The following segment was excerpted from this fund letter.

Perimeter Solutions (NYSE:PRM)

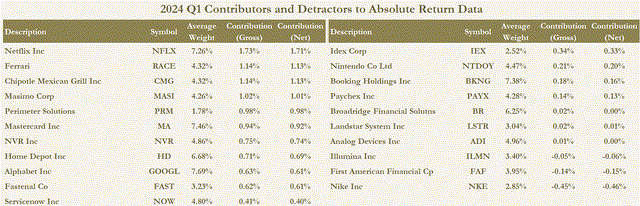

In fact, our best performing stock this quarter is the anthesis of a mega cap tech stock. Perimeter Solutions, a $1 billion market cap company that sells fire retardant to fight forest fires, was up 61%. Given the small cap status, and the relatively thin trading liquidity of Perimeter, we have offered very little in the way of comments on this company. But we thought recent developments, and the jump in the stock price, was worth commenting on to a limited degree.

Perimeter Solutions is the sole company that sells fire retardant to the US Forest Service. This mission critical component, the red stuff you see dropped out of planes during major fires, is needed to protect people, property and forests from out of control wildfires. Around the country, and even outside the US, government agencies that are tasked with protecting society from wildfires often look to the US Forest Service’s list of approved products and only buy items from this list. The general idea is that if it is good enough to pass the Forest Service’s extensive testing requirements, it is good enough for any agency to use.

But the Perimeter Solutions story is bigger than just wildfires. The company was founded by a group of investors led by Nick Howley, the founder of a very successful airplane parts maker called TransDigm (TDG). We owned TransDigm for many years until we sold it just before the COVID pandemic hit and over those years we came to appreciate Howley’s highly successful approach to M&A, running businesses in a profit maximizing way, and aggressively managing the capital structure to the benefit of equity owners.

So while we believe the Perimeter Solutions business by itself justifies a much higher share price, we also think that in the years ahead Perimeter will engage in a number of acquisitions that will drive significant increases in the intrinsic value of the business.

But the path to realizing these anticipated gains has not come easy so far. Last year ended up being the mildest fire season of the last three decades in the critical western region of the US. It seems to us that the stock ended up trading almost like a futures contract on estimated 2023 acres burned. Of course, the value of Perimeter is related to the long term cash flows it will generate over the next couple of decades of wildfire fighting. But even one Wall Street analyst came out with a report suggesting that the mild fire season may mean that the long term risk of wildfires was not as dire as previously thought.

But the evidence is clear that wildfires are a significant and growing risk in the US and around the world. This outlook is not conditioned on climate change triggering ever more risky weather, although we do believe that the science on this risk is very clear. Rather much of the risk comes from many decades of excessive fire suppression that allowed dry fuel to accumulate paired with the climate conditions that are already here.

Importantly, the validity of this risk is something that apolitical, profit seeking insurance companies have been warning everyone about. In California, where insurance regulators require insurers to assume that wildfire risk in the years ahead will be no higher than the average risk of the past 20 years, most home insurance companies have simply refused to write new policies in large part because they know that wildfire risk is in fact much higher.

And after the energy utility PG&E (PCG) was bankrupted and convicted of manslaughter for their role in triggering massive wildfires, utility companies around the world have been sounding the alarm about wildfire risk as well. In his annual letter this year, Berkshire Hathaway’s Warren Buffett warn about the risk of wildfires saying that the big increase in wildfire activity, which he expects to continue to increase, risks the financial success of utilities to the extent they may need to become partially publicly funded entities.

Given Perimeter’s long term working partnership with so many government agencies, most importantly the US Fire Service and California’s Department of Forestry and Fire Protection, and their role as the only provider of fire retardant, the real risk to long term shareholders is not a mild fire season, but a breakdown in the natural monopoly position that Perimeter finds themselves in.

When we first initiated our position in Perimeter, a startup called Fortress had already become the first competitor to have its retardant product added to the Forest Service’s Qualified Product List. But the key to understanding Perimeter’s competitively advantaged business model is in understanding how challenging it actually is to supply retardant under life or death situations.

Rather than the company selling fire retardant as a product, Perimeter often fully staffs and maintains service operations on aerial firefighting bases. Inventory management of fire retardant is challenging because you need every base to be prepared to start fighting a fire at a moment notice, while also recognizing that many bases may not even have a fire each year.

The pilots of these firefighting planes take massive risks to protect the rest of us. A misloaded plane, or the slow loading of a plane, risks lives and properties. Going so far as running out of retardant during an active fire is unacceptable.

The best analogy we’ve come up with is the difference between selling tires and running a pit crew at a NASCAR race. The limiting factor to being a successful pit crew is not just obtaining qualified tires. Rather, running a pit crew is about operating flawlessly under mission critical circumstances. And operating flawlessly for decades is exactly what Perimeter has done.

But last year, as pessimism over the mild fire seasons pressured Perimeter’s stock price, it also became apparent that the federal government was going to give Fortress every possible opportunity to win part of the Forest Service’s annual fire retardant contract. While no one doubts how well Perimeter’s product works, and Fortress has been clear that their service wouldn’t be any cheaper than Perimeter, the federal government has a mandate to minimize sole source vendor relationships. Sole source means there is only one provider. And it appeared clear that despite concerns from firefighters about experimenting with an unproven product, Fortress was going to win at least some of the Forest Service contract.

We had bought Perimeter with this risk in mind because we believed that simply getting on the qualified products list was not winning, but rather Fortress still had a lot to prove in terms of their ability to actually deliver.

