Lands’ End (NASDAQ:LE) is an online apparel retailer focused on vacation occasions, mostly swimwear and outerwear, with an adjacent uniform business.

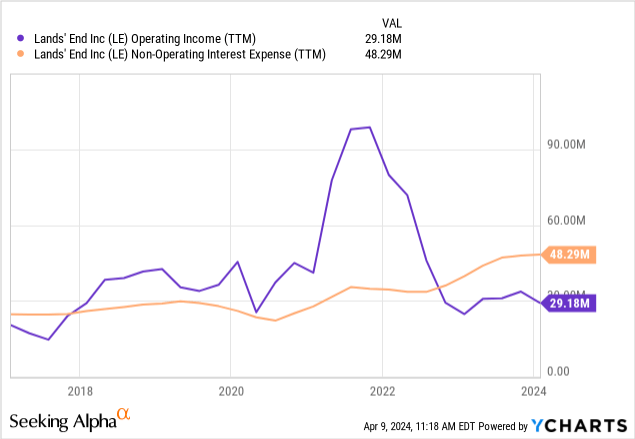

Since spinning off from Sears in 2014, the company’s operations have been okay but not outstanding. It has consistently suffered from overleverage. Today, despite being operationally profitable, Lands’ End cannot cover its interest payments.

A new management team arrived at Lands’ End in late 2022, and I like some of their plans. However, it is a little early to judge.

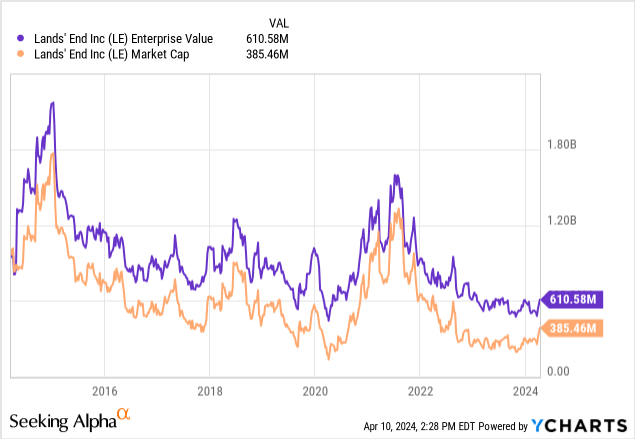

On the valuation side, I believe the company’s current market cap or EV embeds pretty optimistic assumptions about the company’s future, leaving little room for error. For that reason, I think Lands’ End stock is not an opportunity at these prices.

Company intro

Vacation and uniform e-tailer: 90% of Lands’ Ends’ sales are done online, through its e-commerce channels (80%+) and marketplaces like Amazon or Target (8%).

The company’s main brands focus on vacation occasions, heavily on swimwear for spring/summer and outerwear for fall/winter, especially for women. This is clear when one observes the focus of the company’s Instagram page photos.

Lands’ End also has a uniform business called Outfitters, which sells corporate-branded tops, bottoms and outerwear. This segment is strong in school markets and represents 18% of the company’s FY23 sales.

Some brand power: Lands’ End sells its own products, which is generally a good thing for retailers, as it allows them to compete in the more intangible areas of branded products rather than the more tangible aspects of pure retailing. Despite selling most of its production first-party, the company’s margins have not been super high, indicating not super high branding power. The company’s Instagram page has very few followers (160 thousand) for a company of its size. On the other hand, LE has landed license agreements for its brands (the most recent for kids and footwear with Costco), which indicates some brand value; otherwise, the licensees would have no interest in the brand.

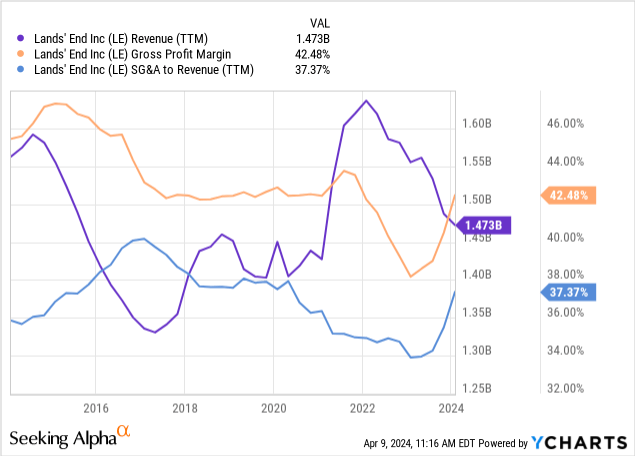

Low operational leverage: One positive aspect of LE’s past operations is that big changes in revenue (as seen post-2014 into 2016, then higher into 2018, and finally during the pre and post-pandemic) have not generally caused high fluctuations in gross margins or SG&A to revenue percentages, with the exception of 2022/23. I believe this is a good characteristic, probably derived from the company’s online focus, with a very small (fixed cost) store footprint.

