Introduction

It’s time to discuss one of my two REIT investments.

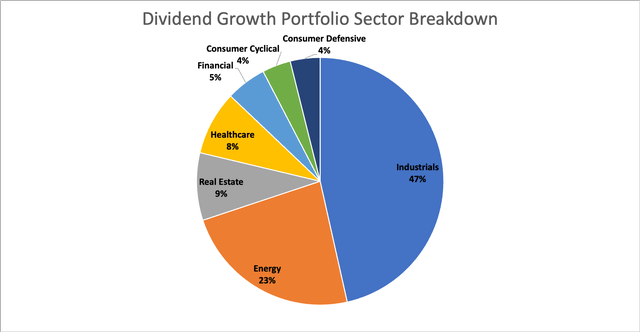

As we can see in the overview below, real estate is my third-largest sector. In this sector, I own Public Storage (PSA) and Extra Space Storage (NYSE:EXR), the star of this article.

Leo Nelissen – Dividend Growth Portfolio

I have written countless (bullish) articles on these two companies. However, in recent weeks, I have thought about diversifying my real estate exposure.

After all, there are a lot of good REITs on the market – I cover many of them – and owning two REITs that are very similar in a concentrated 20-stock portfolio may not be the smartest move.

Moreover, self-storage is an industry with very low entry barriers and elevated occupancy risks. After all, it’s not very hard to start a self-storage business (if you have the necessary capital), and leases are often short-term.

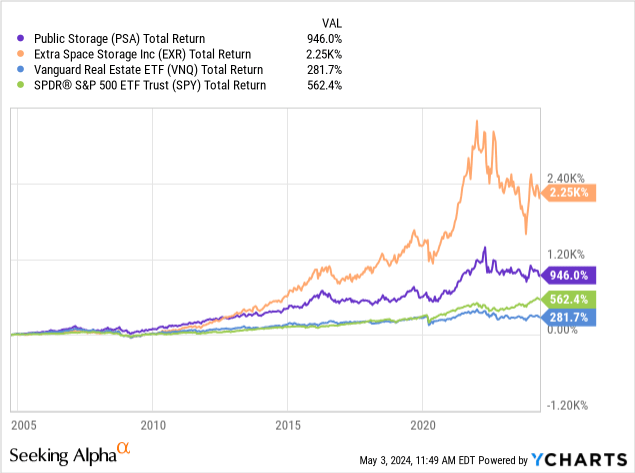

That said, self-storage operators have been among the best-performing REITs on the market. Over the past twenty years, both EXR and PSA have outperformed the S&P 500 and the Vanguard Real Estate ETF (VNQ) by a wide margin.

After all, while we may be dealing with a market with low entry barriers, self-storage has a number of benefits:

- Low Building and Operating Costs: Self-storage facilities are relatively cheap to build and maintain.

- Flexible Pricing: Due to the month-to-month lease structure, self-storage REITs can adjust rental rates more frequently. They are not tied to very long lease agreements with slow rent escalators.

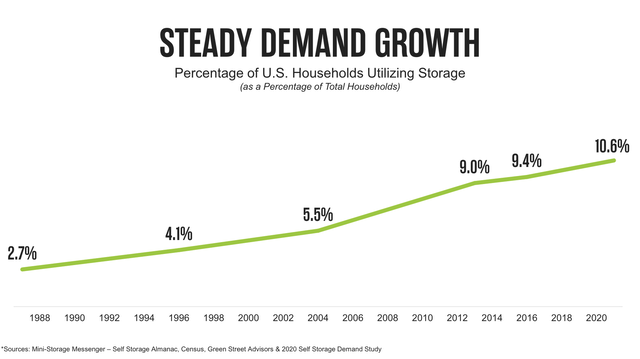

- High Demand: The need for storage space remains high due to various factors that include relocation, downsizing, and consumers buying too much stuff they don’t need. Despite the assumption that younger generations are less materialistic, self-storage demand has steadily grown.

Extra Space Storage

- Automation and Technology: Many operators are adopting automation technology, which can significantly reduce the need for onsite personnel and increase net operating income. In other words, operators who figure out how to efficiently offer a good tenant experience are in a great spot to exploit a highly fragmented market.

