In my 10 Dividend Growth Stocks series, I rank a selection of Dividend Radar stocks and present the ten top-ranked stocks for further research and possible investment. Dividend Radar is a weekly automatically generated spreadsheet of dividend growth [DG] stocks with dividend increase streaks of five or more years.

To look for interesting candidates, I apply different screens every month to highlight different aspects of dividend growth investing.

This month, I’m presenting candidates trading below my risk-adjusted Buy Below prices with projected dividend growth rates above 10%. These screens produce candidates with exceptional total return prospects, as I argued in the article Why Invest In Low Dividend Yield Stocks?

To rank stocks, I perform a quality assessment and sort stocks by quality scores, breaking ties with additional metrics.

Screening and Ranking

The latest Dividend Radar (dated April 26, 2024) contains 721 stocks with dividend increase streaks of at least five years.

This month, I used two screens, one growth screen, and one valuation screen.

Growth Screen

I usually consider three trailing growth metrics:

- 5-year dividend growth rate [5-DGR]

- 5-year EPS growth rate [5-EGR]

- 5-year revenue growth rate [5-RGR]

Since these are trailing metrics, I blend them using the following formula to obtain a stock’s projected dividend growth rate [Proj-DGR].

|

Proj-DGR = min(30%,average(min(D,E,R),median(D,E,R))) where:

|

Essentially, the formula ignores the highest of the trailing growth rates and averages the remaining pair, further limiting the projected dividend growth rate [Proj-DGR] to 30%.

Here is this month’s growth screen:

153 Dividend Radar stocks pass the projected dividend growth screen.

Valuation Screen

I use a survey approach to estimate fair value [FV]. I collect fair value estimates and price targets from several online sources such as Portfolio Insight, Morningstar, and Finbox. Additionally, I estimate fair value using each stock’s five-year average dividend yield. With up to 12 estimates and targets available, I ignore the outliers (the lowest and highest values) and use the average of the median and mean of the remaining values as my FV estimate.

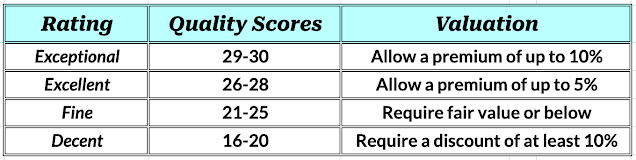

My risk-adjusted Buy Below prices allow premium valuations for the highest-quality stocks but require discounted valuations for lower-quality stocks:

Created by the author

My Buy Below prices recognize that the highest-quality stocks rarely trade at discounted valuations. As a dividend growth investor with a long-term investment horizon, I’m more interested in owning quality stocks than getting a bargain on lower-quality stocks.

For this month’s article, I used the following valuation screen:

- Stock price < risk-adjusted Buy Below price

276 Dividend Radar stocks pass all three valuation screens.

Ranking Candidates

Only 29 stocks pass both of this month’s screens.

To rank the candidates, I sorted them in descending order by quality scores and used the following tie-breaking metrics:

- Simply Safe Dividends Dividend Safety Scores

- S&P Global Credit Ratings

- Forward Dividend Yield

Each stock’s Rank is shown in the tables that follow.

Top 10 Dividend Growth Stocks for April

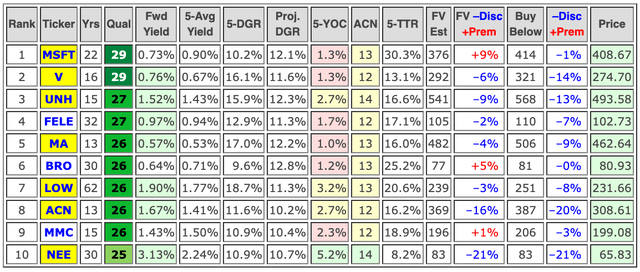

Here are this month’s ten top-ranked DG stocks in rank order:

I own the highlighted stocks in my DivGro portfolio.

The following company descriptions are my summary of company descriptions sourced from Finviz.

