightly year-over-year for the quarter, as stronger trends in March helped to offset softness in January.

Hoya Capital

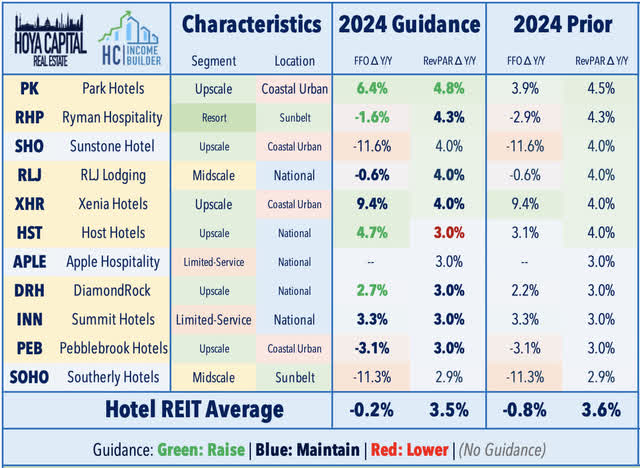

Hotel: The weakest-performing property sector this week, hotel REITs lagged after results showed a modest softening in demand trends following several quarters of very strong results. Host Hotels (HST) – the largest hotel REIT – slipped 1% this week after it lowered its full-year Revenue Per Available Room (“RevPAR”) outlook to 3.0% from 4.0% previously, driven by “lower-than-expected first quarter results, underperformance in Maui and softer-than-expected short-term leisure transient demand.” Accretive M&A, however, led to a notable increase in its full-year FFO growth outlook to 4.7% – up from 3.1% previously. Host announced a $530M deal to acquire two hotels in Nashville – the 215-room 1 Hotel Nashville and the 506-room Embassy Suites by Hilton at a 7.4% cap rate. The properties are expected to be among Host’s top-25 assets based on estimated full year 2024 results. RLJ Lodging (RLJ) and Pebblebrook (PEB) each dipped 3% this week after reporting in-line results and maintaining their full-year outlook, with each noting a downshift in leisure demand, partially offset by a slow-but-steady rebound in corporate and group demand. Park Hotels (PK) also slipped 3% this week despite reporting sector-leading RevPAR growth of nearly 8% raising its full-year FFO and RevPAR outlook, citing “strong group demand and convention calendars, positive trends in business travel, and ongoing resiliency of resorts.” As with its peers, PK acknowledged softness in April, but commented that concerns of a second-quarter slowdown in leisure demand are “a bit overdone.”

