RWE Ag (OTC:RWNEF) (RWEOY) is a German energy company among the leading electricity producers in Europe, with a total installed capacity of 44.4 GW. It is engaged in electricity generation through both conventional (27.8GW) and renewable (16.7GW) sources. The $4.1B acquisition of Con Edison Clean Energy Businesses (CEB) Unit, owner of 3.1 GW of installed capacity, contributed to adding 4.2 GW of renewable installed capacity in FY23. Rising electricity prices in Europe resulted in high operating margins and profitability as well as OCF generation of €13.9B between FY21 and FY23. The cash on hand and debt assumption, are used to finance decarbonization strategy with the goal of becoming one of the leading companies in electricity generation from renewable sources.

The business plan presented in the March 2024 investor presentation is very ambitious, targeting the achievement of Adjusted EBITDA of €9B, adjusted net income of €3B, and an installed capacity of renewable sources exceeding 65GW by 2030. Despite lower electricity prices and high interest rates may represent short-term headwinds, RWE due to its strong balance sheet and considerable cash generation, seems well-headed to achieve these targets through both organic and inorganic growth. Considering these reasons and DCF results, I rate RWE as a buy. I think it is a good investment opportunity to get exposed to renewable energy market in Europe.

Business Overview

RWE Annual Report FY23

RWE’s operations are organized into five segments:

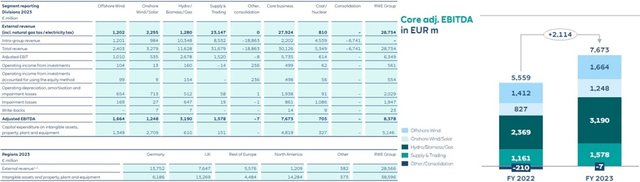

Offshore wind is involved in wind power generation through a network of offshore wind farms distributed across the North Sea, Baltic Sea, and Irish Sea with an installed capacity of 3.5 GW. In FY23, the business unit accounted for 4.2% of external revenue and 19.87% of RWE’s adjusted EBITDA, compared to 3.77% and 22.37% recorded in FY22. EBITDA margin was 69.2% compared to total revenues generated by the segment in FY23.

As of December 2023, the onshore wind/solar segment has an installed capacity of 8.4GW (vs. 7.4GW as of December 2022) of wind and 4.1GW (vs. 0.8GW as of December 2022) of PV. The increase is mainly attributable to the acquisition of CEB. The plants are distributed between Europe, the United States, and Australia. In FY23, the business unit accounted for 8% of RWE’s external revenues and 14.9% of adjusted EBITDA, compared to 5.81% and 13.1% recorded in FY22. EBITDA margin was 38.1% compared to total business unit’s revenue in FY23.

The Hydro/biomass/gas business unit has an installed hydro capacity of 465MW, biomass capacity of 798MW, and gas capacity of 15.5GW. In FY23 the business unit accounted for 4.4% of external revenues and 38% of RWE’s adjusted EBITDA, compared to 4.7% and 37.5% recorded in FY22. EBITDA margin was 38.1% compared to the total revenues of the segment in FY23.

Supply & Trading is engaged in the sale of the electricity generated by the other business units to third parties and consequently accounts for 80.5% of external revenues in FY23. Despite this, it is characterized by low margins, with an EBITDA margin of 5% compared to the segment’s total revenue in FY23.

Coal/Nuclear segment has an installed capacity of 9.7 GW of coal and 146MW of nuclear. In FY23, the business unit accounted for 2.8% of external revenues and 8.4% of RWE’s adjusted EBITDA compared to 2.46% and 11.9% in FY22. EBITDA margin was 13.18% compared to the business unit’s total revenue in FY23.

The table above shows the effective total revenue reported by each business unit, which is significantly different from external revenues because of accounting rules related to intercompany transactions. RWE generated 48.1% of external revenue in Germany, 26.8% in the UK, 19.6% in the rest of Europe, 4.2% in the US, and the remaining 1.3% in the rest of the world in FY23.

