The exterior and parking lot of a Kroger supermarket.

As a fan of baseball, some parallels can be drawn between baseball and investing in equities. Where do I start?

One similarity between the two is that nobody bats a thousand. This plays on Peter Lynch’s idea that in investing, you’re good if you’re right six times out of 10. In baseball, the consensus is that three hits out of every 10 at-bats are good, and four out of 10 are Ty Cobb-like and out of this world. Simply put, everybody gets picks wrong.

A second similarity is that in both investing and baseball, consistent base hits and doubles also go a long way. What I mean is that picking stocks with low fundamental risk (e.g., steadily growing revenue/earnings, a manageable debt load, reasonable valuation, etc.) tends to translate into modest success as the minimum. This can help to reliably build wealth over the long haul.

One of the key differences between baseball and investing, though, is one that was pointed out by Berkshire Hathaway’s (BRK.A)(BRK.B) legendary Chairman and CEO, Warren Buffett.

In baseball, there are called strikes. This happens when a pitcher throws a pitch in the strike zone and the umpire calls it a strike. In baseball, when a hitter has two strikes and a pitch is in the strike zone, they have to swing. No matter how unfavorable it is to swing at that pitch. Otherwise, they risk striking out (if the umpire calls it, anyway).

The good news in investing is that as a retail investor, nobody is forcing me to take a swing at a stock I don’t feel compelled to own. I have the luxury of letting dozens or even hundreds of proverbial pitches whiz past home plate into the catcher’s mitt.

One stock that I felt compelled to recommend as a buy last November was the grocery retailer, Kroger (NYSE:KR). At the time, I noted how Berkshire Hathaway’s 7% stake made it one of the larger holdings within the company’s portfolio. I appreciated Kroger’s safe payout, investment-grade credit rating, and dirt-cheap valuation.

Today, I will be discussing why I am downgrading the stock to a hold rating. As a hint, this downgrade has nothing to do with the fundamentals of the business. As I will discuss later, the business itself appears to be doing well.

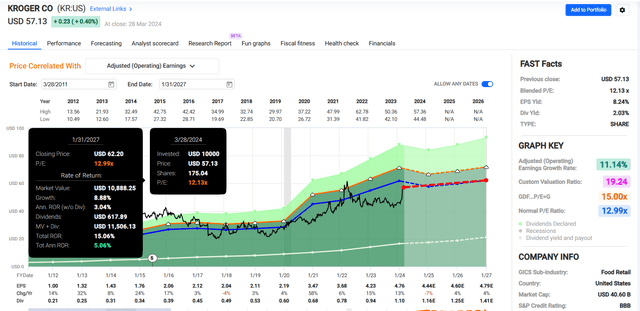

My oh my, how times have changed. Since I recommended Kroger, shares have delivered 34% total returns to the S&P 500’s (SP500) 16% total returns. This has brought the value of Berkshire Hathaway’s Kroger stake up to $2.9 billion – – good enough to be its 14th most valuable investment holding.

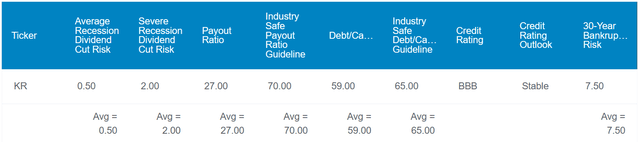

Dividend Kings Zen Research Terminal

Kroger’s 2% forward dividend yield is below the consumer staples sector median of 2.6%. This is why its grade for forward dividend yield is a C- from Seeking Alpha’s Quant System.

To be clear, I still appreciate Kroger’s past and future potential as a dividend growth stock. The company’s 27% EPS payout ratio is comfortably below the 70% EPS payout ratio that rating agencies desire from grocery retailers. Kroger’s 59% debt-to-capital ratio is also better than the 65% debt-to-capital ratio that rating agencies like to see from the industry.