Essentially, I think of self-storage companies as consumer-like stocks that come with (often) consistently rising dividends and business models that do not rely on offering the hottest new trends.

Self-storage is about owning key real estate that supports consumers and small businesses. That’s why I bought it.

My most recent article on EXR was written on January 23, when I went with the title “Why 4.4%-Yielding Extra Space Storage Remains My Favorite REIT.”

Having said all of this, in this article, I’ll discuss my investment in Extra Space Storage and explain why I stick to this company, given its strong performance in a challenging environment and ability to deliver significant long-term value.

So, let’s dive into the details!

Strength Amid Weakness

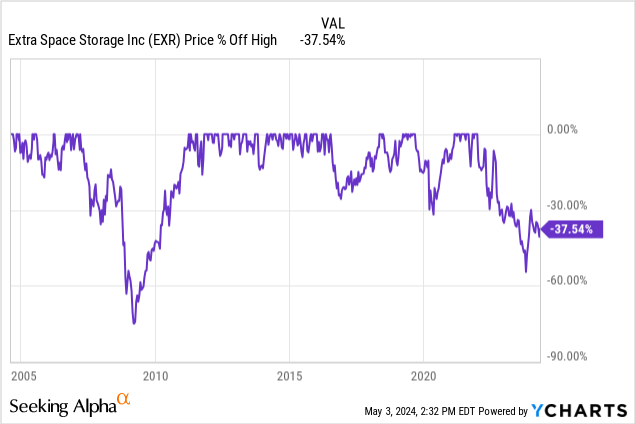

Extra Space is currently in its biggest drawdown since the Great Financial Crisis. After dropping roughly 50%, shares are now 38% below their all-time high.

This makes sense, as the business environment is increasingly unfavorable.

As a result of sticky inflation and elevated rates, consumers are not in a great spot, which hurts demand for storage. This is now resulting in operators fighting for new clients.

This is what Yardi Matrix wrote in its April self-storage report:

[…] the challenges the market faces today, including unclear pricing, difficulty obtaining financing and a “race to the bottom” on street rates, particularly among the public companies.

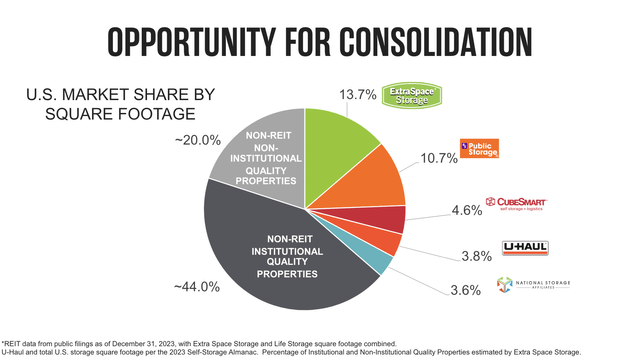

The good news is that EXR isn’t a random self-storage operator. It’s the biggest operator in the United States after merging with Life Storage.

Extra Space Storage

The company has more than 3,700 properties covering 2.6 million units in 42 states.

Moreover, this S&P 500 member also enjoys a BBB+ credit rating, which is just one step below the mighty A range.

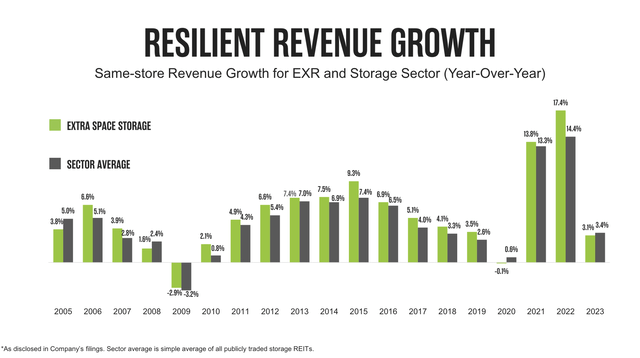

Furthermore, it has outperformed its peers on a same-store revenue growth basis almost every single year going back to 2005.