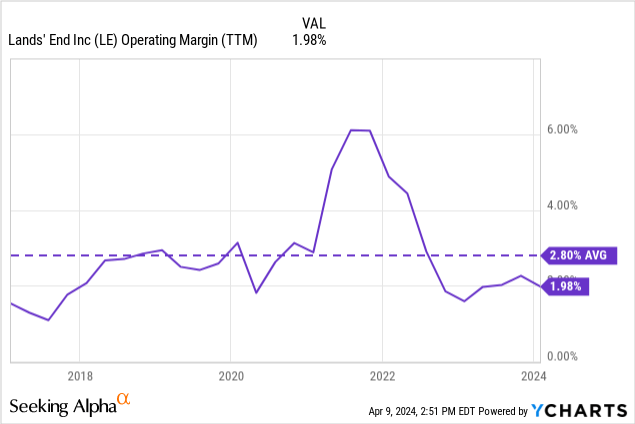

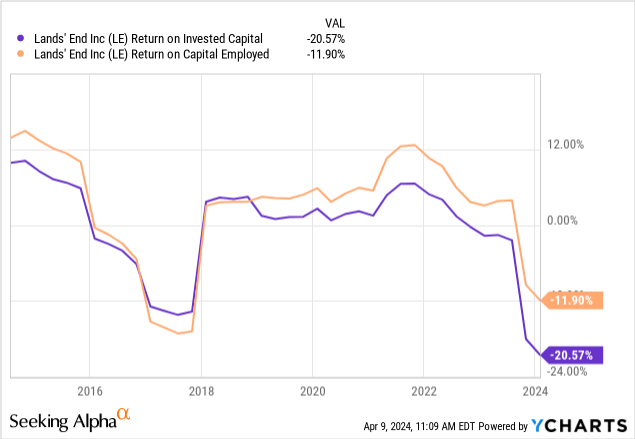

Okayish operations: Lands’ End has posted profitable but unimpressive operations since spinning off from Sears. As seen above, revenues have been basically flat for the past 10 years. Average operating margins have been pretty low, similar to the company’s return on capital.

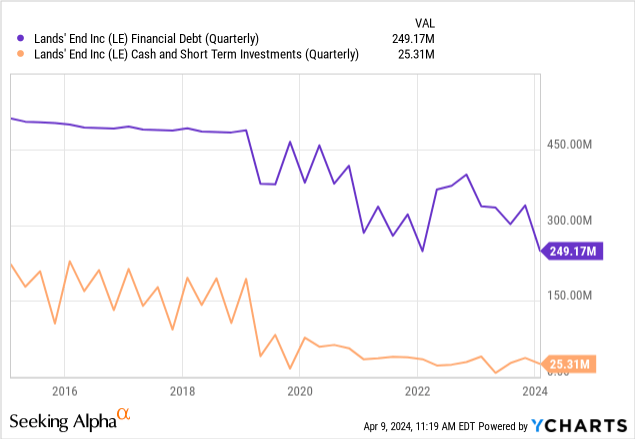

Leveraged: Since starting as a public company, Lands’ End has carried a high level of debt, which has been decreasing in the past few years. The cost of this debt has always been a problem because it has magnified the effects of operational leverage from low margins. In recent years, as seen in the second chart below, the debt problem has worsened as rates have increased. Today, Lands’ End pays SOFR + 8% on its $250 million refinanced term loan, a rate that is well above the company’s average ROCE and that, therefore, destroys value for shareholders.

Strong shareholder: A final positive aspect of Lands’ End’s situation is that it has a strong, long-term shareholder. Edward Lampert, ex Sears’ CEO and fund manager, owns 52% of the name, according to the latest proxy.