These factors account for the company’s BBB credit rating from S&P on a stable outlook. That suggests the risk of Kroger going bankrupt by 2054 is 7.5%.

Kroger’s status as an industry leader, healthy financial metrics, and record as a dividend grower put it at a low likelihood of cutting its dividend in the foreseeable future. The Zen Research Terminal estimates the risk of the company reducing its dividend in the next average recession at 0.5%. In a severe recession, the chance increases to 2%. For perspective, these are the lowest possible probabilities in the Zen Research Terminal.

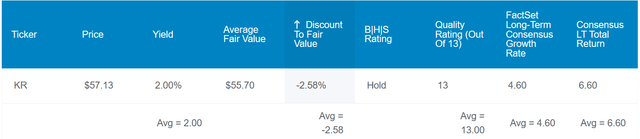

Dividend Kings Zen Research Terminal

As I alluded to earlier, Kroger’s valuation is the one major reservation I have about keeping my buy rating here. The coiled spring that largely powered those mostly fundamentally justified gains is now gone.

Kroger’s average five-year dividend yield of 2.2% could mean shares are worth $53 apiece. Given the company’s rather stable fundamentals, I believe this remains a reasonable assumption for yield moving forward. Relative to the $57 share price (as of March 30, 2024), this implies shares are now slightly overvalued.

Kroger’s 13-year normal P/E ratio of approximately 13 per FAST Graphs indicates that shares are worth $57 each. This is using the current $4.44 EPS consensus for the fiscal year ending Jan. 2025.

Piecing these fair values together, Kroger’s shares could be worth $56 apiece. Against the current share price, this would represent a 3% premium to fair value.

If Kroger matches the growth consensus and reverts to fair value, these are the total returns that could lie ahead over the next 10 years:

- 2% yield + 4.6% FactSet Research annual growth consensus – a 0.3% annual valuation multiple contraction = 6.3% annual total return potential or an 84% 10-year cumulative total return versus the S&P’s 9.8% annual total return potential or a 155% 10-year cumulative total return

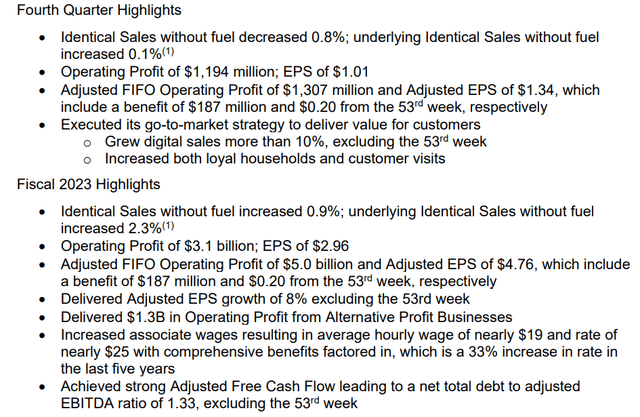

A Strong Finish To The Year

Kroger Q4 2023 Earnings Press Release

When Kroger shared its financial results for the fourth quarter ended Feb. 3 earlier this month, the grocery retailer didn’t disappoint. The company’s total sales surged 6.4% higher year-over-year to $37.1 billion during the quarter. According to Seeking Alpha, this came in $40 million ahead of the analyst consensus for total sales.

The company’s results were even decent when accounting for other variables. For one, the presence of a 53rd reporting week in the fiscal year led to an extra week in the fourth quarter results. Excluding this extra week from results, Kroger’s identical sales without fuel were down 0.8% over the year-ago period to $33.2 billion for the fourth quarter.

Readers may be asking: How is an identical sales decline “decent?”

Wait, there’s more. As noted in my prior article, Kroger announced in September 2022 that it was terminating its pharmacy provider agreement with Express Scripts as of Dec. 31 of that year. When backing that out of the company’s results, identical sales without fuel would have edged 0.1% higher during the fourth quarter.