1. Microsoft (MSFT)

Founded in 1975 and based in Redmond, Washington, MSFT is a technology company with worldwide operations. The company’s products include operating systems, cross-device productivity applications, server applications, productivity and business solutions applications, software development tools, video games, and online advertising. MSFT also designs, manufactures, and sells several hardware devices.

2. Visa (V)

Headquartered in San Francisco, California, V is a payments technology company worldwide. The company facilitates commerce by transferring value and information among consumers, merchants, financial institutions, businesses, strategic partners, and government entities. V provides its services under the Visa, Visa Electron, Interlink, V PAY, and PLUS brands.

3. UnitedHealth (UNH)

UNH is a diversified healthcare company. Its UnitedHealthcare business offers consumer-oriented health benefit plans and services in the United States. Its Optum business delivers care aided by technology and data, empowering people, partners, and providers with the guidance and tools needed to achieve better health outcomes. UNH was founded in 1977 and is headquartered in Minnetonka, Minnesota.

4. Franklin Electric (FELE)

FELE designs, manufactures, and distributes water and fuel pumping systems worldwide. It operates in three segments: Water Systems, Fueling Systems, and Distribution. The company sells its products to specialty distributors, original equipment manufacturers, industrial and petroleum equipment distributors, and oil and utility companies. FELE was founded in 1944 and is headquartered in Fort Wayne, Indiana.

5. Mastercard (MA)

MA is a technology company that provides transaction processing and other payment-related products and services in the United States and internationally. The company offers payment solutions and services under the MasterCard, Maestro, and Cirrus brands. MA was founded in 1966 and is headquartered in Purchase, New York.

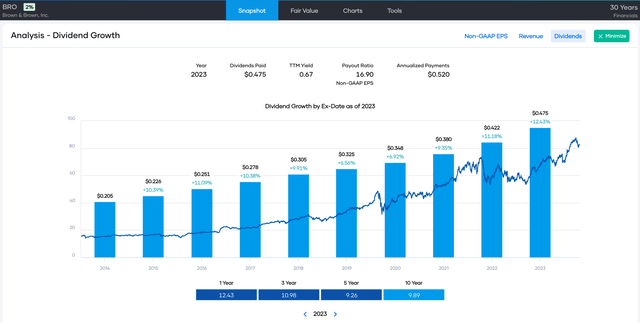

6. Brown & Brown (BRO)

BRO is an insurance agency, wholesale brokerage, insurance program, and service organization. It provides insurance brokerage and casualty insurance underwriting services to various customers, including businesses, public entities, individuals, trade groups, and professional associations. BRO was founded in 1939 and is headquartered in Daytona Beach, Florida.

7. Lowe’s (LOW)

Founded in 1946, LOW is a home improvement retailer based in Mooresville, North Carolina. The company offers a complete line of products for maintenance, repair, remodeling, and home decorating. It also offers installation services through independent contractors, extended protection plans, and repair services.

8. Accenture plc (ACN)

ACN provides management and technology consulting services to clients in various industries and geographic regions, including North America, Europe, and various growth markets. The company was founded in 1951 and is based in Dublin, Ireland. ACN collaborates with Amazon Web Services to develop cross-industry solutions.

9. Marsh & McLennan (MMC)

Founded in 1871 and headquartered in New York, MMC is the parent company of various specialty consultants, including Marsh, an insurance broker, intermediary, and risk advisor; Guy Carpenter, a risk and reinsurance specialist; Mercer, a provider of human resource and related financial advice and services, and Oliver Wyman Group, a management, economic and brand consultancy.

10. NextEra Energy (NEE)

NEE generates, transmits, distributes, and sells electric power to retail and wholesale customers in North America. The company generates electricity through wind, solar, nuclear, coal, and natural gas facilities. It also develops, constructs, and operates assets focused on renewable energy generation. NEE was founded in 1925 and is based in Juno Beach, Florida.

Please note that the top ten DG stocks are candidates for further analysis, not recommendations.

