Thesis

The iShares Core Total USD Bond Market ETF (NASDAQ:IUSB) is a large fixed income ETF from BlackRock. As per its literature:

The iShares Core Total USD Bond Market ETF seeks to track the investment results of an index composed of U.S. dollar-denominated bonds that are rated either investment grade or high-yield.

The followed index is the Bloomberg U.S. Universal Index (ticker LC07TRUU), but despite its broad mandate the index and ETF in fact focus on treasuries and Agency MBS bonds which make up more than 57% of the collateral.

With the yield curve having moved up significantly since the beginning of the year on the back of the market dialing-back rate cuts expectations, we feel that generational opportunities lie with rate sensitive assets such as treasuries and MBS bonds.

In this article we are going to analyze IUSB and its composition, its risk factors and drivers, and articulate why we believe today’s macro environment is an ideal one to buy this name.

Rates have moved higher this year given the strong economy

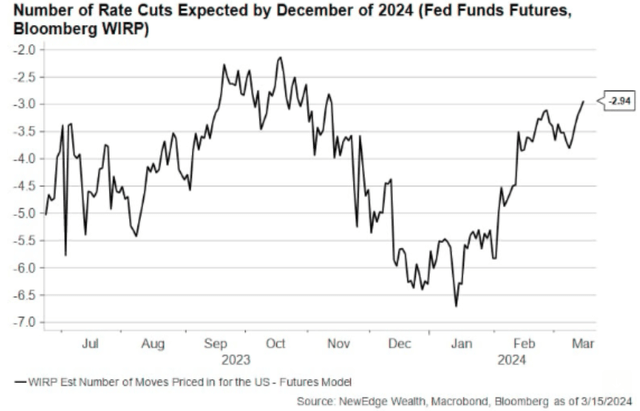

While the market was pricing six rate cuts late last year, the recent strong economic data has seen a significant dialing back of rate cut expectations:

Rate Cuts Expectations (Bloomberg)

The above graph, courtesy of Bloomberg, shows the implied number of rate cuts derived from Fed Funds futures. As the market has limited the number of forecasted rate cuts, the line has moved higher.

It is notable that the Fed’s Neel Kashkari even alluded to no rate cuts in 2024 in his speech yesterday. Fewer priced rate cuts for 2024 have resulted in a higher yield curve, thus lower prices for fixed income. We are seeing generational lows in fixed income prices, and while we cannot predict with certainty when the Fed will start exactly their easing cycle, we can say for sure that a year from now rates will be lower.

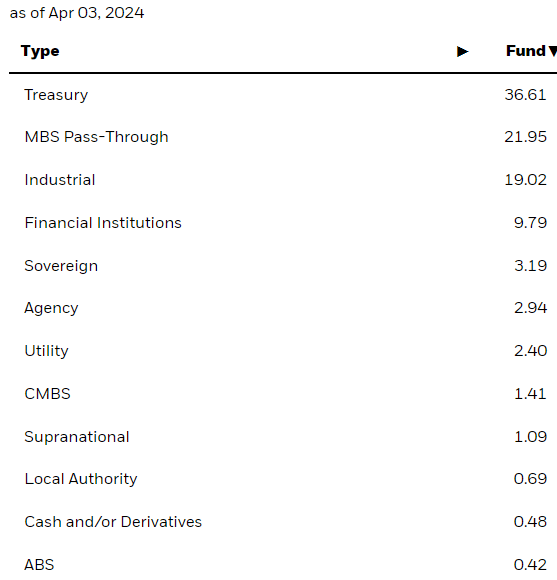

The fund is overweight Treasuries and Agency MBS bonds

Although the ETF takes a cross-sectional view into the bond market, its composition is overweight treasuries and Agency MBS bonds:

Collateral (Fund Website)

Treasuries and MBS make up more than 57% of the collateral, and thus make this fund mainly subject to rate moves via its duration profile. Please do note that the fund parsing now reflects the U.S. as being a double-AA rated jurisdiction:

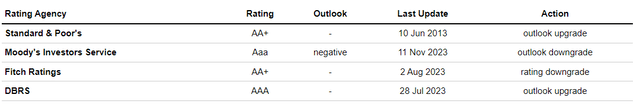

Ratings (Fund Website)

Only Moody’s currently has the USA as a Aaa rated country, with both S&P and Fitch at AA+.