Recent and Future Developments

RWE management is executing a decarbonization strategy, reducing its exposure to coal and investing in new wind, photovoltaic, and storage systems. In March 2023, it closed the CEB acquisition for $4.1B, or $6.8B including net debt of the business unit. The deal increased its market share in the US, adding 3.1GW to its renewables portfolio, including about 90% of PV systems as well as 7GW of development pipeline. RWE also invested €430m in Magnum gas-fired power station at the end of 2022, a useful asset to maintain steady operating cash flows during the phase-out of its coal-fired plants, planned by 2030. In addition, this acquisition is part of the long-term plan to convert gas-fired power stations to blue and green hydrogen production facilities. In FY23, RWE established a partnership with Equinor, a Norwegian energy giant, to produce 2GW of Hydrogen by 2030. In December 2023, it finalized the £963m acquisition of 4.2GW off-shore wind farms from Vattenfall in the UK still under development and expected to be completed before 2030. During FY23 RWE added 4.2 GW of wind and solar capacity with 95% secured through Power Purchase Agreements (PPAs), Contracts for Difference (CfDs), and Feed-in Tariffs (FiTs) contracts. Management aimed to increase its share of recurring revenues reducing revenue volatility, which is still highly dependent on electricity prices. In addition, RWE has solar and wind projects under construction amounting to 6.8GW, 80% already contracted and 15% (1.1 GW Thor offshore wind farm) under negotiation. It also has 1.1GW of storage systems under construction. The schedule presented in the March 2024 investor presentation set a target of 65GW green generation portfolio by 2030, achieved through diversification in both technologies and geographic areas where new electricity generation assets will be built.

Review of Economic Performance and Forecasts

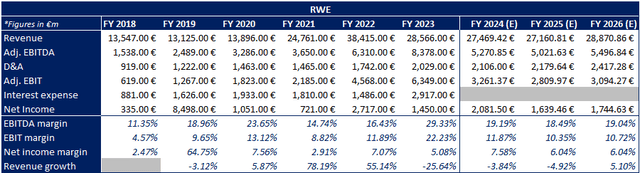

RWE Annual Reports and Author’s estimates

Higher electricity prices in Europe were the main driver of RWE’s revenue growth, which peaked in FY22, then declined to €28.5B down 25.6% YoY in FY23. It achieved an adjusted EBITDA margin of 22.23% (vs 16.4% in FY22) and EBIT margin of 22.2% (vs 11.9% in FY22) in FY23. The improvement in margins can be attributed to higher earnings from energy trading and optimization of power plant. Cost of materials dropped from 81.58% of revenues in FY22 to 70.55% in FY23. Different outcome for income, which fell to €1.45B due to higher taxation and increased interest expenses. The company had a tax income of €2.2B in FY22 compared to tax expenses of €2.4B in FY23. Management released guidance for adjusted EBITDA margin between €5.2B – €5.8B and adjusted net income between €1.9B – €2.4B (EPS: €2.6 per share) in FY24, reflecting worse performance in the supply & trading segment and lower electricity price levels in FY24. In the FY30 business plan, the management targets EPS of €3 per share for FY27 and €4 per share by 2030, with an 8% CAGR between FY24 and FY30.

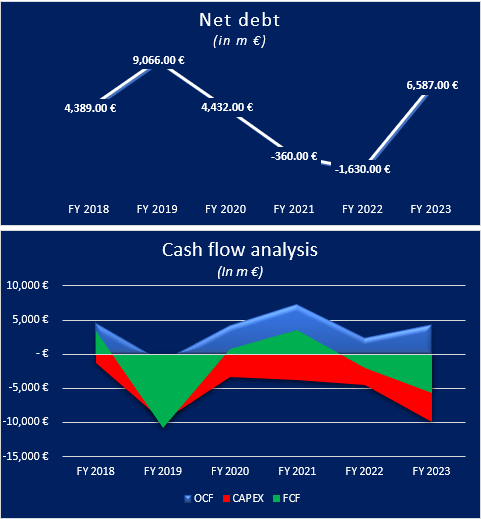

RWE Annual Report and Author’s Analysis March 2024 Investor Presentation

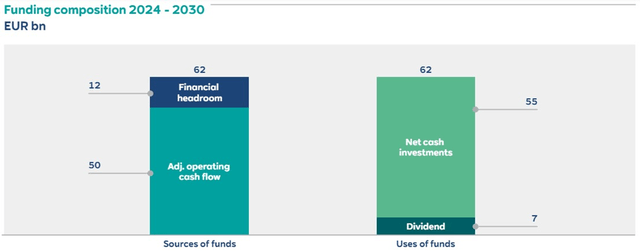

RWE has a net debt of €6.5B as of December 2023, up from €-1.63B in December 2022 due to the large amount of CAPEX (€9.9B) in FY23. The company reported a negative FCF of €5.7B in FY23, driven by the CEB acquisition, partially financed through a €2.4B convertible bond converted on March 2023, increasing Qatar Holding’s position in RWE to 9.1%, with dilutive effects on equity. Management anticipates a similar dynamic in FY24, with a positive OCF failing to cover monetary outflows due to scheduled investments. Over the next 7 years, management anticipates €55B of CAPEX and €7B of dividends, covered through €50B of OCF and €12B of debt. In FY23, the company has a Net Debt/EBITDA ratio of 0.9x (with an upper target limit of 3x), which is already set to increase in FY24. Considering FY30 projected adjusted EBITDA of €9B released in the March 2024 investor presentation, a debt increase of €12B would likely lead to a net debt/EBITDA ratio below the 3x threshold. Short-term liquidity seems also to be reassuring, with a 1.5x quick ratio. A dividend of €1 per share is expected for FY23 (3.08% dividend yield), up 11% compared to FY22. Management targets average annual dividend growth between 5 and 10% by FY2030.

