Investment Thesis

The investment potential of High Tide (NASDAQ:HITI) lies in its possibility to be a long-term compounder, driven by the strategic allocation of free cash flow toward the expansion of new stores. Thereby realizing more free cash flow to have the funds to open stores at an even higher pace. In the subsequent sections, I’ll elaborate on the rationale behind my confidence in High Tide’s ability to generate increasingly more free cash flow over the following years. And additionally, I will assess the company using Chuck Akre’s three-legged stool framework to determine if it meets the criteria of a quality business.

Introduction

High Tide is Canada’s top revenue-generating cannabis company with over 168 brick-and-mortar retail locations and several international cannabis e-commerce platforms, boasting an annual revenue run rate exceeding $500 million CAD. In the last two quarters’ earnings calls High Tide’s CEO gave some specific numbers on the costs of growth, which gives me the possibility to calculate what kind of returns the company can make while executing on this growth. In the subsequent paragraphs, I will evaluate High Tide’s investment potential on the basis of Chuck Akre’s theoretical investment framework, particularly focusing on the three-legged-stool approach. Chuck Akre’s three-legged stool model emphasizes investing in companies with a high return on invested capital (ROIC), sustainable growth potential and strong management teams. By analyzing High Tide’s business model, growth strategies, and financial performance through the lens of Akre’s principles, I aim to provide a comprehensive assessment of its ability to compound value over the long term.

Strategic Shift

In the beginning of 2023, High Tide embarked on a strategic shift prioritizing the generation of free cash flow over fast-paced growth. This deliberate move aimed to strengthen the company’s financial resilience and, more importantly, provide a self-sustaining mechanism for future growth. By generating free cash flow the company can fund the opening of new stores by itself without being dependent on external funding (either via equity or debt). Notably, this strategic initiative bore fruit in the last three quarters, with High Tide successfully generating 4.1 million Canadian dollars in free cash flow in FQ3 2023, 5.7 million in FQ4 2023 and 3.6 million in FQ1 2024. This totals north of 13 million Canadian dollars in the last three quarters. This accomplishment highlights the company’s dedication to smart operational and cost management and sets them up nicely to fund future growth plans using their own resources.

Recent Quarters Cash Flows

In a notable financial performance in the last three reported financial quarters, High Tide demonstrated a commendable free cash flow margin of 3.3%, 4.48% and 2.81% respectively. The conclusion we can draw from this is that the company is making substantial progress in executing its strategic shift.

| Quarter | 23FQ1 | 23FQ2 | 23FQ3 | 23FQ4 | 24FQ1 |

| Revenue | 118M | 119.1M | 124.4M | 127.1M | 128.1M |

| Adjusted EBITDA | 5.5M | 6.6M | 10.2M | 8.4M | 10.4M |

| Adjusted EBITDA Margin | 4.66% | 5.6% | 8.2% | 6.61% | 8.12% |

| FCF | -0.8M | -2M | 4.1M | 5.7M | 3.6M |

| FCF Margin | -0.68% | -1.69% | 3.3% | 4.48% | 2.81% |

However, these margins remain relatively modest, primarily due to High Tide being in the early phases of achieving profitability. But this also means that the company still has a substantial runway for significant margin expansion in the future. The company is strategically positioned for margin improvement through a couple of key avenues. Firstly, the cultivation of higher-margin revenue streams, notably the Cabana ELITE paid membership program, the sales of data through their cabanalytics platform, and the rollout of white label products, which is expected to contribute more and more in the coming quarters. The Cabana ELITE membership program offers consumers attractive discounts while providing the company with stable revenue streams. Additionally, the simple laws economies of scale, driven by a substantial increase in store count over the next two to three years, will likely enhance both free cash flow and adjusted EBITDA margins. In FQ4’s earnings call, High Tide’s CEO Raj Grover projected that between 20-30 new stores will be operational by the end of 2024:

Our expectation is to open 20 to 30 stores in calendar 2024 via a combination of organic builds and M&A while remaining free cash flow positive.