Hoya Capital

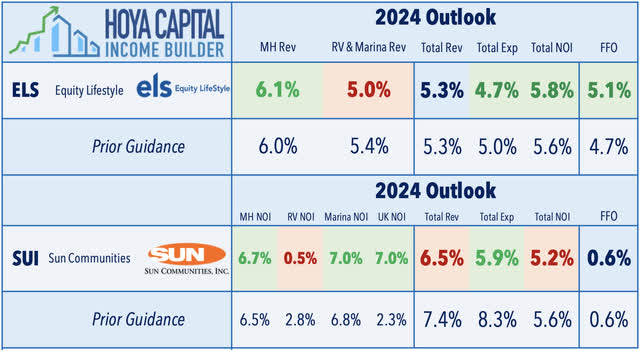

Manufactured Housing: Sun Communities (SUI) slumped 1% after reporting mixed results, as ongoing weakness in its RV segment continues to offset strong performance from its core manufactured housing and marina portfolios. Consistent with trends seen last week from its peer Equity LifeStyle (ELS), the Recreational Vehicle segment – which was a significant drag last year – has again underperformed in early 2024, as the post-pandemic normalization in RV demand has been compounded by headwinds from higher fuel prices and financing costs. SUI trimmed its full-year outlook for RV Net Operating Income (“NOI”) growth to 0.5% – down from 2.8% in its prior outlook. Positively, SUI raised its NOI outlook across its other three segments: Manufactured Housing NOI growth was revised up to 6.7% (+20bps), Marina NOI was boosted to 7.0% (+20bps), and expectations for U.K. NOI were revised up to 7.0% (+470bps). Together, these revisions resulted in a slight downward revision to total U.S. NOI to 5.2% (-40bps), but SUI maintained the midpoint of its full-year FFO growth outlook at 0.6%. Small-cap UMH Properties (UMH) – which focuses exclusively on MH communities – slipped 2% after reporting in-line results, recording a 16% increase in same-property NOI driven by continued occupancy gains. UMH noted that it sold an underperforming sales center to Clayton Homes, but otherwise reiterated its forecast for home sales and rental expansion.

Hoya Capital

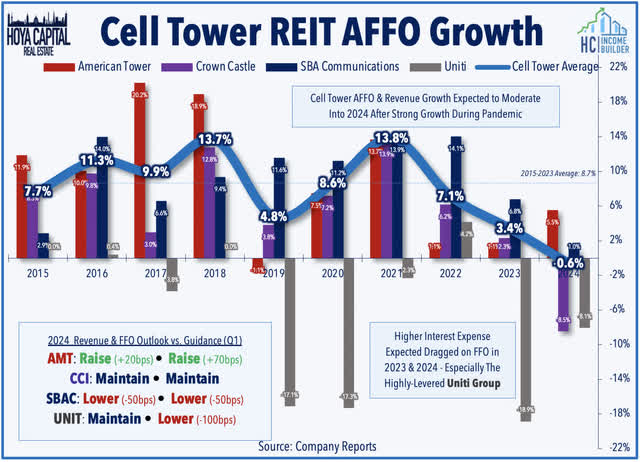

Communications: Results from a trio of communications REITs this week showed sluggish carrier network spending trends in North American markets, but outperformance in several international markets. American Tower (AMT) – the largest tower REIT that has a significant international presence – rallied 6% after raising its full-year outlook, citing “elevated new business growth across many of our emerging markets, positive collection trends in India, and another strong quarter of leasing at CoreSite.” AMT now expects full-year FFO growth of 5.5% – up from 4.7% previously. SBA Communications (SBAC) – the third-largest cell tower REIT, which is focused primarily in North America – slipped 2% after it lowered its full-year revenue and FFO outlook, citing “measured” carrier activity due to “continued macro-economic financial pressures and the high cost of capital.” SBAC now expects FFO growth of 1.0% – down from 1.5% previously. Meanwhile, Uniti Group (UNIT) dipped more than 20% after it confirmed – and provided details on – a long-rumored deal to recombine with its former parent firm and largest tenant, Windstream. Rumors of a potential merger last month had sparked a rally in Uniti shares on speculation that the REIT may be the acquisition target – rather than the acquirer and surviving entity of the combination. The proposed deal, instead, calls for UNIT to effectively acquire Windstream – which has been in and out of bankruptcy for much of the past decade – in a cash and stock deal.