Key Metrics and Fair Value Estimates

Below, I present key metrics of interest to dividend growth investors, along with quality indicators and fair value estimates:

|

|

Color-coding

|

Created by the author from a personal spreadsheet

Here are the Sector and Super Sector designations of each candidate:

| Rank | Company (Ticker) | Sector | Supersector |

| 1 | Microsoft (MSFT) | Information Technology | Sensitive |

| 2 | Visa (V) | Financials | Cyclical |

| 3 | UnitedHealth (UNH) | Health Care | Defensive |

| 4 | Franklin Electric (FELE) | Industrials | Sensitive |

| 5 | Mastercard (MA) | Financials | Cyclical |

| 6 | Brown & Brown (BRO) | Financials | Cyclical |

| 7 | Lowe’s (LOW) | Consumer Discretionary | Cyclical |

| 8 | Accenture plc (ACN) | Information Technology | Sensitive |

| 9 | Marsh & McLennan (MMC) | Financials | Cyclical |

| 10 | NextEra Energy (NEE) | Utilities | Defensive |

Commentary

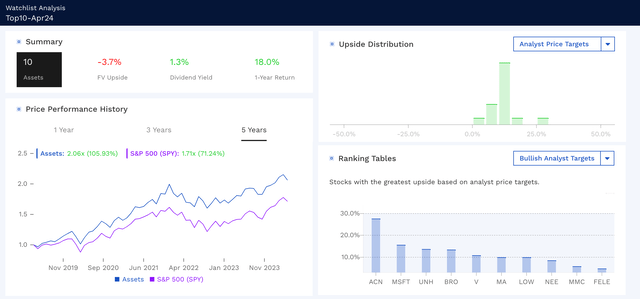

Here’s a comparative analysis of an equal-weighted portfolio of this month’s top ten DG stocks, courtesy of Finbox.com:

Finbox.com

From a price-performance perspective, the portfolio would have outperformed the S&P 500 (as represented by the SPDR S&P 500 Trust ETF (SPY)) over the last five years, returning 106% versus SPY’s 71%.

All of the stocks have positive upsides based on analyst price targets, with ACN topping the list with an upside of 27.7%, followed by MSFT and UNH, with upsides of 15.6% and 13.7%, respectively.

BRO (12.8%), UNH (12.3%), and MA (12.2%) have the highest projected dividend growth rates, while NEE (-21%) and ACN (-20%) are discounted most relative to my risk-adjusted Buy Below prices.

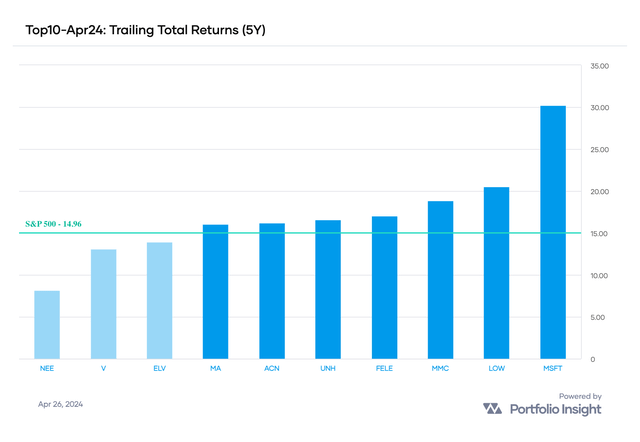

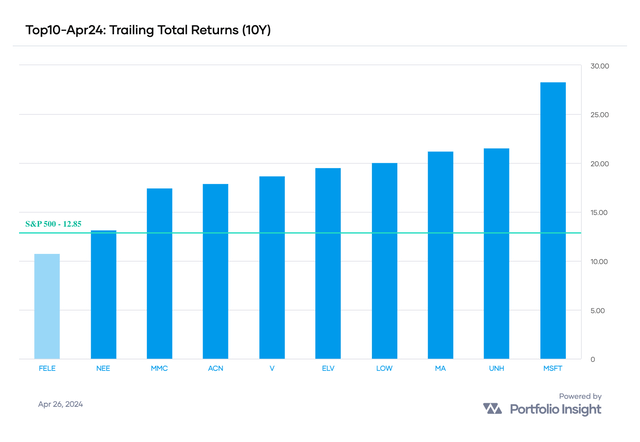

According to Portfolio Insight, seven stocks outperformed SPY over the last five years, with MSFT and LOW the top performers:

Portfolio Insight

Looking back ten years, only FELE failed to outperform SPY. Here, MSFT and UNH are the top performers.