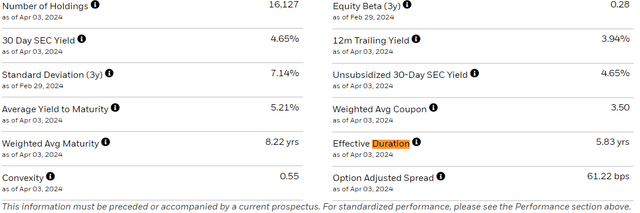

The fund has a 5.8 years duration, making it susceptible to intermediate rates:

Details (Fund Website)

For every 100 bps move lower in 6-year rates, IUSB is set to gain 5.8% in addition to its regular yield of 4.65% (as measured by its 30-day SEC yield).

The remainder of the fund’s collateral is represented by investment grade corporate bonds, with the fund exhibiting an overall option adjusted spread of only 61 bps given its composition. The main risk factor for this ETF is represented by rates, and rates are at historic highs presently.

Expect gains when the Fed cuts

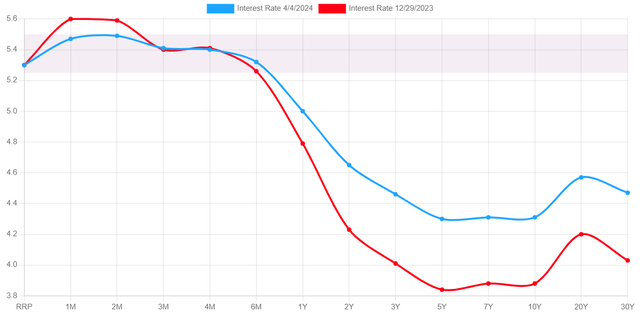

Let us have a look at the yield curve changes this year to better understand where we are going:

Yield Curve (ustreasuryieldcurve.com)

As compared to the end of 2023, we can see from the above graph that the yield curve has shifted much higher, and to be more specific higher by 50 bps for the 5- and 6-year tenors. Do expect that move to reverse once the Fed cuts or once the market starts pricing an imminent Fed cut.

We are anticipating an overall 100 bps move in the 6-year tenor by the end of the year, with only 2 Fed cuts for this year, followed by a pause. In our base case IUSB is set to gain 6% from duration and 4.5% from dividends, thus a total return in excess of 10%.

Kindly keep in mind this is a very low risk bond fund, with an annualized volatility of only 6.4% and a standard deviation of 7% as per the Seeking Alpha ‘Risk’ tab for the name.

Please find further analytics on the fund below:

- AUM: $28 billion.

- Sharpe Ratio: -0.69.

- Std. Deviation: 7%.

- Yield: 4.65%. (30-day SEC yield)

- Premium/Discount to NAV: 0%.

- Z-Stat: n/a.

- Leverage Ratio: 0%.

- Effective Duration: 5.8 years

- Expense Ratio: 0.06%

- Composition: US Agg Bond Fund

You want to buy bonds when rates are high

Bond funds are not usually very interesting because they are a low return / low volatility sector. With rates at levels not seen in more than a decade, the appeal factor for this name has just increased. In the bond world an investor can only expect a dividend yield in a constant rate environment. The only time when an investor can record capital gains is when rates or spreads are moving lower. Given the current level in risk free yields and the market implied pricing, for the first time in a long time an investor can bank on capital gains for the next 12 months here.

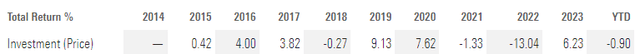

The current re-pricing of inflation expectations and Fed rate cuts is an ideal entry opportunity into IUSB, a fund that otherwise is fairly boring from a total return perspective:

Historic Returns (Morningstar)

The only other historic context in the past decade when the name generated a total return close to 10% was 2019, the year when the Fed lowered rates after having hiked during 2018. Expect the 2024/2025 period to be similar, with Fed rate cuts translating to a lower rate environment and thus capital gains for intermediate duration bond funds.

Risk factors

The main risk factor for this name is the Fed engaging in further rate hikes, which would move the yield curve higher and thus generate capital losses. This possibility is extremely remote, with the Fed chair being fairly specific that rate hikes are behind us.

J. Powell is in a bit of a tough spot because the U.S. debt interest is spiraling out of control, all while in a presidential election year and with a sticky inflation macro picture. We think he will cut just to show the intent, irrespective of the 2% target figure, and he will cut in the summer to avoid being associated with the presidential election period. Cutting during the elections could be perceived as helping the current president for example.

Conclusion

IUSB is a fixed income ETF from BlackRock. The fund aims to follow the Bloomberg U.S. Universal Index and is overweight Treasuries and Agency MBS bonds with a portfolio duration of 5.8 years. With the recent dialing back in rate cuts expectations for 2024, the yield curve has moved significantly higher, presenting an optimal entry point into IUSB. We anticipate a 10% plus total return in the next 12 months, with a 6% capital gain penciled in from duration and a 4% plus dividend yield component.

Read the full article here