New management team

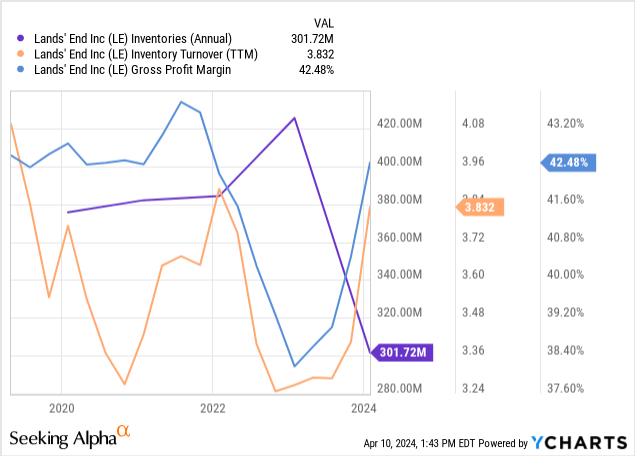

Mistakes, challenges, and change: The pandemic stimulus and the one-time boost to vacation occasion apparel purchases of the post-pandemic consumer lifted Lands’ End’s sales in 2021/2. The management team at the time probably overestimated the boost’s duration and then found itself in the position to liquidate inventories, which led to lower margins. I believe this mistake, coupled with the company’s more precarious financial position caused by rising rates, led to a management change. The CEO in office since 2017 left in 2022 and was replaced by a new CEO, who in turn brought new managers to most positions in January 2023, some of whom were promoted from within.

Merchandise focus and promotional restrain: After struggling with cleaning inventories in 2023, the new team was able to control inventory levels and, therefore, recover a lot of the gross margins lost during clearance, despite revenues continuing to fall.

This was in part due to the focus on the two core categories, swimwear and outerwear. The rest of the categories are not abandoned, but less attended. For example, the company decided to purchase market goods (that is, from manufacturers’ designs instead of doing its own product development) for non-core categories. It also decided to license the kids and footwear category to Costco.

A second reason is the reduction in promotional activity. As I have commented on other articles, promotions are a dangerous drug for retailers because they hide merchandising and brand problems and because they prioritize top-line growth at the expense of profitability. Here are some positive comments from management’s 4Q23 earnings call that I liked in this respect.

While revenue was down 6% year-over-year in Europe, the business increased gross profit dollars by 24% and expanded gross margin by over 1,000 basis points year-over-year.

Our striped chino pant sold through in days, which helped to deliver a message to our customer. Don’t wait for the discounts or you’ll miss out.

Just to give an example of how dangerous this was, even during peak stimulus in December 2021, right in the middle of the Holiday season, the company was offering 70% discounts on all products, according to the Wayback Machine.

Good digital presence: As an online retail company, I was pleased to find that the company’s website has good assets. Some things I liked were the landing page’s focus on occasions and outfits rather than on simple product categories. The landing page was different up to October 2022 at least.

The current website also has all products showcased with models and occasion backgrounds. This is very important to remove the dullness of a traditional e-commerce grid.

The change in digital photography is also visible in the company’s Instagram. You can literally see the day and night change in content consistency and quality after March 2023.

Valuation

When assessing Lands’ End as a stock opportunity, one must merge the positives and negatives into a required return and compare that to the company’s valuation and future perspectives.

Starting with the return required, I inclined more toward the negative side despite Lands’ End having some positive characteristics, mainly relatively low operational leverage, a strong shareholder, and a promising new management team. Low historical operating margins mainly speak of a difficult competitive environment. The company has low brand power, and, above all, very high financial leverage. If a so-so company without growth should at least provide 10% returns, Lands’ End should offer more.

Despite the promising managerial improvements, the new team is still young in the role, and some aspects, like the recovery of margins, could have been macro-driven (although a bad team can ruin a macro tailwind, too).

It is too early to say if the company’s long-term margins will improve compared to their historical average, and therefore I prefer to operate with the historical 3% operating margin. Looking at the long-term average, revenues have been around $1.5 billion. These assumptions, resulting in an operating income of $45 million, are already optimistic from today’s standpoint, considering the company’s TTM margin is 2%, and TTM revenues are $1.47 billion, in a decreasing trend.

On the market cap side, $45 million in operating income does not cover the company’s current interest expenses. This would already make LE a too risky investment because even optimistically assuming a recovery of revenues and margins to historical trends, the company cannot cover interest payments. We cannot calculate a P/E multiple as the expected result is a net loss.

Let’s compare $45 million in operating income and optimistically assume this can all translate to NOPAT, as LE has $125 million in NOLs that can offset against taxation for a few years. We are still talking of an EV/NOPAT multiple of 13.5x or, conversely, an earnings yield of 7.5%.

This is a low expected return for already relatively optimistic assumptions. It does not provide a sufficient return for the risk embedded in LE’s operations, and even the return itself is not very safe, as the company is still challenged on the topline front.

For those reasons, I believe Lands’ End is not an opportunity at these prices, but will continue to follow the name for improvements on its long-term margin perspectives.

Read the full article here