Hoya Capital

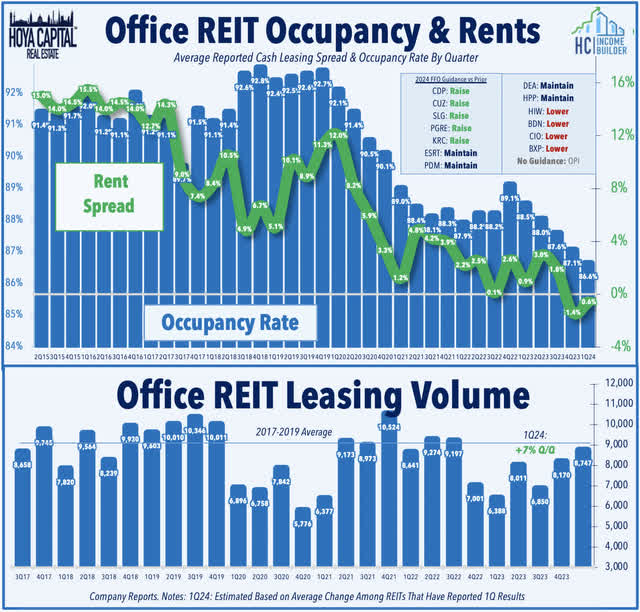

Office: After an impressive start to earnings season, office REIT reports over the past week were hit-and-miss. Boston Properties (BXP) – the largest office REIT – slumped 1% after it lowered its full-year FFO outlook and recorded a sequential slowdown in leasing activity following a very strong back-half of 2023. BXP recorded 894k SF of leasing volume – down 41% from the strong Q4 – but still 35% above Q1 of 2023. West Coast-focused Hudson Pacific (HPP) dipped 4% after it reported mixed results and lowered its property-level NOI outlook, citing a sluggish rebound in its studio business. Positively, HPP leased 509k SF in the first quarter – up 18% from Q4, but took a -5.4% hit in renewal spreads on these leases. Small-cap Office Properties Income (OPI) – which had dipped more than 75% this year after slashing its dividend – rallied over 40% this week after reporting decent results, highlighted by nearly 500k SF of leasing activity, on which it achieved a rent-roll-up of 10.2% – its highest leasing spread since 2022. To address upcoming debt maturities, OPI announced a $610M senior note offering bearing a 9.0% interest rate, which it will use to refinance its maturing 4.5% senior notes. NYC-focused Paramount (PGRE) gained 4% after raising its full-year FFO outlook, citing “better than expected portfolio operations.” Sunbelt-focused Piedmont (PDM) gained 3% after maintaining its full-year outlook and recording a sequential uptick in occupancy rates to 87.8% – its highest-level since the start of the pandemic – driven by gains in Atlanta.

Hoya Capital

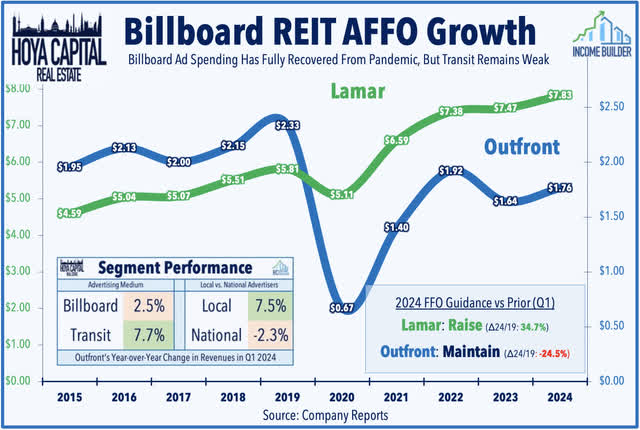

Billboard: Lamar (LAMR) gained 1% after reporting strong results and raising its full-year outlook, citing strength in local advertising spending and a rebound in its digital segment. LAMR now expects FFO growth of 4.8% this year – up from 3.7% previously – which would be 35% above its pre-pandemic FFO from 2019. LAMR’s local segment posted +6.7% revenue growth versus 2023 while national was down -5.5%, noting that it “continues to see some larger accounts taking a cautious approach to their ad spend.” LAMR commented that “pacings for the rest of 2024 are materially stronger than this time last year…and if the year plays out as it appears it will, you will see us raise the distribution in August and perhaps also pay a special dividend at year end.” Outfront (OUT) – which has been among the top-performers this year – slumped 4% after maintaining its outlook for high-single-digit AFFO growth “reflecting steady growth in billboard and a return to growth in transit.” As with Lamar, Outfront reported strong demand from local advertisers – up +7.5% year-over-year – while national revenues were down -2.3%. Encouragingly, OUT’s troubled transit segment – which has dragged on performance since the start of the pandemic – delivered solid 7.7% revenue growth, driven by improved New York MTA ridership and the non-renewal of an unprofitable transit franchise. Both REITs noted that political spending is expected to be a tailwind in the back-half of 2024.

