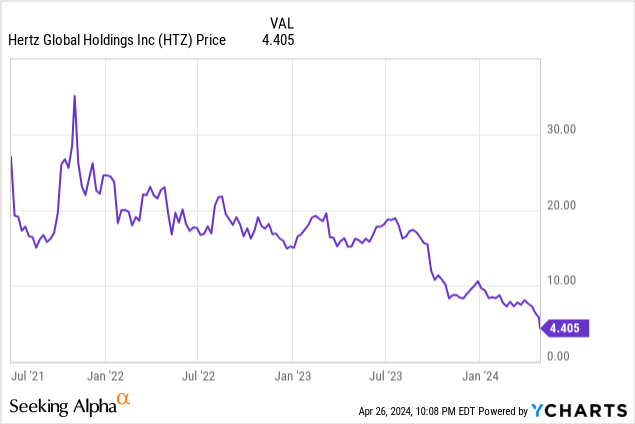

Hertz Global Holdings (NASDAQ:HTZ) (HTZWW) is in financial trouble because of two very irrational decisions by management – massive stock repurchases and electric vehicle purchases. When you add in much higher interest rates over the last two years and lower used vehicle prices, you get a plunging HTZ stock price. Considering that Hertz filed for Ch.11 bankruptcy in 2020, one may have expected that management would become very prudent. Nope. Management took up seats at the roulette table. They recently left the casino and have not made any stock repurchases in 2024, are selling 30,000 of their EVs, and got rid of CEO Stephen Scherr. The problem is that the damage was already done. Can Hertz be saved? HTZ stock price is down approximately 77% since my 2021 sell recommendation article.

Massive Irrational Stock Repurchases

Readers who follow me already know that I am absolutely against share repurchases. Hertz has $3.430 billion treasury stock on their latest balance sheet. Using the 174,812,044 shares repurchased implies the average repurchase cost was $19.62 per share, which compares to the latest HTZ price of $4.40. What was the board of directors thinking? Hertz had recently exited Ch.11 and they already started to repurchase shares. This $3.43 billion should have been used, in my opinion, to reduce their $3.898 billion debt. These irrational repurchases are a major reason why the company is now in financial trouble. Besides blaming the board of directors, much of the blame belongs to myopic traders who encourage these repurchases and are just looking for quick stock price increases instead of long-term investments. Hertz has now joined the list of companies, such as Big Lots (BIG), that are currently in financial trouble because of prior massive stock repurchases.

Vehicle Depreciation Confusion

Before covering the electric vehicle issue it is important to cover the corporate structure. Hertz Global Holdings does not directly own the vehicles they rent to customers. A special purpose entity, Hertz Vehicle Financing III LLC, leases the vehicles to Hertz Global who then rents them to customers. Without getting too complicated, the remote entities purchase and own the vehicles using cash from debt they issue. Hertz Global does not issue nor guarantee this debt.

The amount of the monthly lease payments is based on a number of factors, including a very critical depreciation charge. For non-program vehicles that are not trucks nor manufactured by Tesla (TSLA) (see below for more on Tesla) the depreciation rate ranges between 0.50% to 1.67% depending upon the latest average vehicle market value and the GAAP accounting book value. The greater the current market value is compared to GAAP value, the lower the depreciation charge. (The text of the specifics for determining the depreciation factor can be found in the amended lease agreement.) This was a critical problem for Hertz in early 2020 when vehicle market values plunged, and their required lease payments soared because the depreciation factor soared. Their average monthly depreciation per vehicle per month in 2023 was $332 compared to $112 in 2022 and $81 in 2021 in the Americas. In 1Q’24, it was $649 for Americas, mostly because of EV issues. Because of current low market value versus GAAP book value,, their current depreciation rate is at the high 1.67%.

The vehicle depreciation is not part of the “D” in EBITDA. That “D” is only for non-vehicle depreciation. Some news reports can get confusing if one does not understand the difference in how the “D” is used. The “I” also refers to non-vehicle interest expenses. The depreciation associated with vehicles is an actual cash payment that is part of the monthly lease payments, whereas the non-vehicle depreciation is just some bookkeeping entry item.