Kroger’s adjusted EPS soared 35.3% year-over-year to $1.34 in the fourth quarter. This outpaced the analyst consensus by $0.21 per Seeking Alpha. Factoring out the extra week in the reporting period and the accompanying $0.20 benefit to adjusted EPS, Kroger’s adjusted EPS was still $1.14 – – a 15.2% growth rate. Interim CFO Todd Foley pointed out in his opening remarks during the Q4 2023 Earnings Call that the company’s adjusted FIFO operating profit margin expanded by 18 basis points. This was driven by sourcing benefits, lower supply chain costs, and the terminated agreement with Express Scripts, but partially offset by higher shrink for the quarter.

On the acquisition front, Kroger hit a snag with the Federal Trade Commission announcing last month that it will be suing to block the planned merger with Albertsons (ACI).

Regardless of whether the deal ultimately goes through, I think Kroger wins. Since mega-deals have a reputation for not panning out, it’s always worth being skeptical of them. However, the synergistic potential that the company highlighted is on the table in my view.

On the other hand, the $600 million break-up fee if the deal fails will be a slight headwind. However, Kroger’s balance sheet would remain very strong if the deal wasn’t completed. The company’s net total debt to adjusted EBITDA ratio was 1.33 in fiscal year 2023, excluding the 53rd week of results. This provides a sizable cushion versus Kroger’s targeted range of between 2.3 to 2.5 (unless hyperlinked or noted, all details in this subhead were sourced from Kroger’s Q4 2023 Earnings Press Release and Kroger’s Q4 2023 Earnings Presentation).

Solid Dividend Growth Could Be Ahead

Kroger’s most recent 11.5% hike in its quarterly dividend per share to $0.29 last August was impressive. There’s also reason to believe similar dividend growth can keep up.

Kroger produced $2.9 billion in free cash flow in its previous fiscal year. Against the $796 million in dividends paid in that time, this worked out to a 27.6% free cash flow payout ratio (info according to Kroger’s Q4 2023 Earnings Press Release). That leaves the company with ample cash flow to repay debt, repurchase shares, and grow the dividend further.

In my opinion, the market seems to be pricing in the deal with Albertsons not being completed. After all, the current $21 share price is substantially below the $34.10 per share cash offer from Kroger.

If the deal ended up not being finished, it could be a boon to future dividend growth. As demonstrated above, the status quo leaves Kroger with tons of cash flow to return to shareholders how it sees fit.

If the deal ultimately is completed, dividend growth would moderate to perhaps the mid-single digits for a few years as the company deleverages.

Risks To Consider

Kroger is a fundamentally sound business, but like any business, there are risks to the investment thesis.

On the off chance now that Kroger can acquire Albertsons, it’s not a guarantee that it will create value for shareholders. Years ago, a report from KPMG concluded that over half of mergers destroy shareholder value, and a third made zero difference. If Kroger can’t achieve the $1 billion in annual synergies it expects (slide 6 of 26 of Kroger’s Albertsons Merger Investor Presentation), the deal could end up a bust.

Another risk to the company is the union status of a majority of its associates. If any of Kroger’s 300-plus collective bargaining agreements expire and can’t be successfully renegotiated (per page 14 of 113 of Kroger’s 10-K filing), the company’s operations could be disrupted. This could hurt Kroger’s operating results.

Summary: Kroger Is One For The Watch List

FAST Graphs, FactSet

Kroger’s blended P/E ratio of 12.1 is a bit discounted compared to the 13-year normal P/E ratio of 13. On a forward basis, though, the P/E ratio of 12.9 is in line with the normal P/E ratio.

If the company grows as anticipated and reverts to its normal P/E ratio, 15% cumulative total returns could be generated through January 2027. This isn’t terrible return potential, but it isn’t compelling enough to me to warrant a buy, either. Until I see a correction to around $45 or shares become more valuable, I’m content to rate Kroger a hold here. That’s because around that valuation, I believe the stock would have a more realistic path to 10% annual total returns.

Read the full article here