Hoya Capital

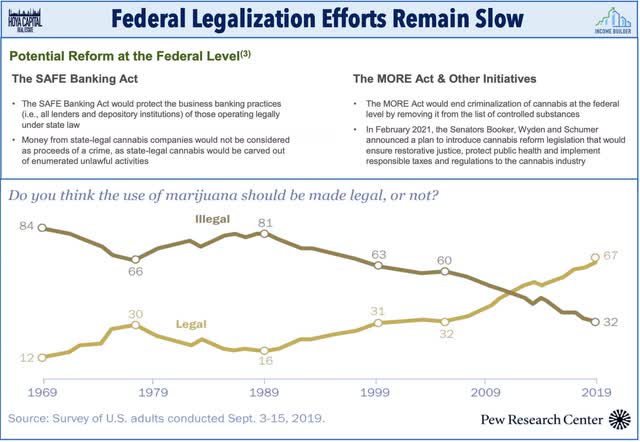

Cannabis: The best-performing REITs this week, cannabis REITs – led by Innovative Industrial (IIPR), NewLake Capital (OTCQX:NLCP), and AFC Gamma (AFCG) were lifted by a report from the AP that the U.S. Drug Enforcement Administration will move to reclassify marijuana as a less dangerous drug, rescheduling it from Schedule I to Schedule III of the US Controlled Substances Act. Perhaps the most significant action towards Federal legalization in several years, the move would recognize the medical uses of cannabis and acknowledge it has less potential for abuse than some of the nation’s most dangerous drugs. However, it would not legalize marijuana outright for recreational use. The federal prohibition – and the resulting limit on access to traditional banking – has forced cultivators and retailers to turn to alternative sources for capital, including Cannabis REITs. While there is concern that incremental steps toward Federal legalization will bring increased competition from traditional capital providers, the more pressing near-term concern is the shaky financial health of these REITs’ tenant operators – stresses that are expected to be improved by these legalization actions.