Used Vehicle Prices Keep Dropping

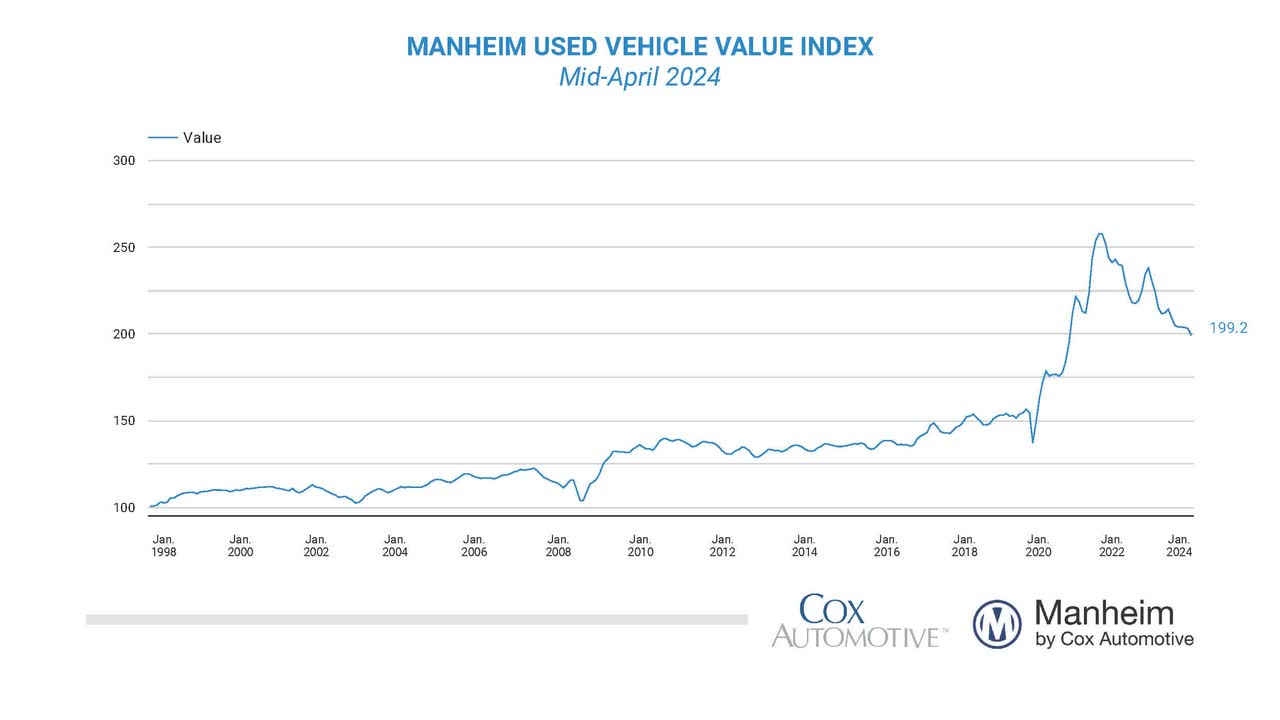

After plunging in early 2020 at the start of the pandemic, used vehicle prices rose sharply. The reality is that the major reason why shareholders of the bankrupt Hertz received a recovery was because of the higher used vehicle values. As the chart below shows, the used vehicle prices dropped 13.7% over the last year.

January 1997=100

site.manheim.com

According to Manheim “over the last two weeks, Manheim Market Report – MMR – prices in the Three-Year-Old Index decreased an aggregate of 0.5%, which is higher than the typical 0.3% decline seen this time of year.” This seems to indicate that the used vehicle issue for Hertz could continue in 2Q’24 and potentially for the rest of 2024.

Electric Vehicles = Massive Losses

Many investors feel that the huge expansion into EVs has been a disaster for Hertz. The implementation of the logistics associated with EVs was poorly planned and executed. Management also greatly overestimated consumer demand for EV rentals. If you re-read their original October 2021 EV purchase announcement, the statements indicate, in my opinion, that Hertz was run by an unqualified management team. They did not seem to understand the rental demand for EVs. Just because “40 percent of U.S. consumers say they are likely to consider an electric vehicle the next time they are in the market for a new vehicle, according to Pew” that does not itself indicate that there was a strong desire by consumers for renting an EV when they need a car rental. There is a major difference, in my opinion. Management also poorly implemented the new logistics associated with EV rentals and charging.

The 2021 amendments to the lease agreement that includes changes specific to Tesla vehicles were a yellow flag to potential future problems. First, Tesla vehicles had an initial 5% depreciation charge, compared to no initial depreciation charge for non-Tesla vehicles. Second, the monthly depreciation was a fixed 2% irrespective of the current market value compared to GAAP book value. This meant that the depreciation factor for Tesla vehicles would greatly increase the total monthly lease payments. It also indicated that the various parties to the amended lease agreement expected that the market for used EVs would be much weaker than “normal” vehicles. The reality is that the used EV market is even weaker than they expected.

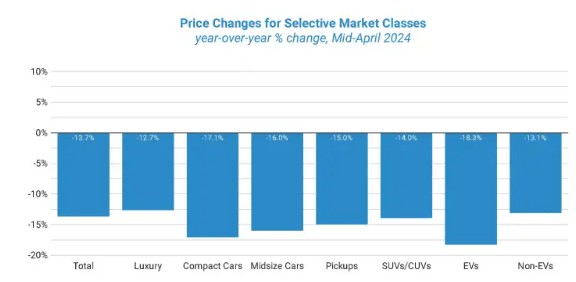

As can be seen in the chart below, the price changes for used EVs has dropped significantly more than non-EVs over the past twelve months. I am not surprised because of the battery issues associated with used EVs and the potential need to replace the very expensive batteries at some point in the future. It also reflects that Tesla has cut prices of some new EVs.

site.manheim.com

I am not sure if their failed EV program indicates weaker demand by consumers for EVs than the EV industry expected, or it just indicates the Hertz EV rental program was a failure. This is an issue bigger than just for Hertz – it is a huge issue for the entire EV industry.

