Just 15 years into its existence, Bitcoin (BTC-USD) has catapulted from a niche cypherpunk computer project to a global powerhouse, valued by the market at $1.2 trillion. With the increase in valuation and market interest comes an increase in the amount of proxies and derivatives available to speculators. One such product is the Proshares Ultra Bitcoin ETF (NYSEARCA:BITU).

Fund Objective & Details

BITU was launched by ProShares on April 2nd, 2024.

- AUM: $121 million

- Expense ratio: 0.95%

The goal of BITU is fairly straightforward. Before fees and expenses, BITU shareholders are attempting to generate 2 times the daily reward of the price of Bitcoin. So if BTC increases by 5% in a given day, BITU would theoretically increase by 10% in the same day. Thus, BITU is a 2x leveraged Bitcoin ETF and is primarily intended for short-term traders and not for long-term investment.

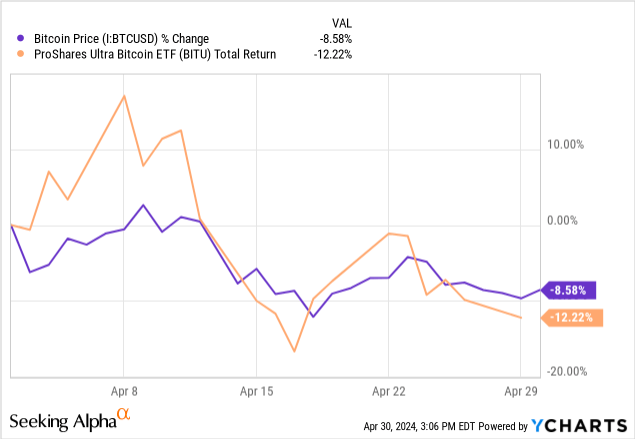

Since the fund is still relatively new, BITU holders who have been in the fund since inception are down 12% while BTC is down closer to 9%. While not as dramatic an underperformance as is possible with a 2x ETF, this does highlight the long-term risk in holding leveraged funds for too long.

Risks with Leveraged ETFs

Leveraged funds like BITU are rebalanced daily. When a 2x long fund is leveraged against a sector or asset that is in a sustained uptrend, the leveraged fund shares can work beautifully at maximizing gains for short-term trades. However, the opposite is also true to the downside. A 2x long strategy tracking an asset going down doubles the pain. But in order to win, leveraged ETF holders need a sustained uptrend. Chop won’t work.

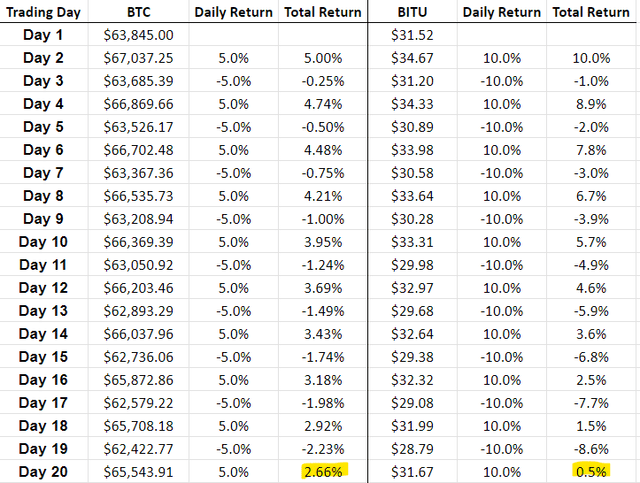

That’s because shareholders of leveraged funds also lose when the sector or asset experiences directional ambiguity. In a prior article covering the GraniteShares 2x Long COIN ETF (CONL), I detailed how long-term decay works with these funds due to daily rebalancing. In that note, I shared a table showing how it only takes a few weeks of holding before the leveraged shares start underperforming the intended strategy, even if the sector or asset can have a positive total return. For the sake of prospective BITU buyers, I’ve updated that table to show it would look here:

Author’s calculations

In the example above, we’re looking at 20 days of back and forth 5% intraday BTC moves that generate 10% back and forth moves in the BITU shares. By Day 20, BITU has underperformed BTC, though both are still marginally higher than from where they started. This illustrates why BITU and generally all 2x funds like it are poor long-term investments and shouldn’t be held for a longer than a few days at a time.

Unlike CONL which intends to track with shares of Coinbase (COIN), BITU shareholders have a greater risk of missing out on potential BTC gains due to the fact that the market for BTC doesn’t actually close. This risk is highlighted in the Summary Prospectus in the Market Price Variance Risk section:

As a result, the value of the Fund’s holdings may vary, perhaps significantly, on days and at times when investors are unable to purchase or sell Fund shares.