Portfolio Insight

NEE (3.13%) offers the highest forward yield, followed by LOW (1.90%) and ACN (1.67%).

In March, I published an article to explain why dividend growth investors should not shy away from investing in low-yielding DG stocks. Such stocks often produce outsized total returns!

Further evidence is in this month’s top ten: NEE, the stock with the highest yield, delivered the lowest 5-year trailing total return. And low-yielding stocks like MSFT and BRO delivered outsized 5-year trailing total returns!

Based on how I calculate target weights, UNH, MSFT, and NEE are overweight positions in my DivGro portfolio, while ACN and LOW are underweight positions. I would need to add 24 shares ($7,463) to ACN and 16 shares ($3,652) to LOW to turn them into full-sized positions.

I don’t have enough cash in the account that holds my ACN position, so I won’t be adding any shares at this time.

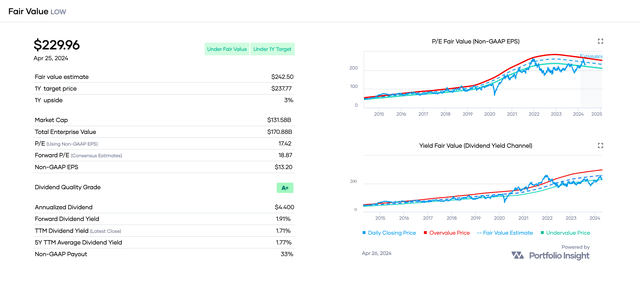

As for LOW, the stock is undervalued but has a 1-year upside of only 3%, according to Portfolio Insight, so I’ll wait for a better opportunity to increase my LOW position.

Portfolio Insight

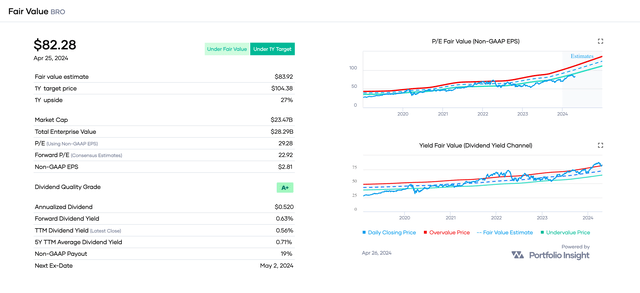

In contrast, BRO is fairly valued but has a 1-year upside of 27%:

Portfolio Insight

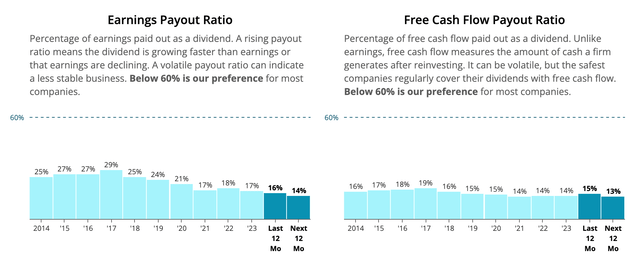

With earnings and free cash flow payout ratios of only 16% and 15%, respectively, BRO has plenty of room to continue paying and raising its dividend. With a Dividend Safety Score of 99, BRO’s dividend is deemed Very Safe by Simply Safe Dividends.

Simply Safe Dividends

BRO’s dividend growth rate is accelerating, so I think it is a good opportunity for growth-oriented and total-return investors:

Portfolio Insight

Concluding Remarks

In this article, I ranked Dividend Radar stocks trading below my risk-adjusted Buy Below prices with projected dividend growth rates above 10%.

I own seven of the stocks in this month’s top ten.

BRO looks like an interesting opportunity for growth-oriented and total-return investors. BRO is a high-quality stock with a very safe dividend and a 1-year upside of 27%.

As always, I encourage readers to do their due diligence before buying any stocks I cover

Thanks for reading, and take care, everybody!

Read the full article here