Summary

The semiconductor sector is an integral part of the modern economy, providing the infrastructure for software to run everything from a smartphone to an airplane to e-commerce and banking and now generative AI. At the same time, the chip sector has many sub-sectors (analog, microprocessor, microcontroller, DRAM, and flash) as well as a long supply chain from chip developers to foundries and their equipment makers. Cadence Design Systems (NASDAQ:CDNS) is part of the research & development of chip designers such as Nvidia (NVDA) that utilize EDA (Electronic Design Automation) and breaks with the cyclicality of the semiconductor sector, providing steady growth and high cashflow margins. The race for AI capabilities is likely to increase R&D spending and Cadence may see an acceleration in growth above the current market consensus that may lead to continued share price gains despite an already premium valuation.

Performance

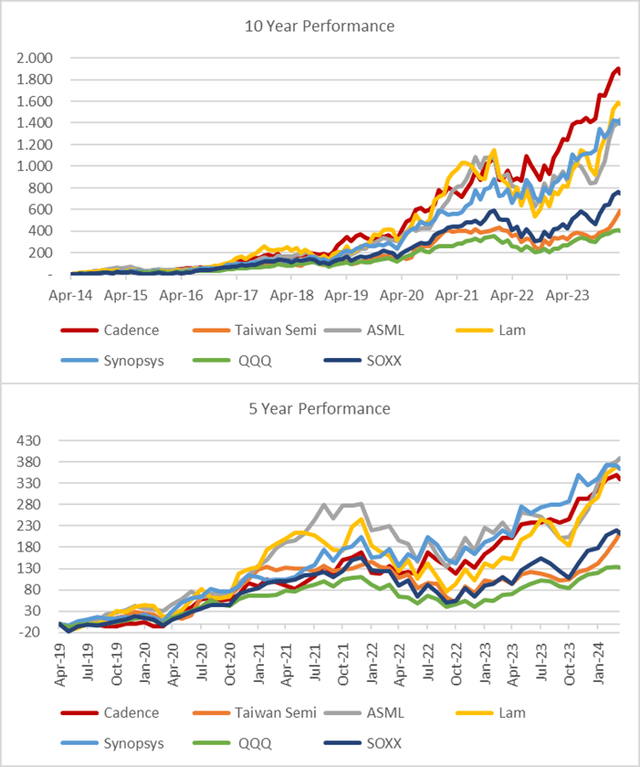

Cadence has outperformed the Philadelphia Semiconductor Index (SOX) as well as most suppliers to semiconductor designers such as Taiwan Semiconductor Manufacturing (TSM) and ASML Holding (ASML) over the last 10 years. In comparison, rival Synopsys (SNPS) and Lam Research (LRCX) have kept pace over the last 5yrs.

Created by author with data from Capital IQ

Premium Valuation

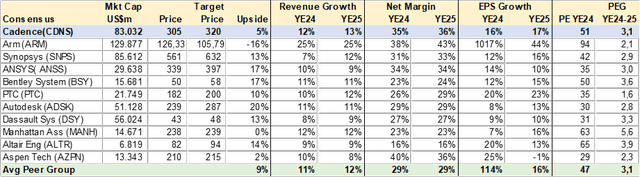

While Synapsis and ARM (ARM) are the closest competitors, I also listed several other application software companies to get a sense of valuation and growth across this sector. As can be seen in the table below, the comparables are trading at over 3x PEG (PE to EPS Growth) while revenue and EPS growth rates are varied the companies have very high margins.

