Investment overview

I give a buy rating for TJX Companies (NYSE:TJX) as I believe management is being conservative in its FY25 guide, and the recent consumer strength coupled with a potential improving macro-outlook makes FY25 seem beatable. While my model shows ~8% upside, which may not seem very attractive, I note that there could be potential upside if TJX beats and raises its guidance for FY25 (especially if it beats in 1Q25 as I expect).

Business description

TJX is a retailer for off-price retail products, primarily in the apparel and home fashion vertical. By revenue, TJX is the largest player in the industry when compared to peers such as Ross Stores (ROST) and Burlington Stores (BURL). As of FY24, TJX has revenue of $54 billion, ROST has $2.73 billion, and BURL has $9.7 billion. TJX mainly focuses on the United States market and has a strong presence throughout the country via five key brands: TJ Maxx, Marshalls, HomeGoods, SIERRA, and Homesense. Their IR page has a good deck on the company background, and I urge readers to take a look.

Recent financials and guidance

TJX most recently reported its 4Q24 results, where it generated $1.22 in EPS, $0.10 above consensus. The outperformance was driven by better same-store sales [SSS], which was mainly supported by a growing number of transactions (i.e., volume) and a better gross margin. For gross margin, TJX reported 29.8%, which was also above the consensus estimate of 28.7%. Better operating leverage also led to TJX reporting a better than expected profit before tax margin of 11.2%, ahead of consensus estimate of 10.8%. For FY25, management is expecting adjusted EPS of $3.94-$4.02, SSS to be in the range of 2-3%, and profit before tax margins to be in the range of 10.9-11%.

SSS acceleration paints a positive outlook

TJX 4Q24’s strong SSS of 5% was a really strong indicator of underlying demand, in my opinion. This was a very different performance when compared to FY23, where SSS growth was all negative due to the rising inflation that hurt consumer willingness to spend. The narrative has turned. TJX is now seeing an increase in customer transactions as the entire driver of comps throughout the holiday season, which paints a very positive outlook for FY25 as it suggests a return in consumers’ appetite to spend. Notably, management noted that they shipped a fresh assortment of gift-giving selections that clearly resonated with consumers, which suggests to me that TJX has acquired new customers, especially in the younger age cohort, which shows TJX is not getting obsolete with its offerings.

Further, each of our divisions continue to affect an outsized number of younger customers to which stores attract an outsized number of younger customers to our stores, which we believe bodes well for the future. Company 4Q24 earnings

My opinion that TJX has a positive outlook for FY25 is being reinforced by the strong 1Q25 comment made by management. Note that this is in light of the poor weather in January that has hit the sales of many retailers. While management guided for 2 to 3% SSS growth in 1Q25 (a deceleration from 4Q24), remember that TJX strongly outperformed guidance the last time the CEO mentioned TJX had a good start. In the 1Q24 earnings call, Herrman (TJX CEO) mentioned that 2Q24 had a good start and guided to 2 to 3% SSS growth, but actual reported SSS growth was 6%. Hence, I think there is a chance for a strong 1Q25 beat.

Looking ahead, the first quarter is off to a good start. In 2024, we have many initiatives planned that we believe will keep driving sales and attract more shoppers to our stores.

From week three on, we were much happier with our comps. So that’s why we’re off to a good start. And by the way, I would say that we when the weather’s like that, it can affect your apparel. Company 4Q24 earnings

FY25 guidance is beatable

If 1Q25 is to perform as I expected, I think there is a good chance for TJX to beat its FY25 guidance on both SSS growth and the EPS front. Firstly, FY25 (CY24) is a better year than FY24 (CY23) because inflation rates are lower, which means consumers can afford to spend more. A positive macro outlook with evidence of consumers’ increased appetite to spend (as seen in 4Q24) suggests that FY25 should see positive (probably accelerating) traction throughout the year (rate cuts in 2CH24). Secondly, as I talked about the potential for outperformance in 1Q25, if TJX prints 6% SSS growth, this implies a sequential slowdown over the next 3 quarters, which is unlikely to happen given the macro outlook and demand strength. Thirdly, the recent guidance laid out by management has proven to be conservative. Over the past 7 quarters of GAAP EPS guidance, TJX has beaten all of it, and by a pretty huge margin of 7% on average.

As of 4Q24, TJX had $5.6 billion in cash and $2.9 billion in debt and generated $2.8 billion in operating cash flow during 4Q. TJX’s strong balance sheet also provides it with another lever to drive EPS growth: share buybacks. Over the past 4 years, TJX has shrunk the number of shares outstanding from 1.203 billion to 1.132 billion, which is a CAGR of -1.5%. TJX FY25 EPS implies a growth rate of 3.1%, of which half could be easily achieved by continuing the trend of buying back shares.

Valuation

May Investing Ideas

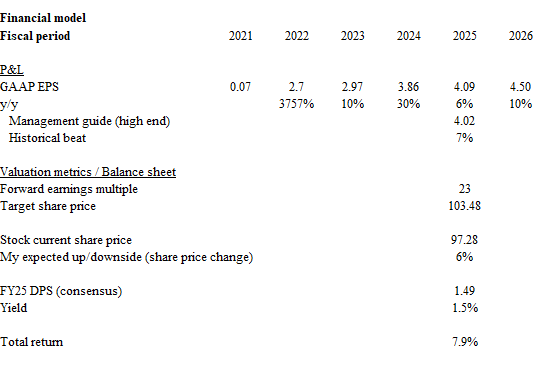

Based on my research and analysis, my expected target price for TJX is $103.48 by FY25, a 6% upside. If we include FY25 DPS of $1.49, the total return is ~8% over a year. My model is based on the GAAP EPS that I expect TJX to achieve over the next 2 years, followed by valuation based on a forward PE basis.

- Management guided a FY25 EPS range of $3.94 to $4.02, of which I expect it to easily come in at the top end of the range based on the current demand strength, a potentially improving macro outlook, and a share buyback trend that yields ~1.5% EPS growth. On top of that, I also believe management is being conservative in its guidance, just like the past few quarters. Assuming the same 7% beat, I got to $4.09 for FY25 EPS. For FY26, I simply assumed things have returned to normal and TJX should revert back to its historical EPS growth CAGR of 10% to low teens.

- TJX generally trades in lines with peers because they all operate in the same industry and are well covered by the market. Currently, peers are trading at 23x forward PE, and I don’t see a reason for TJX to trade at a premium or discount. Hence, I value TJX at 23x forward PE as well.

Risk

The recovery that I am hoping for in FY25 (CY24) might not materialize if inflation continues to stay sticky, leading to the Fed delaying their rate cut until next year. This could dampen consumers’ willingness to spend as they become more conservative about an uncertain macroeconomic environment.

Conclusion

I give a buy rating for TJX. My optimism stems from my belief that management is being conservative with their FY25 guidance. Recent strong consumer spending and a potentially improving macro-outlook point towards TJX exceeding its targets. Additionally, the company’s healthy balance sheet allows for further share buybacks. The main risk to this thesis is inflation persisting at high levels, causing the Federal Reserve to postpone interest rate cuts and dampen consumer spending.

Read the full article here