Lastly, High Tide’s management team has demonstrated effective cost management in the past four quarters, showcasing their capability to navigate the evolving landscape of the cannabis retail sector and optimize profitability in the company’s infant stages.

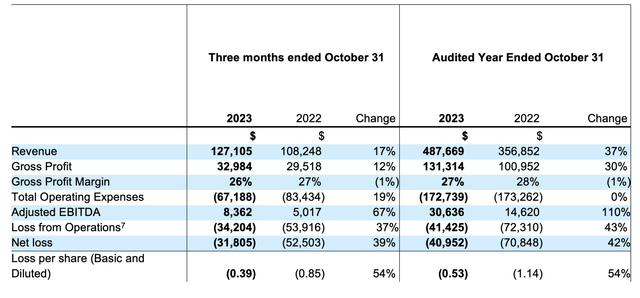

Flat operating cotst while growing significantly (High Tide)

As seen above, operating costs remained unchanged year-over-year in the last full reported year ending on October 31st, while both revenue and gross profit increased by 37% and 30%, respectively. This is impressive, to say the least, and exactly how you want to see a company growing. Furthermore, with significantly growing revenues anticipated over the next two years, the absolute amount of cash the company will generate is poised to increase substantially if it can manage to keep the operating expenses under control.

It is important to state that a large amount (if not all) of the reported free cash flow is generated by the sales of data through High Tide’s cabanalytics platform (high margin revenue of respectively 6.5M, 6.8M and 7.3M in the last three reported quarters). When I study all the numbers I think the brick-and-mortar stores do not generate free cash flow by themselves yet, I think they’re more or less cash flow break even. However, I think it’s essential not to view the brick-and-mortar stores in isolation. Instead, I think a holistic approach that considers High Tide’s entire business ecosystem—including brick-and-mortar stores, e-commerce platforms, paid memberships, and data sales—is warranted. I personally view it as an interconnected ecosystem that both needs but also amplifies each other. The high-margin data business and the paid membership program can only exist by virtue of the existing large-scale store network. That is to say, the high-margin data business and the revenue generated from paid memberships are reliant on the existing large-scale store network. This interconnectedness means that the growth of the store network contributes to the overall value of the ecosystem. As a result, the data becomes more valuable, and the pool of potential paid memberships grows, ultimately impacting the bottom line positively. This integrated view underscores the strategic importance of each aspect of High Tide’s business and how they amplify each other’s value within the broader ecosystem. And, in addition, I believe it demonstrates that even though the brick-and-mortar stores do not directly generate cash by themselves yet, the growth of High Tide’s store network indirectly contributes significantly to the company’s bottom line through the value they deliver to the entire ecosystem.

ROIC

One of the fundamental principles within Chuck Akre’s three-legged stool framework is the recognition that the quality of a business, among other factors, is determined by its ability to achieve a high Return on Invested Capital (ROIC). In the case of High Tide, this principle holds significant weight as we assess the company’s performance and potential for long-term value creation. Calculating the ROIC sheds light on the efficiency with which High Tide utilizes its capital to generate profits, thus offering valuable insights into the quality of its operations and capital allocation strategies. With an average free cash flow margin during the last three reported quarters of 3.53% and CEO Raj Grover’s disclosures regarding store performance and expansion costs, we can calculate High Tide’s ROIC.

If we consider the average free cash flow margin of the last two reported quarters, which stands at 3.53%, we can calculate the absolute amount of free cash flow generated by an average store. While this calculation may not directly illustrate the cash flow from individual stores, it provides an estimation of the additional cash that will flow through the entire ecosystem due to the value added by expanding the store network, as explained above. In the FQ4 2023 earnings call, CEO Raj Grover stated that the average store in Ontario generated 3.6 million, and in Alberta, it was 2.2 million. Let’s take a conservative approach, considering High Tide currently has 59 of its 168 stores in Ontario, and calculate the average between these two figures, which is approximately 2.5 million. With a free cash flow margin of 3.53%, the average relatively mature store is estimated to add value equal to around 88k in free cash flow per year to High Tide’s ecosystem. CEO Grover also stated that the average cost of opening up new stores is 300K (excluding the cash that has to be made free for working capital), a simple calculation states that the return on the invested capital of opening a new store is just shy of 30%. If we also include the difference in working capital (100K, also stated in the FQ4 earnings call) within the invested capital, the ROIC is still 22%.

