FS KKR Is A Leading BDC

FS KKR Capital (NYSE:FSK) is a leading business development company with a market cap of $5.4B. Therefore, FSK is positioned as one of the market leaders focused on the private upper-middle market segment. However, FSK is still valued at a steep discount compared to its NAV and BDC peers. Accordingly, FSK trades at a 22% discount to its NAV. FSK is also valued at a net investment income or NII per share multiple of 6.8x, well below its peers’ median of 8.4x (according to S&P Cap IQ data).

As a result, bullish FSK investors will likely point to further re-rating potential, given its market leadership. However, I assessed that investors shouldn’t be too quick to allay FSK’s execution risks, as the macroeconomic environment could get increasingly challenging in 2024. While I don’t expect the economy to slip into a recession, economic growth is expected to slow further, potentially leading to higher non-accruals in its portfolio companies.

I last updated FSK investors in late January 2024, urging them to capitalize on a Jerome Powell-induced pullback if it happened. FSK topped out in January before a steep selloff that coincided with FSK’s fourth-quarter earnings release in late February. FSK investors were justifiably concerned with the high non-accrual rate in Q4, suggesting increased stress experienced by its portfolio companies.

Non-Accruals Remain Worrisome

Accordingly, FSK reported 8.9% and 5.5% of non-accruals based on cost and fair value, respectively. FSK attributed the relatively poor performance to several company-specific and macroeconomic factors. These include wage inflation, uncertainties in Medicare reimbursement, and higher interest rates. It also drove some of the discussion in FSK’s Q4 earnings conference, as analysts seemed surprised with the level of non-accruals in its portfolio. As a result, the market is likely concerned about whether FSK could face more challenges in 2024, as spreads are expected to narrow. Accordingly, with more competition facing private credit providers in 2024, even leading BDCs like FSK must compete more intensely even as they navigate the headwinds of a more dovish Fed.

FSK’s portfolio is still predicated on mainly floating rates. Accordingly, variable rate debt accounted for 66% of its portfolio (based on fair value). Hence, I believe it’s reasonable to assess that NII per share has likely peaked in 2023. However, the headwinds could be mitigated by a more buoyant private equity sphere as PE firms look to spruce up their activity and return capital to their LPs. As a result, it should drive higher demand for lending from leading players like FSK, bolstered by its support from FS/KKR Advisor, LLC.

Notwithstanding the potentially more constructive M&A environment in 2024, I gleaned that FSK’s material undervaluation likely points to reduced confidence in its non-accruals, which was way above Blackstone Secure Lending Fund (BXSL) over the same period. Accordingly, BXSL reported “a minimal nonaccrual rate below 0.1% at both amortized cost and fair market value,” corroborating its robust execution and risk management framework. With that in mind, I urge FSK investors to remain cautious as potentially weaker economic conditions could escalate worries over FSK’s valuations, leading to further de-rating.

Is FSK Stock A Buy, Sell, Or Hold?

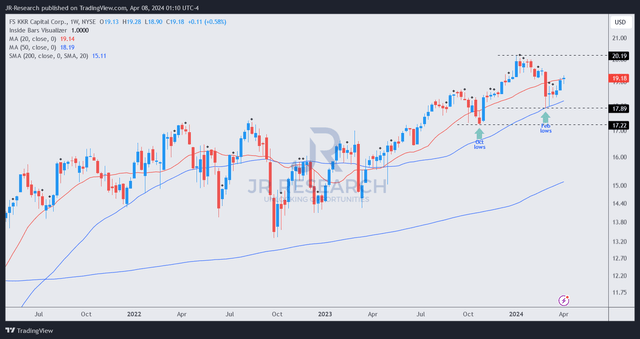

FSK price chart (weekly, adjusted for dividends, medium-term) (TradingView)

Notwithstanding my caution, investors should note that FSK management maintained its confidence in keeping distributions relatively high. Accordingly, FSK highlighted a payout of $2.90 per share in 2024, slightly below last year’s total payout of $2.95.

With an FY24 dividend yield of 15% at the current levels, I assessed that significant downside risks seemed to have been priced in at its selloff in February 2024.

FSK’s recent price action indicates that buying momentum has resumed, lifting FSK over the past four weeks. FSK has also remained in a medium-term uptrend bias, corroborating my bullish thesis. Therefore, FSK investors who missed capitalizing on its February pullback should consider adding more positions before it potentially moves higher to re-test its 2024 highs.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here