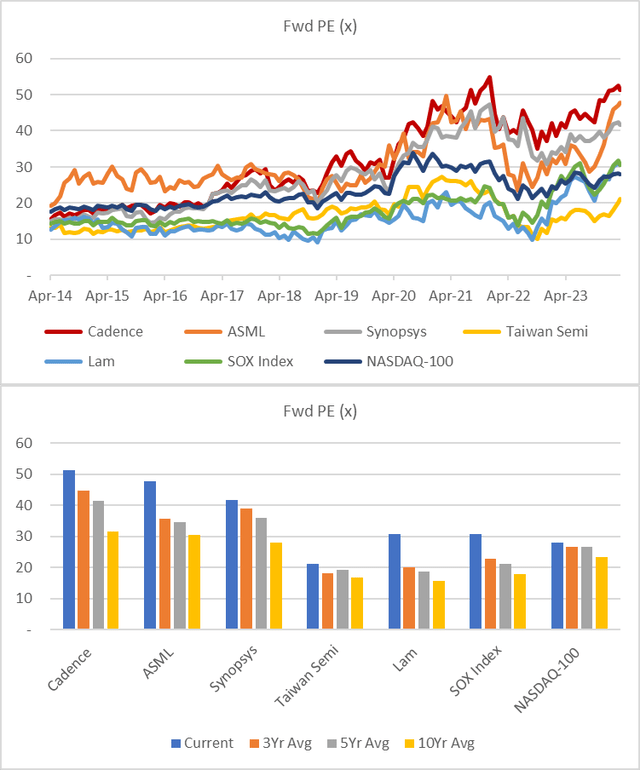

In the proceeding charts, I compared Cadence forward PE to that of the broader tech market such as the Nasdaq 100 (NDX), the semiconductor sector, and several key and well-known suppliers, and found that the EDA providers seem to have the highest valuation. Which may be driven by lower cyclicality, solid growth, and high margins. I also observe that Cadence´s PE has steadily risen from 30x to over 50x while the Nasdaq has remained relatively flat (22x to 28x). The comp and charts help understand that the market is willing to pay up for Cadence shares and while I would not expect or factor in further multiple expansion, it is reasonable to assume the current valuation metrics are sustainable as long as the company and sector deliver on expectations.

Created by author with data from Capital IQ

Created by author with data from Capital IQ

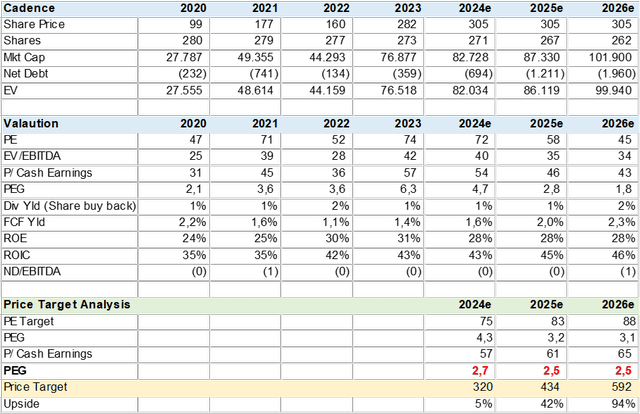

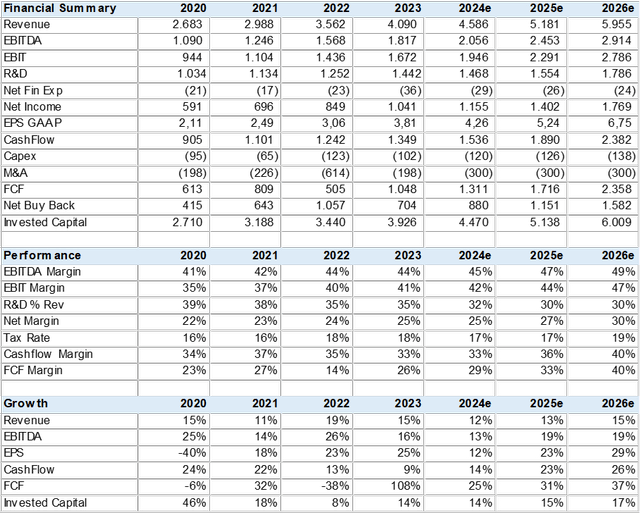

Price Upside Beyond 2024

The consensus price target is currently US$320 which is priced at 75x PE and 57x P/Cash Earnings which I believe is a better metric and backs into a PEG of 2.7x. If I apply a 2.5x PEG to YE25 cash earnings, the price target increases to US$434 or over 40% upside potential from current levels. I provide the rationale for using cash earnings in a later segment.