It’s important to note that not all currently opened stores have reached a mature status and may not be operating at optimal profitability yet. At the same time, we also have to keep in mind that High Tide’s history of cash generation spans just three quarters, so we also have to take current free cash flow margins with a grain of salt. The longer they stay positive and can improve, the more value we can attribute to them. Achieving an ROIC of 22% for a company in this early stage of profitability is very impressive in either case. This can be attributed to the fact that, unlike traditional brick-and-mortar businesses, High Tide operates their brick-and-mortar stores relatively capital light. They don’t own the land and stores; instead, they lease them at favorable prices due to their scale. For opening new stores, it’s just a matter of rebuilding the store space and buying inventory. Another factor contributing to their high ROIC is, as explained above, I think that their store network amplifies some of their higher-margin revenue streams. By opening a new store, they not only generate cash through the store counter but also leverage the increased value of their store network through data sales. These revenue streams are more profitable than the classical retail business, indirectly boosting their ROIC.

High Tide’s impressive ROIC indicates that the company passes one of the three legs of Chuck Akre’s stool framework. This strong financial performance reflects High Tide’s smart use of capital and efficient operations, which are key factors Akre looks for in quality businesses. High Tide’s ability to deliver solid returns on its invested capital suggests it has the potential for long-term growth and success, fitting well into Akre’s investment principles.

Growth Opportunity

The second leg of Chuck Akre’s stool framework is all about a company’s ability to reinvest its earnings effectively. This means finding opportunities where profits can be plowed back into the business to fuel future growth and value creation. Akre emphasizes the importance of businesses being able to use their earnings wisely to generate high returns, which ultimately leads to long-term wealth creation for investors. This focus on reinvestment highlights the significance of companies having a clear strategy for deploying their profits back into the business to drive sustained growth over time. As Akre writes in one of his investment letters:

Over a period of years, our thinking has focused more and more on the issue of reinvestment as the single most critical ingredient in a successful investment idea, once you have already identified an outstanding business.

I think High Tide meets this condition. High Tide runs a very scalable business. By opening up new stores in an area where potential consumers live who don’t have access to cannabis products (or the discount model of High Tide itself) yet, they can reach a new customer base. In Canada alone, there are still a lot underpenetrated regions and therefore potential customers to reach. In addition, recent regulatory shifts, such as the doubling of the store cap in Ontario from 75 to 150 stores, allow the company to grow significantly in its most profitable market. High Tide currently has the target to reach 300 stores in Canada in the next few years (from 168 currently), but I personally am convinced there’s room for ample further growth behind this milestone. The legalized cannabis business in Canada is still in its infancy, when the consumption of cannabis products has reached a more mature state of social and cultural acceptance I think a penetration of more than the current 8% is viable. In conclusion, I think in Canada alone the company can grow to more than double their size in the next three to four years.

Moreover, the anticipated regulatory changes in both Germany and the USA hold the promise of unlocking a whole new level of market opportunities for High Tide. Just recently Germany accepted laws making cannabis legal for recreational use. Although the country has not opened the gates yet for commercial sales, the plans are that it will happen in 2025. With Germany having more than double the amount of citizens in comparison to Canada, the opportunity would be huge. In addition, the USA also presents a potentially huge opportunity for High Tide. Currently, Nasdaq regulations prevent them from doing actual cannabis business in the United States, but with the passage of the SAFER banking act this could change. When the rules permit them to operate, the growth potential is seemingly boundless. I view both the US and Germany as option-type opportunities, but significant ones.

High Tide’s exciting growth prospects signal its adherence to the second of the pillars of Chuck Akre’s investment philosophy. This outlook reflects High Tide’s ability to scale up and seize opportunities in the market with their cash flows, qualities that Akre values in strong businesses. With its potential for expansion, High Tide aligns well with Akre’s approach, which emphasizes long-term growth and value creation for its shareholders.