Hoya Capital

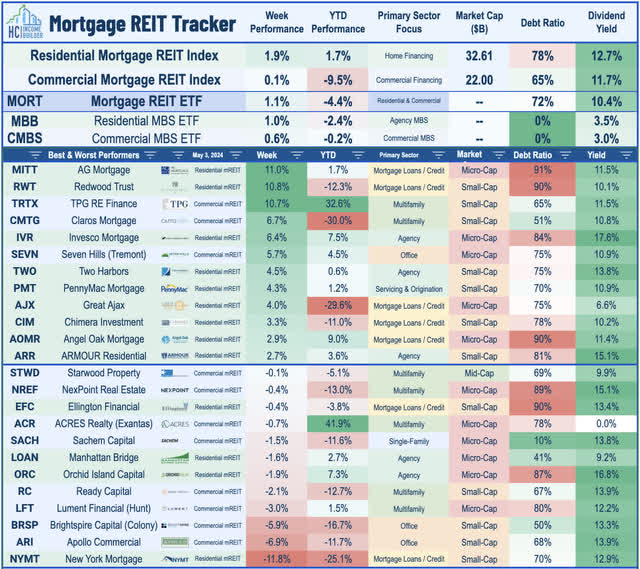

Mortgage REIT Week In Review

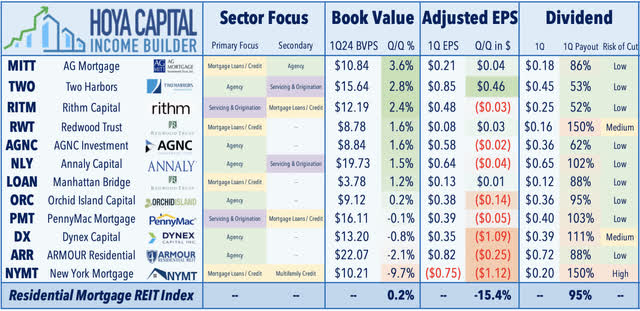

Mortgage REITs delivered another solid week – with the iShares Mortgage REIT ETF (REM) advancing 1.1% – driven by strong earnings results from residential mREITs, which offset hit-and-miss results from commercial lenders. Beginning with the upside standouts, AG Mortgage (MITT) rallied 11% this week after it reported that its Book Value Per Share (“BVPS”) rebounded by nearly 4% in Q1 following a rough patch in late 2023, addressing some uncertainty related to its acquisition of fellow mREIT Western Asset Mortgage. MITT’s comparable EPS recovered to $0.21, which again covered its $0.18/quarter dividend. Following downbeat results from several of its commercial mREIT peers last week, TPG Real Estate (TRTX) surged 11% after it reported solid results highlighted by 100% loan performance and no incremental loan downgrades. TRTX – which focuses on multifamily (50%), office (20%), life science (10%), and hotel (10%) – reported that its BVPS was roughly unchanged in Q1, while its distributable EPS improved to $0.30 – covering its $0.24/quarter dividend. Redwood Trust (RWT) also rallied 11% after it reported that its BVPS increased 1.6% in Q1 while recording GAAP EPS of $0.16 – which covered its $0.16/quarter dividend.

Hoya Capital

Among other highlights on the residential mREIT side, Two Harbors (TWO) gained 5% after it reported that its BVPS rose 2.8% to $15.64 – the strongest behind MITT – and reported comparable EPS of $0.85 – up sharply from the prior quarter and once again covering its $0.25/quarter dividend. Rithm Captial (RITM) gained 1% after it reported that its BVPS rose 2.4% in Q1 to $12.19 – among the strongest in the sector thus far. RITM noted that it had “a terrific quarter hitting on all cylinders,” reporting comparable EPS of $0.48 – easily covering its $0.25/quarter dividend. On the downside, New York Mortgage (NYMT) dipped 11% after it reported that its BVPS declined by nearly 10% in Q1 – the worst in the mREIT sector this earnings season – driven primarily by mark-to-market impairments on several joint venture equity interests in multifamily properties. One of the few notably weak reports from residential mREITs this earnings season, NYMT hinted at a potential dividend reduction, noting that it “expects undepreciated earnings per share to remain below the current dividend as we continue to rotate excess liquidity for reinvestment in a more attractively priced market.”

Hoya Capital

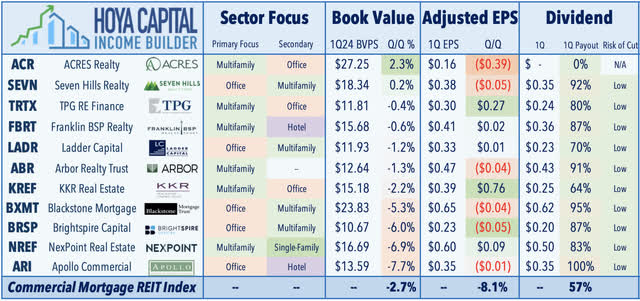

Earnings results have been shakier on the commercial mREIT side, however, as results showed a further uptick in office loan distress, but also relatively steady loan performance across non-office-related sectors. Seven Hills (SEVN) rallied 6% after it reported that its BVPS increased 0.2% to $18.34, while reporting comparable EPS of $0.38 – covering its $0.35/share dividend. Arbor Realty (ABR) gained 0.5% after reporting in-line results and relatively steady delinquency trends, noting that its BVPS was down about 1% in Q1, while its distributable EPS continued to cover its dividend. ABR did provide cautious commentary, however, warning that the current period of “peak stress” may drag into Q3 and Q4 if rates remain elevated. On the downside, Apollo Commercial (ARI) dipped nearly 10% after it reported that its BVPS declined 7.7% due primarily to a downward mark-to-market adjustment on a construction loan backing an NYC residential development. BrightSpire (BRSP) slumped 6% after it reported a 6% dip in its BVPS in Q1 driven by downgrades to two office loans. Multifamily-focused Franklin BSP (FBRT) finished flat after it reported that its BVPS slipped 0.6% in Q1, while its comparable EPS increased to $0.41 – covering its $0.36/quarter dividend. NexPoint Real Estate (NREF) was a laggard after recording a 6.9% decline in its BVPS and a dip in its distributable EPS driven by an early prepayment on a $500M single-family rental loan to Front Yard Residential.