Last month, the challenges of this industry because clear when the Forest Service announced that they would not be signing a contract with Fortress because further testing had shown that their product corroded the airtanker planes it was used in.

In a press release, Fortress stated, “we have to assume based on this new information that Fortress’ proprietary, magnesium chloride-based aerial fire-retardant formulation will not be utilized for the foreseeable future in the fight against wildfires.”

There are many different kinds of competitive moats that give rise to lucrative businesses. But one of the least discussed is simply “doing truly difficult and important things really well.” We think Perimeter Solutions is a great example of just this sort of moat.

|

Disclosures  PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. It should not be assumed that the recommendations made in the future will be profitable or will equal the performance of the securities listed above. The performance information shown above has been calculated using a representative client account managed by the firm in our core equity strategy and represents the securities held for the quarter ended 03/31/2024. The individual quarterly net contribution to returns are calculated by reducing the gross contribution to return by 1/4 of the weighted average of the firm’s highest management fee, which is 1.00% per year. Information on the methodology used to calculate the performance information is available upon request. The performance shown in this chart will not equal Ensemble’s composite performance due to, among other things, the timing of transactions in Ensemble’s clients’ accounts. ADDITIONAL IMPORTANT DISCLOSURES Ensemble Capital is an SEC registered investment adviser; however, this does not imply any level of skill or training and no inference of such should be made. The opinions expressed herein are as of the date of publication and are provided for informational purposes only. Content will not be updated after publication and should not be considered current after the publication date. We provide historical content for transparency purposes only. All opinions are subject to change without notice and due to changes in the market or economic conditions may not necessarily come to pass. Nothing contained herein should be construed as a comprehensive statement of the matters discussed, considered investment, financial, legal, or tax advice, or a recommendation to buy or sell any securities, and no investment decision should be made based solely on any information provided herein. Ensemble Capital does not become a fiduciary to any reader or other person or entity by the person’s use of or access to the material. The reader assumes the responsibility of evaluating the merits and risks associated with the use of any information or other content and for any decisions based on such content. Ensemble’s Equity strategy is intended to maximize the long-term value of the underlying accounts. The strategy generally invests in U.S. common stocks, but from time to time the underlying accounts may hold cash and/or fixed- income investments in an attempt to maximize capital gains. The strategy holds mostly large and medium-capitalization stocks, although accounts may also hold small-capitalization stocks. Performance results for the Ensemble Equity composite since the composite’s inception on December 31, 2003, are unaudited and are subject to change. The Ensemble Equity composite includes realized and unrealized gains and losses, the reinvestment of dividends and other earnings, and is net of management fees, brokerage transaction costs and other expenses. Taxes have not been deducted. Net of fee performance was calculated using actual management fees. Management fees for an Ensemble Equity account range from 1.00% to 0.50% on an annual basis and are typically deducted quarterly. Fees are negotiable, and not all accounts included in the composite are charged the same rate. Results are based on fee paying, fully discretionary, unconstrained accounts managed with an Ensemble Equity objective and include those Ensemble Equity accounts no longer with the firm. Accounts must exceed $500,000 to be included in the composite. Accounts with assets below $500,000 and accounts with objectives other than Ensemble Equity are excluded. Unless otherwise stated, returns for periods exceeding 1 year are annualized. The comparative benchmark is the Standard and Poor’s Total Return Index of 500 Stocks (“S&P 500”), an index of 500 large capitalization equities, generally considered a comprehensive indicator of market performance. The S&P 500 Total Return Index includes realized and unrealized gains and losses, the reinvestment of dividends and other earnings and is not subject to fees and expenses. It is not possible to invest directly in an index. The holdings in the Ensemble Equity strategy may differ significantly from the securities that comprise the benchmark. All investments in securities carry risks, including the risk of losing one’s entire investment. Investing in stocks, bonds, exchange traded funds, mutual funds, and money market funds involve risk of loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be profitable or suitable for a particular investor’s financial situation or risk tolerance. Some securities rely on leverage which accentuates gains & losses. Foreign investing involves greater volatility and political, economic and currency risks and differences in accounting methods. Future investments will be made under different economic and market conditions than those that prevailed during past periods. Past performance of an individual security is no guarantee of future results. Past performance of Ensemble Capital client investment accounts is no guarantee of future results. In addition, there is no guarantee that the investment objectives of Ensemble Capital’s equity strategy will be met. Asset allocation and portfolio diversification cannot ensure or guarantee better performance and cannot eliminate the risk of investment losses. As a result of client-specific circumstances, individual clients may hold positions that are not part of Ensemble Capital’s equity strategy. Ensemble is a fully discretionary adviser and may exit a portfolio position at any time without notice, in its own discretion. Ensemble Capital employees and related persons may hold positions or other interests in the securities mentioned herein. Employees and related persons trade for their own accounts on the basis of their personal investment goals and financial circumstances. Some of the information provided herein has been obtained from third party sources that we believe to be reliable, but it is not guaranteed. This content may contain forward-looking statements using terminology such as “may”, “will”, “expect”, “intend”, “anticipate”, “estimate”, “believe”, “continue”, “potential” or other similar terms. Although we make such statements based on assumptions that we believe to be reasonable, there can be no assurance that actual results will not differ materially from those expressed in the forward-looking statements. Such statements involve risks, uncertainties and assumptions and should not be construed as any kind of guarantee. Readers are cautioned not to put undue reliance on forward-looking statements. |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here