Stocks bounced yesterday after a three-week decline in anticipation of earnings reports from more than one-third of the companies in the S&P 500 this week. The highest hopes are for the largest technology companies benefitting from the boom in artificial intelligence, but I am more interested in profits beyond the Magnificent 7, which are critical to an improvement in breadth for this bull market and a continuation of the economic expansion. I think we will see the broad strength we need to bring an end to the market pullback, escaping correction territory of a 10% drawdown, but the upside for the major market averages may be limited if the rotation in leadership from technology to the rest of the market occurs, as I expect. Technology stocks have a lot more to prove to support current valuations than the rest of the market does today.

Finviz

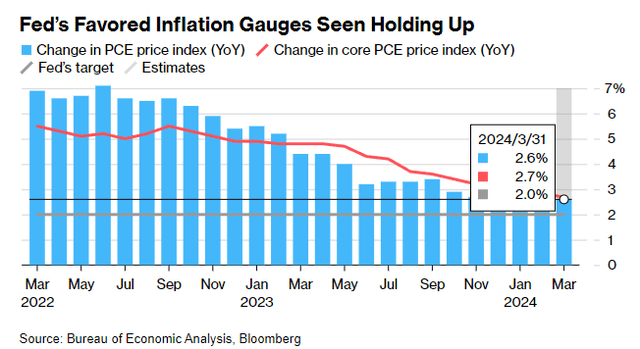

In addition to this week’s earnings reports, a lot also depends on Friday’s inflation data in the Personal Consumption Expenditures (PCE) price index. The consensus expects further progress on the core rate, which should decline from 2.8% in February to 2.7% in March, while the headline number ticks up from 2.5% to 2.6%. This is the Fed’s preferred gauge of inflation, and we are closing in on its target of 2%, yet there has been a lot of fearmongering of late about a rebound in inflation due to a few of the components of the index realizing price increases over the past couple of months. As a result, some pundits are even suggesting that the Fed’s next move may be a rate increase, which I think is ludicrous.

Bloomberg

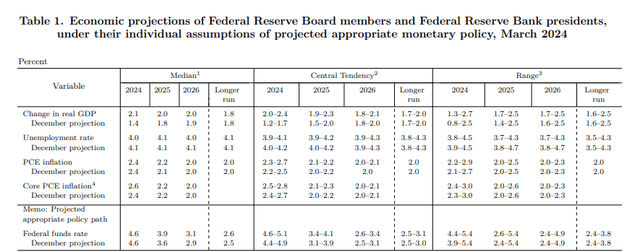

In the Fed’s most recent Summary of Economic Projections, which was released last month, the consensus view is to now see three rate cuts this year that lower short-term rates to a range of 4.5-4.75%. This is consistent with what the Fed anticipated at the end of last year. This came despite a year-end estimate for the core PCE to fall to 2.6%.

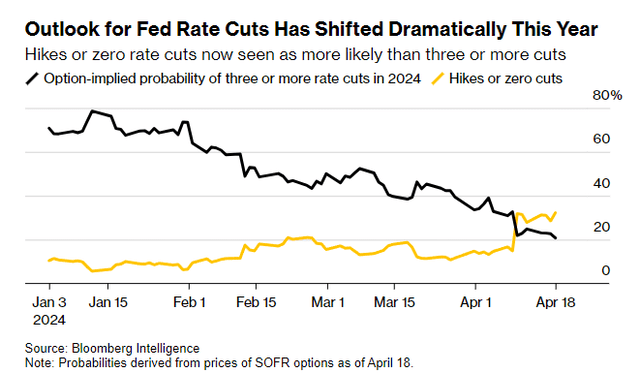

Federal Reserve

If Friday’s report shows the core falling to 2.7%, it means we are just one-tenth of a percent from the year-end target in April! I find it hard to believe we will see virtually no more progress than that over the coming eight months, yet that is what the Fed has conditioned its three rates cut on for 2024. I find it hard to believe that the Fed will roll back rate-cut expectations at the same time it may be forced to lower its core PCE projection for year-end. Regardless, a growing number of investors see zero rate cuts or an actual hike as more likely than the three rate cuts the Fed has forecasted.

Bloomberg

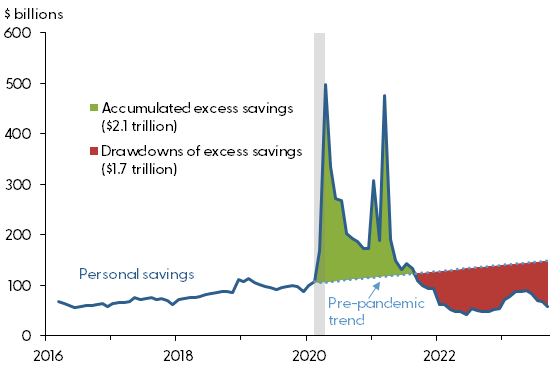

I think some investors are looking at the economic strength in the first quarter and projecting it into the next three, but that is not consistent with the lagged impact that the Fed’s monetary policy tightening over the past two years ultimately has on the economy. Granted, consumers and corporations have shown unprecedented resilience in the face of higher interest rates, due primarily to post-pandemic stimulus and refinance activity that locked in historically low borrowing costs, but this does not negate the impact of today’s rate regime.

The rate of wage growth has been decelerating since reaching its peak in August 2022, while excess savings levels from post-pandemic stimulus have been drawn down to approximately $400 billion, according to the San Francisco Fed. That suggests that at current spending levels, these excess savings will be depleted at some point during the second half of this year.

San Francisco Fed

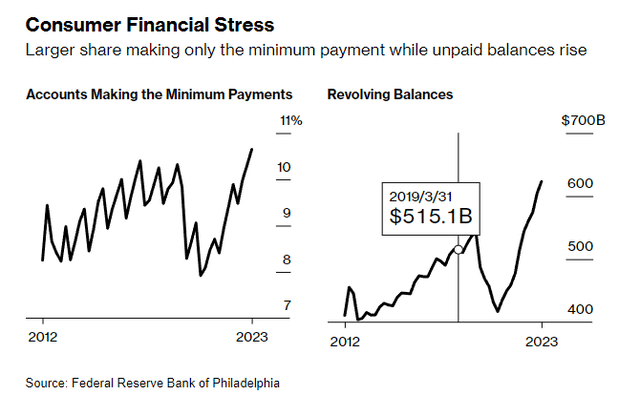

Furthermore, we are starting to see some cracks in the consumer when it comes to credit that suggests the rate of consumer spending growth should slow. At the low end, delinquency rates are rising, and a larger percentage of consumers are making the minimum monthly payment on their credit cards. Credit card balances have also risen dramatically.

Bloomberg

These developments can easily be taken out of context to warn of an impending recession, but that ignores the fact that consumers started to realize real (inflation-adjusted) wage growth 15 months ago to help offset depleted savings. Those with savings are also earning more than 5% on money market balances, which has been estimated to be adding $50 billion per month in interest income to the pockets of consumers.

Therefore, these offsetting factors should help the economy land softly during the second half of the year, but tighter monetary policy is taking its toll, just on a very lagged basis. The rate of consumer spending, which is the primary fuel for economic growth, should slow in the coming quarters. That will adversely impact the rate of job growth and should slow the price increases in the services sector that have kept inflation “sticky” during the first quarter of this year. The Fed will need to start lowering rates towards a more neutral level in advance of softer activity, because rate cuts work with the same lag that rate hikes have had over the past two years. This is why the Fed still maintains three rate cuts in its Summary of Economic Projections for 2024. A rate hike would be ludicrous.

Read the full article here