Extra Space Storage

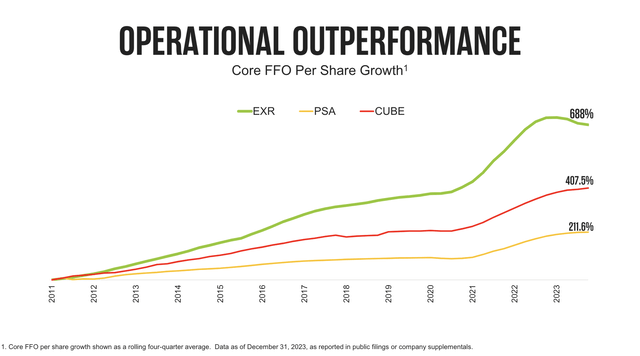

Since 2011, the company has grown its per-share core FFO (funds from operations) by 688%, beating its closest peer by roughly 280 points!

Extra Space Storage

In light of these numbers, the company’s recent 1Q24 results confirm strength in times of weakness.

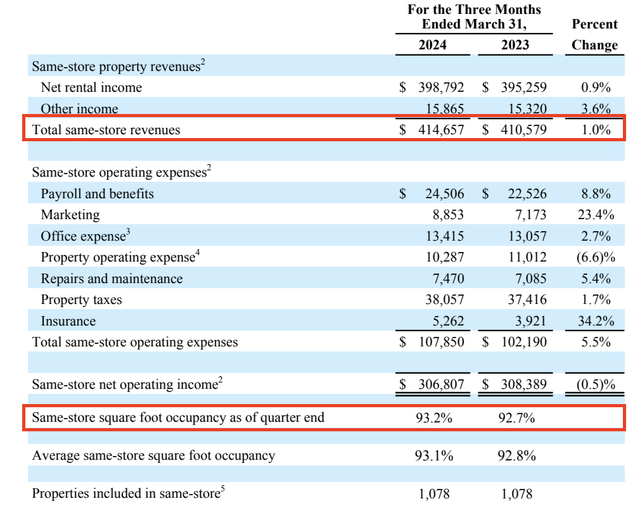

Despite the traditionally slower seasonal period, occupancy in the Extra Space same-store pool increased by 50 basis points year-over-year, reaching 93.2%.

This improvement came with a notable 8% sequential increase in average move-in rates from a seasonal low in January.

Extra Space Storage

Moreover, the company’s revenue strategy effectively balanced occupancy gains with rate improvements, resulting in a 1% improvement in same-store revenues. This result aligned with internal projections.

On the expense side, as expected, same-store expenses increased by 5.5%, which provided a lot of relief for investors who may have expected inflation to have a bigger impact on the bottom line.

As a result, the same-store net operating income decline was limited to just 0.5%. Although it’s far from perfect, it’s more than decent in the current challenging environment.

Adding to that, despite a slow transaction market, the company added 72 net third-party managed stores.

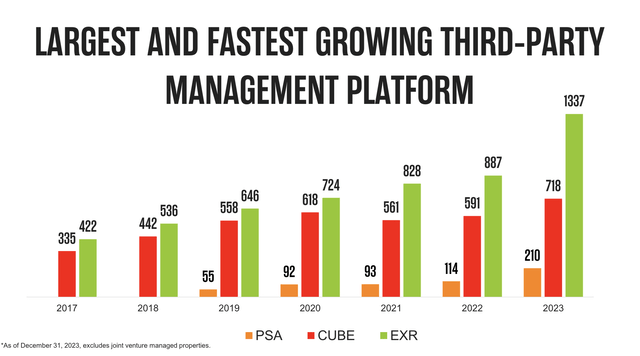

In fact, EXR is the largest and fastest-growing third-party self-storage manager, which is a very efficient, asset-light way of growing, as the company receives fees for managing third-party self-storage assets.

This also creates relationships for potential acquisitions down the road.

Extra Space Storage

The company also completed the sale of a $600 million bond used to repay a bridge loan used for the acquisition of Life Storage.

This move not only improved the company’s balance sheet but also reduced exposure to variable interest rate debt, improving financial stability and flexibility.

