The day before the Fed’s meeting, I surmised that Chairman Powell would keep his cards close to his chest, as he has done consistently over the past year, acknowledging the progress in achieving the Fed’s dual mandate, while cautioning that there is more work to be done to reach the inflation target of 2%. In other words, steady as she goes. The consensus was anticipating a far more hawkish announcement from the Fed in reaction to economic reports that in recent weeks have shown stronger-than-expected inflation data, which was expected to push bond yields higher and stock prices lower, but none of that came to pass.

Finviz

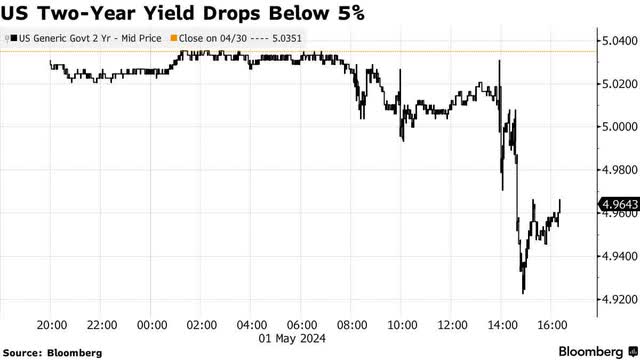

To the contrary, the Fed’s official statement that preceded Powell’s comments leaned dovish by announcing that “the risks to achieving its employment and inflation goals have moved toward better balance over the past year.” There was no mention of raising interest rates again, as some had seemingly hoped. That lifted stock prices, as bond yields fell, in the minutes before Powell spoke. The Fed also adjusted policy by indicating it would reduce the number of Treasuries allowed to run off its balance sheet from $60 billion per month to $25 billion, while mortgage-backed securities would remain at $35 billion. That is a positive rate of change that further fueled risk asset prices. Less supply coming to market reduces the upward pressure on interest rates. Most importantly, the 2-year Treasury yield, which is the proxy for where investors see short-term rates approximately one year from now, fell below 5%. This is another positive rate of change that boosted stock prices.

Bloomberg

The major market averages faded during the final hour of trade to give back those Powell-powered gains, but that was largely due to the rotation out of expensive technology names that have profited from the boom in artificial intelligence (AI). Advanced Micro Devices and Super Micro Computer, which are two of the largest beneficiaries of the AI-spending bonanza, both slumped following strong earnings reports. They have simply become too expensive. That dragged the technology sector down 1% yesterday, but I suspect investors will be back to buy any dip in the broad market that results, because Powell emphasized that the Fed has been delayed but not derailed by the first-quarter spike in inflation.

The Chairman acknowledged that it will take longer than previously thought to achieve its 2% target, but that the disinflationary trend is intact. That means the Fed will not be reducing rates as soon as it had expected at the beginning of this year, but the strength of the economy is allowing it more time to do so. This is a far cry from tightening policy, which Powell emphasized is not on the central bank’s agenda. The Fed will remain data dependent, which means markets will refocus on the incoming high-frequency economic data to predict when the first rate cut will come.

There is clearly a contingent out there who wants to see higher interest rates, a big stock market decline, and ultimately a recession. They claim that this is the only way to arrest the recent price increases for the services categories that have slowed the progress of the headline inflation number during the first quarter. Chairman Powell clearly disagrees with them, and so do I. The goal should be a soft landing that restores price stability without the pain and suffering caused by mass job losses and an economic downturn. I think Powell is doing his best to thread the needle.

The primary lever to more stock market gains will be the 2-year Treasury yield. Two weeks ago, I asserted that bond yields were setting stocks up for an inevitable rally that would recover the losses of the past month. That is because the rise in the 2-year yield has reduced the number of rate cuts expected to just one. Therefore, the yield has most assuredly peaked at 5%, but the market response has been relatively muted, as the economy continues to expand at a healthy clip. As growth weakens and disinflation ensues, the 2-year yield should start to fall again, and that should support higher stock prices between now and year-end.

Stockcharts

Read the full article here