Hoya Capital

2024 Performance Recap

Through eighteen weeks of 2024, real estate equities have continued to lag behind the broader equity benchmarks following a powerful year-end rebound in 2023. The Equity REIT Index is lower by -7.2%, while the Mortgage REIT Index is lower by -3.8%. This compares with the 7.9% gain on the S&P 500, the 5.7% gain for the S&P Mid-Cap 400, and the 0.8% decline for the S&P Small-Cap 600. Within the REIT sector, 6 of the 18 property sectors are higher for the year, led by Speciality, Apartment, and Healthcare REITs – while Industrial, Cell Tower, and Storage REITs have lagged on the downside. At 4.50%, the 10-Year Treasury Yield is higher by 62 basis points on the year, while the 2-Year Treasury Yield has risen 44 basis points. Following a late-year rally in the final months of 2023, the Bloomberg US Bond Index is lower by -2.0% this year. Behind much of the renewed inflation headwinds, WTI Crude Oil is higher by 12.7% this year, lifting the broader Commodities complex higher by 5.3%.

Hoya Capital

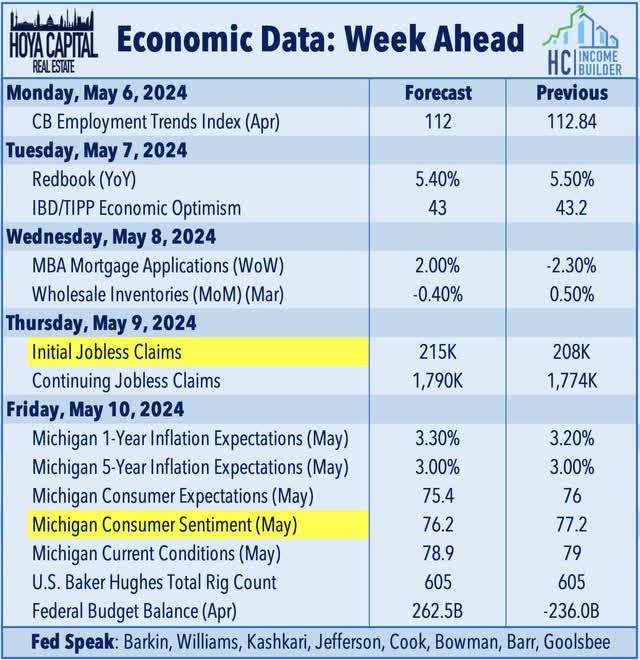

Economic Calendar In The Week Ahead

Following a frenetic two-week stretch of economic data in the lead-up to the Federal Reserve’s May meeting, the economic calendar finally slows down in the week ahead. “Fed Speak” will be a major focus – with scheduled commentary from nearly a dozen officials during the week – which will be closely parsed for indications on whether the relatively “dovish” tone from Fed Chair Powell is shared by his FOMC colleagues. On Friday, we’ll get our first look at Michigan Consumer Sentiment data for May, which includes a closely watched inflation expectations survey. Corresponding to the upward movement in gasoline prices, consumer sentiment has dipped while near-term inflation expectations have increased over the last two months. We’ll also be watching weekly Jobless Claims data for confirmation of the softness seen in the latest BLS nonfarm payrolls report this past week.

Hoya Capital

For an in-depth analysis of all real estate sectors, check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Hoya Capital

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here