As of March 31, the company has 77.2% fixed-rate debt. The weighted average interest rate of the company’s debt was 4.5%, with a weighted average maturity of roughly 4.9 years.

Outlook & Dividend

In addition to a strong performance in a tough environment and the ability to maintain a very healthy balance sheet, the company remains optimistic about its future.

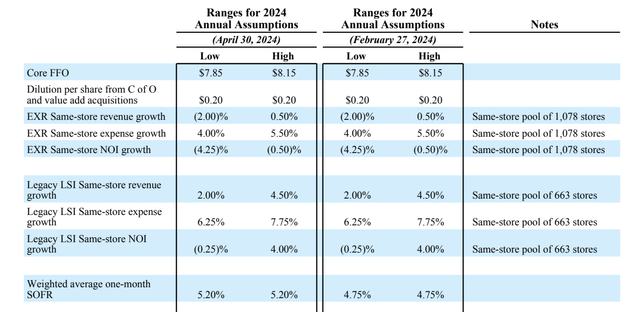

As we can see below, the company stuck to its same-store expectations, including revenue growth, expenses growth, and net operating income growth.

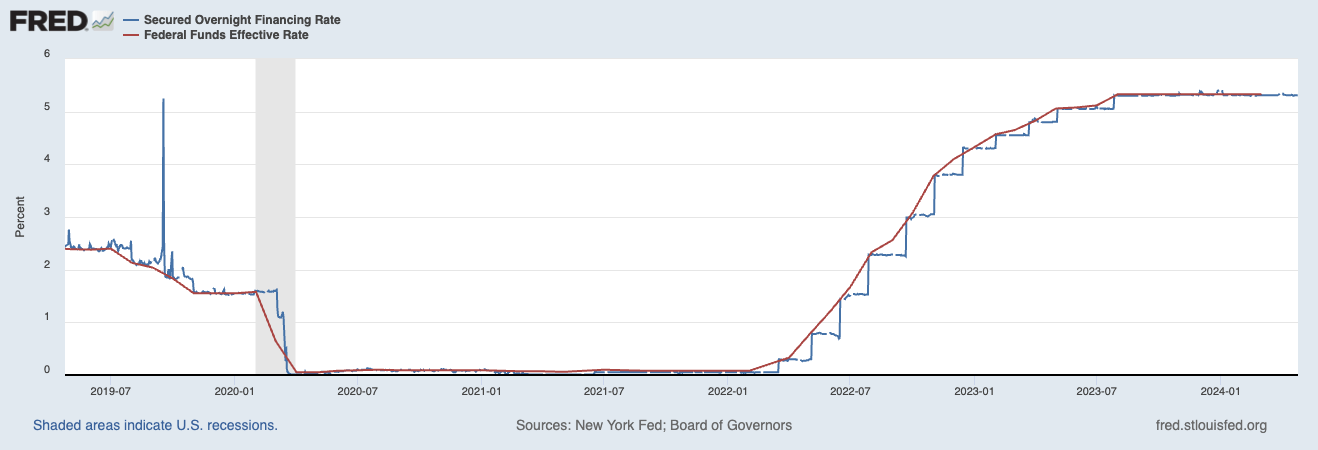

This year, it expects net operating income contraction between 4.24% and 0.50%, with a higher-than-expected SOFR rate of 5.2%. SOFR is an interbank short-term lending benchmark that replaced LIBOR.

FRED

I am very glad that EXR expects that number to be 5.2%, as it implies not a single interest rate cut from the Fed. This shows me the company is prepared for a higher-for-longer environment for both interest rates and inflation.

Extra Space Storage

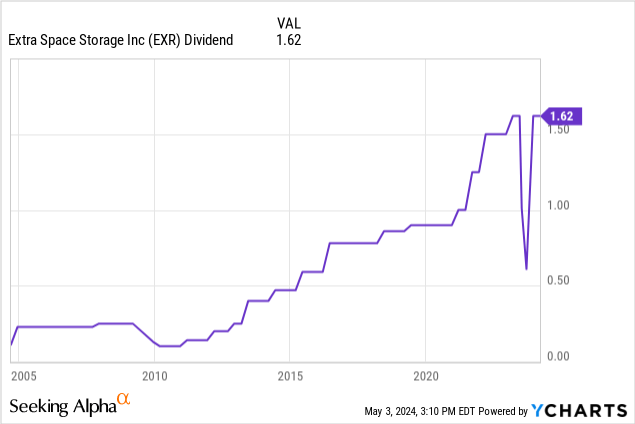

While the outlook suggests weakness to persist for a while, I’m not worried about its dividend.

