The electric vehicle space has been one of the most competitive industries in recent years. Unfortunately for investors, many startups in this space have seen their stocks plunge as growth targets have been missed and large losses and cash burn have piled up. On Wednesday, we received the latest results from VinFast (NASDAQ:VFS), the upstart Vietnamese vehicle company, which was one of the biggest stock bubbles in the market last year. The Q1 results showed more of the same struggles we’ve seen in this space, meaning this stock could continue to set new lows.

Previous skepticism of the name:

VinFast followed in the footsteps of a number of other electric vehicle names, going public last year through a SPAC merger. With an extremely low float, shares initially soared several times over, giving the company a peak valuation well above $210 billion despite selling a small number of vehicles. Once reality set in, shares came back down to earth, and they went into Tuesday’s report just a little above $3 a share.

A couple of months ago, I warned investors again that the financial situation here was extremely ugly. While the company was showing impressive revenue growth, costs were soaring even more so VinFast was losing billions when you annualized the quarterly figures. Since that article, shares have lost over 45% of their value, with the S&P 500 being flat over the same time.

Q1 results fall short:

Wednesday morning, we received first quarter results from VinFast. The company grew its EV deliveries by almost 450% over the prior year period, but still delivered less than 9,700 units, and that was a decrease of about 28% from Q4 2023. E-scooter deliveries were even less, showing huge declines on both a sequential and year over year basis.

Overall, total revenues came in at $302.65 million. While this number was up nearly 270% over Q1 2023 levels, the figure badly missed street expectations by nearly $120 million. The expense base remains way out of whack, with the company’s gross loss of over $150 million, meaning gross margins were nearly negative 50%. Throw in other costs like operating expenses and interest, and VinFast lost over $618 million for Q1 2024, more than double the amount of revenue generated.

VinFast is quickly expanding, adding more delivery partners in the US, Asia, and Middle East. As a result, management expects substantial growth in the remainder of 2024, as it is looking to deliver 100,000 electric vehicles for the year despite seeing less than 10,000 deliveries in Q1. I should note that 56% of deliveries in the quarter were to related parties of the company, as a number of vehicles are sold to Green and Smart Mobility (“GSM”), a Vietnamese taxi company controlled by the carmaker’s parent Vingroup.

An ugly balance sheet:

With these large quarterly losses come large cash burn, as we’ve seen with many newer companies in this space. VinFast reported negative operating cash flow of nearly $517 million, and this was before capital expenditures of $200 million. Total cash and investments on the balance sheet finished the first quarter at just over $123 million, down more than $44 million sequentially. At the same time, total debt rose by over $77 million, ending the period at more than $3 billion.

VinFast reported negative working capital of nearly $4.7 billion at the end of Q1, a number that has more than doubled in just six months. The equity deficit here ballooned by more than $575 million sequentially to over $3.33 billion. It’s possible that the parent company infuses some more capital here, but the numbers aren’t good, and rising debt only leads to higher interest expenses moving forward. I’d really like to see an equity raise here, despite shares trading near all-time lows.

Valuation still too high:

Despite VinFast shares being down more than 95% from their peak, this is still a name that looks quite a bit overvalued. At an early Wednesday morning price of $2.80, the company’s market cap was still over $6.5 billion. Going into the Q1 report, the street was expecting roughly $2.7 billion in revenues from the company this year. If I don’t adjust that revenue number down despite the quarterly miss, since yearly EV delivery guidance was reiterated, that gives VinFast a price to sales ratio of nearly 2.50 for this year.

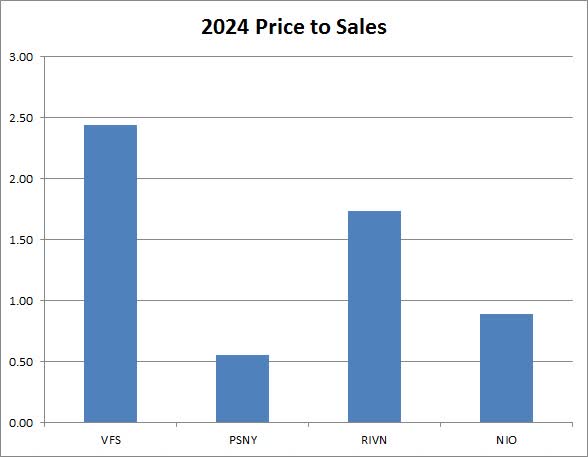

While that price to sales ratio is only about half of industry leader Tesla (TSLA) currently, it still dwarfs that of many more comparable electric vehicle names. As the chart below shows, VinFast has a price to sales figure that’s well above other significant money losing and cash burn EV names like Nio (NIO), Rivian (RIVN), and Polestar (PSNY).

2024 Price to Sales (Seeking Alpha)

Those three other names, a couple of which have better balance sheets than VinFast, average about 1.06 times their expected sales for this year. If we were to give VinFast the same valuation, that would imply almost 57% downside from current levels. More traditional US automakers are valued even less at around 0.3 times their expected sales, and a name like Fisker (OTC:FSRN) traded at just about 0.2 times its projected revenue before being de-listed with bankruptcy concerns swirling.

My ongoing recommendation:

Despite shares dropping to new lows recently, I continue to rate VinFast shares a sell. We don’t yet know how US-based sales will fare in the long run, and losses and cash burn are just way too high currently. Before I can even think about the possibility of raising this name to a hold, I need to see dramatic improvement in the financial picture along with at least one more meaningful capital raise. I also have to see the price to sales valuation come down rather substantially, because shares trade at too much of a premium currently.

In the end, VinFast reported a disappointing Q1 on Wednesday, with the financial picture here remaining quite ugly. Revenues for the period fell way short of street estimates, with total electric vehicle deliveries coming in under 10,000. Management still expects to have a big year, but that implies a lot of improved execution throughout 2024, and the balance sheet here remains a major problem. With the valuation here still a bit stretched to comparable industry peers, my sell recommendation here remains unchanged.

Read the full article here