Whitestone REIT (NYSE:NYSE:WSR) is a promising passive income investment as the real estate investment trust is growing its FFO related to its concentrated real estate footprint.

The portfolio is also seeing occupancy growth and the trust guided for a double digit growth rate in its FFO in 2024. Whitestone REIT is focused on just two main real estate markets which are economically vibrant and have potential to deliver above-average FFO growth moving forward.

Taking into account that Whitestone REIT solidly covers its dividend with FFO and that the trust just raised its dividend by 3%, I think that the risk/reward relationship is very compelling for passive income investors.

My Rating History

A couple of months ago, I presented Whitestone REIT as a Buy primarily because the REIT was concentrated in a small number of core markets in Texas and Arizona which presented strong potential for FFO growth.

The trust last month raised its dividend and is forecasting robust growth in FFO for this year. With a raised dividend and a low FFO pay-out ratio, Whitestone REIT deserves to be included in a passive income portfolio.

Portfolio Concentration Remains A Major Strength

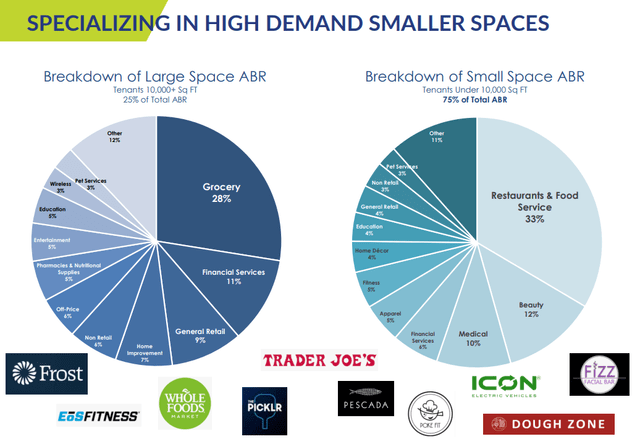

Whitestone REIT acquires, operates and develops open-air, retail shopping centers in a small number of markets, Texas and Arizona. The trust’s portfolio, as of December 31, 2023, included 55 properties which represented 5.0 million square feet of gross leasable area.

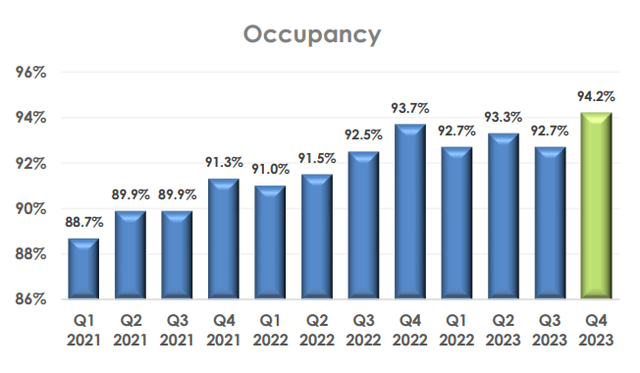

Whitestone REIT’s properties, in total, were leased to 1,453 tenants and the portfolio had an occupancy rate of 94.2% as of the end of 2023. The portfolio is primarily centered on grocery stores and restaurants which leads to a steady amount of foot traffic for retailers that lease space in Whitestone REIT’s open-air shopping centers.

Portfolio Overview (Whitestone REIT)

The trust’s occupancy has been rising over time as real estate dynamics in Texas and Arizona favor real estate landlords (limited shopping center supply, strong population growth, Whitestone REIT is active in markets with above-average household incomes).

As a consequence, Whitestone REIT has a strong lease position that translates into robust same-store net operating income growth potential.

Occupancy (Whitestone REIT)

FFO Trend, Dividend Raise And Pay-Out Ratio

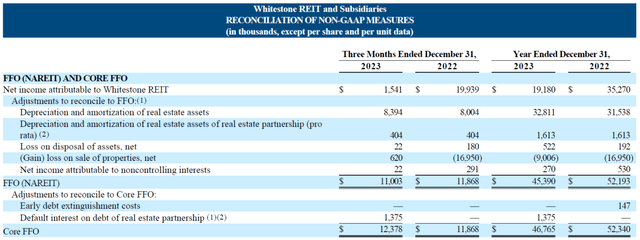

Whitestone REIT produces $11-12 million per quarter in FFO which makes the trust relatively small, particularly when compares against retail REIT giants like Kimco Realty Corporation (KIM) or Realty Income Corporation (O).