EXR currently pays $1.62 per share per quarter. This translates to a yield of 4.6%.

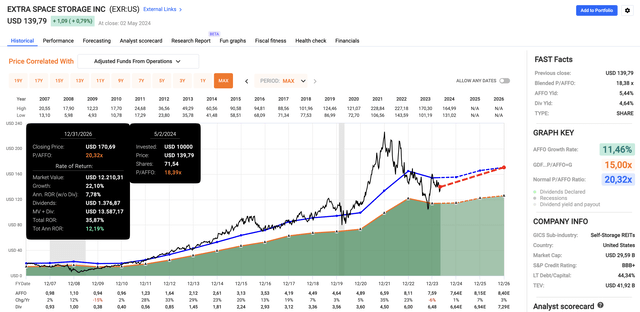

According to the FactSet data in the FAST Graphs chart below, analysts expect the company to generate $7.64 in per-share AFFO this year, indicating a 1% improvement. This number also indicates a dividend payout ratio of 85%.

In 2025 and 2026, per-share AFFO is expected to grow by 7% and 3%, respectively. This bodes well for dividend safety and dividend growth. The most recent dividend hike was 8% on February 16. Going forward, I expect low-to-mid-single-digit annual dividend growth until we get a path to subdued inflation and lower rates.

Until that happens, I’ll collect the company’s juicy dividend.

Please note that the company did NOT cut its dividend last year. The decline in the chart above was caused by EXR breaking up its dividend due to the acquisition of Life Storage. The total amount was unchanged. it just paid more than four dividends.

The current underperformance and solid outlook also bode well for its valuation. Using the chart below, EXR trades at a blended P/AFFO ratio of 18.4x, which is below its long-term normalized AFFO multiple of 20.3x.

FAST Graphs

Although a higher multiple will require a path to lower interest rates and subdued inflation, a return to a 20.3x multiple paves the way for 12% annual returns, including its dividend.

Since 2007, EXR has returned 14% per year, including the Great Financial Crisis stock price implosion.

While I do not expect interest rates to come down anytime soon – at least not without a potential recession triggering the Fed to act – I am buying high-quality REITs at great prices.

EXR is one of them, which is why I decided that I will not be selling it.

Despite all the great REITs I discuss regularly, I believe EXR gives me a shot at beating most of them on a long-term basis.

Takeaway

Despite challenges like elevated inflation and rate hikes, EXR’s strategic moves, including debt refinancing and expansion into third-party management, support its financial stability.

Meanwhile, the company’s ability to maintain high occupancy rates and implement effective revenue strategies amid industry headwinds gives me confidence in its long-term prospects.

With a solid dividend yield and growth potential, EXR remains a cornerstone of my diversified portfolio, offering a path to sustained returns even in uncertain economic times.

Pros & Cons

Pros:

- Resilience: EXR demonstrates strength during market downturns, maintaining occupancy rates and implementing effective revenue strategies.

- Financial Stability: Strategic moves like debt refinancing and expansion into third-party management enhance EXR’s balance sheet and flexibility.

- Dividend Yield: With a solid dividend yield of 4.6% and a history of consistent growth, EXR offers reliable income for investors seeking income.

- Growth Potential: Despite challenges, EXR should continue to benefit from secular growth in the self-storage industry.

Cons:

- Industry Headwinds: The self-storage industry faces challenges like inflation and rate hikes, which could impact EXR’s performance.

- Market Volatility: EXR’s stock price may experience volatility, particularly during economic uncertainties.

- Dependence on Economic Factors: EXR’s performance is closely tied to economic conditions like consumer sentiment, making it prone to downturns.

Read the full article here