Main Risks

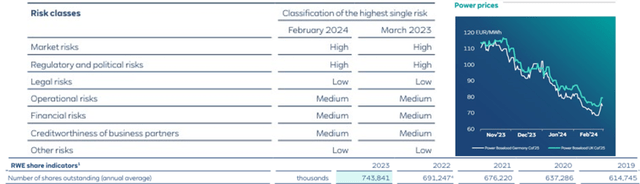

RWE Annual Report FY23

RWE is exposed to market risk. Even if it is increasing its share of recurring revenues, it is still extremely dependent on electricity prices. A decrease in electricity prices may have a negative impact on the company’s economic and financial performance.

As all energy sector companies, it is highly sensitive to regulatory risk. US presidential and European Parliament elections in 2024 may potentially introduce regulatory changes, with negative effects on RWE’s economic performance.

As of December 2023, 23% of installed capacity consists of coal-fired power plants. The shutdown of these power plants, although accompanied by government subsidies such as the Coal Phase-out Act, may incur additional costs, leading to lower operating margins. In addition, €705m of adjusted EBITDA, or 8.4% of RWE total adjusted EBITDA, derived from coal in FY23.

The current economic environment characterized by high interest rates is a negative driver for a capital-intensive company like RWE, leading to higher interest expenses and lower borrowing capacity.

RWE bears capital dilution risk. Outstanding shares increased from 614,745,000 in FY19 to 743,841,000 in FY23.

Discounted Cash Flow

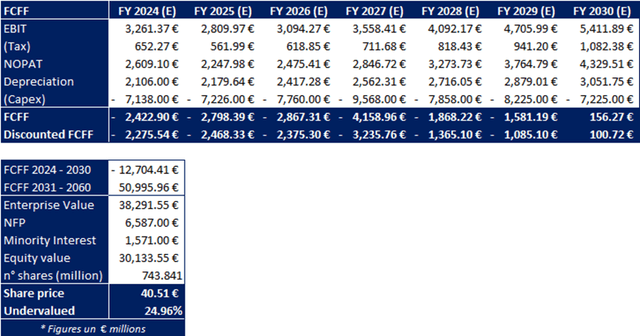

I conducted a DCF analysis to assess RWE’s intrinsic value, returning a valuation of €40.51 per share, about 25% above the current market price.

A two-stage model was employed, the first of which included estimates up to FY30. The sum of CAPEX between FY24 and FY30 was set equal to €55B, consistent with March 2024 investor presentation estimates. The same was done to estimate EBIT used for the terminal value. For the calculation of the TV, a discounting of cash flows generated over 30 years (FY31-FY60) was performed, a period consistent with the average life of photovoltaic or wind farms. For the evaluation, the following assumptions were made:

Beta = 0.64x obtained from Investing.com

MRP (5.69%) and Risk-Free rate (3.28%) were obtained by using 2024 Fernandez’s data, weighted by the geographic breakdown of the company’s revenues. It resulted in a cost of equity of 6.95%.

The cost of debt of 5.93% was obtained by dividing the interest paid by RWE by its total debt.

WACC= 6.48% and g = 2% in line with the inflation target in Europe.

Author’s Analysis & Estimates

Conclusion

RWE is a financially healthy company, with a Net Debt/EBITDA of 0.9x and a quick ratio of 1.5x in FY23. It delivers a dividend yield of over 3%, expected to grow between 5% and 10% annually until 2030. Despite this, it is committed to an aggressive growth strategy, financed mainly through operating cash flows. The business plan, if well implemented, will allow to achieve adjusted EBITDA of €9B and an adjusted net income of €3B by FY30. At the same time, this will enable the company to hit the decarbonization of its business. In addition, the DCF analysis based on management’s estimates, reported in the March 2024 investor presentation, returns a valuation 25% higher than the current market value. RWE presents some risks that shouldn’t be underestimated, but they don’t represent excessive cause for concern. For these and other reasons discussed within the article, I rate RWE as a buy.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here