Originally, they planned to dispose of 20,000 of their 60,000 EVs, but during the recent conference call management stated they were going to sell 30,000 this year, and they had already sold 10,000. The sale of approximately 10,000 EVs resulted in a $41 million loss in 1Q’24 and there was also a $154 million write-down of the 20,000 that they are planning to sell this year.

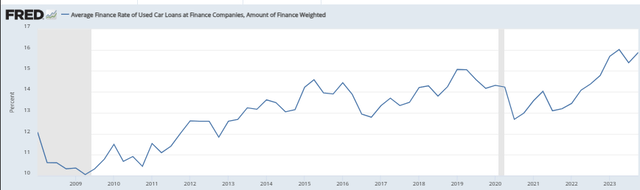

Interest Rates – Higher for Longer

Soaring interest rates over the last two years had a disastrous impact on Hertz. Approximately 30% of their debt is based on variable interest rates. Total interest expenses were $793 million in 2023 compared to adjusted EBITDA of only $561 million and total interest expenses were $328 million in 2022 compared to EBITDA of $2.305 billion. Higher interest rates make it more expensive to buy vehicles for many consumers who have to finance new and used car purchases. Interest rates for financing used car purchases dipped during the pandemic, but then rose sharply, which significantly hurt used vehicle prices. The financing rates are currently the highest they have been for many years and continue to put downward pressure on used vehicle prices.

Average Finance Rate of Used Car Loans at Finance Companies

fred.stlouisfed.org

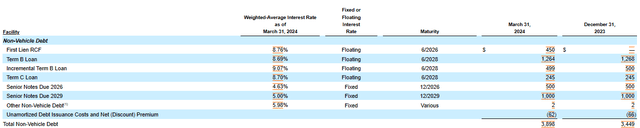

Interest expenses could be even higher going forward in 2024 because Hertz borrowed $450 million under their revolver in 1Q’24. Currently, there is not a critical liquidity issue, but I have concerns going forward. Their current liquidity was also mentioned a number of times by various analysts during their recent conference call. As of March 31, they have $1.331 billion ($465 million cash+$866 million available under the revolver) but that is down almost $700 from just three months ago when they had $2.030 billion ($766 million cash+$1.266 billion available under the revolver) on December 31, 2023.

Non-Vehicle Long-Term Debt

10-Q (sec.gov)

The new CEO, Gil West, seems to understand their liquidity problem because Hertz is taking a conservative approach for new vehicle purchases. They are buying lower priced vehicles, which should mean lower monthly lease payments, and maintaining their fleet to be sized below the expected demand. It seems they would rather be short on cars instead of having excess capacity that takes capital to carry. (It is unclear how much, if any, the new airline regulations will have on the number of flyers in the future, which would directly impact the demand for car rentals at airports.)

I am expecting interest rates to remain higher for longer. I actually want the Federal Reserve to raise their fed funds target 0.25% at the May 1 meeting to bring the rate of inflation down, but that is very unlikely. If interest rates remain high or go even higher, used car prices will be negatively impacted, which means high depreciation numbers included in their monthly lease payments.

Conclusion

The results for Hertz Global could dramatically improve if the monthly depreciation amount is reduced. This could be just the reverse of the increase in the average monthly depreciation per vehicle to $332 in 2023 from $81 two years earlier in 2021. To illustrate the impact per share, the total depreciation of vehicles and lease charges in 2023 were approximately $6.67 per HTZ share. In order for this to happen, used vehicle prices would have to increase significantly. To get higher used car prices, you most likely need a sharp drop in interest rates. That is the problem. Interest rates may remain high for a very long time. Therefore, Hertz could continue to be in trouble as depreciation rates remain high. There is also the risk that highly leveraged Hertz may eventually need a restructuring.

I think the new CEO seems much sharper than their prior CEOs. They are trying to get the EV problem under control by selling 30,000 EVs, but they took some large losses on that poorly executed program.

Since I expect continued weakness in used car prices due to high interest rates that could result in Hertz reporting losses, it is difficult to establish an intrinsic value for HTZ stock. Much of the current HTZ value is effectively a call option on bond prices. If interest rates drop, which means bonds prices, HTZ may also rise, but if interest rates rise further, HTZ could drop. In theory, my “hold” recommendation with HTZ trading at $4.40 is an upgrade from my July 2021 sell article, but the current recommendation is based on completely different factors and the stock price already dropped 77%.

Read the full article here