Introduction

I expected Pool Corporation (NASDAQ:POOL) to deliver a flat to negative return in 2024.

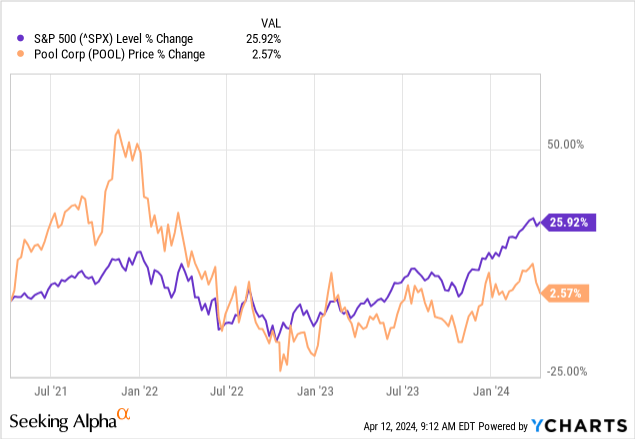

After its staggering performance during Covid, the pool equipment distributor struggled to deliver for two consecutive years. It plummeted about 44% in 2022 and rebounded 24% in 2023. The broader market (SPX) performed much better in 2022, declining around 18%, before its resurgence to the 4700 level in 2023.

I opined the stock is now fairly valued, and unlikely to have any meaningful upside in 2024 withthe current gloomy housing market.

A Review on POOL’s Magnification Performance during Covid

POOL was one of the beneficiaries during COVID.

The work-from-home trend exponentially increased the time people staying in a safe family-friendly environment. This trend heightened interest in enjoying existing pools and outdoor living spaces, combined with the insatiable demand for new pools, had created an amazing opportunity for the pool industry, as Mr. Peter Arvan presented in his prepared remarks for Q4 Fiscal 2020 earnings call.

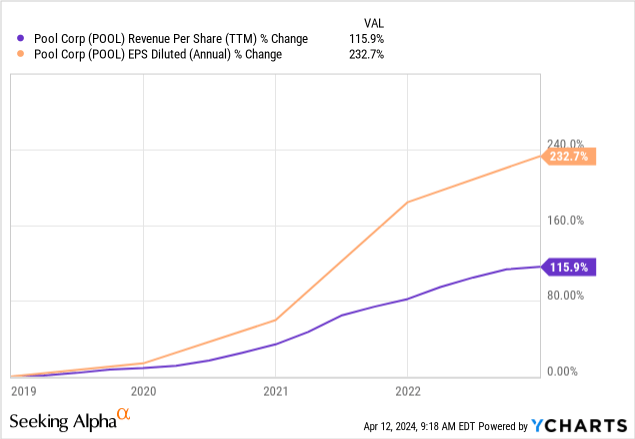

It propelled both the revenue and earnings of POOL to record-high levels.

Its revenue skyrocketed from $3,200M in 2019 to $6,180M in 2022, while its EPS almost tripled from $6.40 in 2019 to $18.70 in 2022, representing a 93% and 192% increase, respectively.

Fiscal Year 2023 – A Slightly Positive Performance

Despite POOL’s excellent performance, I learned from my previous costly mistakes that explosive growth is unlikely to last.

In Fiscal Year 2023, Pool Corp’s revenue declined by $638M to $5,542M, representing a 10.3% decrease from the 2022 level. Its gross margin and operating margin also dropped from 31.29% and 16.6% in 2022 to 29.96% and 13.47% in 2023, respectively.

As a result, its diluted earnings per share fell to $13.35, from $18.7 in the previous fiscal year, or a 28.6% decrease.

Although the above figures suggest that Pool Corp had an awful year, I still view its Fiscal Year 2023 Financial Results as slightly positive.

Here are the few main reasons:

First, the increase in EPS from $6.40 in 2019 to $13.35 in 2023 poses a 20.17% CAGR growth from the mentioned period, matching the pre-COVID growth rate. EPS of POOL grew by 21.2% CAGR from 2014 to 2019. Therefore, from my point of view, its long-term profitability was not affected.

Second, its balance sheet improved as cash or equivalent surged by almost 50% and book value per share increased by 8.26% from 2022. Meanwhile, Pool Corp paid off about $2,455M of its long-term debt, while issuing $2,121M, which led to overall long-term debt level reducing by one-fourth. Under the current high interest rates environment, this move can reduce interest payment and thus be considered a good move.

Third, cash flow from operating activities and free cash flow per share almost doubled in the latest fiscal year. As the management team substantiated in the previous earnings call:

This result positively demonstrates our working capital management capabilities, capital capacity, and insightful and opportune investments in inventory.

With the above consideration, the performance pullback during 2023 shall not constitute any fundamental issue regarding its long-term development.

Pool Corporation is Fairly Valued

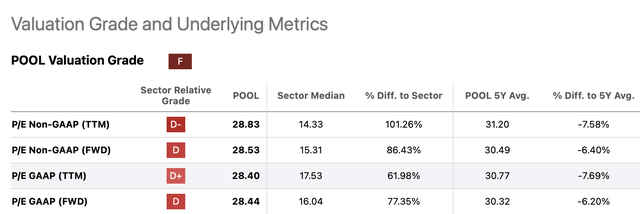

Down 5% year to date, the pool equipment distributor is now trading at a level near its 5-year price-to-earnings ratio and EV/EBITDA.

Seeking Alpha

There was a divergence between its stock performance and fundamentals in the previous year, which I believe was not unjustified. The stock traded at half of its P/E average in late 2022, and I mentioned it was a no-brainer buy. POOL was trading at extreme pessimism due to disappointing housing data but has now returned to its middle point of the pendulum.

The attractiveness of buying the stock due to its valuation has vanished.

Flat to Negative Return Expected in 2024

The fate of POOL ties to the nebulous housing market.

The company revealed the guidance for 2024 of EPS $13.1 to $14.1, a 2% decrease or 5.6% increase from the 2023 level. As existing home sales still hovered at a low level, demand for new pool construction and pool refurbishment activities shall be limited. In the previous year, the former declined by about 25% to 30%, while the latter dropped by 12%.

The company expected these two sectors continue to underperform in 2024.

The new pool construction sector and the pool refurbishment and modeling sector are accountable for less than 40% of POOL’s net sales, while the pool repair and maintenance sector make up for approximately 60% of its net sales. Under an unfavourable economic backdrop, the weighting for repair and maintenance sector tends to increase.

CPI for March 2024 climbed by 3.5% on a year-over-year basis, which further reduced the chance of having the headline inflation data dropping back to 2%, and hence, the Federal Reserve would be less likely to implement three rate cuts this year, as previously claimed. This is bad news for the housing market.

However, POOL earns significant recurring revenues from the repair and maintenance segment, which can slightly safeguard POOL from economic turmoil and reduce cyclicality of the company.

Without attractive valuation and growth in earnings, POOL is unlikely to perform well in an underperforming housing market amid high interest rate environment.

Therefore, I anticipated POOL to deliver a 0% to -10% return in 2024.

Please feel free to leave a comment below to share your view. Thanks for reading.

Read the full article here