In 2023, Whitestone REIT’s properties produced $45.4 million in FFO, reflecting a decline of 13% due to strategic asset sales. Given the guidance for 2024, the trust obviously anticipates to return to positive FFO growth this year.

Though Whitestone REIT has a small amount of FFO that it generates from its real estate assets, the trust has a very low pay-out ratio which implies a very solid margin of dividend safety for investors.

Reconcilitation Of Non-GAAP Measures (Whitestone REIT)

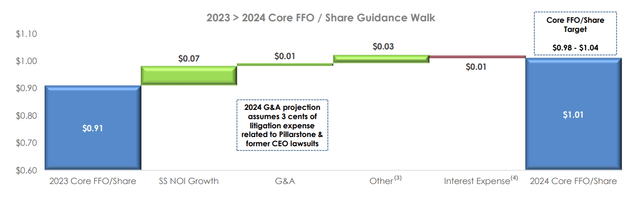

It is critical for passive income investors to determine how safe a REIT’s underlying dividend is, for obvious reasons. The trust announced a $0.04125 per share per month dividend in March, reflecting a 3% raise, which equates to an annualized dividend of $0.495 per share. With $1.01 per share in core FFO anticipated in 2024, the trust has an implied dividend pay-out ratio of 49%.

In 2023, Whitestone REIT paid out 53% of its core FFO. Kimco Realty paid out 59% of its core FFO in 2023, so Whitestone REIT offers an even higher margin of dividend safety.

The low FFO pay-out ratio allows the REIT to invest more cash into the growth of its underlying real estate portfolio moving forward and concentrate on expansion.

I anticipate that Whitestone REIT will also want to invest into other states with attractive economic fundamentals to broaden its revenue base and diversify its income. States that I could see Whitestone REIT make a move for are New Mexico and Florida which are also growing quickly and have strong economic fundamentals.

FFO Multiple

Whitestone REIT sees $1.01 per share in core FFO in 2024, reflecting a YoY growth rate of 10.9%, driven by strong anticipated growth in same-store net operating income for the existing portfolio. Based on a stock price of $11.14 at the time of writing, the REIT’s FFO are thus valued at a multiple of 11x.

With that being said, the trust has seen a drop in its stock price on Wednesday, in the amount of 5%, as investors reacted sensitively to the latest inflation figures that showed that consumer prices gained 3.5% in March. However, inflation figures should not affect Whitestone REIT’s cash flow outlook or portfolio performance.

At the beginning of February, Whitestone REIT’s stock was selling for 12.9x core FFO and I think that the trust could return to this valuation plateau in the long-term (implied intrinsic value of $13. Of course, passive income investors get to collect a nice 4.4% dividend in the meantime.

Funds From Operations (Whitestone REIT)

Why The Investment Thesis Has More Risk

Whitestone REIT obviously is much-less diversified than other retail-focused heavyweight REITs like Kimco Realty or Realty Income. This lack of diversification could be a double-edged sword as the REIT is very concentrated in just two states.

Put simply, if the Texas or Arizona economies were to drift into a recession, Whitestone REIT is poised to take a much harder hit to its FFO than a more diversified REIT with properties located in more states.

Texas’ economy is grew faster than the overall U.S. economy, a fact that held also true in 2022, and the state is a net migration state, meaning more people are moving to Texas than are leaving it. In 2023, close to half a million people moved to Texas. Arizona’s economy is growing slower than Texas, but the state is also a net migration state and its population grew 115,900 from July 1, 2022 to July 1, 2023.

My Conclusion

I think it makes sense to add Whitestone REIT to a more broadly diversified passive income investor portfolio that includes other REITs.

Whitestone REIT is concentrated in just two states which allows the company to participate in the strong economic growth of those states and thus produce above-average FFO growth. From a valuation angle, I think that Whitestone REIT has 17% re-rating potential to an implied intrinsic value of $13.

The trust also last month hiked its dividend by 3% and the estimated FFO-based pay-out ratio is below 50%, leaving a lot of room for Whitestone REIT to invest in new properties in its core markets, or even expand into new states. Buy.

Read the full article here