Right at the end of 2023, I wrote an article about PIMCO Corporate and Income Opportunity Fund (NYSE:PTY), which is a fixed income biased CEF managed by PIMCO.

In the article, I was rather optimistic on PTY’s prospects to register price appreciation in 2024 due to the forthcoming normalization in the interest rates that should act as a catalyst pushing fixed income valuations higher. Yet, at the same time I emphasized the risk that is associated with the FED not moving to the more accommodative direction at a pace and magnitude what the market had priced in back then.

On a YTD basis (effectively since the publication of my article), PTY has delivered 17.5% of total returns clearly exceeding the S&P 500.

Ycharts

Having said that, if we now factor in the new data points, which are relevant in the context of PTY’s return prospects, I think that there is a more solid basis to really trim down the position or even avoid the CEF completely.

Here is why.

Thesis update

Let’s start with the basics, outlining the underlying sensitivity of PTY to interest rate dynamics:

- Most of the investments are placed in fixed income instruments, where circa 53% of the total exposure lies in relatively high risk assets such as emerging market credit and high yield.

- While the duration exposure is distributed nicely across the short, medium and long-term segments, the consolidated effective duration lands at slightly above 7 years, which implies an elevated presence of duration factor.

- On top of this, PTY has assumed a notable load of external leverage mostly in the form of reverse repurchase agreements, which all together explain 26.5% of the PTY’s asset base.

From this the bottom line is clear: PTY is extremely sensitive to any rate of change in the interest rates, where in the case higher for longer scenario, the bond and credit positions would keep trading below their par value until the relevant maturity dates. Similarly, the reverse repo leverage component would still continue to inflict damage on the underlying cash generation due to expensive debt service costs (i.e., reverse repo is tightly correlated with SOFR which is now in the ~5% territory).

Granted, if the interest rates drop, the opposite effects would be true.

However, here is the thing. While PTY has appreciated by ~14% on a YTD basis (this is excluding the distribution effect), I would argue that the prospects have significantly deteriorated.

There are two major aspects that substantiate such assumption.

First, the distribution coverage metrics continued to worse, showing no signs of recovery. In the table below, we can see how PTY has to increasingly divest parts of its asset base to cover the currently attractive (~10%) dividend yield. For example, one of the most recent distributions on which we have available breakdown was covered only 42% by the underlying cash generation, while the rest came from realizing long-term investments. Really, the shorter or more up to date distribution coverage we pick, the worse the coverage levels look. The overarching issue with selling chunks of its asset base is that the timing is very unfavorable as the fixed income securities are generally depressed, trading below their par values due to higher interest rate environment. It would be better to wait for their maturities, but since PTY has so ambitious distribution target, such option is not possible (unless PTY decides to cut).

PIMCO Investments LLC

Second, the single largest driver that could send PTY higher from here and place it back into more sustainable territory in terms of the distribution coverage is the decrease in interest rates.

The chart below, which depicts FOMC dot trend line sends a fundamentally sound signal for PTY as already in 2025 it seems that we will be back in a somewhat more accommodative environment, and after that even in better place.

Yet, in this chart we can also notice how the individual estimates are rather dispersed, where several FOMC dots actually have landed significantly above the trend line.

Bloomberg, Federal Reserve, 3/20/2024

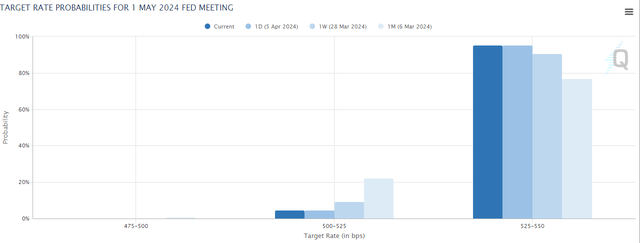

Furthermore, the chart below captures nicely how the market has slowly but surely moved away from the assumption of having some first rate cuts in May (the same applies for the ensuing FED meetings), and instead accepted the status quo in having relatively restrictive interest rates for some additional time ahead.

CME Group Inc.

Having said that, it is clear that buying or selling assets based on the forthcoming interest rate levels (their change) is not investing but rather a speculation.

Yet, for me investing is also about having a margin of safety in place so that my investments and their current income streams are not affected in a negative way if, for instance, the higher for longer scenario comes true.

The bottom line

Against the backdrop of unsustainable dividend coverage, which exhibits worsening momentum, triggering incremental divestments of underlying assets at an unfavorable time, it is hard to deem PTY as an enticing investment.

Moreover, the interest rate outlook seems to be tilted more and more towards the higher for longer scenario that is certainly bad for PTY (i.e., imposing continued headwinds on the distribution coverage shortfall and unfavorable asset divestitures).

I think that the fact that PTY has delivered ~17% in returns so far this year, offers a great opportunity for investors to take at least part of these profits home and consider allocating elsewhere.

In the meantime, placing this in a short category is also too risky given that it really boils down to the path of interest rates, where in the case of sudden decrease (exceeding the current expectations), PTY would most probably surge higher.

For all of these reasons, PTY is a hold for me.

Read the full article here