For example, if Bitcoin rallies by 10% over the weekend and then falls back down to its Friday level, BTC will be even but BITU shareholders would have missed a 20% rally in the fund shares. This is also a risk for spot ETFs as well, but those fund objectives are different and meant for longer term holding rather than short term trades.

Bitcoin Correction

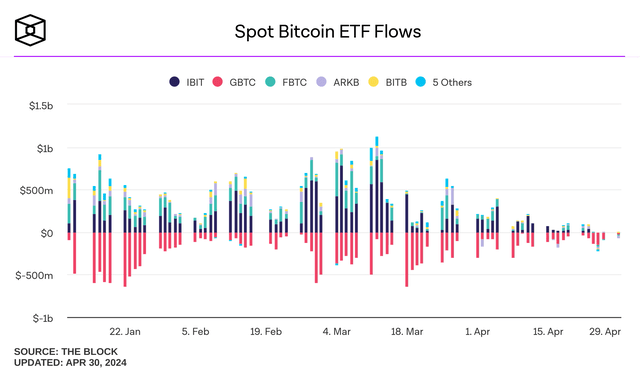

Given the obvious risks with buying BITU, timing is the most important factor and I suspect even short-term traders likely want to avoid this fund with BTC showing signs of an imminent deeper correction. Fundamentally, spot ETF flows started turning negative in April:

The Block

According to data from Farside Investors, daily net flows in the spot Bitcoin funds have been negative 9 out of the last 12 sessions as of April 29th. Up until recently, the only spot ETF that was experiencing outflows was the Grayscale Bitcoin Trust ETF (GBTC). However, April has seen more of the other funds now turning to net outflows as well. This is an indication that investment demand for BTC has started to reverse, with the block reward halving now in the rearview mirror.

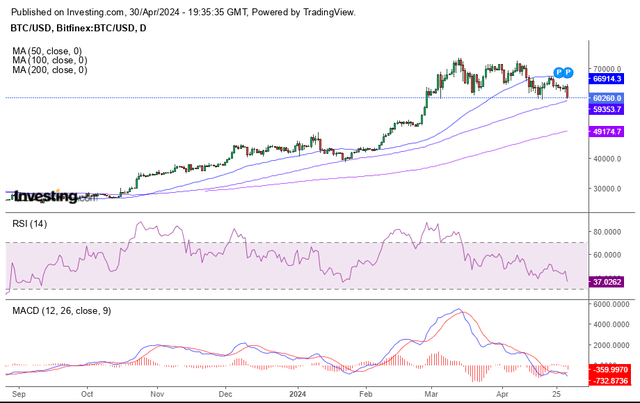

BTC Daily (Investing.com)

Technically, I see additional downside for Bitcoin in May as the coin retests important moving averages and prior areas of resistance. Consider the 50 DMA curling lower, the MACD crossing back down and the fact that the RSI has yet to hit oversold territory as it is still only at 37. Given the interest rate environment and general weakness in the equity market, I don’t think BTC will be immune from further declines if the broader market is in risk-off mode, as I suspect it currently is. The point is, this is not an environment where I’d want to be trying to catch knives in BITU.

Closing Summary

BITU is not a fund for long-term investment. It could actually be a terrific trading instrument for short term tactical buyers, but we have yet to see the fund perform well for bulls since it’s still such a new ETF. Not only are spot ETF investors starting to take profits, but the technical setup indicates further downside in BTC, in my opinion. Furthermore, I don’t think the time is right to long BITU given the macro setup.

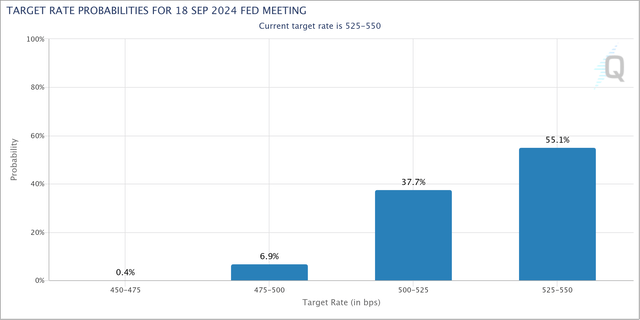

September Rate Probabilities (CME FedWatch)

The broader financial markets have been expecting numerous interest rate cuts in 2024, and we have yet to get a single one. In fact, the market is now pricing in the possibility that the Federal Reserve won’t start cutting until September. In my view, this is going to further weight on risk assets like BTC. I’m still bullish BTC longer term. But in my view, it’s best to express that idea through the spot ETFs for now and wait for a more clear indication of a trend shift back up before speculating with BITU.

Read the full article here