Funding of Growth

As stated above, the company wants to expand the store count with 20 to 30 stores in calendar year 2024. This will cost the company 6M to 9M and an additional 2M to 3M in working capital that has to be added to the balance sheet. If we extrapolate the 13.3M free cash flow of the last three reported quarters to the full year, we get a yearly free cash flow of 17.9M. The most aggressive goal of opening 30 stores can, if we depart from the figures the company provided in FQ4 earnings call, easily be funded from the current free cash flow. And, in addition, the company has also cash left for other strategic growth investments besides opening up new stores or debt repayment. The current growth plan with regard to opening up new stores can, thereby, be seen as conservative. As free cash flow grows due to the increasing value of their ecosystem, I think the company can easily increase the pace of opening new stores to an amount of 50 to 70 per year in the next 2 to 3 years. Roughly speaking, this will cost the company 15M to 21M in opening costs and an additional 5M to 7M of working capital that has to be made free. My estimation is that, with the additional cash flows generated from recent store openings and those planned in the near future, the ability to fund the opening of 70 new stores per year solely from free cash flow is not too far away. Considering this, it’s important to note that the company currently operates 168 stores. With the potential ability to fund the opening of 70 new stores per year from free cash flow alone, this implies the potential for a 40% increase from the current total store count within one year, without requiring any external funding.

Management

The third and last leg of Chuck Akre’s three-legged stool considers the management. Although there’s not a huge track record to evaluate High Tide’s management, it is certain that, under the leadership of Raj Grover, the management has demonstrated glimpses of exceptional quality and a lot confidence. It has led the company from an annual revenue of 10M to a current run rate of almost half a billion in under five years. This 50x is impressive, to say the least. With regard to profitability, the management team successfully turned the business around from a fast-growing but loss-making entity to one that generates free cash flow when market conditions changed. I think this swift transformation reflects the ability to execute operational improvements effectively. Furthermore, Raj Grover’s substantial personal investment in High Tide, holding over 8% of the company’s shares, underscores his alignment with shareholders. His recent additional share purchases, along with other insiders, further highlight their alignment with shareholders’ interests and their belief in the company’s long-term potential. This blend of forward-thinking strategy, effective operational tactics, and substantial personal commitment aligns perfectly with the excellent management leg of Chuck Akre’s three-legged stool. All in all, I think High Tide’s management is on track to prove themselves to be excellent stewards working for shareholders’ interests.

Valuation

If we start from a ROIC of slightly more than 20%, I think a current free cash flow multiple of at least 25 is completely warranted with a company with this significant growth ahead. A very conservative yearly free cash flow of 15M would make for a current market cap of 375M Canadian dollars. With the recent run-up at the day of writing (6th of April), the company currently trades at a market cap of around 275M Canadian dollars. In my opinion, there’s still 25% upside to reach the current fair value. As the company grows and more stores reach a mature status, I think the yearly free cash flow will exceed 15M by a large extent. When they reach their current goal of 300 stores in Canada, and a free cash flow margin of 5% (which should be easily achievable on a larger scale), a free cash flow of at least 43.5M is achievable. When this is the case, the share price could easily 3x from current levels to a market cap of nearly 900M Canadian dollars. I will personally track the company’s execution and see if they’re able to continue their growth and improve their profitability. If so, I see no problems reaching the 900M valuation in the next three years. When they’re able to operate in either Germany or the US, I will have to reevaluate, because the potential for growth and shareholder returns could reach much higher levels.

Conclusion

With notable strides in recent quarters, characterized by substantial free cash flow generation and judicious cost management, High Tide is poised for sustained growth. The company’s ambitious expansion plans, alongside potential regulatory landscapes both domestically and internationally, could pave the way for promising opportunities ahead. Additionally, upon evaluation against Chuck Akre’s three-legged stool framework, High Tide demonstrates alignment with all key criteria, which qualifies it as a quality business. However, since the track record of the company – especially regarding profitability – is not that long, we still need to monitor the company quarter by quarter to ensure that its execution remains consistent.

Read the full article here