Created by author with data from Capital IQ

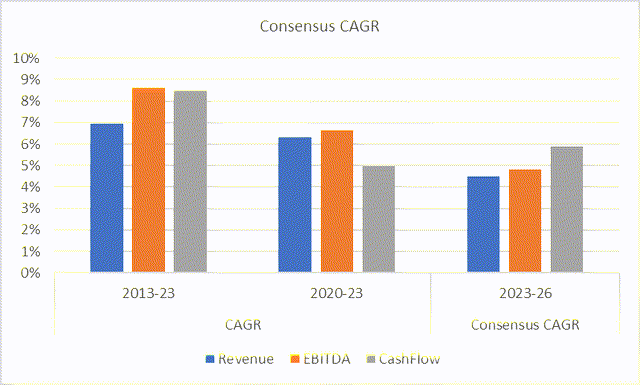

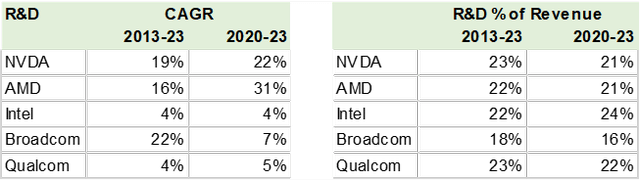

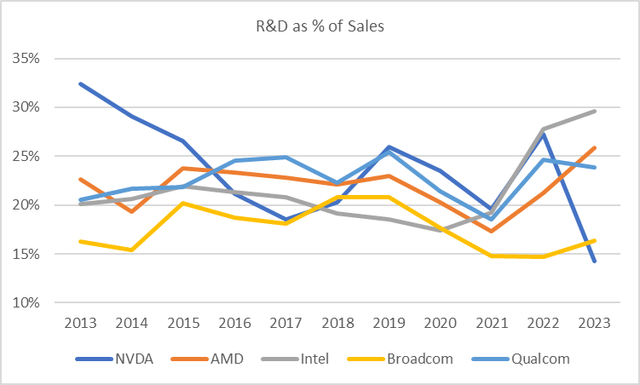

Growth driven by Semiconductor R&D

Cadence provides EDA software and hardware solutions to chip designers amongst other sectors that are classified as research and development spending. I compared Cadence’s financial growth with that of some key semiconductor companies’ R&D spending and found that there may be a case for increased demand for EDA. Nvidia and Advanced Micro Devices (AMD) have grown R&D spending by over 20% while others such as Intel (INTC) have grown R&D spending by less than 7%. The need for AI computing power may require higher R&D and those companies not currently participating in this sector may be forced to step up R&D. There is an upside risk to Cadence’s revenue growth in my view that may materialize during 2024.

Cadence Consensus Growth (Created by author with data from Capital IQ)

Created by author with data from Capital IQ

Created by author with data from Capital IQ

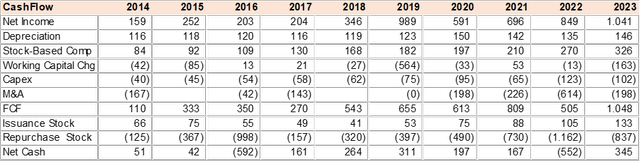

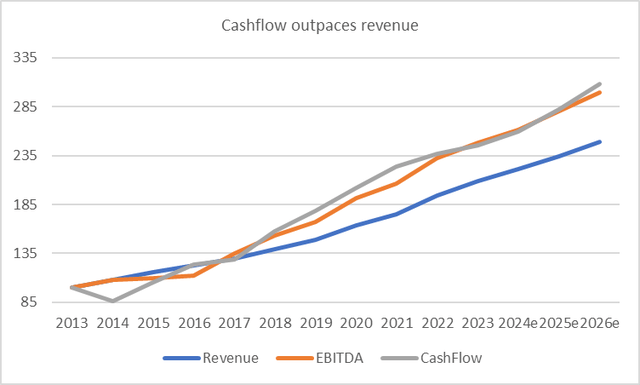

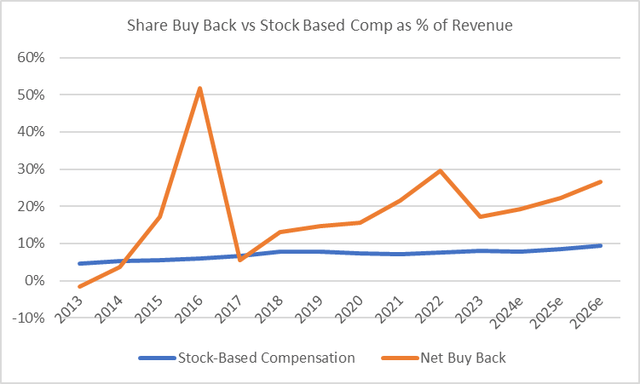

Cashflow higher than earnings

Net income underreports earnings power that is largely due to stock-based compensation. Cadence is not a new tech company that needs to pay in stock to keep workers while the business scales. However, it still pays around 8% of revenue in stock, which represents 30% of net income and cuts into reported EPS. This stock compensation is a non-cash charge and is added back to cash flow that is then used to buy back stock and more than fully offsets future dilution. As can be seen in the table and charts below, the company cash flow has grown faster than revenue and net buybacks are twice stock compensation.

Created by author with data from Cadence

Cashflow vs Revenue Growth (Created by author with data from Capital IQ)

Created by author with data from Cadence

Financial Summary

Below I provide a financial summary with consensus estimates for 2026. The market estimates that the top line will continue to grow at under 15% with increasing margins that drive far faster EPS and cash flow growth. As mentioned earlier, there is a positive risk that revenue and demand for EDA increases above forecast as the semiconductor sector scrambles to participate in AI demand.

Created by author with data from Capital IQ

Conclusion

I rate Cadence a buy. The company offers investors a revenue-resilient and high free cash flow stock that should keep pace if not exceed semiconductor R&D spending in the scramble to meet AI computing power. The main drawback is an already very well-valued stock that may require a longer holding period to reap significant returns.

Read the full article here